Data Center Tour Guide

What are they?

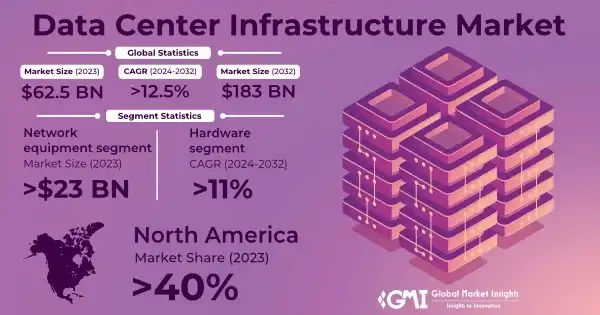

Data centers are at the core of modern digital infrastructure, serving as centralized hubs where vast quantities of data are stored, managed, and disseminated. They enable critical services such as cloud computing, big data analytics, artificial intelligence, etc. As the demand for data services increases, so does the importance of data centers, driving investments across various sectors that make up the data center ecosystem.

AI and Data Center Demand

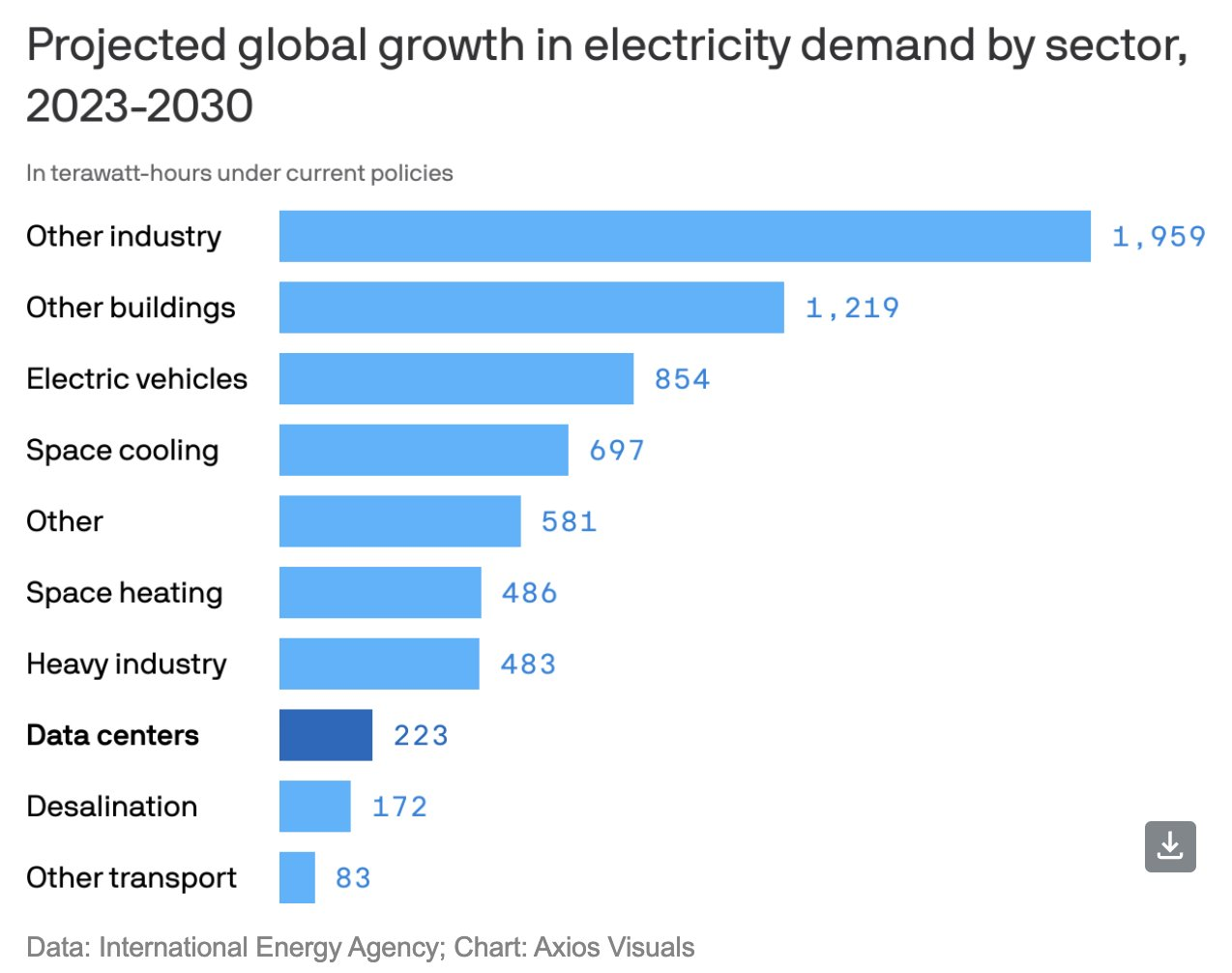

The demand for AI-driven workloads is pushing data centers to expand rapidly. By 2030, U.S. data centers are expected to consume 35 gigawatts (GW) of power, nearly doubling from 2022. AI workloads are far more power-intensive than traditional tasks, with AI queries (ChatGPT) requiring almost 10 times more power than regular internet searches. Generating AI-made music, photos, and videos further increases power use, with forecasts projecting that AI alone could account for a significant portion of future data center consumption.

Traditional Search vs AI Search: A Google search uses 0.3 watt-hours (Wh), while an AI query can consume 2.9 Wh.

Electricity Impact: AI’s growing power demands could cause data centers to consume 4.6% to 9.1% of U.S. electricity by 2030.

Continuous Operation and Rising Demand

Data centers operate continuously, requiring substantial power for both IT equipment and infrastructure like cooling and power conditioning systems. In 2023, data centers consumed 7.4 GW of power globally, a 55% increase from 2022. By the end of the decade, electricity consumption is projected to reach 35 GW globally.

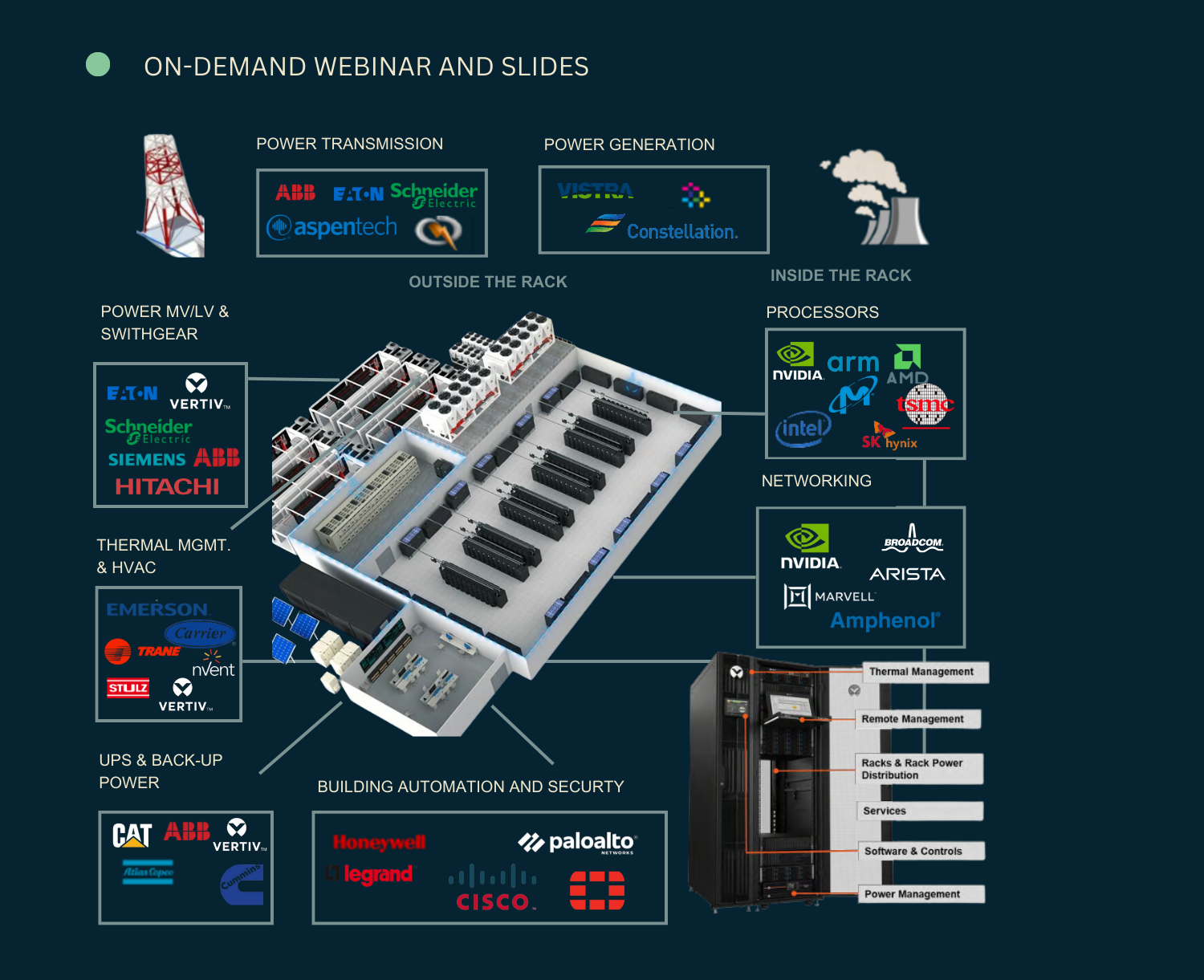

The Data Center Ecosystem

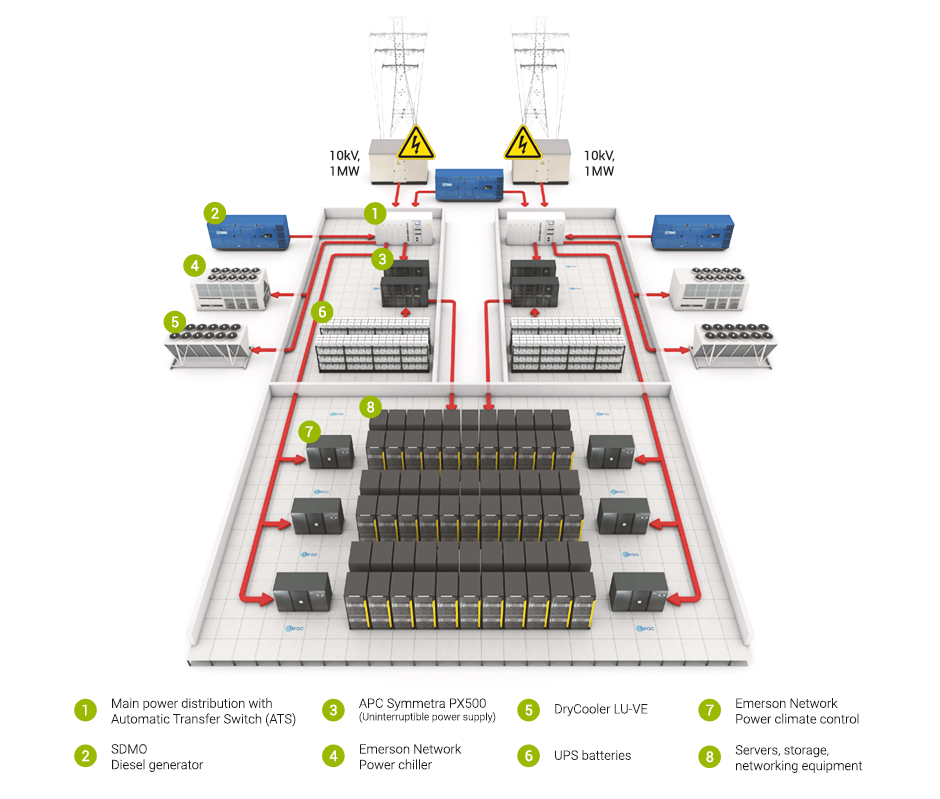

The data center ecosystem consists of several essential components, each playing a critical role in ensuring that these facilities operate efficiently:

Semiconductors: Power computing, memory, and networking functions.

Servers: Core hardware that runs applications and processes data.

Networking: Connects servers, storage, and external networks.

Storage: Manages and holds massive amounts of data.

Power and Cooling: Ensures operational efficiency and prevents overheating.

Cloud Providers: Offer computing, storage, and network services.

Third-Party Operators: Host and manage data centers, providing colocation services.

