It’s time to selectively buy homebuilders. I’m not suggesting we rush out and triple mortgage our net worth to buy homebuilder stocks. But, as a contrarian investor, it’s my nature to question the conventional wisdom and to look for opportunities in areas of the market that the majority is avoiding.

The general opinion which seems to be evolving is that the homebuilding boom is over. I’m not so sure, although the sector is becoming more individualized with some stocks looking better than others.

Certainly, higher interest rates are changing the dynamics of the housing market while an apparent increase in existing home inventory is starting to affect builder strategies on both incentives and the rate of new home builds.

Recent data suggests both new home sales and existing home sales for March were below expectations. The limiting factor seems to be persistently higher prices.

But that’s not the whole story. There are other factors which are starting to reassert themselves, and which could provide a boost to both new home and existing home sales in the not too distant future. Spoiler alert; the Great Migration may be picking up steam.

Over the last few days, I’ve seen a significant uptick in out of state license plates in my neck of the woods, North Texas – the DFW metroplex. On a recent trip to the grocery store, which spanned an area of a few miles and a time span of 20 minutes there and back drive time, I saw nine out of state license plates – on cars, not trucks; five from California, and one each from Oregon, Idaho, Missouri, and Wyoming. The Missouri one was not that uncommon these days.

The five plate cluster from California was certainly worth noting. Of course, these license plates are in addition to the usual gaggle from Illinois, Florida (lots of Florida), Virginia, Nevada, Mississippi, Oklahoma, South Dakota, Alaska, Iowa, and the occasional Massachusetts and Maine. Still, it had been a long time since I’d seen that many on the roads in such a short period of time.

What’s up with Florida? I’m starting to note more New York plates too. Is there any truth to what this guy is saying on You Tube? Leave me some comments, but keep it friendly. I’m not interested in the politics just in the potential for an acceleration of demand for housing in the South.

Horton Delivers Upside Surprise

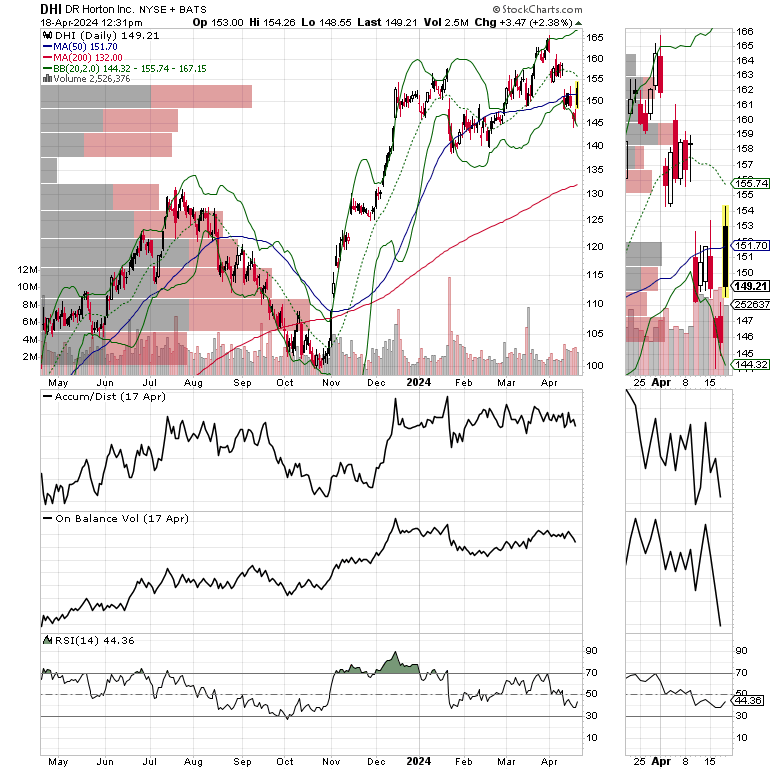

In Q4 2023, homebuilder D.R. Horton (DHI) laid a big egg on its earnings report, missing across the board. I wrote about it extensively here. The big problems were a derivative trade that went wrong, and a rise in empty houses sitting on lots as higher interest rates bit into home buyer’s appetite for new digs.

Flash forward to Q1 and Horton is back in the saddle, delivering beats across the board and raising its forward guidance. The biggest growth is sales registered in the Southern U.S.

The stock is having quite a day. I own shares in DHI.

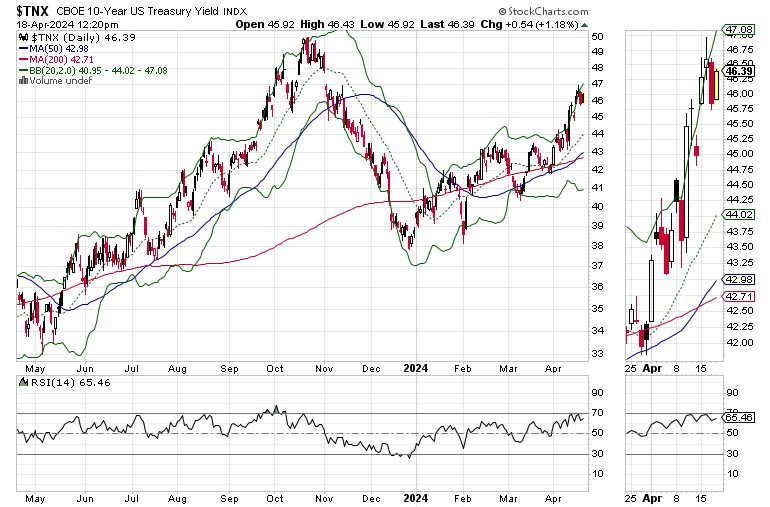

The Fed Says It’s Losing the Battle on Inflation

Fed Chairman Powell recently spooked the bond market when he noted that the Fed isn’t seeing as much progress on inflation as it had been in the recent past. He was clearly referring to the recent CPI and PPI numbers. The market took it as a signal that there won't be any rate cuts anytime soon.

