Boeing

(This is a big overview, more specific One Pagers are coming soon about recent news, potential new plane, partnerships, Airbus vs. Boeing, etc to dig deeper. A lot of random thoughts at random times during this one because there's so many moving parts going on currently, bear with me on the formatting).

A lot of eyes currently on Boeing to see if they can financially survive and get past this union strike, if you know me or have see any of my twitter posts then you’ll know Boeing WILL survive this and will become America’s darling manufacturing powerhouse it once was. It’s a matter of when, not if Boeing turns it around, simply because they have to. America can't lose Boeing and ultimately gives Boeing a safety net knowing the government won't let them fail ($$ given during covid for example). Insane backlog, thousands of jobs, crucial for national security defense, and part of the strongest duopoly in the world providing for the safest form of travel.

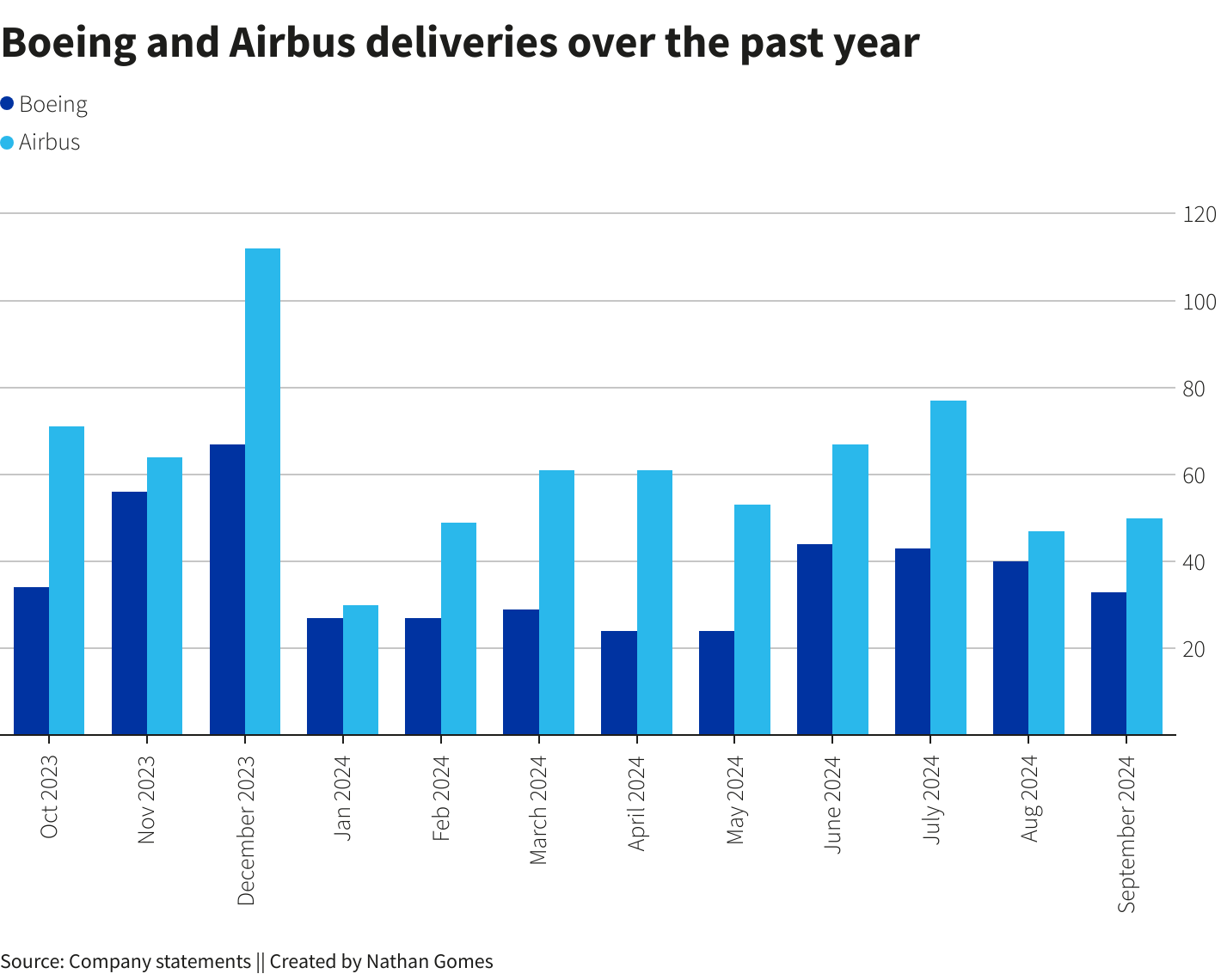

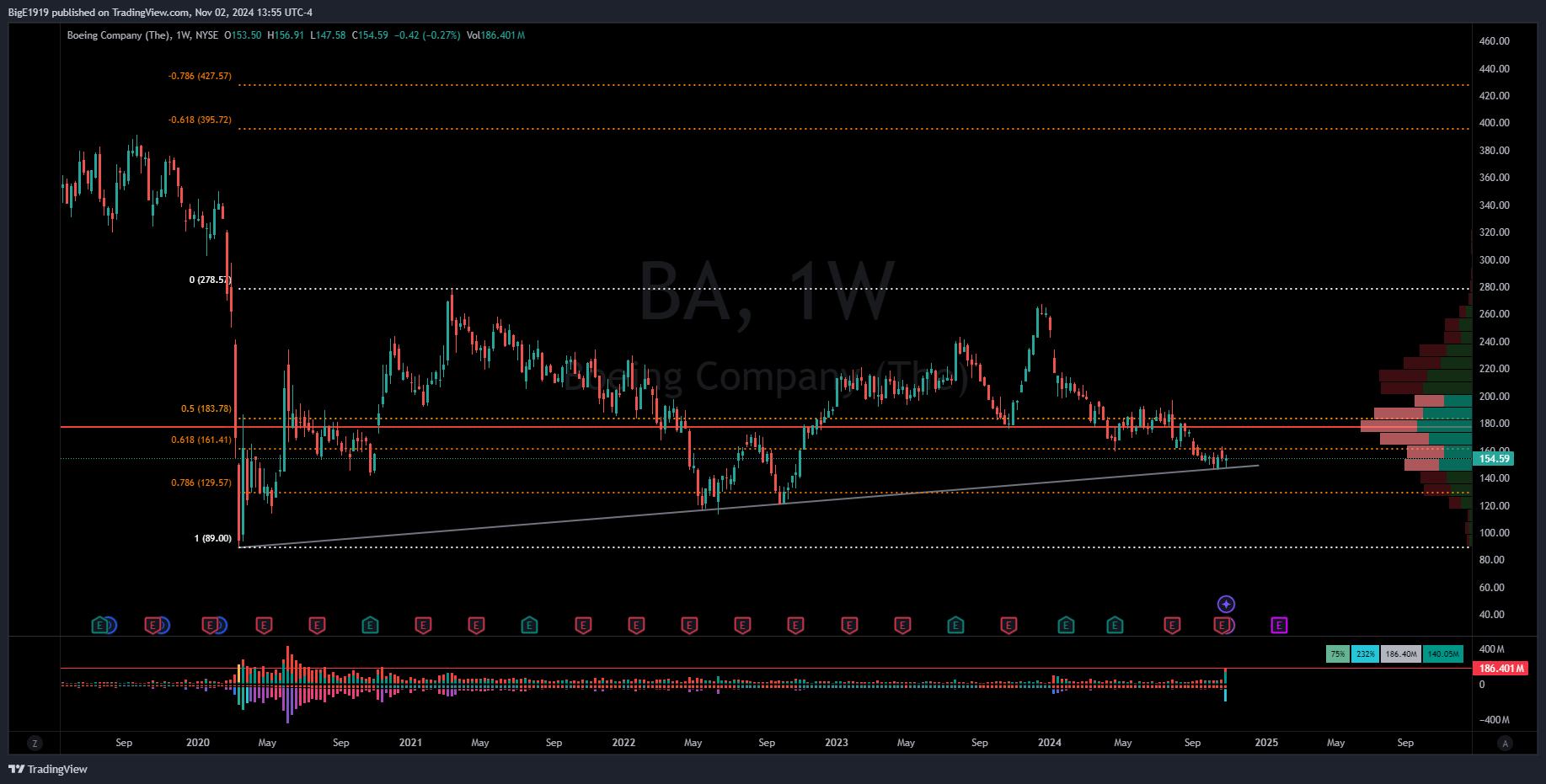

Quick take before we get started, Boeing been through hell in the news all year and recently the bad news hasn’t been crushing the stock. Even with the dilution, strike, and horrible earnings we’re holding 145-150 which is a key level. Massive volume is here and ready to go. Once the strike ends I’m looking for a pop and ultimately 175 area to flip to support for long term(200 can come fast). I personally believe Kelly Ortberg the right man for the turnaround given his track record and CEO style and I'm excited to see what he can do at the helm. I'm long Boeing and believe we've bottomed. However if we see more downside 120 will be a huge level to hold. This is a LONG TERM play for me, yes money will be made in the short hand with pops but the big money will be made swinging leaps. Lets end the strike, get production stable and get back to excellence. Doesn't have to be rushed, the backlog will be there to pick away at, don't need to worry about losing ground to airbus or beating them on deliveries. There's room for both companies to feast and Boeing needs to stay in its lane for now at least until they become stable again.

**Strike vote is Monday 11/4/2024, we'll find out after market close on Monday**

Let’s get started with this big overview, down the very bottom I share some tips for BA

Boeing - BA

Boeing is one of the world's largest aerospace and defense companies. It designs, manufactures, and sells airplanes, rockets, satellites, and military and space systems, making it a key player in both commercial and defense sectors. Boeing is known for its iconic aircraft models like the 737, 777, and 787 Dreamliner, and it collaborates globally with governments and commercial airlines to advance aviation technology and innovation. Boeing and Airbus share a very tight duopoly in the aviation manufacturing world.

