As interest rates fall, there’s more bullish news coming in housing.

Investors who have been patiently waiting for a rebound in the homebuilder and real estate investment trusts (REIT) have been rewarded of late as the decline in mortgage rates and the ongoing tight housing supplies are starting to revive the housing market.

My bullish thesis on the homebuilders has proven to be correct based on the market’s reaction to the latest earnings report from homebuilder D.R. Horton (DHI) a long term holding in the Joe Duarte in the Money Options.com Rainy Day Portfolio. Horton beat earnings across the board and offered stable guidance for the rest of the year.

This is a big deal because the company, along with other homebuilders, continue to make money in a tough interest environment, which is changing as mortgage rates continue to fall. Get the details below.

As the price chart above shows, the doom gloom set which had been shorting the homebuilders have gotten destroyed. The stock is certainly due for a consolidation, but those investors who have remained patient in the shares have been rewarded.

The bottom line for Horton and for the rest of the homebuilders is that these companies learned their lesson after the 2008 subprime mortgage crisis. Thus, they have not overbuilt their lots and are keeping up with and adjusting to real time demand. In other words, if no one is buying, they’re not building.

They have also combined low enough prices and incentives to attract qualified buyers, especially in the Southern U.S. and areas to which the migration from states which have not recovered from COVID continues.

The combination of these thoughtful strategies, and strong balance sheets, continues to deliver stable to low growth earnings. And in this market, because interest rates are high, that’s excellent performance.

The good news is that when the Fed lowers rates, these companies are poised to do even better. I own shares in DHI.

Patience Pays Off

Over the last few months, I’ve been recommending staying patient with both homebuilders and home rental REITS. In my most recent real estate post I wrote: ”The clouds may be parting and at sliver of light is starting to cut through the darkened horizon of the housing market. It may be the first sign of a potential awakening of potential home buyers.”

I based my conclusion on three simple facts:

· There were no bullish investors in the housing market;

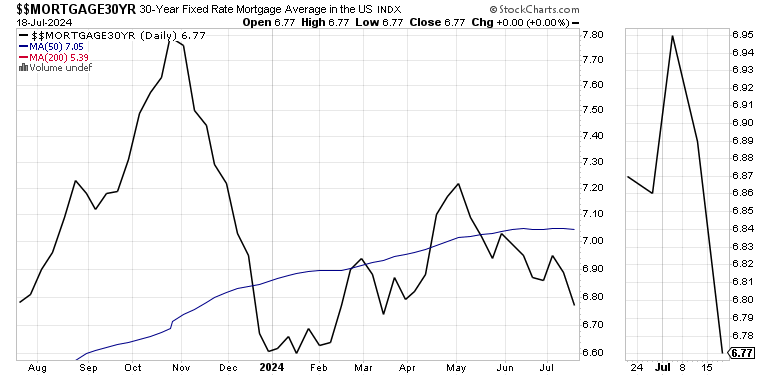

· Mortgage rates have been below 7% for several weeks; and

· In the real world, my neighborhood, there are signs of a burgeoning awakening in the market.

My on the ground observations were given a boost on 7/18/24 via D.R. Horton’s earnings, which were preceded on 7/17/24 when housing starts and building permits rose more than expected in June (yes, it’s old data), with multi-family permits leading the way with a 22% gain vs. February 2024 data. Single family home starts were the lowest since October 2023 – down 2.2%.

That said, the most recent mortgage activity numbers are showing an increase in activity as rates seem to have topped out for now. Specifically, mortgage refinancings jumped 15% last week, year over year, last week. Mortgage activity for home buying, remains near its lows.

On the other hand, there are three fine points to consider. Since mortgage rates were the same a year ago, this is a significant change in behavior. Consider the following about the rise in refinancing:

· It could be a sign that home owners with tight wallets, are tapping their home equity for expenses and are taking current rates instead of waiting for further drops in the future;

· An increase in refinancing activity may also suggest homeowners are uncertain about the future of rates and a sign of fear; and

· Changes in refinancing trends often precede changes in home buying trends.

All things considered, the sudden rise in refinancing activity could translate into the Federal Reserve being forced to lower rates sooner than expected – July, instead of September, instead of as some expect, after the election. No matter what, a Fed rate cut will likely increase the activity in both refinancings and home buying activity.

Kicking the Tires

As usual, I’ve got eyes and ears on the ground. And what I’m noticing is a subtle change in behavior. The number of listings in existing homes is starting to increase. It’s not a tidal wave by any means. Indeed, it’s more of a trickle; one new house on the market here, another one there. But it’s a change.

In addition, I’m seeing a bit of action by flippers, including big corporate flippers such as Opendoor Technologies (OPEN). This company has been in deep trouble since it bought too many homes back in the summer of 2022 and 2023 and struggled to fix them well enough to move them in a tough and highly expensive market. And while it’s still a penny stock, it’s worth watching as it’s a bellwether for the existing home market. I’ve got my eye on some of their listings and will see how long it takes them to unload them.

