Correct sizing of positions can translate into success or disaster.

Certain investors like to shoot for the moon. They are wont to over-emphasize some of their favorite stock picks, believing that if they turn out to be correct they’ll make a big score. Of course, they never consider the downside of this proposition.

If they run out to be wrong, and their judgment was faulty, they lose bigly.

Possible Mistakes

If you bet big on a stock, then another, larger company winds up eating their lunch, this can turn out to be one of the biggest mistakes rookie investors can make.

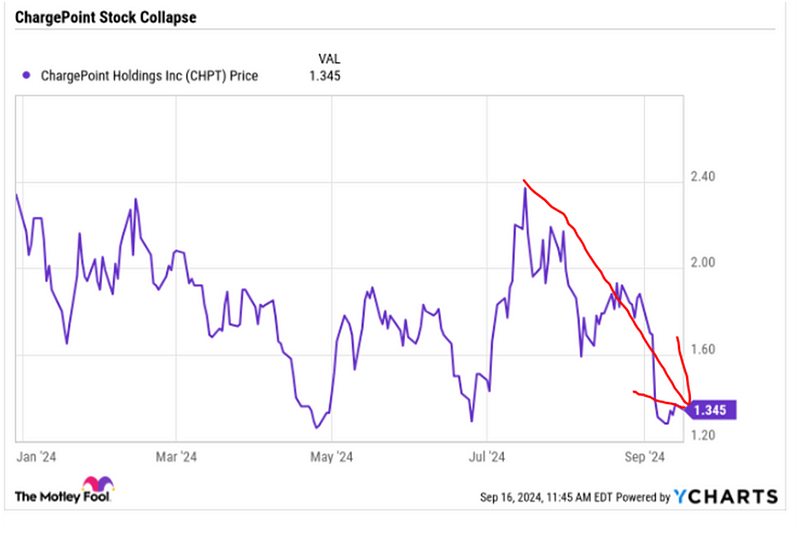

We bet that Charge Point (CHPT), a small EV power charging station business would succeed since EV sales were on the rise. After all, electric vehicles need to recharge their batteries every 100 miles or so ( some sooner, some later). Along with other investors, we assumed that since CHPT was a concentrated pure play, and ancillary to the success of EVs, the company would succeed if it took enough market share.

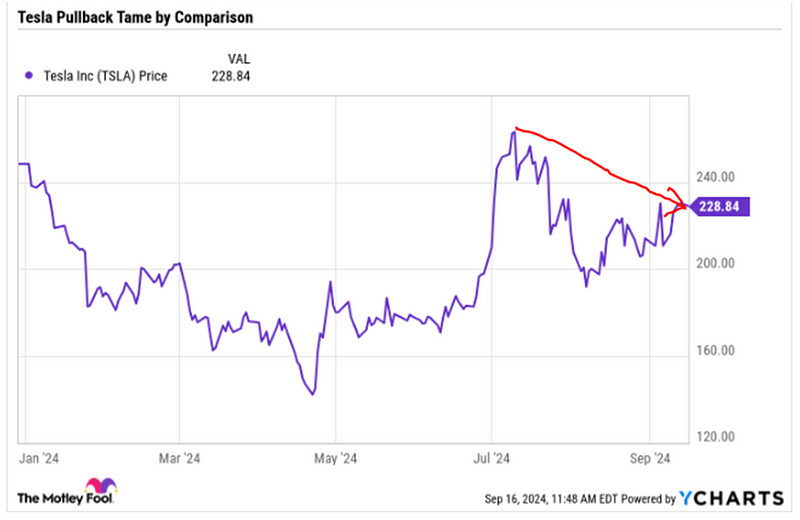

Little did we anticipate that EV sales would slow, and Tesla (TSLA) would adapt their own power charges to allow other competitor’s cars to charge at their own power stations, nationwide.

In other words, TSLA ate their lunch and CHPT stock lost almost 50% of its value in no time.

In comparison, Tesla’s stock pullback has been rather tame, in comparison as investors increasingly bet that Tesla would eat ChargePoint’s lunch and win the competition for EV charging station business. Its stock price decreased only 10% in the comparable time period.

