The new normal for housing is low supplies and high mortgage rates. The bottom line is that this two-headed monster is putting the squeeze on homebuilders.

A recent report by broker Wedbush Morgan noted that homebuilders such as D.R. Horton are feeling the pinch of higher mortgage rates but remain “upbeat” given that potential home buyers are still visiting model homes at a healthy clip and that given the tightness in supplies in many markets potential demand remains favorable.

The problem, unfortunately, is in converting people who want to buy a home into people who actually buy a home. Recent polls suggest that only one third of potential homebuyers can afford a home currently. The flip side is that the potential pool of buyers will increase rapidly once conditions improve.

As a result, homebuilders are shifting their strategies toward building smaller homes with fewer standard options, expanding their townhome offerings, and offering more incentives such as offering higher mortgage buydowns.

The bottom line is a shift toward affordability in order to move those potential buyers off the sidelines and into new homes.

On the other hand, lower lumber prices are likely to be helpful in preserving profits and margins even as home prices stabilize. And the migration to suburbs, and the sunbelt is not likely to abate anytime soon.

Have Bond Yields Finally Topped Out?

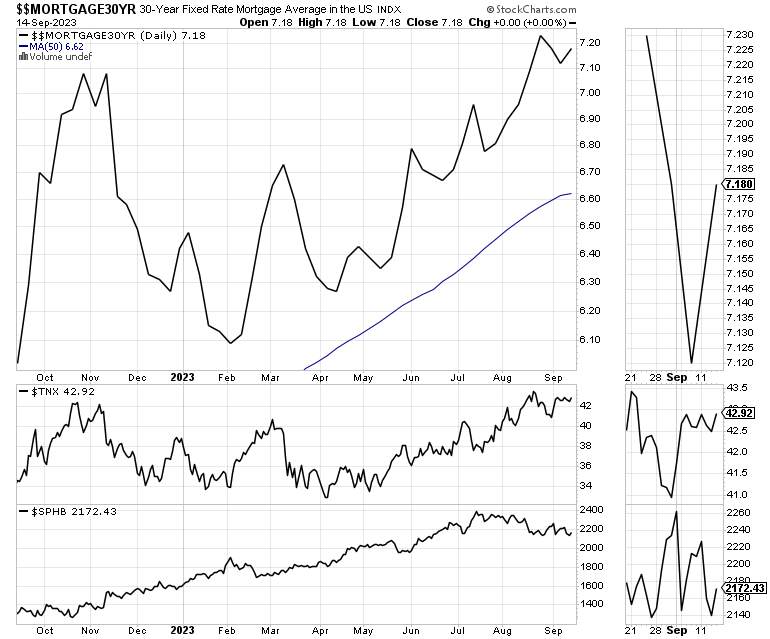

The U.S. Ten Year Note yield (TNX) is the benchmark for 30 year mortgages in the U.S. As a result, the relationship between TNX, mortgage rates (Mortgage), and the S&P Homebuilder sector (SPHB) is important to monitor. You can see the remarkably close ties between the three in the chart below.

What we’ve seen over the last four months is a steady rise in TNX which has led to an equally steady rise in mortgage rates. Currently, there is roughly a three point difference between TNX and the 30 year mortgage average.

What’s most interesting, however, is that the homebuilder stocks ignored the rise in mortgage rates and TNX until TNX crossed 4% and mortgage rates followed by rising above 7%.

In other words, those seem to be the magic numbers for this stage of the cycle. Thus, a reversal below those key rates would likely lead to a rebirth in the homebuilder sector.

Currently both bond yields and mortgage rates are testing the upper borders of their recent trading ranges. What’s encouraging is that even though both consumer (CPI) and producer prices (PPI) came in hotter than expected for August, mostly due to higher oil prices, the response in the bond market has been relatively subdued.

This is encouraging in the short term.

Are Homebuilders Stocks Bottoming Out?