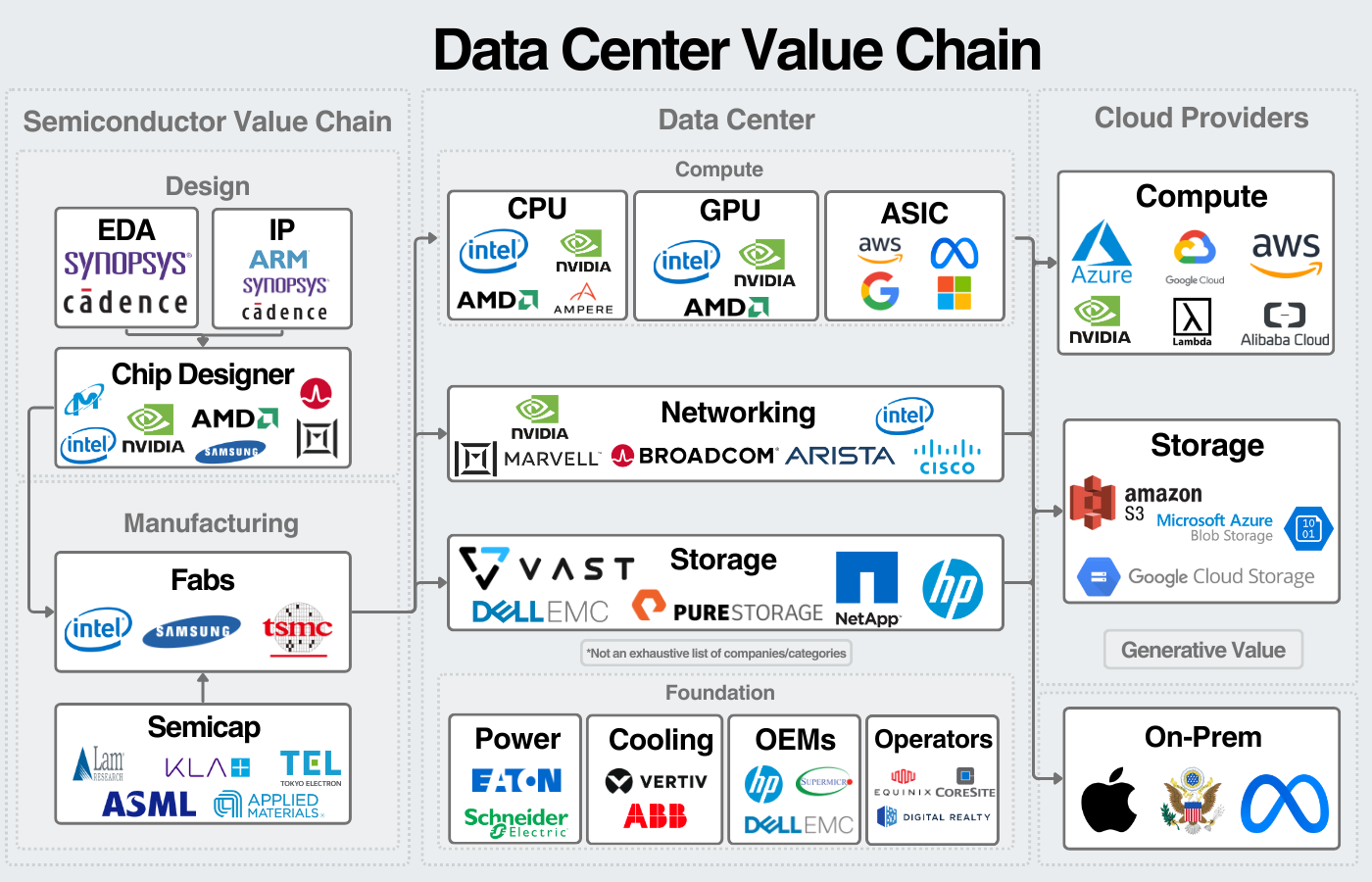

1. Semiconductors

Semiconductors are the backbone of computing within data centers, powering CPUs, GPUs, and networking equipment. The rising demand for advanced chips is driven by AI, machine learning, and high-performance computing workloads.

Key Players:

NVIDIA: Dominates AI and GPU computing.

AMD: Competes with Intel through EPYC CPUs and MI300 GPUs.

Intel: Focuses on AI hardware with Gaudi accelerators.

Broadcom and Marvell: Leaders in networking semiconductors.

**These companies play an integral role in the computing infrastructure of data centers

2. Servers

Servers are the engine of data centers, integrating CPUs, GPUs, and memory to run data-heavy applications. The rise of AI and cloud computing demands more efficient and powerful server systems.

Key Players:

Dell: A top provider of enterprise servers.

Hewlett Packard Enterprise: Known for enterprise-grade servers.

Super Micro Computer: Focuses on AI-specific servers.

IBM: Leader and involved in quantum computing, one of my favorites long term.

These companies enable data centers to scale as needed, ensuring that applications run on powerful hardware optimized for performance.

3. Networking

Networking connects servers, storage, and external networks. Reliable, high-speed networking is essential to ensure low latency and high performance.

Key Players:

Cisco and Arista Networks: Leaders in high-performance networking.

NVIDIA/Mellanox: Powers AI-driven workloads through InfiniBand networking.

Astera Labs: Specializes in high-performance interconnect solutions.

Networking companies ensure that data centers can process, store, and retrieve data rapidly.

4. Storage

As data grows exponentially, efficient and high-capacity storage solutions are essential. Data centers must store, retrieve, and manage data with low latency and high reliability.

Key Players:

Fluence Energy: Leads in energy storage.

Dell, NetApp, Pure Storage: Provide enterprise storage solutions for hybrid and AI workloads.

These storage providers ensure that data centers have the capacity and speed to manage massive amounts of information efficiently.

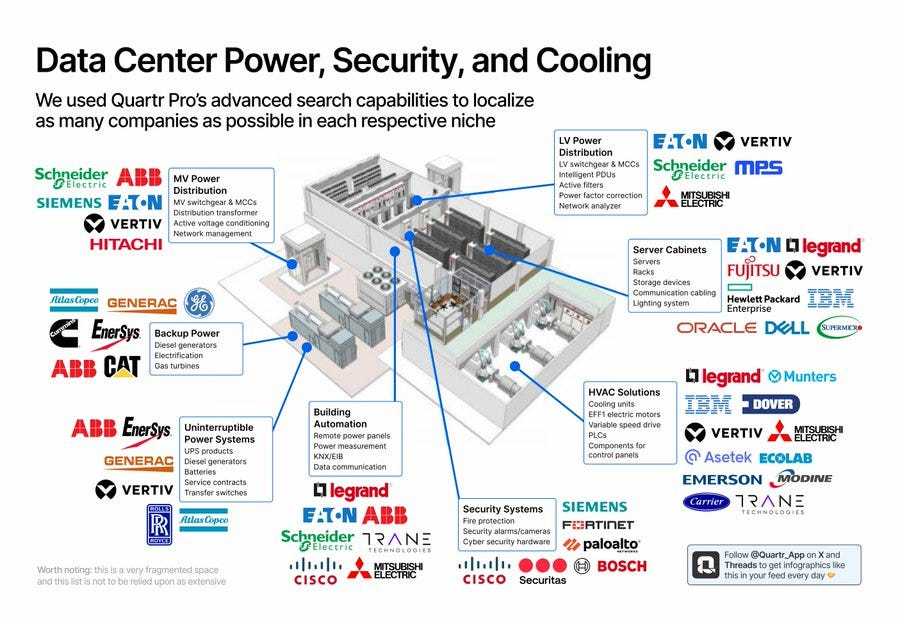

5. Power and Cooling

Data centers consume vast amounts of energy and generate significant heat. Reliable power management and efficient cooling solutions are essential as they prevent downtime and reduce operational costs.

Energy Efficiency Innovation

Liquid Cooling: More efficient than traditional air cooling.

AI-Driven Cooling: Google uses AI-powered systems to optimize cooling and reduce energy usage by up to 40%.

Key Players:

Eaton, Schneider Electric, Vertiv: Leaders in power distribution and cooling.

Generac: Specializes in backup power solutions.

Bloom Energy, Golar LNG: Provide clean, reliable energy solutions using fuel cells and LNG.

Resilience: Fuel cell technology and LNG solutions are more resilient than grid-based energy systems, providing distributed and reliable power, which is essential as data centers scale and their power needs become more complex.

A New Era with Blackwell: Nvidia's Blackwell processors demand more power and advanced cooling systems, leading to a shift toward liquid cooling and high-density power setups.

Efficient power and cooling solutions are critical as data centers scale, ensuring they remain operational and energy-efficient, particularly as workloads become more compute-intensive. Meta’s decision to rebuild facilities to be AI-ready reflects the broader industry move toward systems that support more efficient cooling and higher power outputs. As a result, power and cooling suppliers are becoming increasingly important in the data center industry.

6. Cloud Providers

Cloud providers use vast networks of data centers to deliver essential services such as computing power, storage, and machine learning tools. These providers are the backbone of the digital economy. As cloud providers scale their infrastructure, their reliance on energy-efficient, scalable, and secure data centers increases.

Key Players:

AWS: The largest cloud provider.

Microsoft Azure: Provides AI-focused cloud services.

Google Cloud: Focuses heavily on AI and machine learning.

These cloud providers enable businesses to scale without building their own data centers, making digital transformation accessible to companies of all sizes.

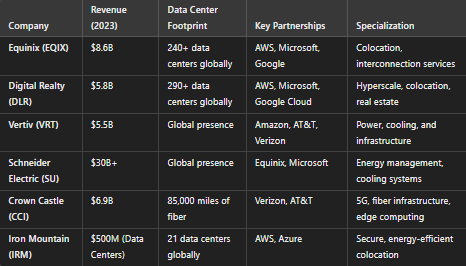

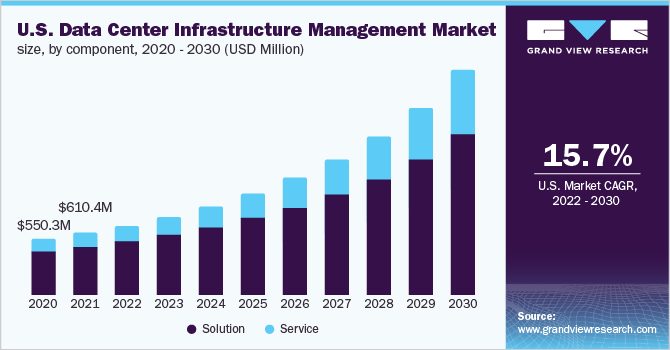

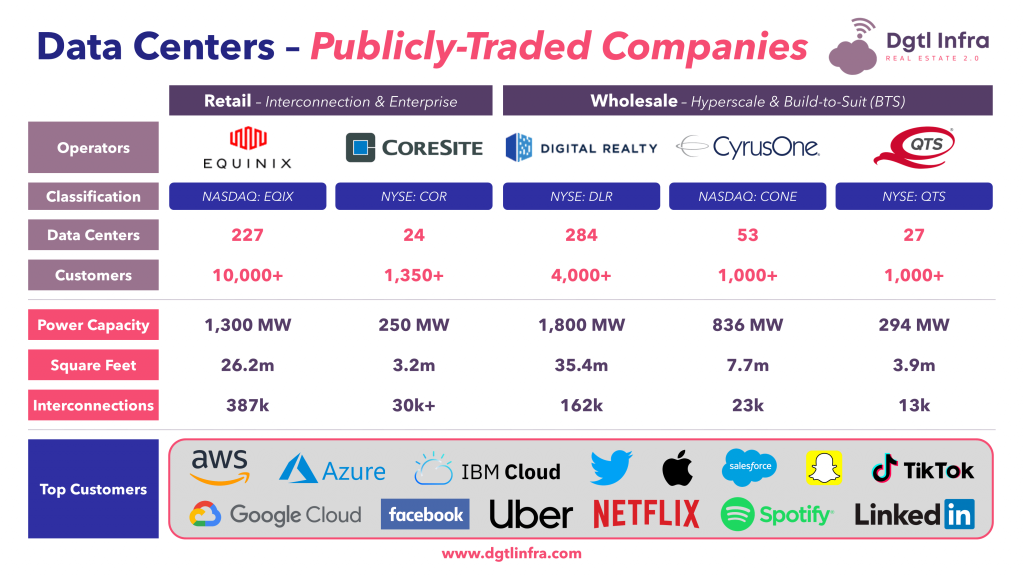

7. Third-Party Operators

Third-party operators provide colocation services, allowing companies to rent space in their data centers. This is essential for businesses that want the benefits of a large data center without the costs of building and managing their own facilities.

Key Players:

Equinix: The largest colocation provider globally, Equinix offers space, power, and interconnection services.

Digital Realty: Specializes in hyperscale data centers, providing infrastructure for large-scale cloud and enterprise operations.

CyrusOne: Recently acquired by KKR, CyrusOne focuses on high-security colocation, serving government, financial services, and other compliance-heavy industries.

Iron Mountain: Iron Mountain has expanded into data center colocation services, offering energy-efficient, highly secure facilities.

CoreSite: Specializes in low-latency colocation and edge computing, with a focus on 5G infrastructure and AI applications.

QTS Realty Trust (BlackRock): Acquired by BlackRock, QTS Realty Trust is a major player in hybrid colocation solutions.

Third-party operators enable companies to leverage the benefits of a world-class data center infrastructure without the associated overhead, providing flexibility and security.

