If passive income is your end goal in retirement, Realty Income (O) is your path to getting there.

Are you curious about investing in real estate without having to buy property yourself? One way to do this is by investing in a special type of company called a REIT, or Real Estate Investment Trust. Realty Income (NYSE: O) is a popular REIT, and here’s why it might be a smart choice for your investment portfolio.

The first 50 new paid annual subscribers this week will receive a FREE digital Stock Market Investing Application of their choice, up to a $99.99 retail value. Choose from these Stock Market Investing Applications.

Stock Market Investing Applications

What is Realty Income?

Realty Income is a REIT, which means it owns and manages properties like shopping centers, drugstores, and convenience stores. What makes it special is its business model: it uses something called “triple net leases.” This means that when a business rents a property from Realty Income, the business pays not just the rent but also the property taxes, insurance, and maintenance. This helps Realty Income earn steady income without worrying about extra costs. In addition, Realty Income has built in automatic rent escalators into its leases. This means that rents are guaranteed to rise to keep up with inflation. It guarantees that investors will share in this by continually receiving a portion of these rising revenues in the form of rising dividend payments.

The Advantage of Monthly Dividends

One of the best things about Realty Income is that it pays dividends every month. Most companies pay dividends only once a quarter, but Realty Income makes sure you get paid monthly. This is fantastic because it provides you with regular income that you can use or reinvest. It always leaves you in the driver’s seat. You can change your designation at will whenever your needs may change.

Dividend Growth History

Realty Income has a long history of increasing its dividends. It has been raising its monthly dividend for over 30 years! This speaks to the company’s reliability. They don’t just increase their dividend once or twice a year — they usually do it 6 or 7 times annually. This regular increase helps keep the dividend yield around 5.0% for new investors. At the same time, earlier investors who continue holding their shares see their yield on cost, the amount they paid for their shares, continually rise skyward.

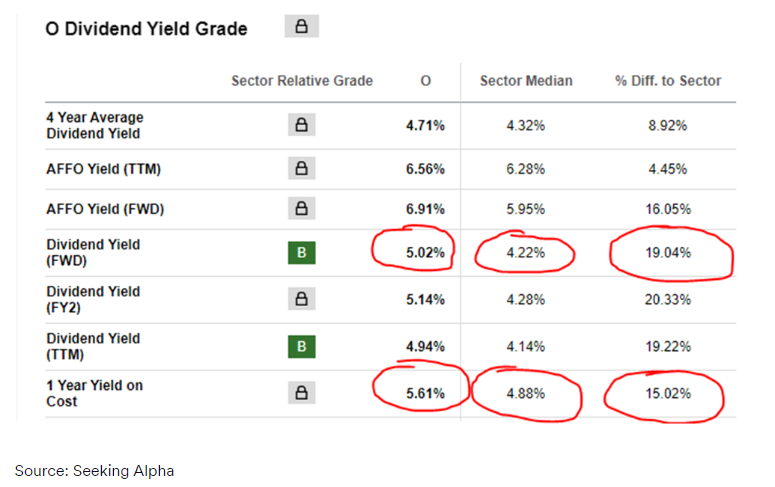

You can see from the above chart that Realty’s current yield is 5.02% compared to its sector median of just 4.22%, meaning it pays a dividend 19% higher. In addition, its one year yield on cost indicates 5.61%, also 15% higher than its sector median.

source: YCharts

source: YCharts

Here you can observe that Realty Income’s dividend payout has been rising in lock step with its stock price. The investor has been benefiting from a double barreled approach that has brought terrific capital gains in step with strong dividend income growth.

Compound Investing and Super-Compounding

Here’s where it gets even more interesting: when you reinvest your monthly dividends, you’re adding more money to your investment. This process is called compound investing. It’s like earning interest on your interest. Over time, this can lead to something called super-compounding, where your investment grows faster because you’re continually reinvesting your earnings.

Benefits of Steady Dividend Increases

Hedge Against Inflation

One of the great benefits of steady dividend increases is that they can help protect you against inflation. Inflation is when prices go up, and your money buys less over time. With Realty Income’s regular dividend increases, your income can keep up with inflation, so you don’t lose purchasing power. When the cost of a latte at Starbucks rises from $5.00 to $5.50 per cup, Realty’s increased dividends maintain your purchasing power so you can still afford that morning pick-me-up.

Hedge Against Market Fluctuations

Realty Income’s regular dividend payments can also help cushion the blow when the stock market drops, even more than a little bit — like when it falls by 1% or 2%. Even if the stock market is down, you still get your monthly dividends, which can make investing less stressful. This is helpful if you begin to panic and get the urge to sell your shares. Knowing that your dividend stream will continue coming to you monthly from such a stalwart payer aids in calming your nerves and keeps your fingers far away from the panic-sell button.

source: Bing image creator

source: Bing image creator

Disadvantages of Investing in Realty Income

While Realty Income has many advantages, it’s important to also consider its disadvantages. One drawback is that its stock price might not grow as fast as some other stocks because it focuses on steady income rather than high growth. Additionally, since it relies on rent from tenants, if those businesses struggle and can’t pay rent, it could affect Realty Income’s profits.

Your Takeaway

Investing in Realty Income offers several benefits:

Monthly Dividends: You receive regular income every month.

Dividend Growth: The company has a strong track record of raising dividends for over 30 years.

Compound Investing: Reinvesting dividends helps your investment grow faster.

Inflation and Market Hedge: Regular dividends help protect against inflation and market downturns.

However, there are some disadvantages:

Slower Growth: It might not grow as quickly as other investments.

Tenant Risk: If tenants can’t pay rent, it could impact the company’s earnings.

Overall, Realty Income is a solid choice for investors looking for reliable, steady income and protection against inflation and market dips. If you’re patient and plan to invest for the long term, it could be a great addition to your investment portfolio.

Real Time Portfolio Trackers and investment applications to enhance your investing returns and income are available here.

The first 50 paid annual subscribers this week will receive a FREE digital Stock Market Investing Application of their choice, up to a $99.99 retail value. Choose from these Stock Market Investing Applications.

Stock Market Investing Applications

To date, subscribers to my investment newsletter, “Retirement: One Dividend at a Time” who faithfully mirrored our portfolio have attained annual dividend income over $132,000.00.

You are welcome to a free, two-week trial to my investment newsletter, “Retirement: One Dividend at a Time”. Just shoot me an email at [email protected]

To receive notice whenever I publish new articles, simply click the follow button at the top of the article next to my name. Better yet, also click the “Subscribe” button and you’ll receive an email notifying you whenever I publish. Thank you.

So glad you can join me here today. Please consider becoming a paid subscriber of this community so we can do even more.

buymeacoffee.com/georgeschneider

For just $5 per month, or $50 annually, you’ll receive full access to every article I write, complete access to my entire archive of articles, access to a special chat group of similarly minded investors and deep-dive articles with recommended dividend growth stocks to supplement your Social Security benefit.

Discover my archive of articles on Substack, here.

Other articles you may find valuable reading:

This Perpetual Money Well Never Runs Dry

Stay Sane When the Markets are Going Insane

What If No One Ever Sold Even One Share of Stock?

Slave Labor is Alive and Well In the USA

Best,

the author

the author

George Schneider

Founder and publisher

Retirement: One Dividend At A Time

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am long all RODAT Portfolio names. The Portfolio continues to build dividend income with reliable, dependable equities which have long histories of increasing the dividend.

Copyright ©2024, George Schneider