The Federal Reserve will announce its latest interest rate move at 1:00 P.M. Central Time today. There is a growing consensus in the markets that the central bank will not raise interest rates this time. A smaller consensus suggests the Fed may be done raising rates altogether.

The truth is no one knows what the Fed will do. What we do know is that it pays to be prepared.

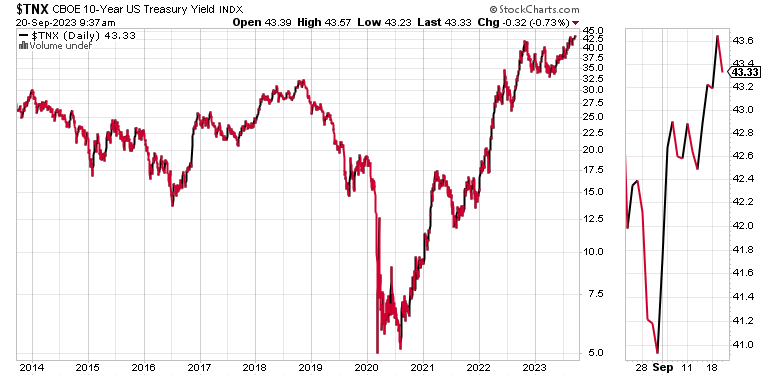

Ahead of the Decision, here are some important price chart points to consider. First, the U.S. Ten Year Note yield (TNX), which is knocking on the door of a multi-year high has eased. This is a positive, but it could reverse after the Fed's announcement.

The U.S. Ten Year Note yield is the basis for most 30-year mortgages. The recent rise in TNX has led to a steady decrease in mortgage activity. Interestingly, the latest mortgage numbers show an increase in mortgage refinancing activity. At first sight, this makes little sense. But a closer look suggests that homeowners may be tapping into their equity in order to pay off rising credit card debt.

The key chart point is 4.37%. If TNX rises above 4.37% after the Fed's announcement it will likely have a negative cascade effect through the real estate markets, starting with the homebuilder stocks and spreading through the real estate investment trusts (REITs).

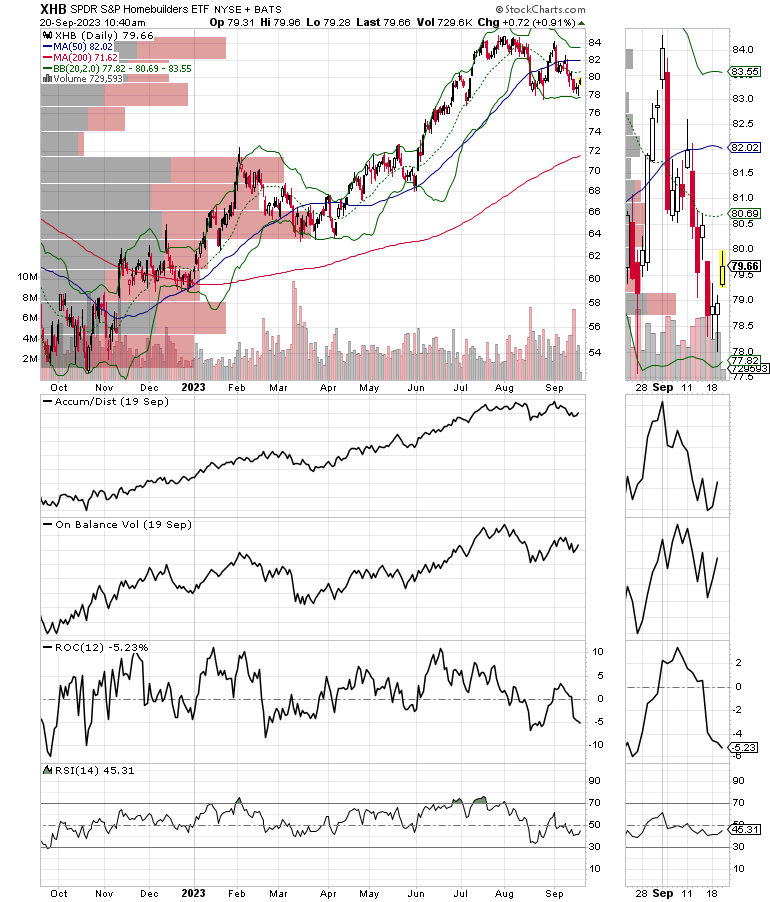

The action in the homebuilders, as in the SPDR S&P Homebuilders ETF (XHB) was encouraging ahead of the Fed's announcement. As I noted here last week, the recent action in XHB has been encouraging. That's because the $78 price support area in XHB has held up. Moreover, both the Accumulation/Distribution (ADI) and On Balance Volume (OBV) lines are showing signs of turning up.