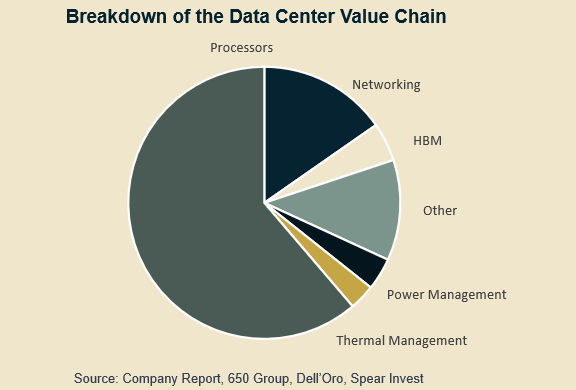

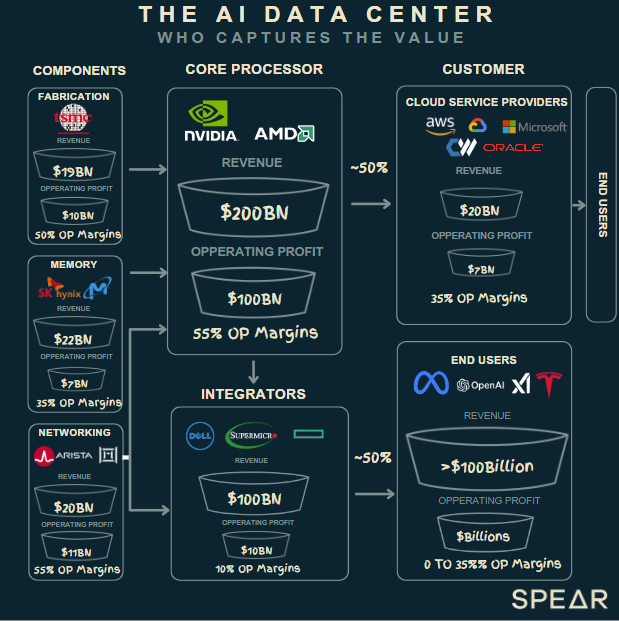

The AI Data Center - Who Captures the Value:

Fabrication (Chip Manufacturing):

Key Players: TSMC, Intel

Revenue: $19 billion

Operating Profit: $10 billion (50% OP Margins)

Role: Manufacture high-performance processors essential for AI workloads.

Memory:

Key Players: SK Hynix, Micron

Revenue: $22 billion

Operating Profit: $7 billion (35% OP Margins)

Role: Provide memory components crucial for data storage and quick access during AI processing.

Networking:

Key Players: Arista, Cisco

Revenue: $20 billion

Operating Profit: $11 billion (55% OP Margins)

Role: Ensure connectivity and data transfer within and between data centers for efficient AI processing.

Core Processors (AI Chips):

Key Players: NVIDIA, AMD

Revenue: $200 billion

Operating Profit: $100 billion (55% OP Margins)

Role: Power the AI workloads, making these processors one of the most critical components in the AI data center value chain.

Integrators:

Key Players: Dell, SuperMicro

Revenue: $100 billion

Operating Profit: $10 billion (10% OP Margins)

Role: Build and integrate hardware, including servers and infrastructure, to make AI data centers operational.

Cloud Service Providers (CSPs):

Key Players: AWS, Microsoft, Google Cloud, Oracle

Revenue: $20 billion

Operating Profit: $7 billion (35% OP Margins)

Role: Host and manage data centers, offering AI infrastructure to customers.

End Users:

Key Players: Meta, OpenAI, Tesla

Revenue: Over $100 billion

Operating Profit: Varies (0% to 35% OP Margins)

Role: Use cloud services and AI infrastructure to deploy models and applications such as autonomous driving or AI systems.

Technological Innovations

Liquid Cooling Advancements:

Liquid cooling is becoming essential in high-density environments, particularly for AI workloads. Companies like Vertiv and Schneider Electric are developing advanced liquid cooling systems that are more efficient than traditional air cooling. These systems are already in use at Meta’s hyperscale data centers and Google’s AI facilities, where AI training models generate vast amounts of heat. (Think about your computer giving off heat, just amplified a lot)

5G Integration:

5G’s low latency and high data transfer rates are driving the growth of edge data centers. Crown Castle and Digital Realty are actively developing infrastructure to support 5G demands. These smaller distributed data centers minimize latency, enhance content delivery, and support applications like augmented reality and autonomous vehicles.

Photonic Computing:

Intel and Ayar Labs are at the forefront of photonic computing, which uses light to transfer data instead of electricity, significantly increasing data transfer speeds while reducing energy consumption. This is critical for handling large-scale AI workloads and improving overall data center efficiency.

Quantum Computing:

Companies like IBM and Google are advancing quantum computing technologies, which are expected to be integrated into data centers in the future to handle complex computations with unprecedented speed and efficiency.

Edge Computing:

Smaller, distributed data centers located at the edge of networks will play a critical role in reducing latency and enabling faster data processing, particularly for 5G and Internet of Things (IoT) applications.

AI-Driven Infrastructure:

Artificial Intelligence is increasingly optimizing data center operations, improving efficiency in cooling, power management, and workload distribution, ensuring that data centers can handle the growing demands of AI-driven workloads.

Compute Express Link:

CXL is a new technology standard enabling memory pooling between CPUs, GPUs, and other accelerators, increasing data throughput while minimizing latency. Astera Labs is a leader in this space, providing CXL chipsets that optimize high-bandwidth data transfers for AI and cloud workloads.

Power systems:

AI-ready data centers need advanced transformers, UPS systems, and switchgear to handle the higher power demands of AI workloads. Innovations like Google’s AI-powered cooling optimization can reduce energy use by up to 40%.

Edge Computing

Edge computing is reshaping the landscape of data centers by moving data processing closer to the source, reducing latency and enabling real-time data processing for applications like autonomous vehicles, augmented reality, and IoT devices. The 5G rollout is critical to the expansion of edge computing, allowing faster data transfer and lower latency. Edge computing refers to the practice of processing data closer to its source (the "edge" of the network) rather than sending it to centralized cloud data centers

Major Edge Projects and 5G Integration:

Verizon’s 5G Edge Networks: Verizon, in collaboration with AWS Wavelength, is deploying 5G edge computing infrastructure to reduce latency for industries like autonomous driving, gaming, and smart cities.

Crown Castle’s 5G Expansion: Crown Castle is developing small cell networks across major U.S. cities to support edge computing and 5G applications. The network infrastructure allows for faster data transmission, making it essential for IoT and real-time analytics.

Impact on Data Centers:

Edge data centers, often smaller and more distributed, are integral to low-latency services such as content delivery and cloud gaming. As companies build out their edge infrastructure, the focus shifts to balancing compute power with energy efficiency, as these centers will be closer to urban environments.

AI and Quantum Computing Impact on Data Centers

AI is becoming the dominant driver behind data center expansion, especially in high-performance computing environments. AI model training for large-scale models like OpenAI's GPT-4, require immense compute resources and produce significantly more heat, which places new demands on cooling systems and energy efficiency.

AI’s Power Demands:

AI Workloads & Power Consumption: Training an AI model can require up to 10x more energy than traditional data center tasks. Generative AI and deep learning workloads are pushing data centers to rethink their infrastructure.

AI-Driven Infrastructure Optimization: AI is also being used to optimize data center operations, with AI-driven cooling systems like those developed by Google, reducing energy consumption by up to 40%.

Quantum Computing:

Quantum computing will be the next frontier in data centers, transforming how data is processed at speeds unimaginable by today’s standards. Companies like IBM and Google are leading the charge with quantum computers that will soon become integral for processing complex AI and HPC tasks.

Quantum Processing Power: Quantum computers are expected to be up to a million times faster than current supercomputers, meaning they can solve complex problems in seconds. However, quantum computing also requires specialized cooling solutions.

Long-Term Impact: As quantum computing becomes more mainstream, data centers will need to accommodate quantum processors and related infrastructure, likely transforming how large-scale data and AI models are processed.

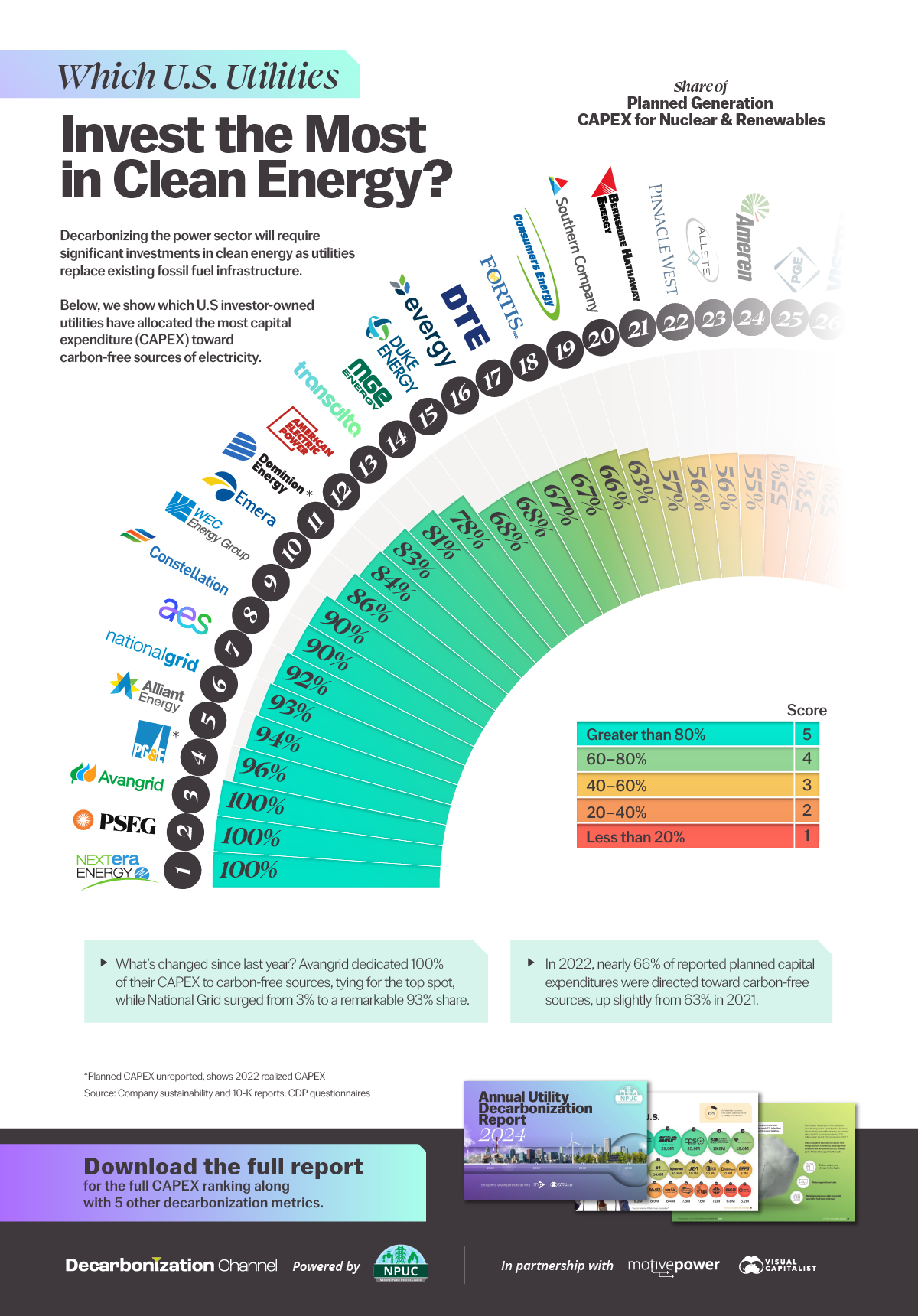

Renewable Energy Synergy and AI's Role in Grid Optimization

Demand for Clean Energy: The push for renewable energy is driven by both AI infrastructure and global sustainability efforts. Leading sources such as solar, wind, and hydropower are seeing significant growth to meet the rising energy needs of data centers and other industries.

AI-Powered Efficiency: AI technology is transforming grid management. Utilities utilizing AI-driven optimization tools, like those offered by Schneider Electric and Johnson Controls, can manage peak loads more effectively, predict future energy demands, and enhance overall grid stability.

Automated Grid Balancing: AI systems automate energy distribution and balancing, ensuring power flows efficiently to where it's needed, especially in regions with high data center activity. This results in improved grid performance and reduced energy waste.

GE Vernova’s diverse energy portfolio provides renewable and traditional energy solutions tailored to data centers. Its wind, gas, and nuclear power options allow for scalable and reliable energy, helping to meet the growing energy demands of AI-driven data centers.

Key Players:

NextEra Energy: The largest producer of renewable energy in the U.S., is a leader in solar and wind power

Bloom Energy: Provides fuel cell technology that operates on natural gas or hydrogen

Below is from WSJ

The Importance of Materials Used to Build and Run Data Centers

Data centers are the center of the modern digital economy, facilitating everything from cloud services and AI applications to everyday internet use. Building and running these complex facilities requires a carefully coordinated use of materials to ensure durability, efficiency, and scalability. Each component plays a crucial role in ensuring the data center can handle the growing global demand for computing power and data storage.

1. Construction Materials: The Structural Foundation

Steel and Concrete: These materials are the pillars of the physical structure of data centers. Steel provides the strength to support heavy equipment like servers, cooling units, and electrical systems. Concrete offers durability and thermal mass, which is important for managing heat in large data centers. Without strong structural materials, data centers would not be able to house the weight and size of modern computing and storage equipment. For example medium-sized data centers often use thousands of tons of concrete and steel.