Yet, the Fed’s most recent Beige Book seems to be taking a much more sedate view on the economy than Mr. Powell. The latest installment noted that two Fed districts reported no growth while the other ten reported slight or moderate growth. Other highlights were: non-discretionary consumer spending is slowing, labor supply seems to be increasing, except in specialized areas, and wage growth may be slowing. Interestingly, respondents noted that they were having a hard time passing price increases on to customers.

Thus, “soft” or anecdotal data, the stuff we actually see and experience when we go around and visually inspect and participate in the economy, and gets reported in the Beige Book, as opposed to using seasonally adjusted data, suggests that maybe the economy is slowing. One set of data is right and the other set is certainly raising some questions.

For the housing markets, a recession would be a negative. But a slower pace of growth may be just enough to lower interest rates, and could well spur the next up leg in the sector.

Interest Rates and Supply

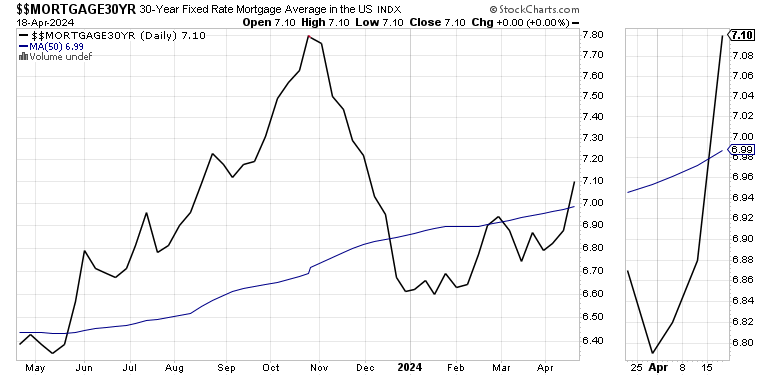

Over the last few weeks, in multiple posts, I’ve noted that the housing market has become very attuned to interest rates and is now a fully integrated timing mechanism with potential buyers and sellers waiting for declines in market interest rates, via bond yields and their direct effect on mortgage rates before flooding the market with bids and offers.

Nowhere was this more evident that in this week’s housing starts data which delivered a big miss to expectations via a 14.7% month to month decline in housing starts and a 4.3% drop in building permits. This is the largest month to month drop in housing starts since the start of the pandemic.

The biggest subcategory hit came in rental home starts which dropped nearly 21% month to month, leaning heavily on multifamily (apartment) rentals. This should come as no surprise given the increasing difficulties being faced by commercial real estate firms, a sector where office building defaults are increasingly common.

If you’re looking for a reason beyond interest rates, look to supply, which may be increasing. According to the latest data from Housingwire.com, the number of single family homes on the market is now up by over 13,000 units over the last week of reporting with the total number at 526,432. This is likely the main reason why housing starts fell in the past month as builders scale back their new starts as competition from existing homes hits the market. On the other hand, if more people are coming to the South, the rise in inventories may be temporary.

According to Housing Wire, in some cases, builders are having to cut prices on new homes in order to lock in buyers. It seems to have worked for Horton, which is selling higher numbers of smaller, lower priced homes.

For their part, interest rates are testing key areas of resistance. Specifically, the U.S. Ten Year Note yields, which is the primary driver of mortgage rates, is near 4.7%. A move above 4.8% would be a big negative as it would raise the odds of another move toward 5%.

The average 30-year mortgage rate is now above 7% with the crucial point being 7.2%. A move above that would be very negative for the housing market.

Bottom Line

My contrarian brain is telling me to stay alert to the action in the homebuilders as few investors seem to want to own them. The “hard data,” such as CPI and monthly payrolls suggest the economy is not just strong, but in an inflationary phase. Yet, my grocery bill, although higher than last year’s, doesn’t seem to be getting bigger, although I wish it would start falling. My grocery bill is more reflective of the Fed’s Beige Book than of CPI.

The bond market remains fickle, which is straining the economy, and the stock market is responding to the bond market’s fickle tantrum with volatility.

The Fed is signaling that it’s not going to lower rates any time soon. Yet, the Beige Book says that the economy is just muddling along. That suggests that any external shock could push it into a potential recession.

The Great Migration seems to be picking up steam, which may be the reason for D.R. Horton’s bullish earnings, as the largest portion of its sales boost came from the Southwest, the Central South, and the Southeast.

What’s my point? Homebuilder stocks are highly interest rate sensitive, but also moved by supply and demand, which is now in flux and could tip over to a period where supplies fall as builders are building few homes. If the bond market starts to ease up on its skittishness, and mortgage rates drop, we are likely to see a boost in the homebuilders. I for one am preparing.

Incidentally, I just added two new homebuilder picks at Joe Duarte in the Money Options.com. Check them out with a Free Two Week Trial here.

If you have any questions or comments about Buy Me a Coffee related content, you can contact me through Buy me a Coffee or through this e-mail: [email protected]. Please refer all your Buy me a Coffee questions as above, not through Joe Duarte in the Money Options.com.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.