Those are signs that money is moving back into the homebuilders. Of course, long term, the market's supply and demand balance favors homebuilders. In the short term, however, negative news from the Fed would likely push XHB down.

The take home message here is that as long as XHB holds up above $78, the case for an improvement in the homebuilder sector remains intact.

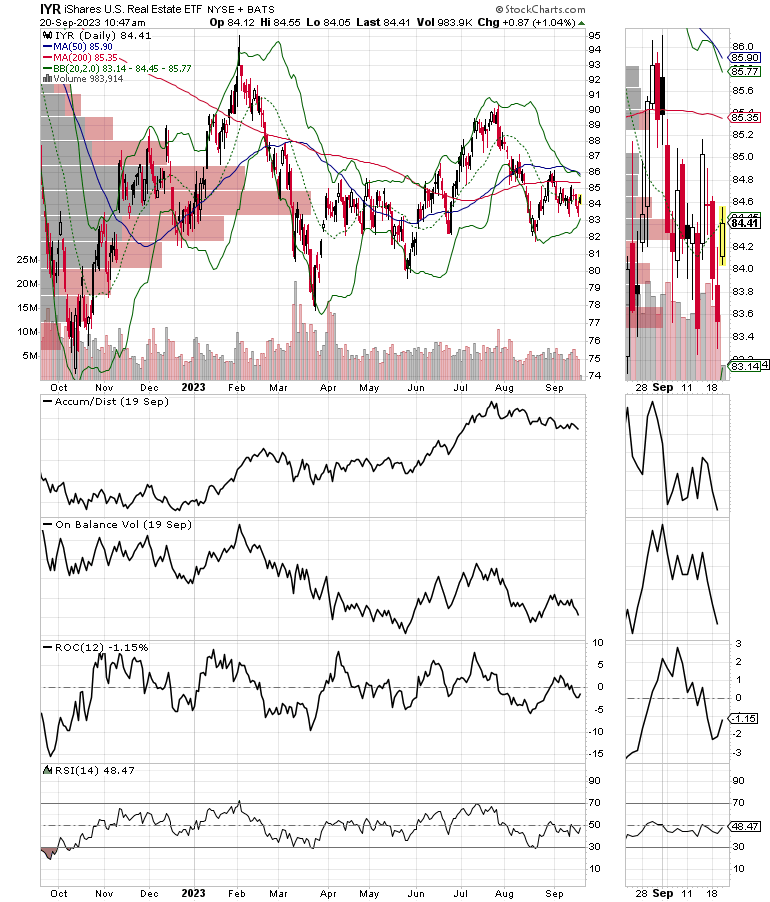

The REIT sector has also been forming a base of late, which is encouraging. The iShares U.S. Real Estate ETF (IYR) has held well above its April price bottom, also at $78. The difference between IYR and XHB, however, is that ADI and OBV for IYR are more sluggish than those for XHB.

The reason is that IYR holds both commercial (CRE) and residential REITs. The ongoing problems for CRE weigh down the CRE holdings in IYR and thus five the ETF a weaker appearance than what we see in XHB which is a pure play on homebuilders and closely related companies.

Bottom Line

The take home message here is twofold; investors in the homebuilder sector are presently more optimistic than those in commercial real estate. If the Fed's next move on interest rates is seen as bullish by the markets, expect both IYR and XHB to rise.

If the U.S. Ten Year Note yields (TNX) rises above 4.37% in response to the Fed's move, it will likely be very negative for all areas of real estate, and the stock market in general.

As long as XHB and IYR don't fall below $78 per share, however, the bullish case remains alive.

I have a lot more detail and individual homebuilder and REIT stock picks at Joe Duarte in the Money Options.com. You can check them out with a FREE two week trial to the service by clicking here.

Thanks to everyone for their support. This page is growing steadily thanks to you. I really appreciate it.

If you like this report and want to receive it on a weekly basis, consider becoming a member.

I also appreciate single coffees, which you can buy me here.

Please hit the Like button. It helps to spread the word.

You’re the music. I’m just the band.