I’ve been bullish on the homebuilder stocks for a long time, and I haven’t changed my long term positive view. Lately, the sector has had some ups and downs related to the ebb and flow of interest rates. Yet, the long term fundamentals remain strong, as there aren’t enough homes in the market to accommodate the steady demand, especially in the Southern U.S. and parts of the Midwest.

Subscribers to Joe Duarte in the Money Options.com have profited from this bullish stance for some time, especially recently when I recommended increasing position sizes in our homebuilder holdings, as I described in this timely post.

But as the long term trend in the homebuilder sector matures, especially in light of no major changes in the supply demand scenario, a new wrinkle is emerging, the potential for a rush into company mergers and takeovers.

The First Shot Across the Bow

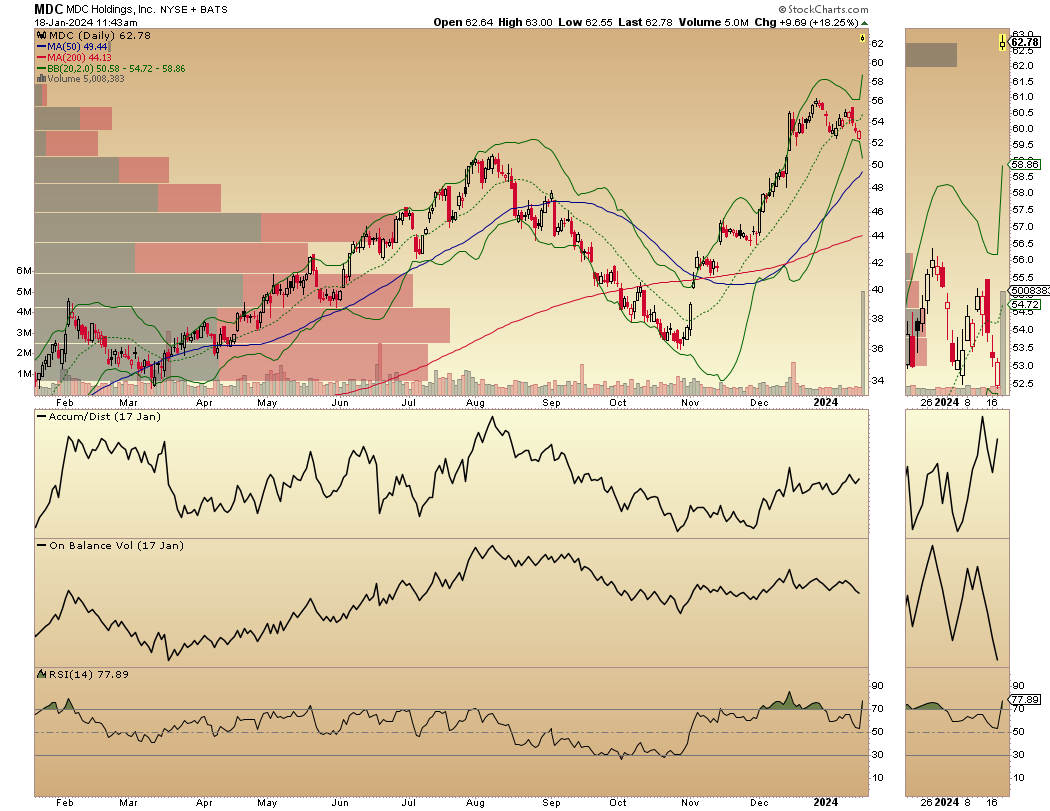

In a surprising development, Japanese homebuilder, Sekisui House (SKHSY) has bought U.S. homebuilder MDC Holdings (MDC) for an all cash offer of $4.9 billion ($63 per MDC share), pushing MDC’s price 18% from the prior day’s close.

What makes this purchase interesting is that Sekisui is pursuing the goal of building 10,000 homes per year outside of Japan. Moreover, the news put a floor on the homebuilder sector which has been limping lately as bond yields have been on the rise.

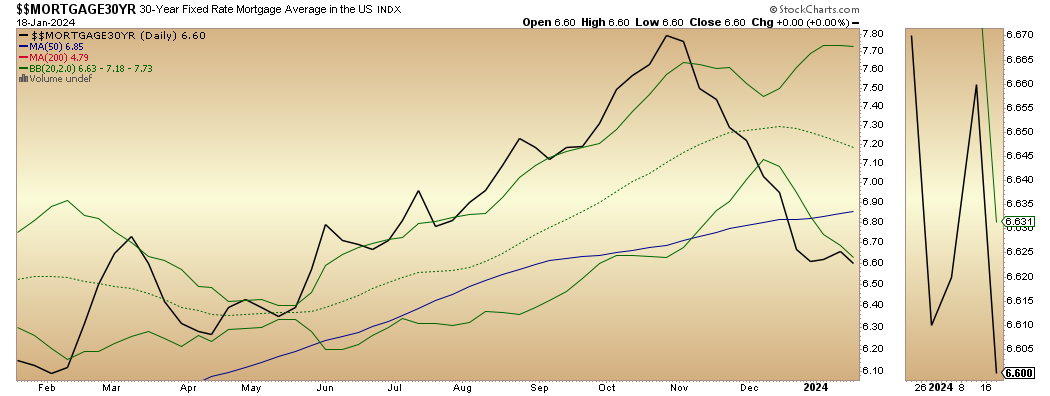

The U.S. Ten Year Note yield (TNX), the benchmark for the U.S. mortgage market, has been creeping up of late. Most recently, it has crossed above the 4.1% area, which is of concern. Much of the climb has resulted from the recent climb in U.S. CPI, and the walking back of rate cut talk from the Federal Reserve. A move above 4.2% would likely signify an acceleration of the yield rise.