Most Recent News: Earnings, Union Strike, and Restructuring at Boeing

Union Strike & Financial Impact

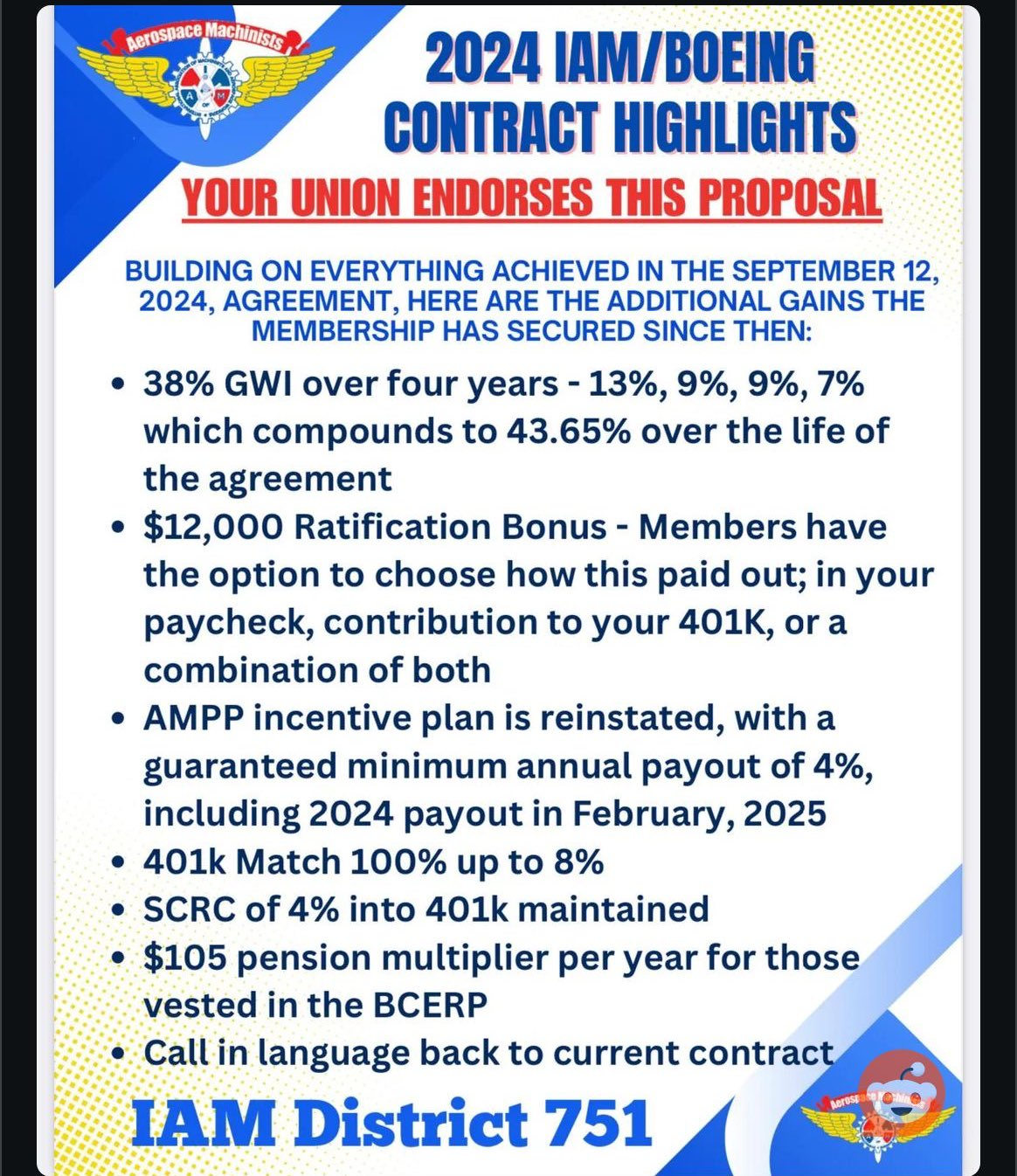

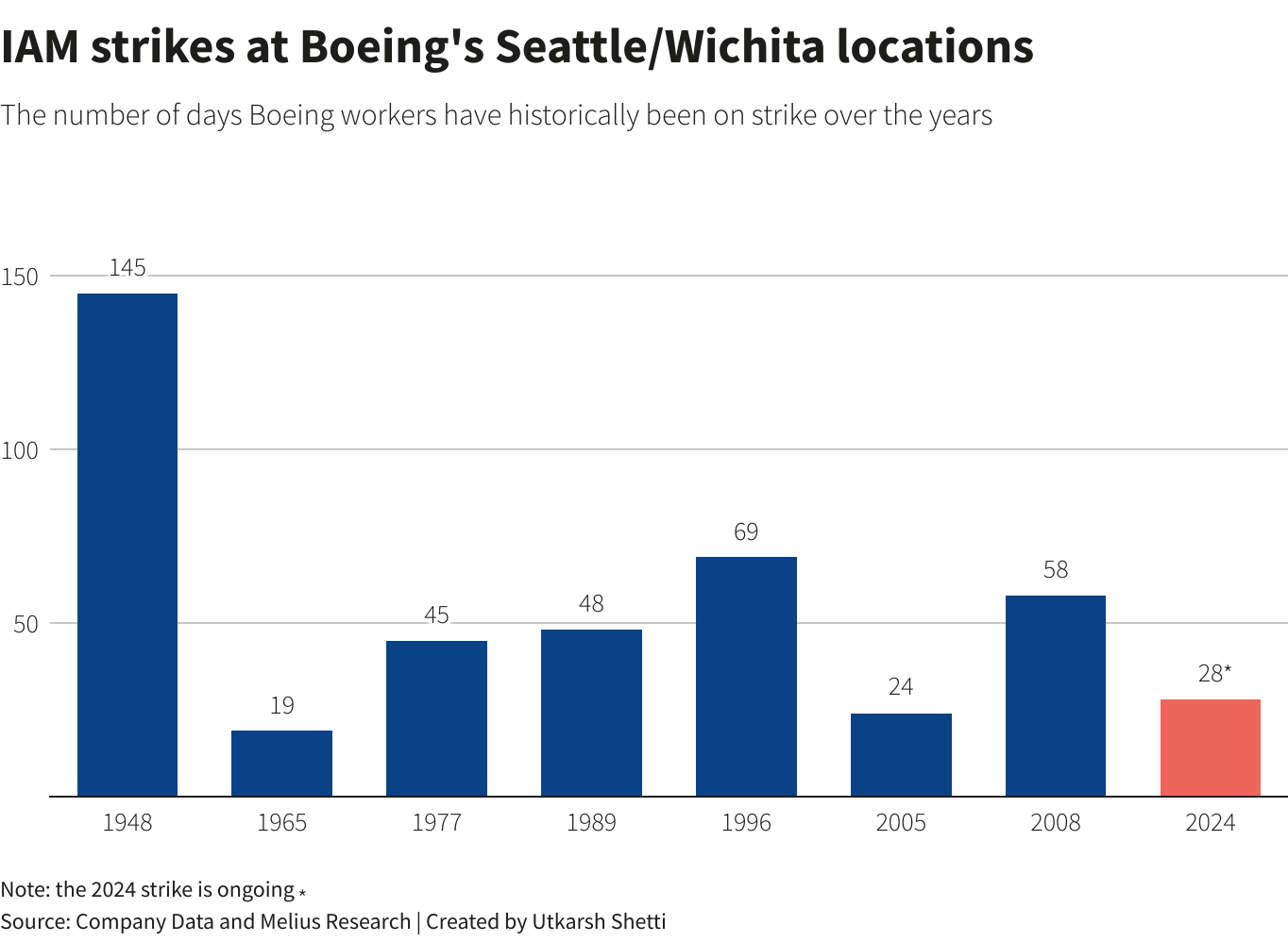

The ongoing strike by the International Association of Machinists (IAM), which began in September 2024, has significantly impacted Boeing’s production. Key models like the 737 MAX and 787 Dreamliner have been halted, costing Boeing approximately $50 million per day, translating to around $1.5 billion per month in lost revenue.

I think this vote has a good chance of passing, holidays coming up and its been a while without a real paycheck for these members.

Key Strike Developments:

On October 23, 2024, 64% of the 33,000 union members rejected Boeing’s latest contract proposal, extending the strike into its sixth week.

Union Demands: The IAM is pushing for a 40% wage increase and the reinstatement of pensions, which were eliminated in 2014.

Boeing’s Latest Offer on 10/31 (to be voted on November 4, 2024): A 38% wage increase /(compounding to 43.65% over four years), a 401(k) match up to 8% plus an additional 4% company contribution, and a $12,000 ratification bonus.

Each month the strike goes on pushes out the peak production of 737 by 9 months to a year. This is a big problem for Boeing, Airlines, Supply chains, etc.

Impact on Production Goals: The strike has disrupted Boeing’s delivery schedules for the 737 MAX and 787 models, which are critical for meeting revenue targets and reducing the backlog of orders. An extended strike could further weaken Boeing’s market position and delay key production goals.

Long-Term Outlook: Prolonged labor disruptions may influence Boeing’s future negotiations, operational planning, and ability to fulfill contracts on time, particularly in a competitive market where delivery speed is crucial.

Leadership and Workforce Restructuring

Under CEO Kelly Ortberg, Boeing is undergoing a significant restructuring plan aimed at improving efficiency and program execution across both its defense and commercial divisions. The strategy includes leadership changes, workforce adjustments, and an organizational shift toward a hands-on management style to drive operational stability.

CEO Background:

• Over 35 years in aerospace, primarily with Rockwell Collins.

• Former CEO of Rockwell Collins; led its expansion and integration into United Technologies (now RTX).

• Appointed CEO of Boeing in 2024.

Leadership Style:

• Focuses on operational efficiency and engineering excellence.

• Emphasizes strong team-building and a culture centered on safety and quality.

• Known for transparency, decisive actions, and direct engagement with production operations.

CEO Strategy and Vision: Ortberg’s approach is “hands-on,” emphasizing direct involvement of leadership in production processes to enhance oversight and accountability. His vision centers on restoring Boeing’s competitive edge and operational stability through restructuring and strategic focus on core business areas.

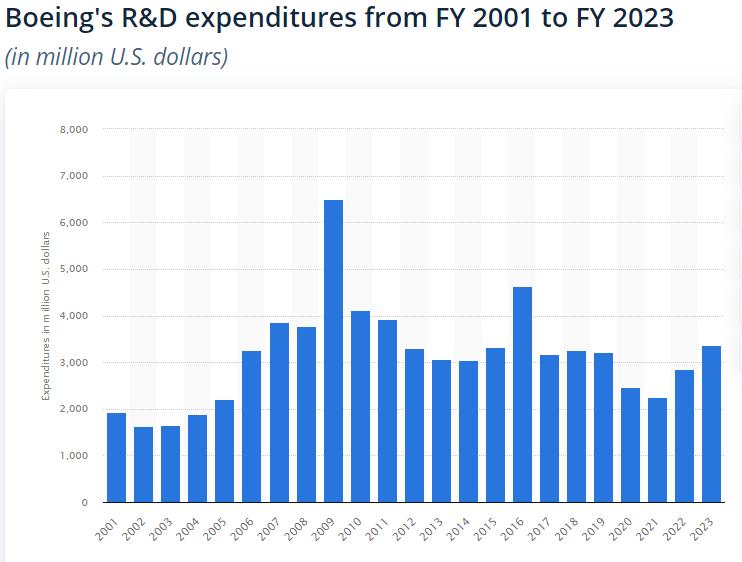

Organizational Changes: Boeing has implemented layoffs, particularly in white-collar roles, and consolidated management in the Defense division. This restructuring targets $500 million in annual savings, which Boeing plans to reinvest in R&D for advanced defense technologies.

