However, the crypto projects close connections to big tech, it’s heavy venture capital backing and it’s messy main net launch have left many in the crypto community questioning Aptos’s endgame.

Today, I’m going to tell you everything you need to know about Aptos, including where it came from, who made it how it works, the tokenomics of APT, and whether this crypto project has any potential.

Note: The whole content is converted from Coin Bureau’s “Aptos Review: APT Any Potential?! This You Need To Know!” YouTube video after requested the whole permissions.

Aptos History

As some of you will know, the history of Aptos begins with DIEM. For those unfamiliar, DIEM was Facebook’s now META’s failed digital currency project.

Facebook’s blockchain arm started working on DIEM in 2017. Back then DIEM was known as Libra, which might ring a bell. Now in contrast to actual cryptocurrencies, Libra was going to be a centralized blockchain controlled by Facebook and its constituents.

The Libra coin itself was going to be a stable coin backed by a basket of fiat currencies. What’s interesting is that Libra was actually supposed to decentralize after five years.

Wwhen Libra was revealed to the public in 2019, governments around the world went into crisis mode, the idea of a big tech company with billions of users rolling out its own digital currency terrified them. If you read any of our articles about crypto regulations, you’ll know they were largely inspired by Libra.

The regulator’s cracked down on Libra harder than the asteroid that killed all the dinosaurs 66 million years ago, Libra tried ditching its plans to decentralize, tried to bow to the global banks and even tried rebranding to DIEM to get through all the red tape. It didn’t work and DIEM died in January this year.

However, that didn’t stop some of DIEM’s developers from starting their own crypto projects. To my knowledge, there are two the first is Aptos and the second is SUI. SUI recently raised $300 million from crypto VCs but has yet to launch its main net we will cover Suey once it’s up and running.

Next ADA, SOL & ATOM: APTOS and SUI, Two Ex-META (Facebook) Team’s Projects

New two Layer-1 projects are too fast over 130.000+ TPS.

As for Aptos. It was founded in late 2021. As a fun fact. Aptos is the name of an unincorporated town on the coast of California. Aptos reportedly means for the people in the indigenous language of the area, but some sources suggest it means meeting of two waters.

In any case, being named after a coastal area of California is one of the many similarities Aptos shares with Solana. For context Solana was named after a California and beach town that’s about 30 minutes north of San Diego. Not surprisingly, the teams behind both Solana and Aptos are based in Silicon Valley.

About Aptos

Aptos was founded by Mohammed Shaikh and Avery Ching. Mohammad holds a master’s in business administration and his previous work experience is as impressive as it is terrifying. His resume includes BlackRock, the Boston Consulting Group, Ethereum buildup consensus, and of course META.

Avery, meanwhile, holds a PhD in computer science and has spent most of his career working as a principal software engineer at Facebook, one of the highest positions in the company. I also couldn’t help but notice that Avery briefly worked at the Los Alamos laboratory in Nevada, a facility famous for its military research.

Now, what’s odd is that Aptos reportedly has over 350 developers working on its blockchain. Yet only Mohammad and Avery are noted as being part of the Aptos Labs team on the company’s website. The Aptos Labs LinkedIn also has a low number with just 78 employees at the company.

What’s even more odd is that there isn’t any information about the Aptos Foundation, which oversees the crypto projects development, nor its members. The terms and conditions of the website revealed that the Aptos Foundation is based in the Cayman Islands. Recall that Aptos Labs is based in the USA.

Despite these peculiarities, Aptos managed to raise $350 million from various crew to VCs across two funding rounds. The first funding round was for $200 million in March this year, and the second was for $150 million in July this year. The Aptos white paper was published in August.

Aptos is second funding round was especially significant, because it was led by FTX Ventures. It looks like FTX is one of the largest, if not the largest investor in Aptos. Heavy investment from FTX is another thing that Solana and Aptos have in common.

FTX is investments in Aptos seem to have either made binance nervous or just more bullish. That’s because binance announced it had invested an additional undisclosed amount in Aptos Labs in September. Some have taken this as a sign that Aptos has serious potential.