Impact: These materials ensure the reliability of data centers in any geographic region, including high-seismic areas, protecting against physical degradation over time.

Copper: Copper is critical for power distribution and wiring, ensuring that the energy needs of data centers are met without interruptions. Copper’s high conductivity makes it indispensable for powering servers and ensuring network communications remain stable.

Impact: Copper allows for seamless power transmission, ensuring data centers run at full capacity, often with over 100 miles of copper wiring involved in large projects.

Aluminum: This lightweight material is used in server racks and other enclosures, providing the necessary support without adding significant weight. This ensures the flexibility of data center design.

Impact: Aluminum helps in creating scalable solutions for data center equipment arrangement and server cooling.

2. Cooling and HVAC Systems: Regulating Heat

Water: Many data centers rely on water cooling systems to maintain optimal operating temperatures for servers. The scale of water usage can be immense, with companies like Google using up to 2 million gallons of water per day to cool their data centers.

Impact: Water is essential for ensuring that data centers remain cool and operational, especially when dealing with high-intensity workloads from AI and cloud services.

Refrigerants and Coolants: These are used in HVAC systems to dissipate heat generated by the servers. Newer facilities are moving towards liquid cooling systems to improve energy efficiency and reduce the environmental impact of traditional refrigerants.

Impact: Efficient cooling systems are critical for maintaining data center uptime and preventing overheating, which could lead to downtime and equipment damage.

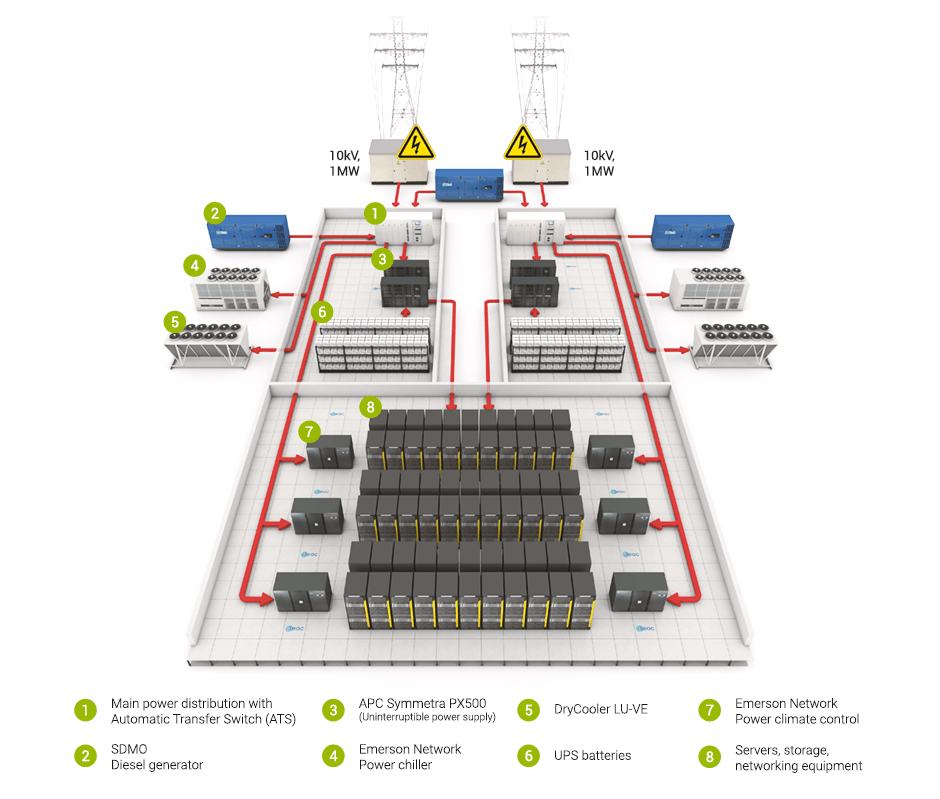

3. Energy Supply and Backup: Ensuring Continuous Power

Battery Storage (UPS): Data centers use uninterruptible power supplies (UPS) based on lithium-ion batteries to provide backup power in case of outages. These batteries prevent downtime and protect against data loss.

Impact: UPS systems ensure uninterrupted operation, especially during power fluctuations, which is crucial for services like cloud hosting and real-time applications.

Diesel and Natural Gas Generators: These provide essential backup power in the event of a grid failure. The ability to switch seamlessly to generators is vital for preventing operational disruptions.

Impact: Backup generators ensure resilience, maintaining operational capacity even during prolonged power outages, which is critical for disaster recovery scenarios.

Solar and Renewable Materials: The shift to renewable energy sources such as solar power is becoming increasingly common in modern data centers. These systems reduce carbon footprints and make data centers more sustainable, using materials like silicon, silver, and aluminum.

Impact: The adoption of renewables ensures long-term sustainability and aligns with the tech industry's push for net-zero emissions.

4. IT Equipment: Powering the Digital Core

Silicon, Gold, and Platinum: Silicon chips power servers, GPUs, and CPUs, while small amounts of gold and platinum improve the efficiency of semiconductors. These materials ensure that the core computing functions of data centers operate at peak performance.

Impact: These materials are essential for the efficiency and processing power of servers, ensuring smooth operation for data-intensive tasks like AI and big data analytics.

Rare Earth Metals: Elements like neodymium and dysprosium are used in the magnets for hard drives, cooling fans, and other key components of data centers.

Impact: Rare earth metals ensure reliability and precision in the functioning of critical data center equipment.

Fiber Optic Cables: Fiber optics are indispensable for high-speed data transmission, making them a core component of modern data center design. Fiber cables enable rapid data transfer over long distances, ensuring that data centers remain connected to the global network.

Impact: Fiber optics deliver high-speed connectivity, essential for handling vast amounts of data generated by cloud computing and AI applications.

5. Power Distribution Systems: Managing High Energy Demands

Transformers and Switchgear: These components are used to manage and distribute power throughout the data center. They are essential for controlling the large-scale electricity needs of modern facilities.

Impact: Power distribution systems ensure that energy is efficiently managed and directed to the right parts of the data center, minimizing energy waste and improving uptime.

Insulation and Fireproofing Materials: Materials like fiberglass and intumescent coatings protect data centers from electrical faults and fires, ensuring the safety of both the infrastructure and the data stored within.

Impact: These materials provide protection from potential hazards, ensuring that data centers are both safe and secure.

6. Sustainability Initiatives: Reducing Environmental Impact

Carbon Capture Materials: Companies are beginning to incorporate carbon capture technology to offset emissions from data centers powered by natural gas plants. Materials like metal-organic frameworks (MOFs) are being explored to capture and store CO2.

Impact: Carbon capture helps data centers align with sustainability goals, reducing the environmental footprint of large-scale energy usage.

Energy-Efficient Materials: Innovations like phase-change materials (PCMs) are being developed to improve the efficiency of data center cooling systems, reducing reliance on traditional air conditioning.

Risks & Challenges

Location is a key determinant of which utility companies will benefit most from AI-driven demand. Regional differences in infrastructure readiness and energy policies will shape growth prospects.

Texas: A deregulated energy market offers pricing volatility but also profit potential, as utilities can charge higher rates during peak demand.

More regulated markets: These regions may see slower growth but provide greater grid stability and predictable revenues, making them less vulnerable to the pricing fluctuations that Texas experiences.

Regulatory Challenges:

Regulations like the General Data Protection Regulation (GDPR) in the EU and India’s Data Protection Bill require companies to store data locally, increasing the need for region-specific data centers and driving costs higher. This forces companies to establish data centers in multiple regions, increasing infrastructure and operational costs. Compliance with these laws can also slow down expansions.Energy Shortages:

Power reliability is a major concern. For instance, in Texas, the Electric Reliability Council of Texas (ERCOT) struggles to meet growing energy demands during extreme weather events. Energy shortages can lead to outages, making backup systems like those from Generac and Bloom Energy crucial.Geopolitical Tensions:

Global supply chain disruptions, driven by tensions between countries like the U.S. and China, have affected semiconductor availability. Companies like Intel and AMD have faced production delays due to export restrictions, which impacts data center expansions reliant on advanced chips.

Infrastructure Strain and Expansion Needs

The regions where new or expanding data centers are situated will be the primary beneficiaries of the AI boom, but many of these areas face infrastructure strain.

Texas: Challenges maintaining a stable electric supply due to a growing population, rising commercial demand (especially from tech), and its deregulated energy market. Texas’ grid is disconnected from the national energy grid, leading to volatile pricing.

Southern California: Population growth and tech demand have outpaced existing infrastructure, compounded by droughts affecting hydroelectric power.

Semiconductor Shortages and Supply Chain Constraints

Semiconductors are the foundation of modern data centers, and the ongoing global semiconductor shortage has posed significant challenges for the industry. The supply of chips has become critical for AI hardware, networking equipment, and storage systems in data centers.

Semiconductor Shortage Impact:

Production Delays: Intel, AMD, and NVIDIA have experienced production delays due to the shortage, affecting the rollout of new servers and AI accelerators for hyperscale data centers.

CHIPS Act Benefits: In response, the U.S. has passed the CHIPS Act, which allocates billions of dollars to boost domestic semiconductor production. Intel is receiving government support to build new fabs, while AMD is ramping up production of its EPYC processors.

Supply Chain Diversification: Companies are also diversifying their supply chains by investing in production facilities in regions like Southeast Asia and India, reducing dependency on Chinese manufacturing.

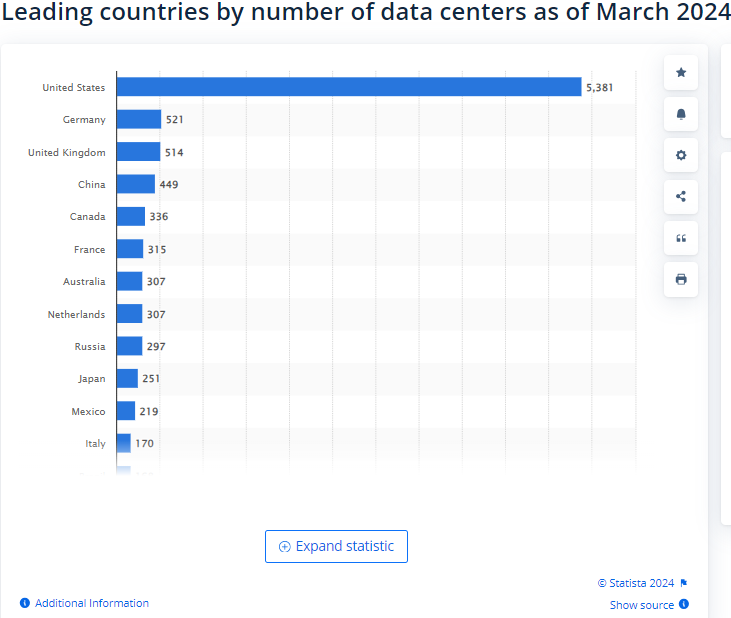

Data Center Growth

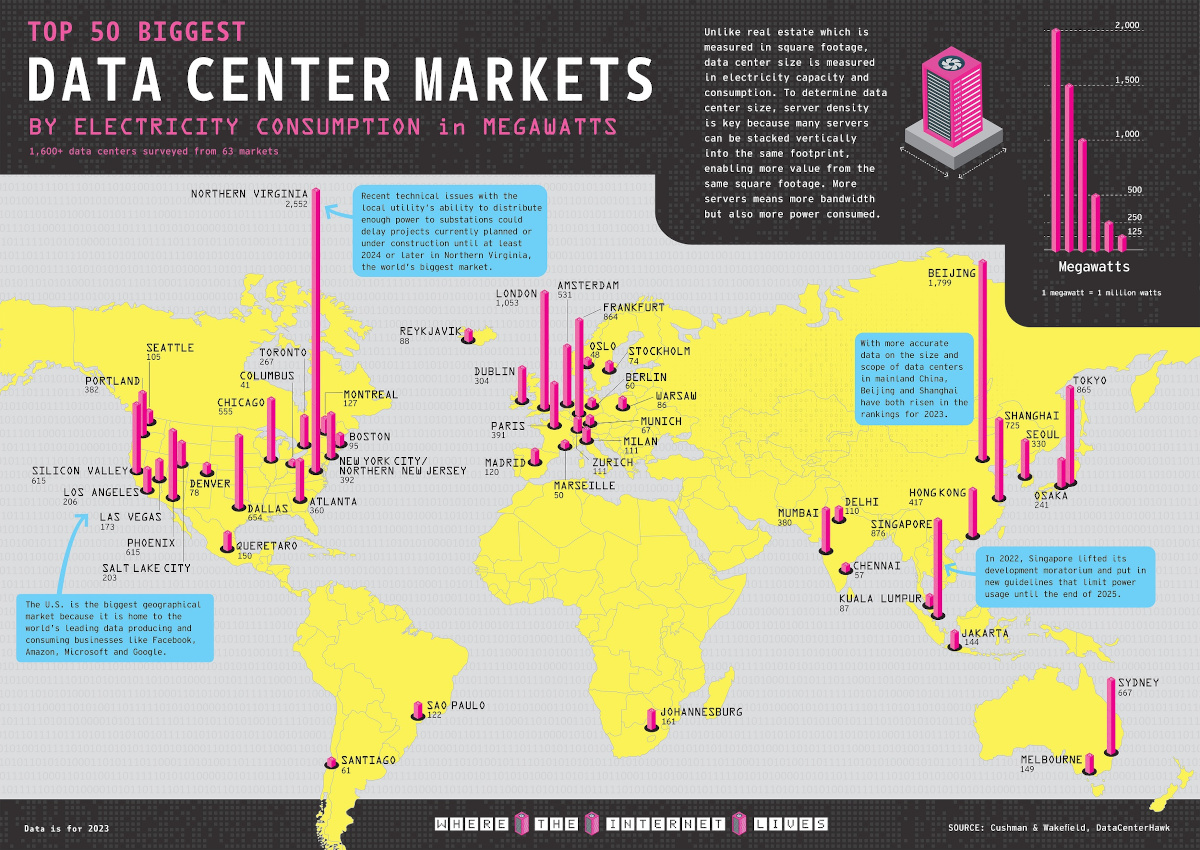

As demand for data centers grows in the U.S., regions like Northern Virginia, Dallas, and Phoenix are becoming key hubs. Northern Virginia leads with over 280 data centers in development and power consumption projected to exceed 10 GW by 2028. Dallas and Phoenix are each expected to add more than 3 GW of capacity in the same timeframe.