Leadership Adjustments:

Theodore Colbert III was removed as CEO of Boeing Defense as part of the restructuring, with the Defense division now merging teams and reducing management roles.

Stanley Deal, formerly CEO of Boeing’s Commercial Airplanes division, retired as part of Ortberg’s leadership shift, addressing delivery and operational inefficiencies.

DEI Department Adjustment: Boeing integrated Diversity, Equity, and Inclusion (DEI) initiatives into core HR functions, aligning these efforts with Ortberg’s focus on employee experience and oversight.

Cultural Shift: Ortberg is fostering a culture centered on efficiency, quality, and rebuilding Boeing’s reputation. His leadership aims to create a new organizational ethos that prioritizes long-term stability and safety.

Boeing's Potential Space Division Sale

Boeing is exploring the sale of its NASA operations:

The Starliner project, which has faced numerous delays and issues along with the infamous leaving of Astronauts in space

Support roles for the International Space Station (ISS).

Key Details:

The sale is part of CEO Kelly Ortberg’s strategic initiative to streamline operations and cut losses, especially given Boeing’s $3.1 billion in losses on $18.5 billion in revenue from its defense and space divisions in 2024.

Boeing may retain its Space Launch System (SLS) contract, while divesting other NASA-related assets due to a diminished role in NASA programs, where SpaceX has become the preferred partner.

United Launch Alliance (ULA) Discussions: Boeing is also exploring the sale of its stake in the United Launch Alliance (ULA), a joint venture with Lockheed Martin. Previous discussions have involved potential buyers like Blue Origin

