The stock market has been on a roller coaster as fears of inflation have been on the rise. The most recent set of inflation numbers, this morning’s Personal Consumption and Expenditure indicator (PCE), the Fed’s favorite inflation gauge came in a bit hotter than expected. But given the worse inflation numbers reported over the past month, and the market’s very negative reaction to the data, the PCE turned out to be mostly a non-event.

I watched the action in the homebuilders and the Real Estate Investment Trusts (REITs) as both the bond and stock markets sold off aggressively on 4/25/24. In case you missed it, the GDP reading for Q1 2024 delivered a doubly negative dose of data.

First, GDP growth was cut over 50% from Q4 2023, coming in at a year over year growth of 1.6%, vs. the expectations of at least a 3% growth rate. In addition, the GDP Deflator, an embedded measure of inflation inside the data came in at 3.1% year over year growth, also above expectations which were centered at the 3% area.

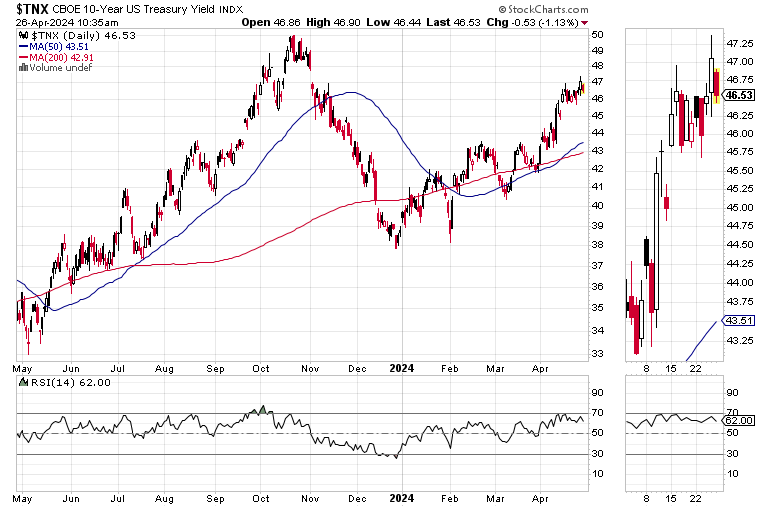

The battle cry for STAGFLATION rose among the Wall Street crowd and stocks sold off as bond yields moved decidedly higher. The U.S. Ten Year Note yield, the benchmark for the average 30-year mortgage moved toward its recent high of 5%.

On the other hand, just as I’ve been expecting, money has been sneaking into the homebuilders and the residential REITs as the demand for housing continues to outpace supply. I recently detailed why I have become more bullish on the homebuilder sector, as I recently posted here.

In brief, as the price charts below illustrate, we are in a once in a generation megatrend where the pandemic created a population migration dynamic, which seems to be accelerating, and which favors homebuilders.

So, while homebuilders are highly interest rate sensitive, the ongoing supply squeeze for housing, especially in areas of the country where populations are migrating to, continues to overshadow the pressure exerted on potential buyers by rising mortgage rates.

All of which favors homebuilders, while the market is waking up to the attractiveness of residential REITs.