If an investor had 100% conviction on this bet and invested 100% of her capital, she would have lost more almost 50% of her capital

100% X .40% = 40% capital loss

Had she invested just .50% of her available capital, as we did, she would have lost just .5% of her capital.

.005X 100%= .5% capital loss

Obviously, there’s a big difference between losing just .5% of your capital compared to 40%. Eighty times the difference, in fact.

That’s how you factor in risk into your portfolio. Controlling for exposure and sizing positions properly will always preserve your capital and insure you never lose too much of it.

Blink Charging, BLNK, is another good example. In the same field as CHPT, we believed that spreading our bets between it and CHPT would help to reduce risk to the portfolio. Unfortunately, because it suffered the same fate as CHPT, TSLA’s monstrous hold on the EV charging station market proved too much of a challenge. Obstacles like this often prove too much for small competitors to overcome. The upstarts can go into a downward spiral costing investors large losses.

It, too, fell precipitously in value, losing more than 50% of market capitalization in short order.

Once again, an investor who went overboard in this investment, buying too many shares, over-weighting her position, would have lost much too much capital by expressing too much enthusiasm in her judgment. The loss would have been over 60% in this instance.

The investor who kept her enthusiasm in check, however, limiting her investment to just .50% of portfolio value, took an infinitesimal loss, one that was almost unperceivable.

Your Takeaway

There’s nothing wrong about becoming enthusiastic about an investment and wishing to take part in the success of a company’s new technology.

The mistake, however, is getting too committed to any one idea, over-weighting your position and holding on too long if things don’t work out as expected.

Wedding yourself too strongly to any one investment idea and later, not being able to admit the mistake, can turn the best of intentions into catastrophic failures.

Better safe than sorry, as they say. Simply size your portfolio positions correctly to avoid this pitfall in order to gain if you’re right and more importantly, to limit your losses if you’re wrong.

My Real Time Portfolio Trackers and stock market investment applications to enhance your investing returns and income are available here.

Stock Market Investing Applications, source: author

Stock Market Investing Applications

To date, subscribers to my investment newsletter, “Retirement: One Dividend at a Time” who faithfully mirrored our portfolio have attained annual dividend income over $132,000.00.

You are welcome to a free, two-week trial to my investment newsletter, “Retirement: One Dividend at a Time”. Just shoot me an email and request your free trial, at [email protected]

To receive notice whenever I publish new articles, simply click the follow button at the top of the article next to my name. Better yet, also click the “Subscribe” button and you’ll receive an email notifying you whenever I publish. Thank you.

So glad you can join me here today. Please consider becoming a paid subscriber of my Substack community so we can do even more.

The first 100 annual subscribers this week will receive the RODAT Portfolio Income Tracker ($99.99 retail value) which will reveal every RODAT stock in our subscriber portfolio, share counts and dividend amounts. With this digital tool, you may track the portfolio and mirror your own portfolio with the names you find suitable for your needs.

In addition, the first 100 annual subscribers this week will receive the digital Stock Market Investing Tool of your choice ($99.99 retail value), many of which are in real time and will greatly enhance your potential for capital gain and dividend income.

Make your complimentary choice here.

For just $5 per month, or $50 annually, you’ll receive full access to every article I write, complete access to my entire archive of articles, access to a special chat group of similarly minded investors and deep-dive articles for paid subscribers only, with recommended dividend growth stocks to supplement your Social Security benefit.

If you found value in this article and would like to support my efforts, please consider buying me a coffee, here.

buymeacoffee.com/georgeschneider

Discover my archive of articles on Substack, here.

Other articles you may find valuable reading:

This Perpetual Money Well Never Runs Dry

Stay Sane When the Markets are Going Insane

What If No One Ever Sold Even One Share of Stock?

Best,

the author

George Schneider, M.A.

Founder and publisher

Retirement: One Dividend At A Time

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am long all RODAT Portfolio names. The Portfolio continues to build dividend income with reliable, dependable equities which have long histories of increasing the dividend.

Copyright ©2024, George Schneider