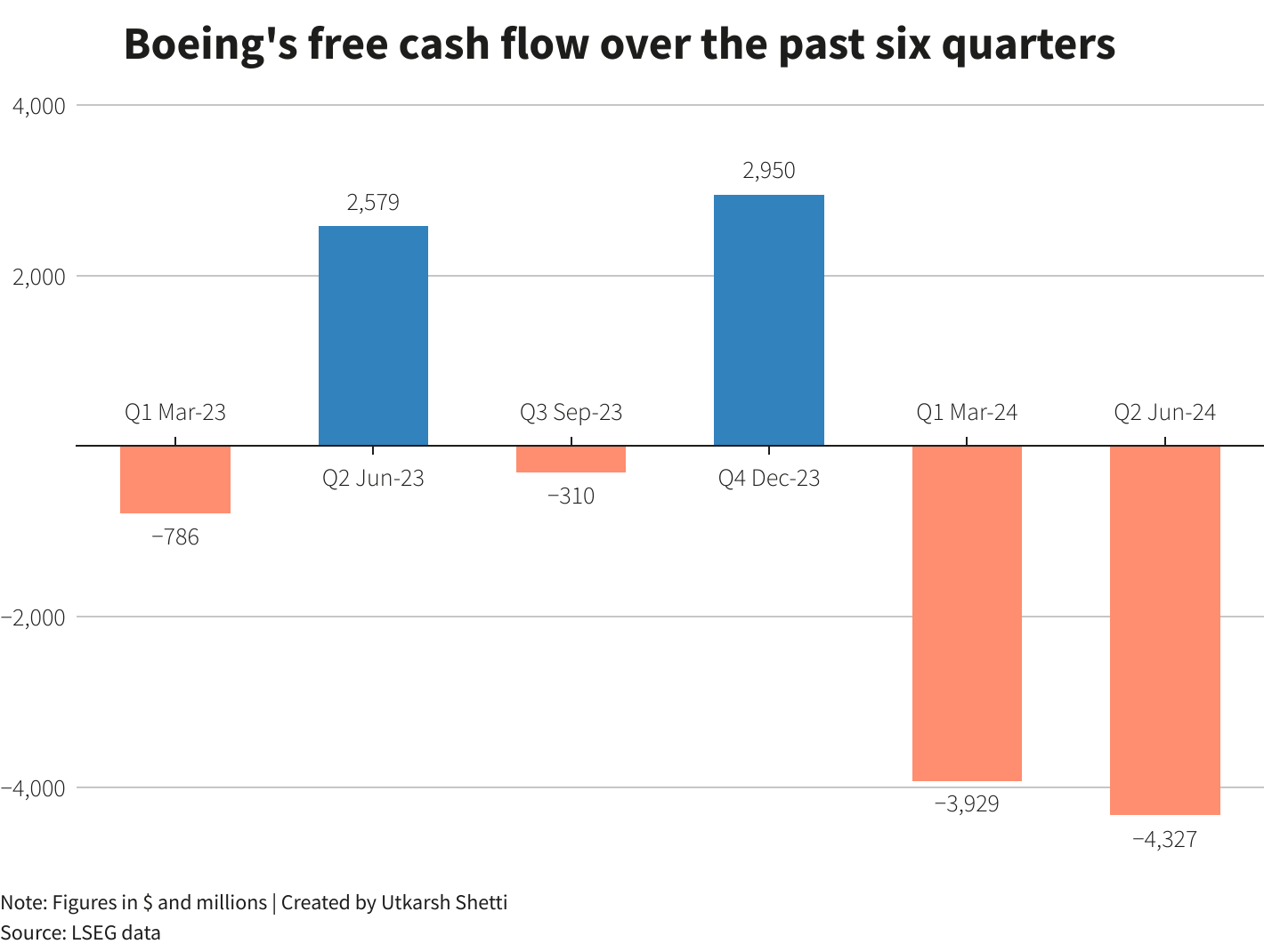

Boeing Q3 2024 Earnings Overview

Financial Highlights

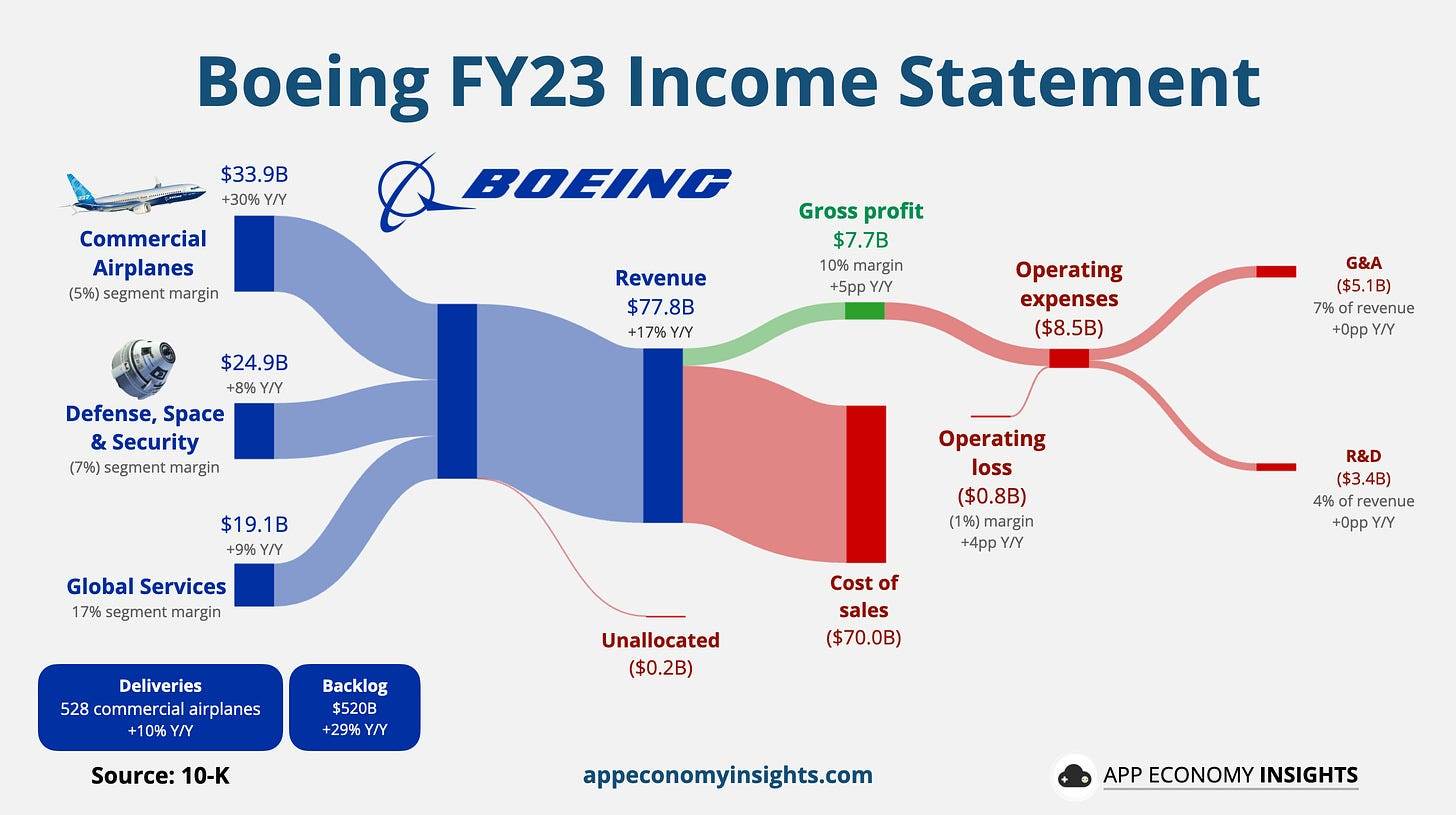

Revenue: $17.84B (down 1% YoY) compared to $18.14B in Q3 2023.

GAAP Loss Per Share: ($9.97) vs. ($2.70) in Q3 2023.

Core Loss Per Share (Non-GAAP): ($10.44) vs. ($3.26) in Q3 2023.

Operating Cash Flow: -$1.345B (compared to $22M in Q3 2023).

Free Cash Flow: -$1.956B (down significantly from -$310M in Q3 2023).

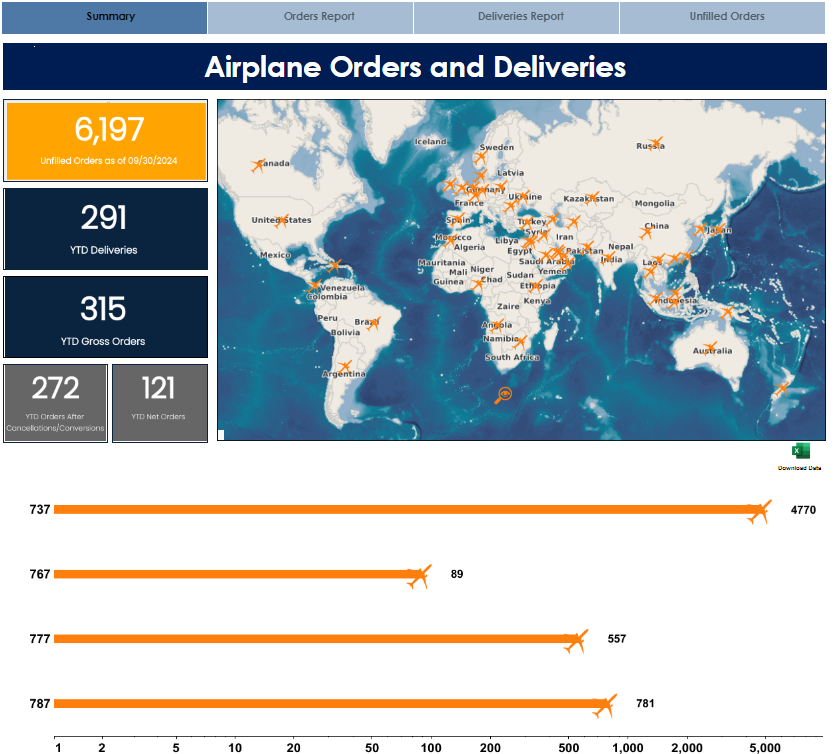

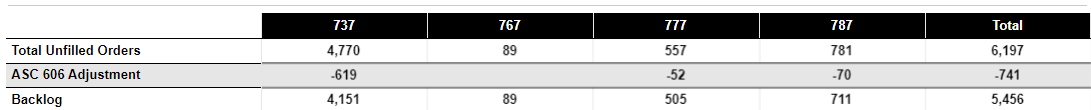