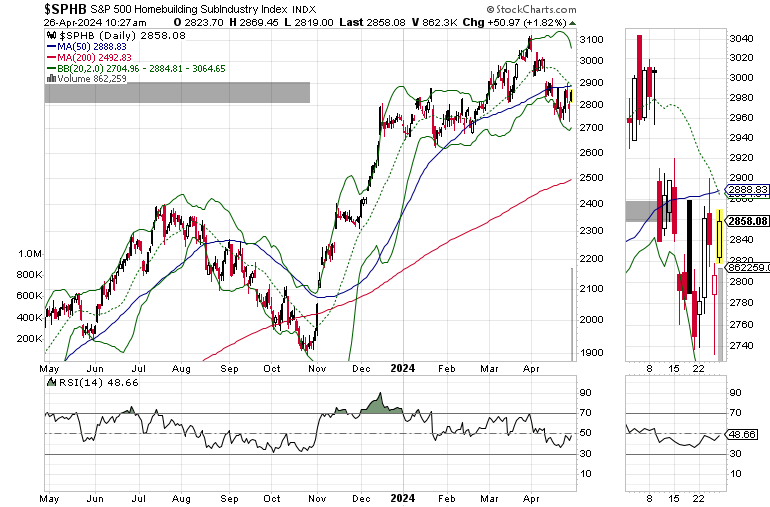

Homebuilders Bent but Didn’t Break on Inflation Data

Interestingly, although they initially sold off on the bad inflation news earlier in the week, the homebuilders, as in the S&P 500 Homebuilding Subindustry Index (SPHB) found support toward the lower end of their multi-month trading range after the negative inflation barrage we’ve seen lately.

The sector, overall, remains in a neutral position, with a bullish bent. That’s because even though interest rates are rising, and the Federal Reserve isn’t likely to lower them anytime soon, there is still a tight supply environment in the housing sector, which favors homebuilders.

Both new and existing home sales continue to hold steady, and homebuilder earnings, such as for D.R. Horton (DHI) and others in the sector continue to beat expectations more often than not. This, is not by accident, which is why I’ve recently added homebuilder positions to both Joe Duarte in the Money Options.com, the Smart Money Passport Substack and the Sector Selector ETF service, hosted here at Buy me a Coffee for members only.

There are two salient points to note in the SPHB chart. First, the index is still in a trading range, although it is bouncing off the bottom of its recent trading range. But you’d expect the action in the U.S. Ten Year Note yield (TNX) and mortgage rates; see below, to have decimated this sector.

They haven’t, which is why I’m increasingly bullish.

The answer as to why higher mortgage rates haven’t crushed the homebuilder stocks is that supply remains on the side of the homebuilders because even though existing homes are starting to move back into the market, causing a slight rise in inventories, the homebuilders, via incentives and the ability to negotiate due to their scale and size, are able to make deals while individual homeowners aren’t as able or willing to do so.

In addition, homebuilders continue to make money by building homes and selling them to REITs who then rent them. This offers homebuilders, an albeit smaller, but additional income stream.

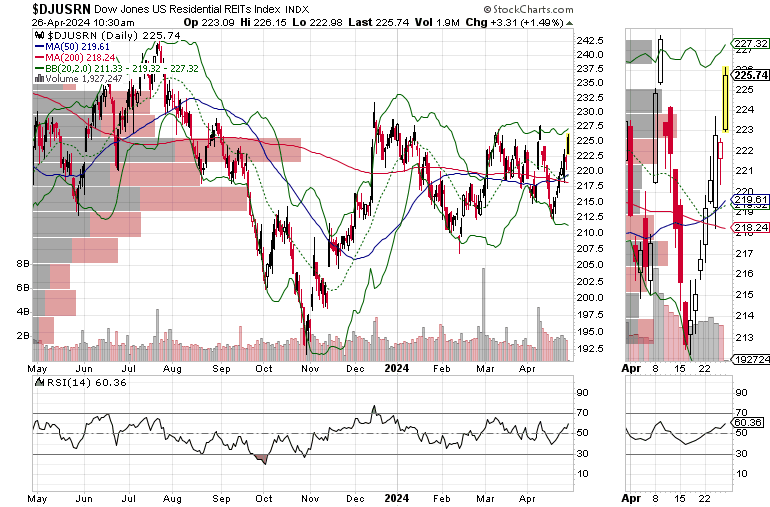

Residential REITS Power Higher

Just as interesting is the action in the real estate investment trusts (REITs), especially the residential REITs where the Dow Jones US Residential REIT Index (DJUSRN) is tracing out a similarly patient chart pattern to SPHB above.