Mergers & Acquisitions in the Energy Sector

As energy demand surges, M&A activity is increasing among utility companies. Smaller firms struggling to scale may become acquisition targets for larger players.

Increased Energy Demand: Growing energy needs, especially driven by AI, are expected to boost M&A activity in the utility sector.

Smaller Firms as Targets: Companies struggling to scale their infrastructure may be acquired by larger, better-funded firms.

Renewable Energy Focus: Utilities providing innovative renewable energy solutions or improving grid efficiency will be attractive to tech firms and private equity investors.

Overview of the Utilities Sector

Wide range of products and services, including gas, water, electric, and telecom utilities. Some companies offer diversified services, such as providing both gas and electrical services, using natural gas for electricity generation. The electricity and natural gas segments are receiving the most market attention due to the rising demand driven by data centers and AI applications.

Many utility companies generate revenue through:

Usage charges: Based on total consumption.

Demand charges: Fees during peak usage, which can be variable and lucrative.

Service or access fees: Charged for infrastructure access.

Some utilities participate in energy trading markets, providing surplus electricity during times of high demand. This revenue model is evolving due to the growing influence of AI and data center operations, which significantly increase electricity demand.

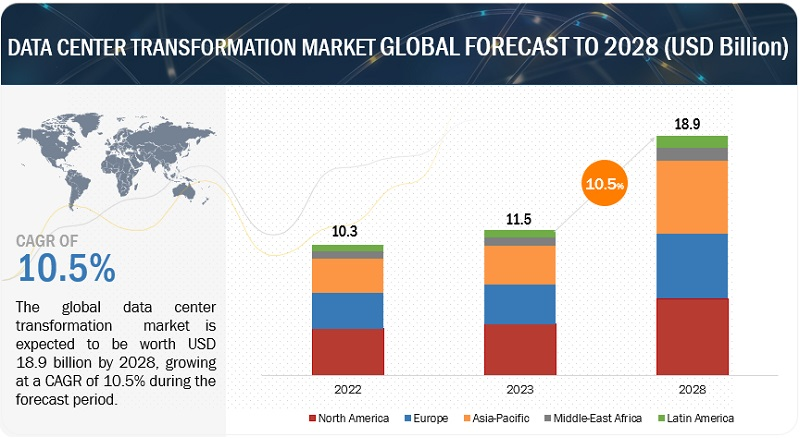

Emerging Markets for Data Centers

Emerging markets in Asia, Latin America, and Africa are experiencing significant growth in data center investments due to increasing internet penetration and the expansion of digital economies.

Middle East (UAE, Saudi Arabia): Emerging Data Center Hub

The Middle East is rapidly establishing itself as a major destination for data center investments. This growth is fueled by capital-rich governments, favorable regulatory environments, and strategic efforts to diversify economies away from oil, particularly through investments in AI and cloud computing infrastructure.

Key Drivers for Growth

Vision 2030: Saudi Arabia’s Vision 2030 initiative aims to reduce dependence on oil and stimulate growth in sectors like technology, AI, and digital infrastructure, positioning the country as a hub for innovation and high-tech investment.

Easy Access to Capital: Backed by sovereign wealth funds and affluent governments, countries in the Middle East can quickly attract global tech giants and develop large-scale data centers.

Accelerated Construction Capabilities: Streamlined regulations and abundant natural resources allow countries like Saudi Arabia to build power plants and data centers at a rapid pace, bypassing the extensive red tape often encountered in the U.S. and other Western markets.

Major Companies Investing

AWS (Amazon): Committed to investing $5.3 billion in at least three data centers in Saudi Arabia to support AI, cloud computing, and other technology needs. This aligns with AWS's broader strategy to establish localized cloud infrastructure in key markets.

MGX (Abu Dhabi-based): A participant in a $100 billion alliance aimed at developing data centers in Saudi Arabia and globally, underscoring the region’s commitment to infrastructure expansion.

Google Cloud: Partnering with Saudi Arabia’s Public Investment Fund (PIF) on a $100 billion AI and data center hub, reinforcing the region's role as a strategic location for Google’s AI and cloud operations.

G42 (Abu Dhabi): In partnership with Microsoft, G42 is investing $1.5 billion to build data centers, further cementing Abu Dhabi as a technology and AI hub.

Microsoft: Collaborating with G42 on data center projects and exploring additional opportunities across the Middle East.

Equinix: Recently expanded its UAE presence by opening its fourth facility, further enhancing the region’s infrastructure for global tech companies.

Security & Geopolitical Concerns

Strategic Importance: Saudi Arabia’s close alignment with the U.S. offers a geopolitical advantage compared to other regions with potential security risks, like China. However, the growth of AI infrastructure abroad presents risks; models trained overseas are more susceptible to intellectual property theft and espionage.

Export Control Risks: The U.S. is evaluating export controls on AI chips to the Middle East, similar to those imposed on China. While these controls are designed to protect national security, they risk straining U.S. relations in the region and could push Middle Eastern nations to strengthen ties with China.

“Conditional Compute Sharing” Initiatives: To address security concerns, Saudi Arabia and UAE companies have begun reducing involvement with Chinese tech firms. The U.S. may formalize “conditional compute sharing” to ensure that data center investments in the region align with American security interests.

Energy Infrastructure and Sustainability

Natural Gas and Solar Power: Saudi Arabia is investing heavily in solar energy to support data centers and reduce its reliance on oil. Additionally, the country’s robust natural gas infrastructure provides a stable energy supply for the high-power demands of data centers.

Expanding Renewable Energy Capabilities: The country’s investment in solar and other renewables makes it attractive to global tech companies that prioritize sustainability, supporting a long-term vision for eco-friendly data center operations.

Challenges & Opportunities for U.S. Involvement

Regulatory Flexibility: Unlike the stringent permitting and environmental regulations in the U.S., the Middle East benefits from faster construction approvals, enabling rapid data center expansion. This flexibility is appealing to tech companies seeking efficient development timelines.

National Security Risks: The export of U.S.-trained AI models and technologies to the Middle East raises risks around intellectual property security and compliance. Recently, Microsoft faced export control restrictions, emphasizing the U.S. government’s intention to safeguard advanced technologies.

Balanced Strategic Engagement: To maintain influence while supporting AI development, the U.S. could pursue partnerships contingent upon security conditions, providing access to compute resources while ensuring compliance with American security standards. This “conditional compute sharing” approach could solidify relationships with Middle Eastern allies and counterbalance China’s influence in the region.

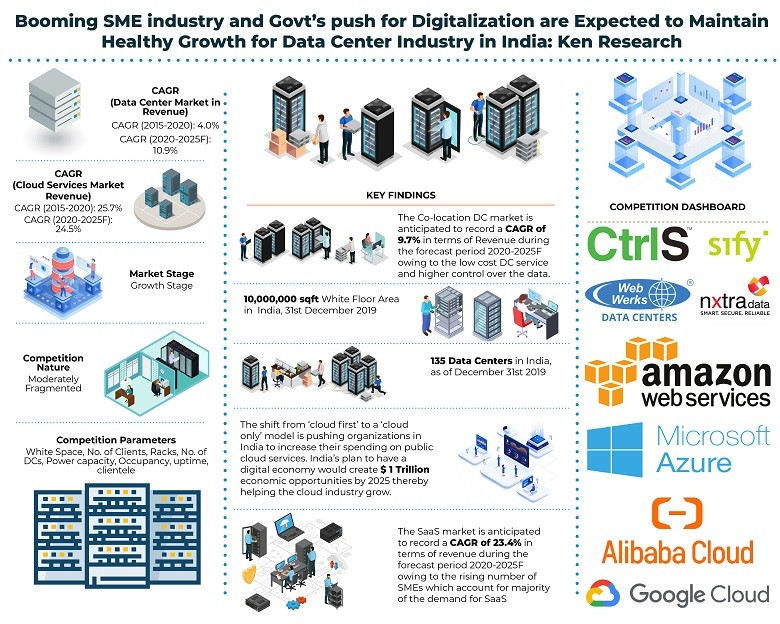

India: Rapidly Expanding Data Center Market

India’s data center industry is experiencing exponential growth, driven by its large internet user base, rising demand for digital services, and data localization requirements. With a fast-growing economy and a tech-savvy population, India is emerging as a critical market for global cloud providers and infrastructure companies.

Key Drivers for Growth

Massive User Base: With over 700 million internet users, India is one of the world’s largest digital markets, fueling the need for local data infrastructure to meet consumer and business demand.

Data Localization Laws: Government mandates on data localization require global companies to store data within India’s borders, encouraging major cloud providers to establish and expand local infrastructure.

Digital Transformation Initiatives: Programs like Digital India are promoting digital adoption across sectors, increasing the demand for data centers to support this growth.

Infrastructure & Cooling Demand

High Cooling Needs: India’s warm climate drives the demand for advanced cooling solutions, including liquid cooling, to maintain data center efficiency.

Supporting Companies:

Carrier Global (CARR): Provides energy-efficient cooling systems suited to India’s climate.

Schneider Electric (SU): Offers advanced cooling and energy management solutions tailored to high-density data centers.

Mueller Industries (MLI): Supplies copper-based cooling solutions critical for India’s expanding data center infrastructure.

Renewable Energy Push: The Indian government and private sector are heavily investing in renewable energy sources like solar and wind to support sustainable data center operations. This aligns with the sustainability goals of global cloud providers, reducing energy costs for power-intensive facilities.

Major Companies Investing

Adani Enterprises & Yotta Infrastructure: These Indian conglomerates are developing large-scale data centers, particularly in major urban hubs like Mumbai, Delhi, and Bengaluru.

AWS (Amazon): Expanding its infrastructure with new availability zones to cater to the demand from Indian enterprises and global clients, while partnering with local providers for enhanced cloud accessibility.

Microsoft Azure: Investing in regional data centers to support cloud services, including Microsoft 365 and Azure, meeting the needs of businesses, government entities, and startups.

Google Cloud: Increasing its footprint by establishing additional data centers to meet enterprise demand, while collaborating with telecom partners like Jio to improve cloud service access across India.

Southeast Asia (Indonesia, Singapore, Malaysia, Vietnam): Emerging Digital Hub

Southeast Asia’s strategic location, rapid digital growth, and access to major trade routes are positioning it as a significant hub for data center expansion. The region’s population, rapid digital adoption, and strong government incentives also make it a focal point for global data center investments.

Additional Drivers for Growth

Government Initiatives and Investment Incentives: Southeast Asian governments offer incentives and regulatory support to attract technology investments, particularly in digital infrastructure. Countries like Singapore have strong policies to promote data center efficiency and sustainability.

Growing E-Commerce and Fintech Markets: The rise in e-commerce, digital payments, and fintech has fueled demand for cloud infrastructure and local data centers, particularly in markets like Indonesia and Vietnam.

Infrastructure Improvements: Countries in the region are investing in high-speed internet and connectivity, essential for supporting large-scale data operations.

Key Players Investing

Equinix: Expanding rapidly across Singapore, Malaysia, Indonesia, and Vietnam, catering to cloud and digital service demand across the region.

AWS (Amazon): With established data centers in Singapore, AWS is expanding into Indonesia and Vietnam to support digital and cloud growth in these emerging markets.

Microsoft Azure: Investing in Singapore, Indonesia, and Malaysia to serve local and global business needs, while also working with local governments to ensure data sovereignty and compliance with regional regulations.

Google Cloud: Expanding its data center presence in Singapore and exploring options in Malaysia and Indonesia to support Southeast Asia’s growing tech ecosystem.