The VC battle makes sense when you realize that Aptos uses a proof of stake blockchain. This means whichever entity owns the most APT has the greatest influence over the blockchain. In Aptos’s case this investor influence is especially acute due to Aptos’s upcoming on chain governance.

It’s also important to note that one of the largest investors in Aptos’s first funding round was Three Arrows Capital the infamous crypto hedge fund that went bankrupt earlier this year. What’s concerning is that Aptos has since removed all references to 3AC from its blog posts.

How Does Aptos Work?

Whereas DIEM was essentially a centralized shit coin Aptos aims to be what Libra was supposed to be at the end of its original roadmap, a decentralized cryptocurrency. That said Aptos seems to have a lot more in common with DIEM than it does with say, Bitcoin or Ethereum.

Maybe it’s just me, but the way that Mohammad and Avery have spoken about Aptos in the few interviews they’ve given makes it sound like the project is a covert continuation of DIEM. Case in point Aptos. His mission is to unite Web2 and Web3, and it is working uncomfortably closely with Google in order to do this. There is more evidence under the hood.

Aptos uses a delegated proof of stake blockchain. Like many modern cryptocurrencies, the team behind Aptos claims its blockchain is simultaneously scalable, ie fast, decentralized and secure something that’s logically impossible due to the blockchain trilemma. To quickly recap the blockchain trilemma states that a cryptocurrency can only be decentralized and scalable, scalable and secure, or secure and decentralized. Every crypto project ultimately makes a trade off of some kind. In Bitcoin’s case, for instance, it trades scalability for robust security, and decentralization.

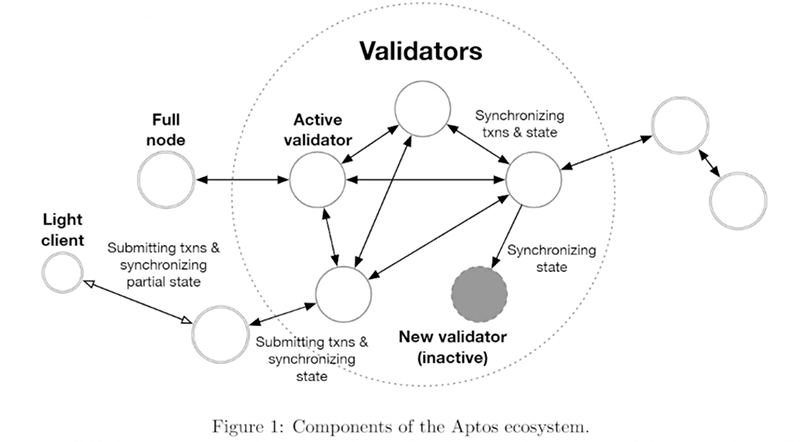

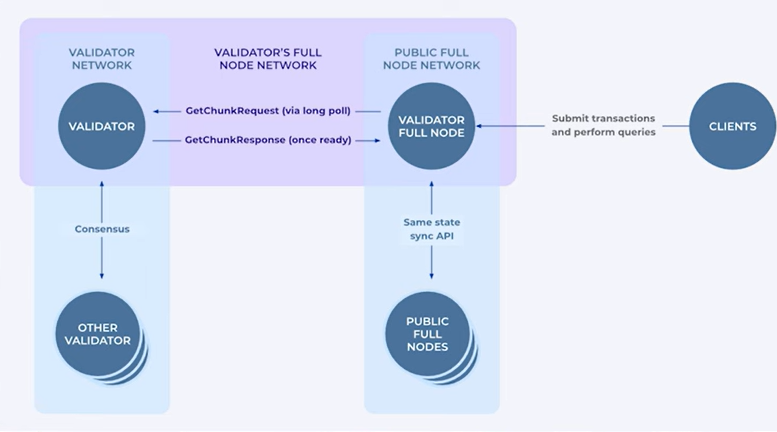

In Aptos’s case, it not so subtly trades, decentralization for scalability and security. Although the Aptos blockchain boasts 10s of 1000s of full nodes, it only has 102 validators. What’s annoying is that the number of full nodes on Aptos does not appear to be noted on any of its blockchain explorers. But don’t let the term full node fool you.