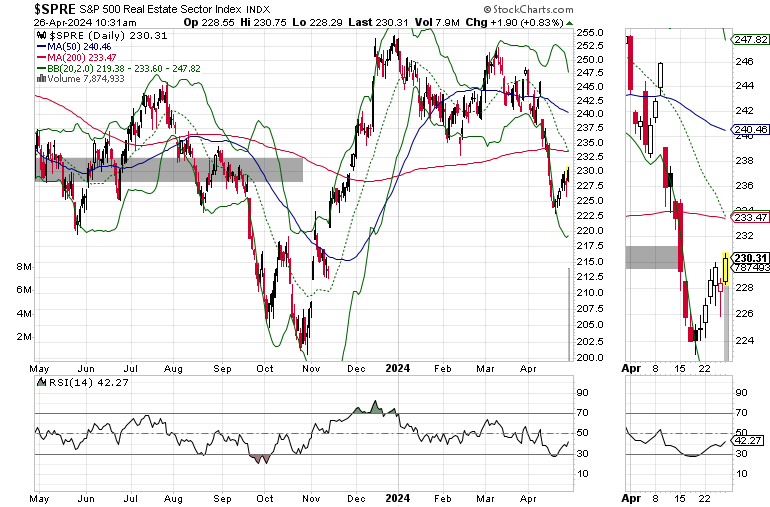

Note that DJSRN is not just trading above its 200-day moving average and that the ADI and OBV lines are both moving higher as money is moving into residential REITs, but that the sector is nearing a breakout, where a move above $230 could push it significantly higher. Compare the residential REIT chart to that of the overall REIT sector, as in the S&P 500 Real Estate Sector Index (SPRE) which also includes commercial real estate (CRE) REITs.

So, while the residential REITs are bucking the downward pressure of higher interest rates, again due to a favorable supply and demand situation, the rest of the REIT sector is struggling as CRE continues to weigh on investor psyches.

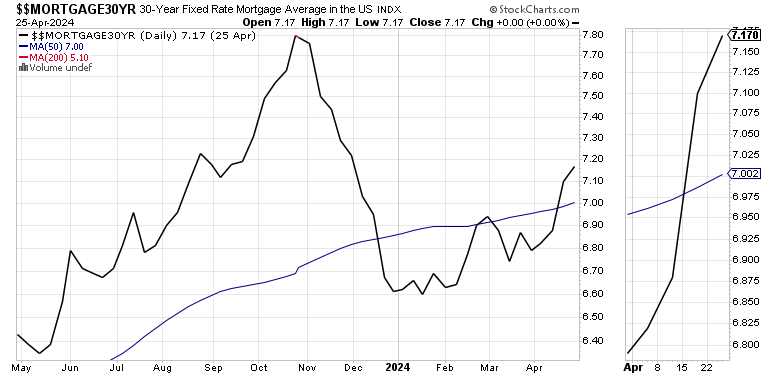

Bonds and Mortgages Rise

The U.S. Ten Year Treasury Note yield (TNX) threatened to rise above 4.7% in response to the worse than expected inflation numbers we’ve seen of late. But, so far, this level has been difficult to conquer for bond bears.

Mortgage rates, however, have been moving higher more aggressively, with the 7% area now becoming a tough support level. On the other hand, expect a bullish move in homebuilders and residential REITs if mortgage rates fall below 7% in the next few weeks.

Bottom Line

Homebuilders and residential REITs are showing significant strength in the face of rising bond yields and mortgage rates. That’s because the housing shortage is still operational and supply and demand are in their favor.

Any drop in bond yields we experience over the next few weeks, will likely drop mortgage rates. That kind of trading action should be bullish for both homebuilders and residential REITs. As a result, I have added several homebuilder and residential REIT trades to all of my services recently.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks also to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

I also appreciate single coffees, which you can buy me here.

If you like this post, please hit the Like button and share it with your friends. It helps the service grow.

For short term trading opportunities have a look at the Smart Money Passport Substack.

For intermediate and long term trading dividend generating investment picks take a Two-Week Free trial to Joe Duarte in the Money Options.com.

If you have any questions or comments about Buy me a Coffee or Substack, you can contact me through Buy me a Coffee or through this e-mail: [email protected].

You’re the music. I’m just the band.