Latin America (Brazil, Mexico): Expanding Digital Economy

Latin America’s digital economy is growing quickly, with Brazil and Mexico leading the region in digital adoption, making it a prime market for data center investment.

Additional Drivers for Growth

Urbanization and Digital Transformation: Rapid urbanization and the increasing adoption of digital technologies by businesses and government agencies are fueling demand for data centers, particularly in large cities like São Paulo and Mexico City.

Cloud Adoption and Fintech Growth: Latin America’s fintech sector is one of the fastest-growing in the world, necessitating local data centers to meet regulatory and operational demands.

Favorable Economic Policies: Several Latin American governments are implementing policies to promote tech investments, with tax incentives and streamlined regulations for data center operators.

Key Players Investing

Ascenty (Digital Realty): The largest data center operator in Brazil and Mexico, supporting the region’s growth in cloud computing and digital services.

Equinix: Expanding its footprint in Brazil to strengthen its position and meet growing demand in Latin America.

AWS & Microsoft Azure: Both companies are increasing investments in Brazil and Mexico, supporting enterprises and tech sectors with essential cloud and data infrastructure.

Africa (South Africa, Nigeria, Kenya): Rising Data Center Demand

Africa’s data center market is expanding rapidly, led by South Africa, Nigeria, and Kenya, as internet penetration and digital adoption continue to rise across the continent. Growing mobile phone usage, tech startups, and the increased adoption of digital services contribute to Africa’s demand for local data centers.

Additional Drivers for Growth

Improved Connectivity: Initiatives like undersea cables and fiber optic expansions are improving Africa’s connectivity, making it more feasible for data center investments.

Growing Tech Startup Scene: Africa is witnessing a surge in tech startups, particularly in fintech, e-commerce, and edtech, which rely on reliable cloud infrastructure and local data centers to support their growth.

Government and Private Sector Partnerships: Governments and private companies are working together to improve digital infrastructure, with several African nations prioritizing data sovereignty to keep data within their borders.

Key Players Investing

AWS (Amazon): Established a data center in South Africa, providing reliable cloud services to support the continent’s growing tech ecosystem.

Microsoft Azure: Expanding from South Africa into Nigeria and Kenya to support digital transformation and cloud adoption across the continent.

Google Cloud: Exploring opportunities to expand into Nigeria and Kenya, meeting demand for cloud services and supporting Africa’s digital growth.

Big Tech Driving Data Center Demand

Overview of Big Tech’s Role:

Big tech companies like Amazon, Microsoft, Google, Meta, and Apple are the primary drivers of data center demand. These tech giants are investing billions into building hyperscale data centers to support their cloud infrastructure, AI initiatives, streaming services, and other digital operations.

Amazon Web Services (AWS): AWS is the world's largest cloud provider, and its growing list of services (AI, ML, serverless computing) is driving massive demand for data centers worldwide.

Microsoft Azure: Microsoft is rapidly expanding its data center footprint to support its Azure cloud platform and is a leader in enterprise cloud services.

Google Cloud: Google’s AI and machine learning services, coupled with its dominance in internet search, fuel its global data center expansion.

Meta: Meta is building hyperscale data centers to support its social media platforms, VR initiatives (Meta’s metaverse), and AI-driven algorithms.

Apple: Though smaller in the cloud market, Apple invests in data centers for its iCloud services, with a focus on renewable energy usage.

Key Data Center Projects:

Project Natick (Microsoft): Microsoft’s underwater data center project, experimenting with new ways to create efficient, sustainable data centers.

Meta’s Data Centers: Large-scale data center facilities in states like Iowa, New Mexico, and Texas designed to support its social media and metaverse operations.

Google’s Green Data Centers: Google has focused on making its data centers carbon-neutral, and it’s investing heavily in AI-driven cooling and energy efficiency projects globally.

AWS: AWS continues to lead in building out data centers globally, with significant expansions in Asia-Pacific, Europe, and the U.S.

Largest Data Center Projects Globally

Digital Realty’s Virginia Campus: One of the largest data center campuses in the world, located in Northern Virginia, the largest data center market globally.

China’s Big Cloud Push: With Alibaba Cloud and Tencent Cloud, China is building massive hyperscale data centers across multiple provinces to meet domestic cloud demand.

Google’s Denmark Data Centers: Google is investing billions in Europe, including major builds in Denmark, which are powered entirely by renewable energy.

Equinix’s Global Expansions: Equinix continues to expand its global presence with major builds across Asia-Pacific, Europe, and South America.

Operators: The Infrastructure Behind the Scenes

Equinix

Role: World’s largest colocation provider, essential for enterprise and cloud growth.

Strengths: Global presence with data centers across multiple regions. Provides direct connectivity to major cloud providers, making it indispensable for enterprises.

Key Focus: Expanding infrastructure to support the accelerating growth of cloud services, offering unmatched interconnection capabilities.

Digital Realty

Role: Major player in the colocation market, focusing on hyperscale data centers.

Strengths: Expanding its data center footprint, especially in sustainable and energy-efficient solutions.

Key Focus: Prioritizing green energy and sustainability, which is critical as data centers face rising energy consumption concerns.

CyrusOne

Role: Leading provider of enterprise colocation with a growing footprint across North America.

Strengths: Specializes in high-security data centers, making it ideal for government, financial, and healthcare clients.

Key Focus: Expanding its secure, enterprise-grade data centers, catering to clients with stringent data security requirements.

REITs & ETF's

REITs Focused on Data Centers:

Equinix and Digital Realty Trust are leading real estate investment trusts (REITs) in the data center sector.

Why Invest: These REITs offer stable returns by capitalizing on the increasing demand for digital infrastructure. They provide consistent dividends while giving investors exposure to the growing cloud and data center markets.

ETFs Targeting Data Centers:

First Trust Cloud Computing ETF (SKYY) and Global X Data Center REITs & Digital Infrastructure ETF (VPN) are popular exchange-traded funds (ETFs) that focus on data centers and cloud computing.

Why Invest: These ETFs allow investors to tap into the rapid growth of AI, cloud services, and 5G, all of which are driving increased demand for data center infrastructure.

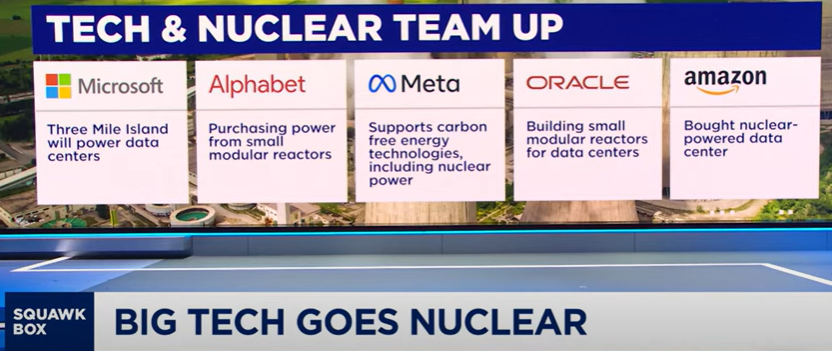

Energy Usage and Sustainability in Data Centers

Data centers consume significant amounts of electricity, projected to rise to 9% of global electricity usage by 2030. As a result, energy efficiency, sustainability, and innovations in power systems are critical.

Energy Sources:

Renewable Energy: Solar, wind, and hydropower are favored due to sustainability goals.

Nuclear Energy: Provides reliable and low-emission energy, critical for large-scale data centers.

Natural Gas: Used as a transition fuel toward more sustainable options.

Energy Storage and Backup:

Battery Storage: Critical for ensuring continuous power. Key players include Tesla and Fluence Energy.

Backup Power Solutions: Generac and Cummins provide diesel and gas generators for backup.

What Energy Sources Are Preferred?:

Renewable Energy: Many large operators like Google, Microsoft, and Amazon are committing to 100% renewable energy sources for their data centers to meet sustainability goals and reduce carbon emissions.

Renewable energy sources, including solar, wind, and hydropower, are becoming more prominent as companies seek to reduce their carbon footprints

Energy sources are Intermittent.

NextEra Energy

Largest producer of renewable energy in the US

Enphase Energy

Specializes in solar energy solutions, particularly inverters and battery storage systems

Switch, Inc.

Switch’s data centers are among the most sustainable, utilizing 100% renewable energy and offering advanced liquid cooling systems to reduce overall energy consumption.

Nuclear Energy: There’s a growing interest in using nuclear energy for powering data centers due to its ability to provide consistent and clean power.

Nuclear power offers a reliable and constant source of energy, making it ideal for large-scale data centers with high and consistent energy needs.

Amazon (AWS):

AWS has invested in X-energy, a developer of SMRs, and is collaborating with Energy Northwest to build SMRs in Washington. The project aims to support more than 5 GW of nuclear energy projects by 2039.

Amazon also acquired Talen Energy’s data center campus near the Susquehanna nuclear power plant in Pennsylvania for $650 million, which could provide up to 960 MW of nuclear-powered capacity

Additionally, Amazon is working with Dominion Energy in Virginia to explore developing an SMR project near Dominion’s North Anna nuclear power station, which could provide at least 300 MW of power

Microsoft:

Microsoft signed a 20-year power purchase agreement (PPA) with Constellation Energy to procure nuclear energy for its Boydton facility, aiming to provide 837 MW of nuclear capacity through the revived Three Mile Island nuclear plant. This partnership highlights Microsoft’s strategy to achieve nearly 100% carbon-free electricity for its data centers

Google:

Google has partnered with Kairos Power to build nuclear micro-reactors for its data centers. This deal includes the installation of small modular reactors (SMRs) aimed at supporting Google's AI and data center needs by adding 500 MW of carbon-free electricity

Other Key Nuclear Players in the Industry:

Southern Company:

Operates the Vogtle nuclear plant and continues to be heavily involved in nuclear power generation.

Constellation Energy:

As the largest provider of carbon-free energy in the U.S., Constellation Energy has over 21,000 megawatts of nuclear capacity and is actively partnering with tech companies to support clean energy solutions for data centers.

Vistra Corp:

Operates several nuclear power plants and focuses on providing reliable and large-scale energy to industrial sectors, including tech and data center facilities.

Natural Gas for Data Centers

Natural gas serves as a critical transitional energy source for data centers, providing reliable, on-demand power as these facilities increasingly shift to sustainable energy options.

Widely Available:

Natural gas is abundant and accessible, ensuring consistent energy availability for data centers that require uninterrupted operations and reliability.

Cleaner than Coal and Oil:

While not as clean as renewables, natural gas emits less carbon dioxide than coal or oil, making it a practical "bridge fuel" that helps reduce emissions as data centers develop renewable energy infrastructures.

Kinder Morgan (KMI)

Extensive Pipeline Network: Operates one of the largest natural gas pipeline systems in North America, transporting approximately 40% of the natural gas consumed in the U.S. daily.

Strategic Initiatives: Exploring opportunities to supply natural gas directly to data centers, leveraging its vast infrastructure to meet the growing energy demands of these facilities.

Williams Companies (WMB)

Transco Pipeline: Operates the Transco pipeline, the largest-volume interstate natural gas pipeline in the U.S., delivering natural gas through its approximately 10,000-mile network.

Data Center Integration: Integrating LNG value chain capabilities to meet growing global LNG demand. Williams has agreements to connect natural gas from the Haynesville basin to LNG export facilities along the Gulf Coast.

TC Energy (TRP)

Pipeline Infrastructure: Operates an extensive network of natural gas pipelines across North America, providing reliable energy transportation services.

Focus on Data Centers: Projects significant growth in natural gas demand from data centers, with an anticipated increase of up to 8 billion cubic feet per day by 2030. TC Energy is reinforcing its pipeline networks and enhancing connections to local distribution companies to support this demand.

Hydropower for Data Centers

Hydropower provides a continuous and renewable source of energy, making it a reliable option for powering data centers.

Brookfield Renewable Partners:

Operates one of the world’s largest hydropower portfolios, offering consistent and sustainable energy solutions across multiple regions.

Duke Energy:

Heavily invested in hydropower in the Southeastern United States, providing reliable power for data centers and other large-scale operations.

Pacific Gas & Electric (PG&E):

Manages several hydropower plants in California, contributing to the state’s renewable energy infrastructure and supporting local data center needs.

Energy Storage (Battery Solutions)

As data centers increasingly integrate intermittent renewable energy sources, energy storage solutions are essential for storing excess power and ensuring 24/7 electricity availability.

Tesla:

Offers Powerpack and Megapack battery storage solutions that provide scalable options for data centers, improving energy storage capabilities and grid reliability.

Fluence Energy:

A leader in grid-scale energy storage, Fluence provides solutions enabling data centers to store renewable energy effectively and balance supply with demand.

Enphase Energy:

In addition to its solar energy solutions, Enphase offers battery storage systems for both residential and commercial applications, making it a key player in energy storage for data centers.

Backup Power Solutions (Diesel & Gas Generators)

To ensure continuous operation during power outages, data centers often rely on diesel and gas generators as backup power sources.

Caterpillar:

Produces diesel and natural gas generators widely used in data centers for emergency power supply, ensuring operational continuity.

Cummins:

Specializes in industrial backup generators, including those for data centers, capable of running on both diesel and natural gas.