Total Backlog: $510.5B, including over 5,400 commercial airplanes.

Q3 Segment Performance

Commercial Airplanes:

Revenue: $7.44B (down from $7.87B in Q3 2023).

Operating Loss: -$4.021B, an increase from -$678M YoY.

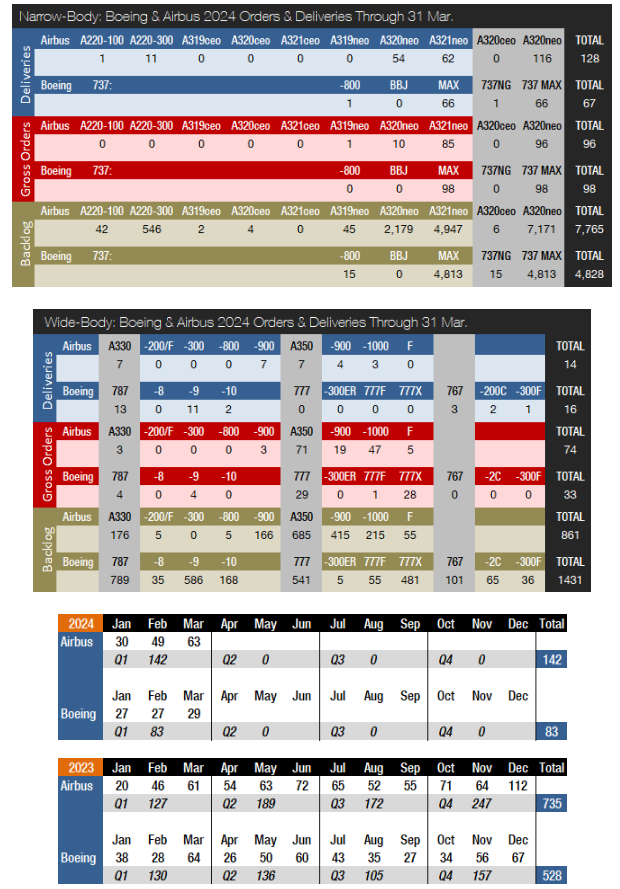

Deliveries: 116 aircraft; 737 (92 units, up 31% YoY), 787 (14 units, down 26% YoY), 777 (4 units, down 50% YoY).

Operating Margin: (54.0%) vs. (8.6%) YoY.

Backlog: $427.733B (down 3.3% from $442.403B YoY).

Defense, Space & Security:

Revenue: $5.54B (up 1% YoY from $5.6B in Q3 2023).

