What is a payment gateway?

There are many payment gateways to choose from, but some of the most common include Stripe, PayPal…

First, you need to create a merchant account and link the payment services with it. The merchant account deposits the payment from the customer directly to your company’s bank account.

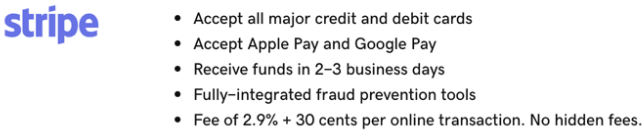

Stripe

Stripe is a popular complete payment platform. It can bill customers as well as accept online and in-person payments. Data security is another plus of using Stripe as the backend payment processor for your website.

Stripe supports processing payments in 135+ currencies, allowing you to charge customers in their native currency while receiving funds in yours. This is especially helpful if you have a global presence, as charging in a customer’s native currency can increase sales.

Their processing fees begin at 2.9 percent plus $0.30 per transaction with their Integrated plan. They also offer a Customized plan that they can tailor to your business needs.

Test Stripe Checkout Demo --> https://techtolia.com/Stripe/

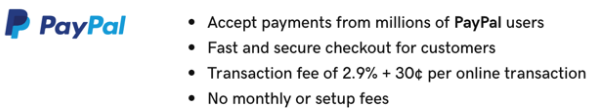

PayPal

PayPal is one of the most popular Online Payment Processing System available in more than 200 countries/regions and support 25 currencies. Customers worldwide know and trust the name.

Small businesses and e-commerce platforms can use PayPal to safely accept payment in person, online, or by phone. Accepted payment types include PayPal, Venmo, and PayPal Credit. PayPal includes the added security of advanced fraud protection technology.

Their processing fees begin at 2.9 percent plus $0.30 per transaction.

Test PayPal Checkout Demo --> https://techtolia.com/PayPal/

Types of Online Payment Methods for Websites

The different types of payment options that you can integrate in your website are:

Cards

Bank redirects

Bank transfers

Wallets

Cards

Support several card brands, from large global networks like Visa and Mastercard . When you integrate a Payment Method, you can begin accepting a diversity of card brands without any additional configurations, including:

American Express

China UnionPay (CUP)

Discover & Diners

Japan Credit Bureau (JCB)

Mastercard

Visa

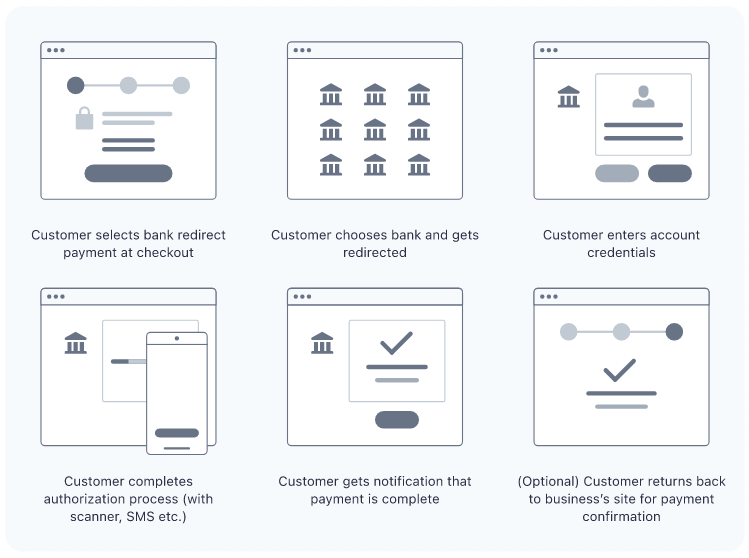

Bank redirects

Bank redirects let customers pay online using their bank account. They drive more than half of online commerce in Germany, the Netherlands. Bank redirects are often used by:

Retailers that want to improve conversion and reduce fraud with consumers in Europe and Asia Pacific.

Software or service businesses collecting one-time payments from other businesses.

Bank redirects may not be a good fit for your business if you sell subscriptions. Some bank redirects don’t support recurring payments.

Bancontact

EPS

giropay

iDEAL

P24

Sofort

BLIK

MyBank

Wallets

Alipay

Apple Pay

Click to Pay (Secure Remote Commerce)

Google Pay

Microsoft Pay

Customers can use wallets to pay online with a saved card or a digital wallet balance.

Retailers often use wallets to:

reduce fraud and increase conversion on mobile

reach buyers in China, where wallets are the most popular way to pay

Wallets may not be a good fit for your business if:

You sell subscriptions. Some wallets don’t support recurring payments.

Bank transfers

Multibanco

Bank transfers let customers send money to you directly from their bank account. Bank transfers are often used by:

Software or services businesses accepting large, one-off payments from other businesses.

Businesses that want a low-cost alternative to cards for large one-time consumer payments, like car or auction purchases.

Bank transfers might not be a good fit for your business if:

You accept many low value transactions. Customers have to initiate bank transfers through their bank account, and can send the wrong amount.

You need payments to be completed at a specific time. It may take a customer hours or even days to send payment via their bank and bank transfers have varying speeds by market

You frequently send refunds. Most bank transfer methods don’t support refunds directly. To refund a transaction, Stripe contacts the customer to find the best way to refund them. The customer may not always respond.

Include an SSL on your website

When a customer enters their personal information and payment details, they need to know they can trust your site. An SSL certificate shows that your website is secure and encrypts credit card information. Be sure to display the certificate or other security credentials on your site or during the checkout process to reassure users that their information is safe with you.