Generac:

A leading manufacturer of backup power systems for various applications, Generac supports data centers with reliable diesel and gas generator solutions.

Energy Efficiency Innovations for Data Centers

Data centers are increasingly adopting technologies and strategies to improve energy efficiency and reduce their environmental impact.

Liquid Cooling Systems:

Companies like Vertiv and Schneider Electric are developing advanced liquid cooling systems that use less energy compared to traditional air cooling methods, enhancing efficiency and reducing operating costs.

AI-Driven Cooling:

Google is utilizing AI technology to optimize its cooling systems, resulting in energy usage reductions of up to 40%.

Modular Data Centers:

Modular data centers, designed by companies like Vertiv, are reducing construction time and energy waste by providing flexible, energy-efficient solutions that can be rapidly deployed and scaled according to demand.

Energy Usage and Sustainability in Data Centers

Renewable Energy: Solar and wind power are commonly adopted to reduce carbon footprints.

Nuclear Energy: Increasing interest due to its consistency and low emissions.

Natural Gas: Used as a transition fuel toward more sustainable options.

AI-Driven Cooling: Google is using AI to optimize cooling systems, cutting energy usage by up to 40%.

Regulatory and Compliance Information

Why Regulation Matters:

Data centers are subject to various local, regional, and international regulations regarding data sovereignty, privacy, and operational standards. Understanding and adhering to these regulations is crucial to avoid penalties and maintain the ability to operate in certain markets.

Key Regulations and Compliance Concerns:

Data Sovereignty: Some countries mandate that data generated within their borders must be stored locally (India’s Data Protection Bill, EU’s GDPR).

Cybersecurity Standards: Compliance with standards such as ISO 27001, SOC 2, and PCI DSS is critical for securing data against breaches.

Environmental Regulations: Governments are imposing stricter energy efficiency and carbon emission regulations for data centers, influencing operational strategies.

Security Threats and Solutions

Why Security Matters:

Data centers house critical data and infrastructure, making them prime targets for cyberattacks, insider threats, and physical security risks.

Key Security Solutions:

Fortinet: Provides firewalls, intrusion detection, and security solutions tailored for data centers.

Cisco: Offers advanced networking security and monitoring tools to protect against cyberattacks.

Physical Security: Biometrics, video surveillance, and secure access protocols are essential for preventing unauthorized access to data centers.

Cybersecurity in Data Centers

Data centers are critical to global infrastructure, making them prime targets for cyberattacks like ransomware and DDoS attacks. Security is essential to maintain business operations and safeguard sensitive data. Companies such as Fortinet, Cisco, and Palo Alto Networks provide advanced firewalls, intrusion detection, and AI-driven threat detection systems to secure these facilities.

Key Considerations

Data Sovereignty & Compliance:

Data centers must adhere to regulations like GDPR (EU) and CCPA (California), requiring secure storage within specific regions.

AI-Driven Security:

AI tools, such as AI-powered SIEMs (Security Information and Event Management), detect threats in real time, offering proactive protection against zero-day exploits and evolving cyber threats.

Physical Security:

Physical measures, including biometric access, surveillance, and strict protocols, are vital to protect against unauthorized access and maintain data center integrity.

Hyper-local Energy and Climate Considerations

Why Climate Matters:

Data center energy usage can vary based on geographic location, due to differences in local climates and energy availability. For example, regions with colder climates may reduce cooling costs, while warmer areas may face challenges related to heat dissipation.

Key Considerations:

Location-Specific Cooling: Colder regions may rely on natural cooling, reducing energy costs.

Renewable Energy Integration: Areas with abundant solar or wind resources, such as California or the Nordics, can integrate more renewable energy into their data centers.

Local Power Grids: Data centers in areas with unreliable power grids often rely more heavily on backup energy solutions like diesel generators or energy storage systems (Fluence).

Lifecycle Management and E-waste

Why Lifecycle Management Matters:

The efficient management of data center hardware lifecycle can reduce environmental impact and operating costs. From acquisition to disposal, managing servers, storage, and networking equipment is critical for sustainability.

Key Lifecycle Management Approaches:

Recycling and Reuse: Dell and others offer take-back programs to refurbish and recycle old equipment.

Hardware Refresh Cycles: Planning and optimizing when to replace aging hardware helps minimize e-waste.

E-waste Regulations: Adhering to local e-waste disposal laws is crucial to minimize environmental harm.

FED Rate Cut

Real Estate and Infrastructure Investment:

Data centers are capital-intensive, requiring investments in real estate, cooling, power systems, and high-tech equipment. A FED rate cut reduces borrowing costs, making it cheaper for data center companies to finance these large-scale projects and infrastructure expansions.

Increased Cloud Demand:

Lower interest rates stimulate economic growth, leading businesses to expand their digital infrastructure. This boosts demand for cloud computing services and data center capacity as companies increasingly migrate their operations online.

REITs and Data Centers:

Many data centers operate as real estate investment trusts (REITs). REITs benefit significantly from lower interest rates because they often rely on heavy borrowing for expansion. Lower rates reduce interest expenses, making these investments more profitable and appealing to investors.

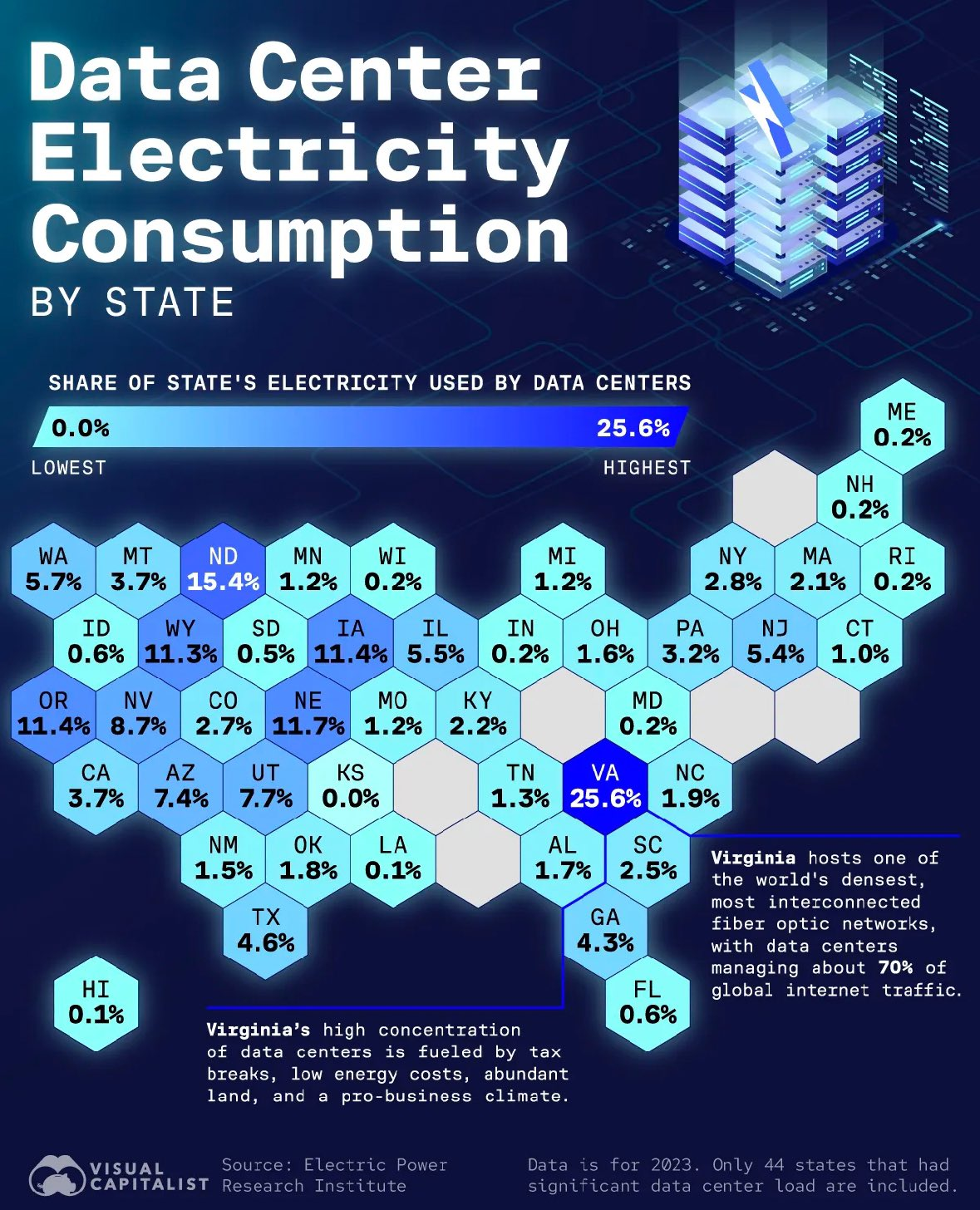

Regional Power Challenges and Strategic Planning

As of 2023, over 10,600 data centers existed worldwide, with about half located in the U.S. States like Virginia, Texas, North Carolina, and California. These are key hubs for data center activity, but regional challenges in power infrastructure can affect their ability to scale. Virginia’s data centers, for instance, consumed 25% of the state’s electricity in 2023, and this could rise to 50% in a high-growth scenario by 2030.

Best States for Building Data Centers Based on Cost of Electricity, Land, and Infrastructure

Virginia

Energy Price: ~$0.0658 per kWh (competitive)

Big Tech Presence: Amazon, Google, Microsoft—Virginia is the "Data Center Capital of the World."

Energy Infrastructure: Strong mix of nuclear, renewable (NextEra), and natural gas (Dominion Energy).

Top/Preferred Energy Source: Nuclear Power from Dominion’s Surry and North Anna nuclear plants.

Competitive Advantage: Proximity to Washington DC, robust fiber network, significant tax incentives, and reliable energy mix.

Texas

Energy Price: ~$0.0753 per kWh (reasonable)

Big Tech Presence: Meta, Microsoft, Google with hyperscale data centers.

Energy Infrastructure: Leading producer of wind energy (NextEra), strong natural gas (ExxonMobil), and nuclear power (Vistra Energy).

Top/Preferred Energy Source: Wind Energy – Texas leads the U.S. in wind energy production.

Competitive Advantage: Deregulated energy market with flexibility and competitive pricing, strong renewable energy mix.

Oregon

Energy Price: ~$0.0655 per kWh (low)

Big Tech Presence: Google and AWS have major data centers in Hillsboro.

Energy Infrastructure: Renewable focus with hydropower (NextEra) and strong natural gas support (Williams Companies).

Top/Preferred Energy Source: Hydropower – Oregon’s access to clean hydropower is a key attractor.

Competitive Advantage: Large reliance on hydropower makes Oregon an attractive location for environmentally-conscious tech companies.

Iowa

Energy Price: ~$0.0582 per kWh (lowest in the ranking)

Big Tech Presence: Meta, Google operate major data centers.

Energy Infrastructure: Strong wind energy capacity (NextEra) and reliable natural gas (MidAmerican Energy, Berkshire Hathaway).

Top/Preferred Energy Source: Wind Energy – Iowa is a leader in wind energy production.

Competitive Advantage: Low energy costs combined with a strong wind energy mix make Iowa a highly attractive location.

Georgia

Energy Price: ~$0.0682 per kWh (competitive)

Big Tech Presence: Google and Meta investing in Atlanta-area data centers.

Energy Infrastructure: Southern Company’s leadership in nuclear (Vogtle), natural gas, and solar (NextEra).

Top/Preferred Energy Source: Nuclear Power – From Southern Company’s Vogtle nuclear plant.

Competitive Advantage: Georgia’s diversified energy portfolio and affordable energy costs make it attractive for data center investments.

North Carolina

Energy Price: ~$0.068 per kWh (competitive)

Big Tech Presence: Google, Apple with large-scale data centers.

Energy Infrastructure: Duke Energy leads in nuclear and solar energy, with Dominion Energy providing natural gas.

Top/Preferred Energy Source: Solar Energy – Duke Energy is one of the largest solar producers in the state.

Competitive Advantage: Duke Energy’s dominance in both nuclear and renewable energy gives North Carolina an advantage for tech companies focused on sustainability and reliability.

Illinois

Energy Price: ~$0.09-0.11 per kWh (competitive for industrial and data center needs).

Big Tech Presence: Microsoft, Google, and Meta have established significant data center operations, particularly in the Chicago metro area and DeKalb.

Energy Infrastructure: Dominated by nuclear power from Constellation Energy, supplemented by growing wind energy farms and reliable natural gas from Nicor Gas and Ameren Illinois.

Top/Preferred Energy Source: Nuclear Power – Illinois leads the U.S. in nuclear generation, with wind energy gaining momentum for sustainability-focused businesses.

Competitive Advantage: Abundant clean energy from nuclear reactors, competitive energy rates, and a central location make Illinois a prime destination for data centers and manufacturing facilities

Utah

Energy Price: ~$0.083 per kWh (higher, but still competitive)

Big Tech Presence: Meta and Oracle have significant data center operations.

Energy Infrastructure: Growing renewable energy from GE Vernova and Rocky Mountain Power, supplemented by reliable natural gas from Questar Gas.