Aptos’s documentation suggests its blockchain only stores the current state of the ledger ie account balances and transactions. This is similar to another crypto project called Mina Protocol, which stores the current state of its blockchain in a small digital snapshot.

Like Mina Protocol, Aptos has a series of nodes which store its historical blockchain data on a quote single version distributed database. The number of nodes storing Aptos’s full transaction history here is unknown.

The documentation suggests it’s the 102 validator nodes, but they aren’t obligated to store it. Now, if you read our article about cryptocurrency, decentralization, you will know that storage of cryptocurrencies long term transaction history is an important part of decentralization. Without this information, a cryptocurrency could be easily corrupted over time, or manipulated by malicious nodes.

This is why I was seriously saddened to hear that Solana had started using Google Big Table to store its data in Arweave, which is a decentralized storage cryptocurrency. It wouldn’t surprise me at all. If it turns out that Aptos is doing something similar, especially since its blockchain is growing quickly to.

The relative centralization of the test blockchain makes it possible for it to process up to 4200 transactions per second with a theoretical maximum of 160,000 transactions per second. Current and maximum TPS scores for major cryptos can be seen here, courtesy of FTX. Note how it shows Solana.

What’s impressive is that Aptos’s current 4200 TPS also applies to more complex smart contract transactions. This is one of the reasons Binance gave for its additional investment into Aptos, which was again probably also motivated by FTX. His own additional investment during the second funding round.

Aptos vs. Solana, Others

Another reason why Binance invested so much in Aptos, is because of its novel coding language and new virtual machine. Everything on Aptos is coded in Move a programming language based on Rust that was invented by DIEMS developers. Aptos uses its own move virtual machine for smart contracts. So three things to note here.

The first is that move isn’t the only thing that DIEM’s developers invented. In an interview, Mohammad explained that DIEM basically had access to unlimited resources for research and development. As a result, Aptos uses cutting edge tech that I am barely scratching the surface of him.

What’s cool is that Aptos Labs actually has a research papers page that looks eerily similar to the research papers library page of Cardano builder IOHK. Aptos’s cutting edge research and development might be why the company behind it is keeping the details of its developers under wraps.

After all, the last thing the project wants is to lose its top talent to equally well capitalized competitors. And this relates to the second thing to note. It’s very rare that a crypto project comes up with its own virtual machine for smart contracts. Almost all of the VMs are variants of Ethereum virtual machine.

Believe it or not, but it’s Aptos’s Move VM that makes it a Solana killer by its own admission. In a panel discussion earlier this year, Solana founder Anatoly Yakovenko tacitly admitted that the Solana team is extremely nervous about the introduction of a competing execution layer for smart contracts.

Anatoly is also hyper aware of how developer friendly the move programming language is. This is in stark contrast to the developer experience on Solana, which Anatoly has likened to quote, eating glass. To make things worse, Solana is coded in Rust, and your recall move is based on Rust.

This makes it easy for developers from Salonpas ecosystem to migrate to Aptos’s. The same applies for developers working on Near protocol and Polkadot.

However, the crypto project that’s most of risk of being killed by Aptos is actually Flow. That’s because Flow is coded in Cadence, which is based on move. If you read our article about Flow, you will know that it actually worked with DIEM’s developers to develop Cadence.

You will also know that Flow uses a multi node architecture that separates the collection ordering processing and verification of transactions on its blockchain for efficiency. As it so happens, Aptos does something similar with its own transaction process, which is outside the scope of this article.