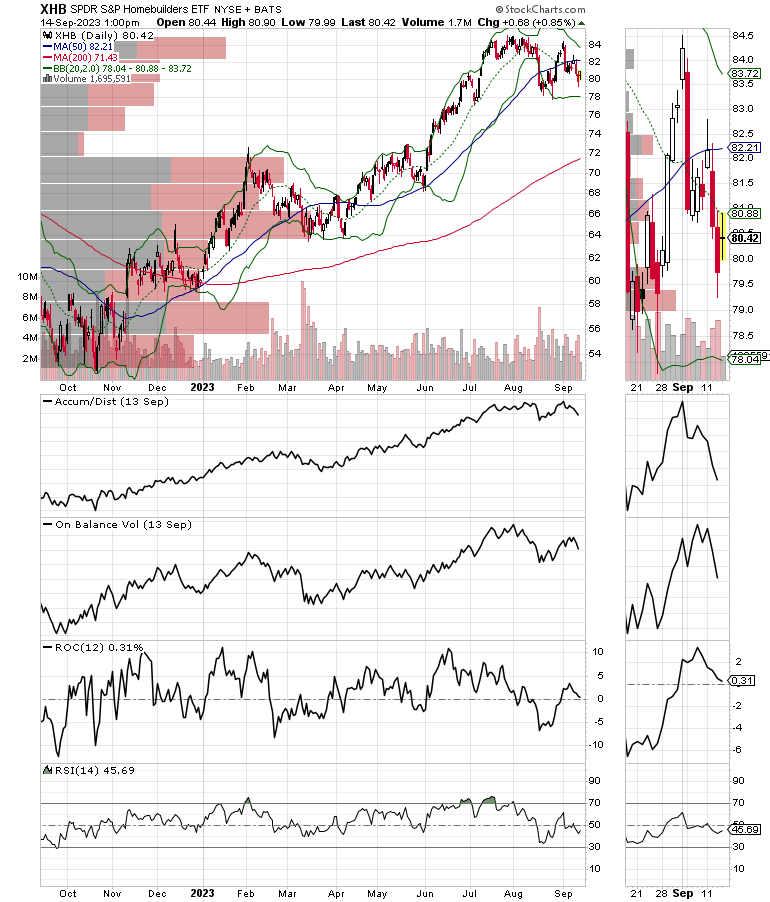

A more direct way to gauge investing in the homebuilders is by monitoring the action in the SPDR S&P Homebuilders ETF (XHB). As the price chart shows, XHB rolled over about the same time as SPHB – when mortgages crossed above 7%.

What we see now, is that XHB is trying to bottom out. Specifically, we’ve seen the price hold at $78 three times (once in June, and twice in August). The longer the XHB price stays above $78, the better the odds of a rebound.

Thus, if XHB remains above $78 and builds a base over time we may have seen the worst for the sector.

Homebuilder stocks are moving toward the top of my Buy list these days. I’m not quite ready to pull the trigger yet. But I’ll be watching this carefully and have some BUY recommendations when the right time comes at Joe Duarte in the Money Options.com.

Bottom Line

If interest rates remain stable, the supply and demand equilibrium will continue to favor homebuilders and related companies. Moreover, a decline in rates will likely revive the homebuilder stocks.

Regular readers of these posts, and subscribers of Joe Duarte in the Money Options.com have been aware of these developments for some time. I continue to adjust real estate and housing related investments in the model portfolios on a weekly basis while providing macro and supportive data here. If you’re not a subscriber take a two week Free Trial and check it out. Click here.

Thanks to everyone for their support. This page is growing steadily thanks to you. I really appreciate it.

If you like this report and want to receive it on a weekly basis, consider becoming a member.

I also appreciate single coffees, which you can buy me here.

Special shoutout to new member Retired Kevin. Thank you for your support.

Please hit the Like button. It helps to spread the word.

You’re the music. I’m just the band.