Top/Preferred Energy Source: Solar and Wind Energy – Utah is increasing its renewable footprint via Rocky Mountain Power and GE Vernova.

Competitive Advantage: Low-cost energy environment and tax incentives make Utah a growing tech hub.

Ohio

Energy Price: ~$0.07-0.08 per kWh (competitive)

Big Tech Presence: Meta expanding in Ohio, Google with significant investments.

Energy Infrastructure: Local nuclear plants (Energy Harbor), wind (GE Vernova, NextEra), and natural gas (AEP).

Top/Preferred Energy Source: Nuclear Power – Provided by Energy Harbor’s nuclear plants.

Competitive Advantage: Affordable energy and growing data infrastructure with strong renewable energy support.

South Carolina

Energy Price: ~$0.09-0.10 per kWh (higher range)

Big Tech Presence: Google investing heavily in Dorchester County data centers.

Energy Infrastructure: Strong nuclear energy from Dominion, natural gas from Piedmont Natural Gas, and renewable projects from GE Vernova.

Top/Preferred Energy Source: Nuclear Power – Dominion Energy’s V.C. Summer Nuclear Station.

Competitive Advantage: Strong energy mix of nuclear and renewable sources, giving South Carolina growing appeal.

Nevada

Energy Price: ~$0.0836 per kWh (higher, but not prohibitive)

Big Tech Presence: Switch and Tesla have major facilities.

Energy Infrastructure: 100% renewable energy for Switch’s data centers, supported by Southwest Gas for natural gas infrastructure.

Top/Preferred Energy Source: Solar Energy – Nevada's focus is heavily on renewable solar power.

Competitive Advantage: Focus on renewable energy and reliable natural gas makes Nevada appealing for companies seeking sustainable solutions.

Arizona

Energy Price: ~$0.0808 per kWh (higher than the average)

Big Tech Presence: Intel and AWS have data centers in Phoenix.

Energy Infrastructure: Large nuclear presence with Pinnacle West’s Palo Verde plant and strong solar solutions (First Solar).

Top/Preferred Energy Source: Nuclear Power – From Pinnacle West’s Palo Verde nuclear plant.

Competitive Advantage: Arizona’s robust nuclear and solar energy mix makes it a solid location for energy-efficient data centers.

Upstate New York

Energy Price: ~$0.09-0.10 per kWh (higher)

Big Tech Presence: Google and AWS expanding their footprint.

Energy Infrastructure: Renewable hydropower from Brookfield, nuclear from Exelon, and natural gas from National Grid.

Top/Preferred Energy Source: Hydropower – Abundant access to hydropower from the Niagara Falls region.

Competitive Advantage: Abundant renewable hydropower and nuclear options give Upstate New York an edge, particularly for companies seeking sustainable energy solutions.

Washington DC

Energy Price: ~$0.10-0.12 per kWh (highest in the ranking)

Big Tech Presence: Strong presence of government contractors and enterprises.

Energy Infrastructure: Renewable energy options from GE Vernova, Brookfield, and reliable natural gas from Washington Gas.

Top/Preferred Energy Source: Renewable Energy – Government focus on sustainability and green energy solutions.

Competitive Advantage: Proximity to federal agencies makes Washington DC ideal for secure and government-focused data centers, despite higher energy costs.

Why the West Coast is Less Ideal for Data Centers

The West Coast, including California and Washington face challenges for data centers due to:

High Energy Prices: Electricity costs are among the highest in the U.S., driven by environmental regulations and reliance on renewable energy.

Strict Regulations: Environmental laws increase costs and delays for data center development.

Expensive Land: High real estate prices make building and operating data centers more costly compared to other regions.

Why Commercial and Industrial Rates Matter:

High Energy Consumption: Data centers consume massive amounts of energy to power servers, cooling systems, and other infrastructure. Therefore, commercial and industrial rates are more relevant as they apply to bulk energy consumption.

Negotiated Contracts: Large data center operators often work directly with energy providers to negotiate long-term contracts for power supply. This can involve large-scale purchases of electricity or even investments in renewable energy sources such as wind and solar, allowing them to manage costs more predictably.

Energy Efficiency Initiatives: Companies like Google and Meta have committed to using 100% renewable energy for their data centers. These efforts are tied to industrial-scale energy management, where they focus on securing green energy at competitive rates.

State-Specific Incentives: Many states offer tax incentives and reduced energy rates for industrial or large-scale data centers to encourage infrastructure investments. These incentives do not apply to residential customers, making industrial/commercial rates more relevant to Big Tech companies.

Sustainability and Environmental Impact in Data Centers

As data centers face increased scrutiny over their energy use, sustainability has become a priority. By 2030, they could account for up to 9% of global electricity demand, making green initiatives crucial for reducing their environmental impact.

Key Sustainability Initiatives

Carbon-Neutral Data Centers:

Companies like Microsoft and Google aim for 100% renewable energy in their data centers. Microsoft plans to be carbon-negative by 2030, while Google uses AI-driven cooling solutions to cut energy use by up to 40%.

Zero-Water Cooling Systems:

To reduce water consumption, especially in drought-prone areas, Google and Microsoft are implementing zero-water cooling systems. These systems use heat recovery and liquid cooling, recycling waste heat for optimized energy use.

Waste Heat Recovery:

Companies like Switch and Iron Mountain are using waste heat recovery technologies, capturing excess heat to warm nearby buildings or feed it back into the power grid, boosting energy efficiency and supporting carbon reduction goals.

NVIDIA CEO Jensen Huang's Recent Comments on Data Centers

Jensen Huang emphasized three key strategies for the future of data centers:

Shift to Renewable Energy: Companies need to rely more on renewable sources like wind, solar, and hydropower to meet growing energy demands sustainably.

Build Near Energy Sources: Data centers should be located closer to energy hubs to improve efficiency and reduce transmission losses.

Partner with Governments: Collaborating with governments will be essential to secure infrastructure, regulatory support, and financial incentives for renewable energy projects.

3 Most Important: Cooling, Infrastructure, and Semiconductors

Cooling:

Data centers generate a lot of heat due to server operations.

Effective cooling (air or liquid) prevents overheating and improves energy efficiency, reducing operational costs.

Infrastructure:

Reliable power supply, network connectivity, and storage are essential.

Scalability and security are key to handling increasing data loads and protecting information.

Semiconductors:

Advanced chips (CPUs, GPUs) from companies like NVIDIA and Intel power data centers.

These semiconductors support AI, big data, and cloud computing with high efficiency.

Some of the World's Largest Data Centers

Switch SuperNAP (Las Vegas, USA)

Size: 3.5 million sq. ft.

Power Consumption: Over 180 MW

Primary Energy Source: Powered by 100% renewable energy, primarily solar and wind

Energy Provider: NV Energy (Owned by Berkshire Hathaway) and Switch’s own Gigawatt 1 solar power project

U.S. Stock Involvement: Berkshire Hathaway, Nvidia (for data center GPUs)

Digital Realty Lakeside Technology Center (Chicago, USA)

Size: 1.1 million sq. ft.

Power Consumption: Over 100 MW

Primary Energy Source: Grid electricity with renewable energy credits

Energy Provider: ComEd (part of Exelon Corp)

U.S. Stock Involvement: Digital Realty, Exelon Corp

Citi Data Center (Texas, USA)

Size: 990,000 sq. ft.

Power Consumption: Around 100 MW

Primary Energy Source: Powered by wind energy

Energy Provider: TXU Energy (Owned by Vistra Corp)

U.S. Stock Involvement: Citigroup, Vistra Corp

QTS Metro Atlanta (Atlanta, USA)

Size: 970,000 sq. ft.

Power Consumption: Around 120 MW

Primary Energy Source: Local grid power with increasing solar integration

Energy Provider: Georgia Power (Southern Company)

U.S. Stock Involvement: QTS Realty (now part of Blackstone REIT), Southern Company

The Citadel Campus (Tahoe Reno, USA)

Size: 7.2 million sq. ft. (projected when complete)

Power Consumption: Estimated at 650 MW

Primary Energy Source: 100% renewable energy, primarily solar and geothermal

Energy Provider: NV Energy (Owned by Berkshire Hathaway)

U.S. Stock Involvement: Berkshire Hathaway

Tahoe Reno Data Center (Reno, Nevada, USA)

Size: 2.2 million sq. ft.

Power Consumption: Estimated at 130 MW

Primary Energy Source: 100% renewable energy, leveraging solar and geothermal power

Energy Provider: NV Energy (Owned by Berkshire Hathaway)

U.S. Stock Involvement: Berkshire Hathaway, Tesla (uses the data center for storage and AI processing)

Apple Data Center (Maiden, North Carolina, USA)

Size: 500,000 sq. ft.

Power Consumption: Estimated at 100 MW

Primary Energy Source: 100% solar energy and biogas fuel cells

Energy Provider: Apple-owned solar farms, Bloom Energy fuel cells

U.S. Stock Involvement: Apple, Bloom Energy

Google Data Center (Council Bluffs, Iowa, USA)

Size: 400,000 sq. ft.

Power Consumption: 100 MW

Primary Energy Source: Wind energy

Energy Provider: MidAmerican Energy (Owned by Berkshire Hathaway)

U.S. Stock Involvement: Alphabet, Berkshire Hathaway

Microsoft Data Center (Quincy, Washington, USA)

Size: 700,000 sq. ft.

Power Consumption: Estimated at 100 MW

Primary Energy Source: Hydroelectric power from the Columbia River

Energy Provider: Grant County Public Utility District (Non-U.S. listed)

U.S. Stock Involvement: Microsoft, significant use of Nvidia chips for Azure cloud

Facebook Data Center (Prineville, Oregon, USA)

Size: 500,000 sq. ft.

Power Consumption: Around 100 MW

Primary Energy Source: Solar and wind energy

Energy Provider: PacifiCorp (owned by Berkshire Hathaway)

U.S. Stock Involvement: Meta Platforms, Berkshire Hathaway

Iron Mountain Underground Data Center (Boyers, Pennsylvania, USA)

Size: 1.7 million sq. ft.

Power Consumption: Approximately 20 MW (expandable to 100 MW)

Primary Energy Source: Mix of grid electricity and renewable energy sources

Energy Provider: Local grid, with Iron Mountain purchasing renewable energy credits (RECs) to offset carbon emissions

Explanation: Located 220 feet below ground in a former limestone mine, providing ultra-secure and energy-efficient data storage

U.S. Stock Involvement: Iron Mountain, Schneider Electric (provides cooling and energy infrastructure)

CyrusOne Data Center (Sterling, Virginia, USA)

Size: 1.5 million sq. ft.

Power Consumption: 100 MW

Primary Energy Source: Grid electricity with renewable energy initiatives

Energy Provider: Local grid and renewable energy credits

Explanation: Located in "Data Center Alley" in Northern Virginia, a key data center hub

U.S. Stock Involvement: CyrusOne (acquired by KKR and Global Infrastructure Partners)

NTT Data Center (Ashburn, Virginia, USA)

Size: 1 million sq. ft. (fully built out)

Power Consumption: Over 100 MW

Primary Energy Source: Grid electricity and renewable energy

Energy Provider: Local grid, NTT's focus on green energy

Explanation: A major facility in NTT's global network in the Data Center Alley

U.S. Stock Involvement: NTT (Non-U.S. listed), using equipment from Intel and Cisco Systems

Oracle Cloud Infrastructure Data Center (U.S. West - Phoenix, Arizona, USA)

Size: 1 million sq. ft.

Power Consumption: Estimated at 80 MW

Primary Energy Source: Grid electricity with increasing renewable energy

Energy Provider: Local grid, with Oracle expanding renewable energy use

Explanation: Key facility for Oracle's cloud infrastructure, powering database applications

U.S. Stock Involvement: Oracle

IBM Cloud Data Center (Dallas, Texas, USA)

Size: 750,000 sq. ft.

Power Consumption: Estimated at 60 MW

Primary Energy Source: Grid electricity with renewable energy credits

Energy Provider: Local grid

Explanation: Supports IBM's global cloud infrastructure for AI and analytics

U.S. Stock Involvement: IBM

Facebook Data Center (Newton County, Georgia, USA)

Size: 970,000 sq. ft.

Power Consumption: Estimated at 150 MW

Primary Energy Source: 100% renewable energy (solar)

Energy Provider: Georgia Power (Southern Company)

Explanation: Part of Meta’s data infrastructure, powered by renewable energy

U.S. Stock Involvement: Meta Platforms, Southern Company

AWS US East Data Center (Northern Virginia, USA)

Size: Distributed across several sites; cumulative capacity over 2 million sq. ft.

Power Consumption: Estimated over 150 MW (collectively across sites)

Primary Energy Source: Grid electricity with renewable energy projects

Energy Provider: Dominion Energy, with Amazon’s renewable energy projects (solar and wind)

Explanation: AWS's largest data center hub, driving significant internet and cloud services

U.S. Stock Involvement: Amazon (AWS), Dominion Energy

Switch Pyramid Data Center (Grand Rapids, Michigan, USA)

Size: 1.1 million sq. ft.

Power Consumption: Estimated at 110 MW (expandable to 200 MW)