I’ll just mention the third thing to note. And that’s that tokens on the Aptos blockchain, which are called coins, for some reason, are apparently controlled by the entity that issues them. What this means is that any token on the Aptos blockchain can be frozen, burned, and or minted at will by whoever created it. This seems to be an intentional design choice, as Mohammad mentioned in an October panel discussion that the Aptos blockchain can be compliant with regulations, just like DIEM make of that what you will.

APT Tokenomics

When it comes to tokenomics, nobody actually knew what the tokenomics of APT would look like until shortly before it started trading. This was perhaps the biggest red flag for the crypto community, who questioned how crypto exchanges could possibly list a coin that had just published its tokenomics.

APT is used to pay for transaction fees on the Aptos blockchain. APT is also used for staking and is used for unchained governance of the Aptos blockchain governance is currently limited to validators, but will eventually be expanded to delegators as well.

The APT coin had an initial supply of 1 billion, around 13.5% of this initial supply was allocated to early investors. 16.5% was allocated to the Aptos Foundation, 19% APT was allocated to core contributors, which presumably means Aptos Labs. The remaining 51% was set aside for the Aptos community.

The vesting schedules for these entities can be seen here. For those just listening in the APT allocated to core contributors and investors will only begin investing after one year. This means the only APT in circulation for the first year will come from that allocated to the Aptos community.

According to the Aptos Explorer, around 180 million APT coins are currently in circulation. This is significantly fewer than the 130 million APT noted by Coin Market Cap and Coin Gecko. Then again, it’s not clear whether all the 180 million APT coins not being staked are in circulation.

From what I can tell Coin Market Cap and Coin Gecko got the details about APT’s initial supply from the tokenomics. posed by the Aptos Foundation. It notes that 125 million APT were made immediately available to the community, and 5 million APT were made immediately available to the foundation.

Of tthe 125 million APT that was allocated to the community. 20 million was airdropped, early test net users after APT started trading the rest. Who knows.

What’s more is that APT has a 7% inflation rate with no maximum supply, and it looks like APT supply has already increased by over 2 million. This is because of the roughly 820 million staked APT that I alluded to a few moments ago. What’s scary is that the Aptos Foundation notes that staking rewards are quote, not subject to restrictions on distribution. This means the early investors, the team and the foundation can sell their staking rewards.

Did I mention that the Aptos Foundation and Aptos Labs custody the AAPT allocated to the Aptos community? That’s more than 51% of the initial supply and it looks like they’re staking this APT tto. That is a lot of money when you do the maths. On the bright side, all transaction fees are burned and APT’s inflation will decline by 1.5% annually until it hits 3.25% which is estimated to take 50 years.

Meanwhile, the AAPT initially allocated to the team early investors the foundation and the community will finish vesting in late 2032. Now the timeline to be on the lookout for is late 2023. This is when the big vesting cliffs will begin. The worst of them will happen in 2024, which is coincidentally around the time the next crypto Bull Run should begin.

APT Price Analysis

In terms of price action. There isn’t much I can say about APT just yet because it’s a brand new cryptocurrency. Even so at first glance, Aptos looks grossly overvalued, a market cap of over 1 billion and a fully diluted market cap of over 9 billion.

Upon closer examination however, it does look like some fundamentals are starting to form. According to the Aptos Explorer, there are over 1.7 million wallet addresses and chances are that number will be over 2 million by the time you see this article. To put things into perspective. Cardano has around 2.3 million wallet addresses according to the ADA Stat Explorer.

This means that Aptos is on track to surpass Cardano by number of users within two weeks of launch. Cardano’s mainnet went live over five years ago. That is some serious adoption.