Operating Loss: -$2.38B (increased from -$924M YoY).

Operating Margin: (43.1%) vs. (16.9%) YoY.

Backlog: $61.641B (up 3% YoY).

Global Services:

Revenue: $4.90B (up 2% YoY).

Operating Earnings: $834M (up 6% YoY).

Operating Margin: 17.0% (improved from 16.3% YoY).

Backlog: $20.449B (up 3% YoY).

Operational and Program Updates

Commercial Program Charges: Boeing reported $3.0 billion in charges related to the 777X and 767 programs as the company works through production challenges and delivery delays.

787 Production Rate: Currently at 4 units per month, with a plan to increase to 5 units per month by the end of 2024.

Defense Program Charges: Boeing incurred $2.0 billion in charges across the T-7A, KC-46A Tanker, Commercial Crew, and MQ-25 programs.

Financial Position

Cash and Investments: Boeing holds around $10.5 billion, which has decreased from $12.6 billion since Q2, reflecting the high cash burn related to production and strike disruptions.

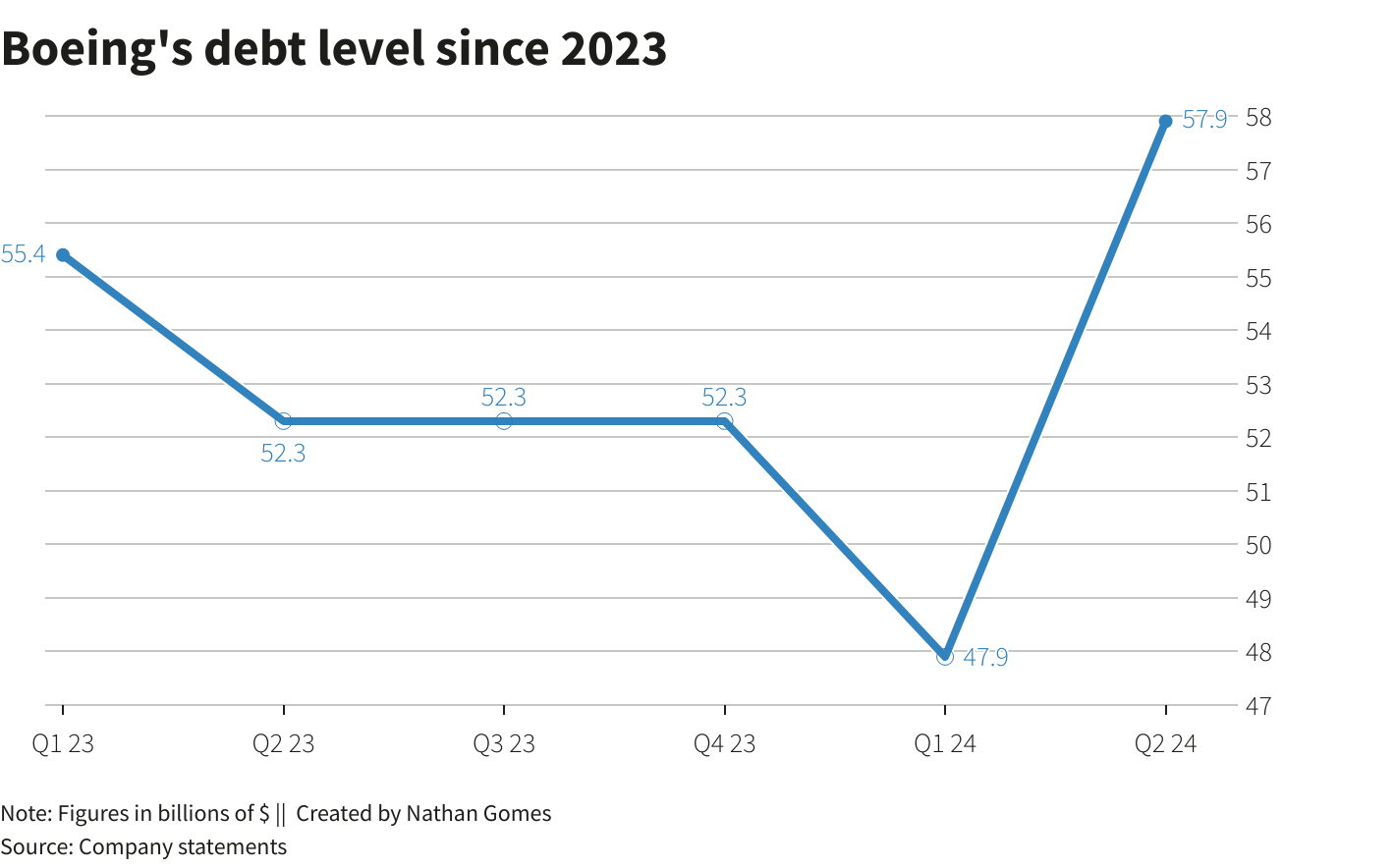

Total Debt: Debt levels have risen to approximately $57.7 billion, up from $53 billion year-over-year, highlighting increased financial leverage. Boeing's restructuring efforts are partly aimed at reducing this substantial debt load over time.

New Cash Raise: Boeing successfully raised around $21 billion through a combination of equity and debt offerings, with a total authorization for up to $25 billion. This included common and preferred stock issuances and aims to stabilize Boeing's balance sheet, preserve its investment-grade rating, and save on annual interest expenses. This infusion of capital will support Boeing through its current strike and operational challenges while strengthening liquidity for future production ramps and growth.

Credit Facilities: Boeing’s credit availability now totals $20 billion, which includes a new $10 billion short-term credit facility added during this cash-raising round. This facility provides additional flexibility for near-term expenses as Boeing addresses labor costs and supply chain issues.

Boeing Employee Costs and Revenue Impact

Employee Costs: Average labor costs, including wages and bonuses, total around $82,000 per employee in 2024.

Revenue per Employee: Each employee generates an estimated $400,000 to $500,000 in annual revenue.

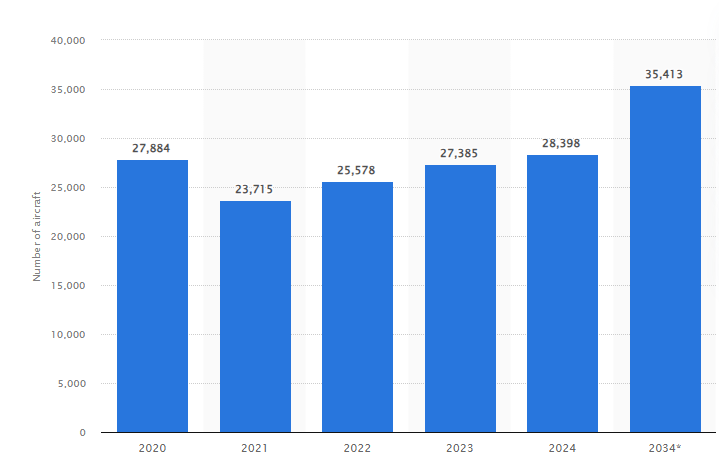

Projected Revenue Growth: Boeing expects moderate growth in the coming decade as demand for aircraft continues to rise

Rising Labor Costs: Labor costs are expected to grow as Boeing adjusts pay and benefits to attract and retain talent, especially amid union negotiations.