Meanwhile, the situation in the Red Sea continues to worsen, hinting at higher shipping costs which may be passed on to consumers and reignite inflation. Regular readers of Joe Duarte in the Money Options.com have been aware of this dynamic for some time, as I noted here.

No Help for Supply Means Steady Action in Homebuilder Stocks

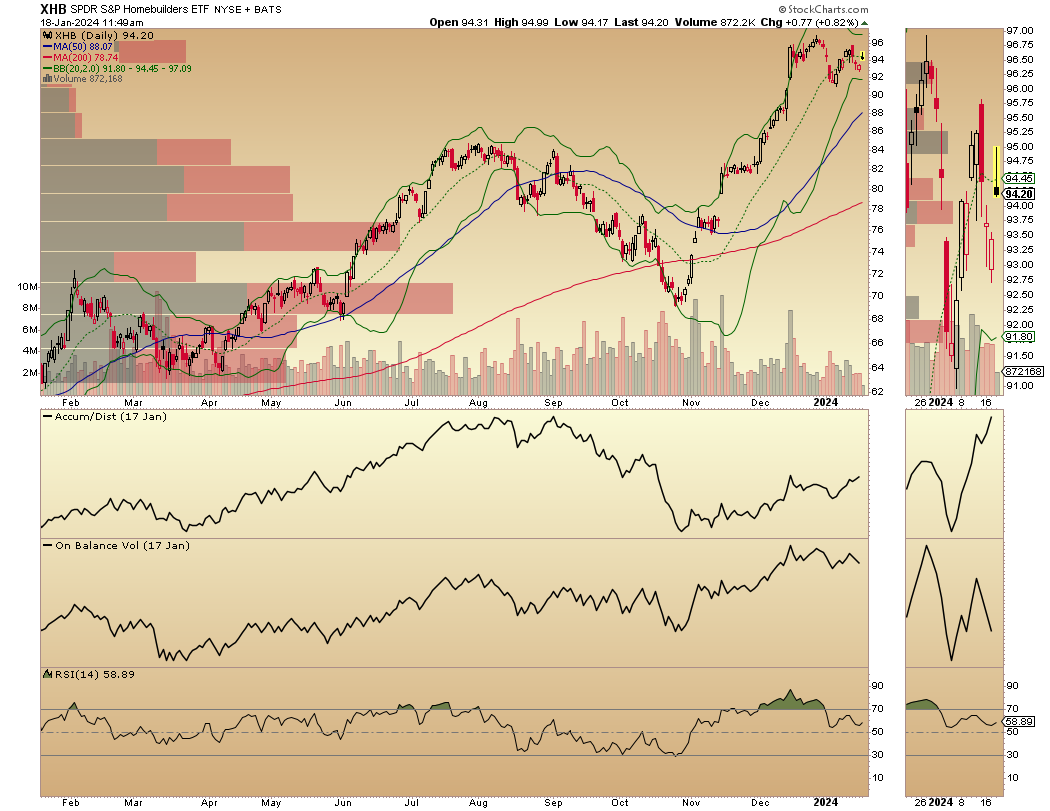

Certainly, higher bond yields are a negative for the housing market, including the homebuilders, realtors, and rental property companies. Still, compared to past cycles, homebuilders are not channeling their recent profits into overbuilding.

Housing starts for the month of November showed a month to month decline while previous numbers were revised lower. Single family led the way. Meanwhile building permits also declined.

Meanwhile mortgage rates were lower for the week, but are likely to rise by next week given the increase in TNX.

In the wake of higher interest rates, the SPDR S&P Homebuilder ETF (XHB) remains in a consolidation pattern. On the positive side, the ADI line is rising, which is a sign that short sellers are not staying in their positions. The opposite is evident in the OBV line which is down sloping as buyers take profits.

The rental property REITs are proving to me more sensitive to the rise in TNX. The iShares Residential Real Estate Capped ETF (REZ) is in a short term down trend, having broken below its 20-day moving average. ADI is stable as short sellers are still holding on to positions while OBV is moving lower as buyers seem to be getting bearish in the wake of the rise in TNX.

For the latest on homebuilders, REITs, and option trades on all sectors, try out a FREE two-week trial to Joe Duarte in the Money Options.com.

Bottom Line

The trend in the U.S. Ten Year Note yield (TNX) remains the key driver of the price direction for homebuilders and REITs.

As long as the Fed continues to pull back its rate cut rhetoric, we should expect yields to creep up unless inflation indicators resume their downward course.

Homebuilders are holding up better than REITs as supply and demand is in their favor and now there is the possibility that a wave of mergers may be about to emerge in the sector.

Thanks to everyone for your support. I really appreciate it.

This weekly report is available on my Buy Me a Coffee Page. If you like this report and want to receive early access this type of content on a regular basis, consider becoming a member.

I also appreciate single coffees, which you can buy me here.

To subscribe to my premium service, Joe Duarte in the Money Options.com, click here.

Please don’t forget to hit the Like button on the posts. It helps to spread the word.

You’re the music. I’m just the band.

# 1 NEW RELEASE ON OPTIONS TRADING

#1 New Release in Options Trading

Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition) Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)

4.5 out of 5 stars 61 ratings

#1 New Release in Investment Analysis & Strategy

# 1 NEW RELEASE ON OPTIONS TRADING