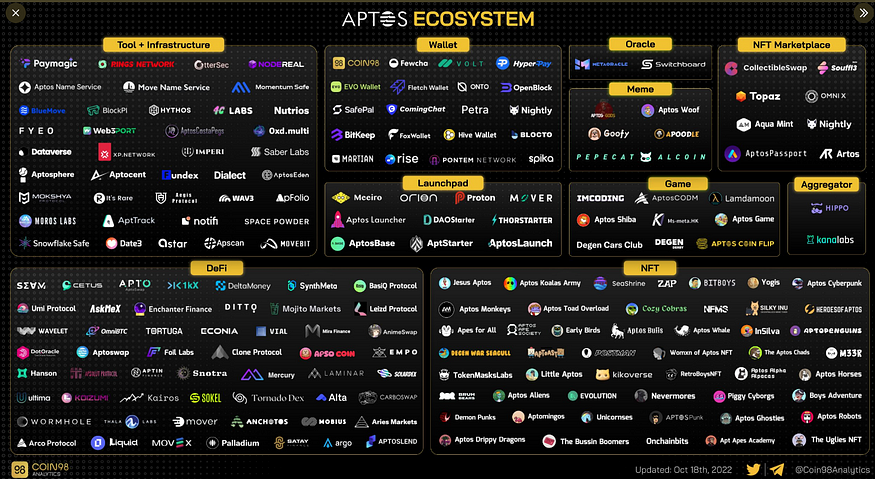

The thing is that the number of wallet addresses on Aptos doesn’t necessarily correspond to the number of users. That’s why I prefer to look at downloads of any web or mobile wallets associated with a crypto. In this case, Aptos’s Petra and Martian wallets have over 1 million downloads combined on Chrome alone. This would be an impressive statistic, were it not for the fact that Defillama suggests there’s only around $17 million of total value locked in Aptos’s dozen DeFi protocols.

What’s frustrating is that Defillama statistics are also inconsistent with the stats on the website of the Aptos dApps. For example, liquid APT staking protocol Tortuga has nearly $3 billion in total value locked with over 330 million APT deposited. This suggests that some early investors, team members and maybe even the Aptos Foundation are secretly liquid staking. This detail isn’t noted in APT’s tokenomics.

If this is true, then it means you probably can’t trust the TVL on any DeFi protocol on Aptos which supports Tortuga’s liquid staked APT. That’s because it would be very easy for early investors team members or the Aptos Foundation to fake a high TVL using their liquid staked APT.

On that note Tortuga seems to be the only way that APT holders can currently delegate to validators. This begs the question of which validators Tortuga to get is delegating too. It also begs the question of who is running the largest validators given that they’re staking almost identical amounts of APT.

What I’m wondering is what the minimum and maximum stake for validators is. Aptos’s documentation is unclear on this along with the locking and unlocking time for the APT coin. What is clear is that there is no slashing risk for misbehavior. So, at least all the VCs won’t have to worry about losing their precious APT.

It would also be nice to know exactly how many dApps there are on the Aptos and how many unique wallets are actually using them. Dappradar hasn’t started tracking Aptos daps yet, but the dApp list in the Martian wallet suggests there are at least 20 up and running. Not bad for a brand new crypto project.

Unfortunately, this doesn’t change the fact that we are in the middle of a crypto bear market that’s likely to last for at least another year. The harsh reality is that almost all APTS price action has so far been driven by speculation, not organic adoption. Luckily, Aptos has lots of milestones ahead of it.

Aptos Roadmap

The closest thing Aptos has to a roadmap is a blog post from March this year titled quote, The Aptos Vision.

The TL;DR is that Aptos wants to scale to support billions of users. And every use case you can think of just like every other new crypto. The difference is that Aptos actually has the tech to do it.

That doesn’t mean Aptos will scale overnight. However, the team and founders mentioned many times that Aptos would be incomplete out of the gates. I reckon most of the issues I’ve identified so far can be attributed to the fact that Aptos is still very much in development, so don’t take them all too seriously.

The first major upgrade to Aptos is expected to happen later this year or in the first quarter of next year. This is consistent with a note in Aptos’s documentation, which implies that the validator requirements will be increased significantly at the start of 2023, and is suggest that Aptos’s speed will increase significantly.

Aadditional Aptos milestones can be found in AMAs, and interviews with the Aptos team and its founders. I’ll reiterate that these AMAs and interviews are few in number, and surprisingly difficult to find. These AMAs were on limited non English language YouTube channels because there is no official Aptos channel.