CEO Kelly Ortberg’s Commentary

Strategic Vision: Ortberg stated, "It will take time to return Boeing to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again." He emphasized stabilizing the business, improving program execution, and setting a strong foundation for the future.

Cultural Shift: Reflecting on Boeing's history, Ortberg commented, "Most of the folks who lived in that culture have retired or moved on." He stressed building a new culture aligned with Boeing’s long-term goals.

Hands-On Leadership: Ortberg emphasized that top executives must be on the production floor and involved in every step of the process. "I want our leadership working hand-in-hand with our employees, showing that we are committed at every level," he said. This approach aims to foster transparency, teamwork, and a stronger connection between management and workers.

Operational Philosophy: Ortberg’s approach is "Doing less and doing it better," focusing on value-added activities over the next five years.

Cash Flow and Production Guidance

CFO Commentary: The CFO projects cash burn to continue into Q4 2025, with negative free cash flow expected. The 38-per-month production target for the 737 has been delayed.

Strategic Developments

Spirit AeroSystems Acquisition: Ortberg confirmed Boeing's commitment to acquiring Spirit AeroSystems, aiming to enhance capabilities post-integration by next year.

Supply Chain Strategy: Ortberg highlighted the importance of worker retraining and acknowledged potential disruptions as Boeing restarts dormant supply chain components, advocating for a realistic approach to timelines.

Recent Developments

Layoffs: Boeing announced 17,000 job cuts, primarily targeting white-collar roles. These layoffs will extend from Q4 2024 into 2025 as the company restructures.

Strike Impact: The ongoing machinist strike, now in its fifth week, is costing Boeing around $1 billion per month, halting production and delaying key deliveries.

Production Delays:

777X: First delivery of the 777-9 delayed to 2026; the 777-8 is pushed to 2028.

767 Freighters: Production will cease by 2027.

Defense Contracts and Sustainability Efforts

Defense Contracts (October 5, 2024): Boeing secured a contract with the U.S. Department of Defense for military aircraft production and maintenance, reinforcing its defense business.

Sustainability Efforts (October 9, 2024): Boeing announced initiatives to develop Sustainable Aviation Fuel (SAF) compatible aircraft in collaboration with fuel technology partners.

Culture

The 1997 Boeing-McDonnell Douglas merger significantly changed Boeing’s culture and is still impacting Boeing today. Many look at this merger as the downfall of Boeing

Shift to Profit Focus: McDonnell Douglas brought a financially-driven approach, prioritizing cost-cutting and shareholder returns over engineering quality.

Leadership Influence: McDonnell Douglas leaders took key roles at Boeing, reinforcing a profit-focused culture over Boeing’s traditional engineering-centered approach.

Competition with Airbus: Facing Airbus pressure, Boeing opted to upgrade the 737 with the MAX model instead of designing a new plane, relying on MCAS software to handle design challenges.

Speed and Cost Pressures: Post-merger, faster, cost-effective production became a priority, potentially leading to safety oversights in the 737 MAX program.

Fuel Costs and Consumption

Fuel Efficiency Innovations

Boeing has prioritized the development of fuel-efficient models like the 787 Dreamliner and 737 MAX, designed to reduce operating costs for airlines and minimize environmental impact. These aircraft incorporate advanced aerodynamics, lighter materials, and more efficient engines, making them attractive options for airlines seeking to manage fuel expenses.

Impact on Airline Customers

Fuel costs are one of the largest operational expenses for airlines, typically accounting for 20-30% of their total costs. Boeing’s emphasis on fuel efficiency not only provides direct financial benefits to airline operators but also enhances Boeing’s market appeal. Offering models with better fuel consumption rates helps Boeing strengthen relationships with customers and gain a competitive edge over manufacturers like Airbus.

Environmental and Regulatory Pressures

As the global aviation industry faces increasing regulatory pressure to cut carbon emissions, Boeing’s commitment to fuel efficiency positions it favorably. Governments and international bodies are setting stricter emissions standards, and many airlines have pledged to achieve carbon-neutral growth. Boeing’s advancements in fuel efficiency align with these goals, showcasing the company’s responsiveness to regulatory trends and environmental concerns.

Market Sensitivity to Fuel Prices

The demand for fuel-efficient aircraft models tends to increase when fuel prices are high. Conversely, during periods of low fuel prices, airlines might be less inclined to replace older, less efficient models. This market sensitivity makes Boeing’s focus on fuel consumption a strategic factor in its product development and sales approach.

Regulatory and Certification

Boeing is working with the FAA to keep the 737 MAX upgrade certifications on schedule and is expediting quality checks for the 787 Dreamliner to meet 2025 delivery targets.

The 777x has hit yet another delay in the certification process, it is crucial for Boeing to figure this out and get the 777x in the air for its customers.

Market and Industry Support

Emirates Orders: Emirates placed substantial orders for Boeing 777 aircraft, showing confidence in Boeing’s ability to recover.

United Airlines’ Optimism: The CEO of United Airlines expressed confidence in Boeing’s turnaround potential, highlighting the company’s efforts to stabilize operations.

Collective Industry Support: Endorsements from key industry leaders demonstrate belief in Boeing’s capability to navigate its challenges and re-establish its position in the market.

Competitive Positioning

Wide-Body Aircraft: Boeing remains competitive in wide-body jets like the 787 Dreamliner and 777X, known for their fuel efficiency and advanced technology.

Commercial Market Competition: Boeing faces stiff competition from Airbus, particularly in the narrow-body segment where Airbus holds over 60% of market share with the A320neo. Boeing’s strategy includes potential development of a new narrow-body aircraft to address short-haul demand gaps.

Regional jets from Embraer

Defense and Space Rivalries: In the defense sector, Boeing competes with Lockheed Martin, Raytheon, and Northrop Grumman, while SpaceX has become a preferred partner for NASA. Boeing is focusing on high-profile defense contracts and next-generation fighter jets to maintain its standing.

Global Market Adaptation: Boeing is expanding into high-growth regions like Asia, Africa, and Latin America to meet rising demand and counter competition from COMAC’s C919 in narrow-body markets. Boeing’s Global Services Division and customer support network offer added value over competitors.

Scale like no other: Boeing stands as a manufacturing powerhouse, with an unparalleled ability to scale production in response to global demand. Boeing possesses unique capabilities in large-scale, complex production that few, if any, American companies can match. This scale allows Boeing to ramp up production more efficiently than competitors, meeting the needs of both commercial and defense markets.

Boeing Business Model:

Industry: Aerospace and Defense

Headquarters: Arlington, Virginia, USA

CEO: Kelly Ortberg

Market Cap: ~$122 Billion

Employees: 139,000+ (updated due to ongoing layoffs)

Core business includes the design, manufacture, and sale of:

Commercial Aircraft

Military Aircraft

Satellites

Missile Defense Systems

Space Exploration Systems

Global Services

Segments:

Commercial Airplanes (BCA):

Focus: Design and sale of jets

Products: 737 MAX, 787 Dreamliner, and 777X.

Revenue: 39% of Boeing’s revenue.