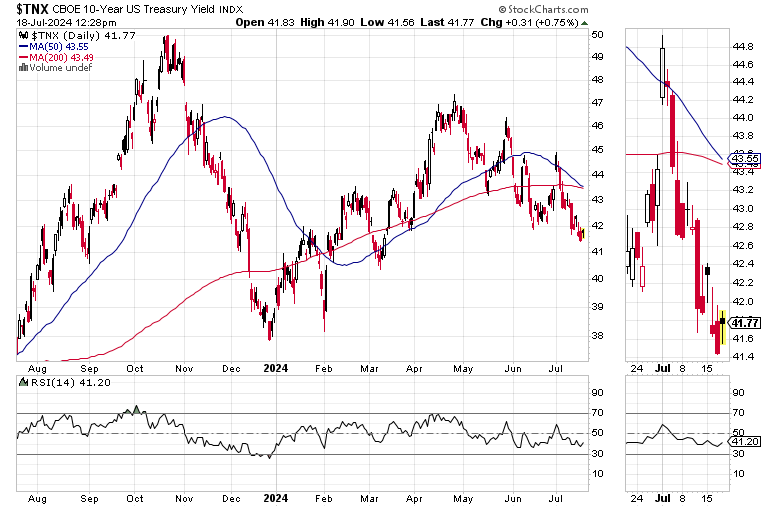

Bond Yields Are Falling Rapidly

Meanwhile, the U.S. Ten Year Note yield (TNX), the benchmark for the average 30-year mortgage, continues to move steadily lower, nearly guaranteeing that mortgage rates will follow.

For their part, mortgage rates are below 7% for eight consecutive weeks, a development which has not been ignored by investors in the homebuilding sector. The average 30-year mortgage topped out at 7.2% on May 1, 2024 and broke below 7% on May 20. This week's reading clocked in at 6.77%.

The iShares Home Construction ETF (ITB), as I’ve been expecting, rallied impressively in response to the better than expected CPI news and Fed Chairman Powell’s comments about the improving inflation picture. ITB is likely to consolidate in the short term. For more on housing related and other top performing ETFs check out the Sector Selector service.

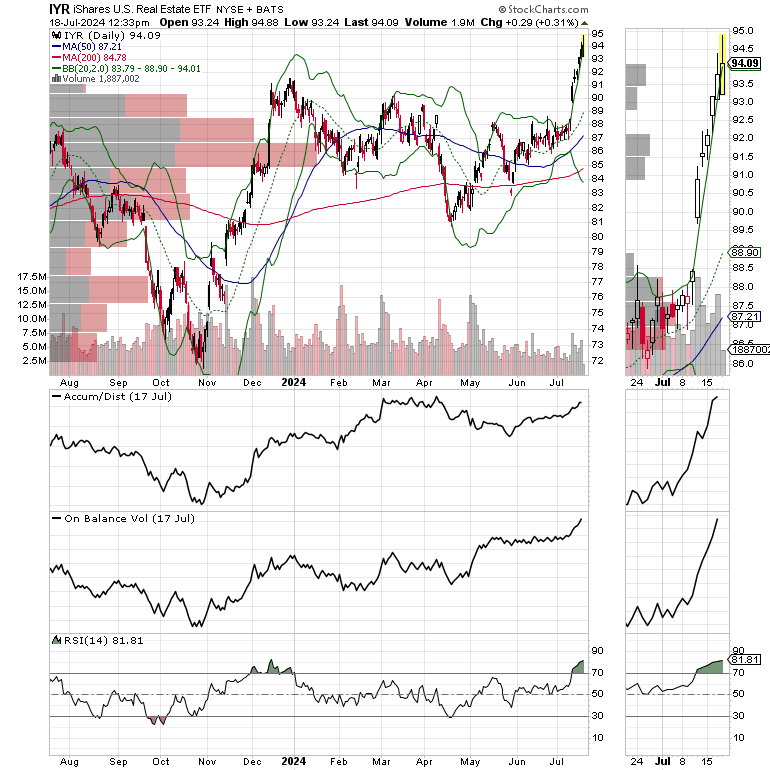

For its part, the real estate investment trusts (REIT) sector continues to move steadily higher. This is likely to continue while interest rates remain supportive. The supply and demand scenario for rental homes and apartments remains a bit murky and is regionally influenced, however. Thus, in some cases, it makes some sense to own specific REITs.

I have handpicked several well positioned housing related REITs, and individual homebuilder stocks which you can inspect with a FREE- Two Week Trial to Joe Duarte in the Money Options.com.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

For intermediate term trading strategies take a Free 2 week trial to Joe Duarte in the Money Options.com.

For active trading, short term trading strategies, check out the Smart Money Passport.

I also appreciate single coffees, which you can buy me here.

If you have any questions or comments about Buy me a Coffee or Substack, you can contact me through Buy me a Coffee or through this e-mail: [email protected].