In an AMA from April, the Aptos team revealed that the project is looking to partner with other big tech companies besides Google. At the same time, the Aptos team revealed that it wants to implement privacy preserving technologies to its blockchain in the future. I reckon it’s one or the other.

In September, Avery explained that Aptos will eventually have a unique fee market for each dApp and use case on Aptos. This is very cool and very logical because it will allow Aptos to remain resilient to the kinds of DDoS attacks that have taken Solana offline, while simultaneously keeping transaction fees low.

In October, Avery explained that Aptos will have a major upgrade every four to six months. This is to ensure that the blockchain will remain future proof. Avery also explained that Aptos will start sharding its blockchain once it starts to become too bloated something that Ethereum is also planning.

I was hoping to find a few more milestones in Aptos’s Governance Forum, but there was nothing about Aptos’s improvement proposals. Funnily enough, I somehow managed to find a link to Aptos’s governance portal for validators, there was only one governance proposal to reduce voting power.

Aptos Concerns

My biggest concern is the ridiculous disconnect between the supposed quality of the project and its transparency and organization. I mean, Aptos has technically been in development since 2017. It had access to unlimited resources for research and development for years. It raised $350 million without a white paper or tokenomics. And there are literally 350 people working for Aptos Labs supposedly

Pardon, but how the holy hell has Aptos still not hammered out the tokenomics of the APT coin? Why did our research team have to go digging through every single link and blog posts to find information that should be on the front page of the Aptos Website? Why is there no YouTube channel? Who is running the validator nodes? How come you can’t see the details of the tokens and NFT’s on the Aptos blockchain? Where is the information about which crypto wallets belong to Aptos Labs and the Aptos Foundation? There’s no way APT supply is distributed as equitably as the explorer suggests. And don’t even get me started about the allegations of Aptos, shutting down its Discord channel and other socials when people started asking these kinds of questions, or about how all the AMAs seem to be restricted to discord and not published anywhere else.

My second concern about Aptos is almost as big and that’s the crypto projects mission. I still don’t quite understand what Aptos’s endgame is, and it’s not just me. Messari CEO Ryan Seleucus was asking what crypto niche Aptos is trying to claim or the angle it’s trying to take at the recent mainnet conference, he didn’t really get an answer.

As far as I can tell, the Aptos Vision of cryptocurrency is a maximalist one where everything is built on the Aptos blockchain. I haven’t seen or heard any discussion about interoperability with other cryptocurrencies only interoperability with big tech companies and the existing financial system.

This attitude comes at a time when crypto VCs are betting on a multichain future with projects like Cosmos. That’s because they know there is no way for everything to be built on a single blockchain unless it’s extremely centralized. And at that point, you’re not dealing with a cryptocurrency anymore.

From where I’m standing, extreme centralization looks like the path that Aptos wants to take. All the talk of decentralization just seems to be an attempt to get retail investors on board. To be blunt, the Aptos team is not even good at selling these talking points ,and it might be because they don’t really believe them.

This ties into my third concern and that’s regulation, DIEM died a brutal death, and if Aptos is in fact a de facto continuation of DIEM, then it is doomed to suffer the same fate. Regulators might be biased, but they’re not stupid.

Speaking of which, I am shocked that US exchanges like Coinbase listed APT, I am by no means an expert in securities laws. This is purely speculation, but I have been watching the SEC for a long time. APT seems to tick every box on the SEC his target list.

The only thing that could protect Aptos is the unprecedented amount of backing it has from both Wall Street aligned crypto VCs and big tech. Both parties are powerful lobbyists, and they will make sure their golden geese don’t get caught in any regulatory nets.

In some, then I have to say that I’m extremely skeptical about Aptos at this point in time, there is no question that Aptos is on the bleeding edge of Web3, but it doesn’t seem to be seriously interested in the core values of cryptocurrency. If anything, it seeks to cement the values of Web2 using blockchain technology.

To support me, you may Buy Me Coffee and/or become Medium member by using my link.