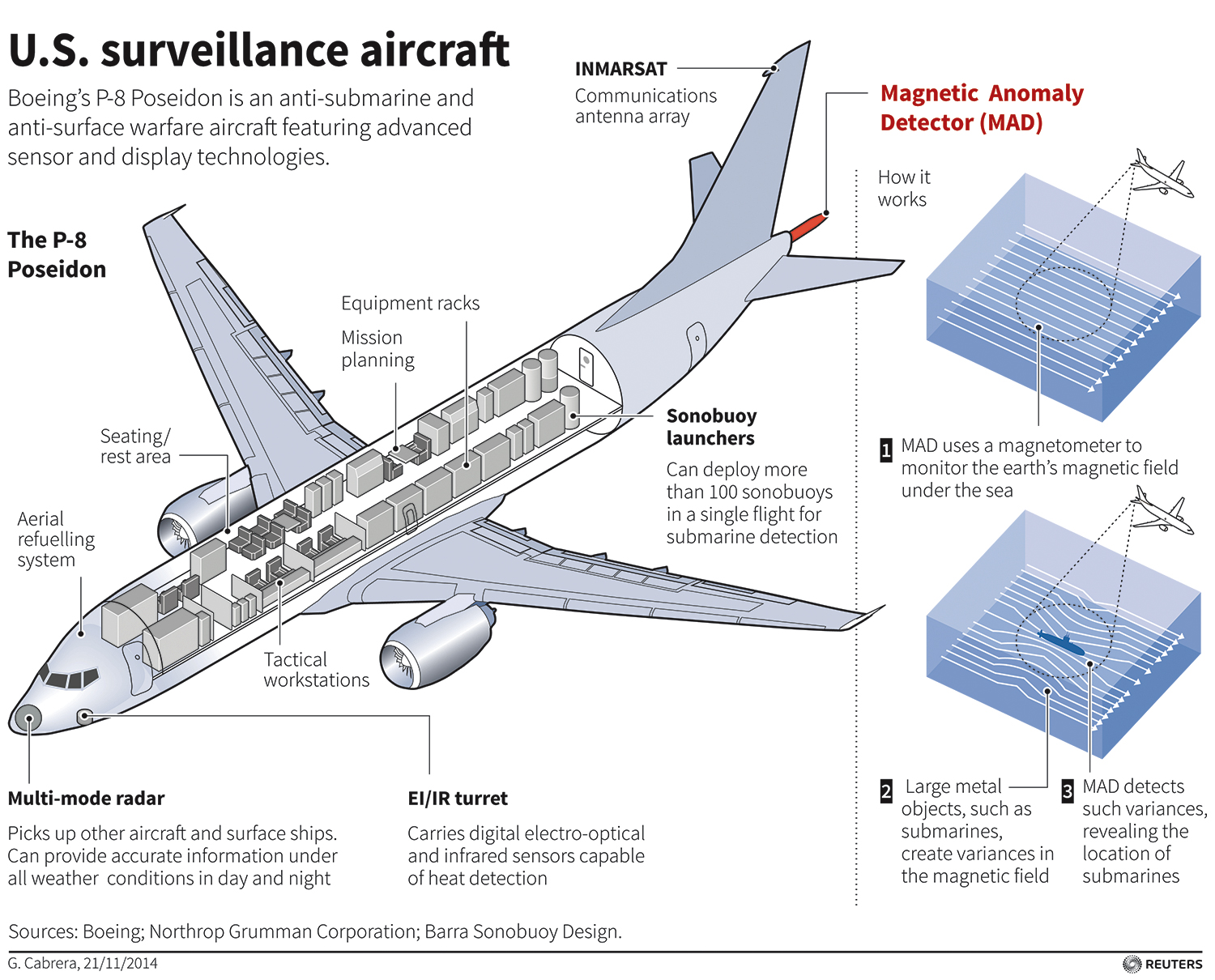

Defense, Space & Security (BDS):

Focus: Military aircraft, satellite systems, and missile defense. KC-46A Pegasus, P-8 Poseidon, and Space Launch System.

Products: KC-46A Pegasus, P-8 Poseidon, Space Launch System

Revenue: 31%.

Rank: Top 5 Government defense contractor

Global Services (BGS):

Focus: Maintenance, repair, and training services. These services support Boeing’s aircraft and defense systems post-sale.

Services: Maintenance, repair, training, logistics.

Revenue: 30%

Geographic Segmentation:

North America: Largest market, driven by U.S. government contracts.

United States and Canada: Boeing's largest market, with a total of 293 aircraft deliveries in recent years.

Aircraft deliveries reduced in Q3 2024 due to strike impacts.

Asia-Pacific: Key growth area, with China and Southeast Asia driving demand.

China: Crucial Market for Boeing to regain

Demand remains, but deliveries face delays; potential China deals remain speculative.

Europe and Middle East: Important markets for both defense and commercial aircraft.

Europe: The second-largest market for Boeing, accounting for 96 aircraft deliveries.

Approximately 83 aircraft deliveries in 2023, adjusted lower in Q3 2024.

Boeing delivered a total of 528 aircraft in 2023

Key Competitors:

Airbus, Lockheed Martin, Northrop Grumman, Raytheon Technologies, Bombardier, COMAC, and Embraer.

Customer Base: Airlines, governments, defense contractors, space agencies, and private companies.

Boeing Moving its Headquarters Back to Seattle?

The idea of Boeing relocating its headquarters back to Seattle is extremely intriguing. Currently just a rumor but it makes sense:

New CEO’s Location: CEO Kelly Ortberg is based in Seattle, close to Boeing’s largest operations. This is something Boeing was missing when Dave Calhoun was CEO residing in New Hampshire. Ortberg wants to be more hands on.

Union Workforce: Boeing’s unionized workers in Everett, are central to its production of key aircraft like the 737 MAX and 777X.

Boeing’s Historical Ties: Seattle has been Boeing’s foundation since its founding in 1916. For decades, the city represented Boeing's engineering excellence and manufacturing prowess, with major milestones in aerospace achieved there. Many believe Boeing’s heart and identity remain deeply tied to Seattle. This is where Boeing became the Boeing everyone once loved

Operational Advantages: With leadership near its Everett plant, Boeing could improve decision-making, production oversight, and workforce morale.

Strategic Benefits: Relocating would enhance cultural alignment between leadership and workers, improve talent retention, and signal a renewed commitment to its roots in the Pacific Northwest.

Top Major Boeing Contracts & Orders

$23B Ryanair Contract (737 MAX)

Date: May 2023

Aircraft Ordered: 150 Boeing 737 MAX aircraft

Status: Confirmed – This significant order boosts Boeing’s single-aisle jet market presence in Europe.

$15B U.S. Air Force Contract (T-7A Red Hawk Trainer Jets)

Date: February 2023

Aircraft Ordered: 351 T-7A Red Hawk trainer jets

Status: Confirmed – A key defense contract, securing Boeing’s position in advanced trainer jets for the U.S. Air Force.

$10B Emirates Contract (777X)

Date: June 2023

Aircraft Ordered: 115 Boeing 777X aircraft

Status: Confirmed – Emirates' substantial order is crucial for Boeing's wide-body aircraft recovery.

$23.8B U.S. Air Force C-17 Sustainment Contract

Date: July 2024

Aircraft Ordered: No new aircraft; covers sustainment of over 200 C-17 aircraft

Status: Confirmed – This long-term support contract underpins Boeing's defense business stability.

$9.8B Ground-Based Midcourse Defense (GMD) Contract

Date: March 2024

Status: Confirmed – Boeing’s involvement in U.S. missile defense ensures a critical role in national defense systems.

Backlog & Demand:

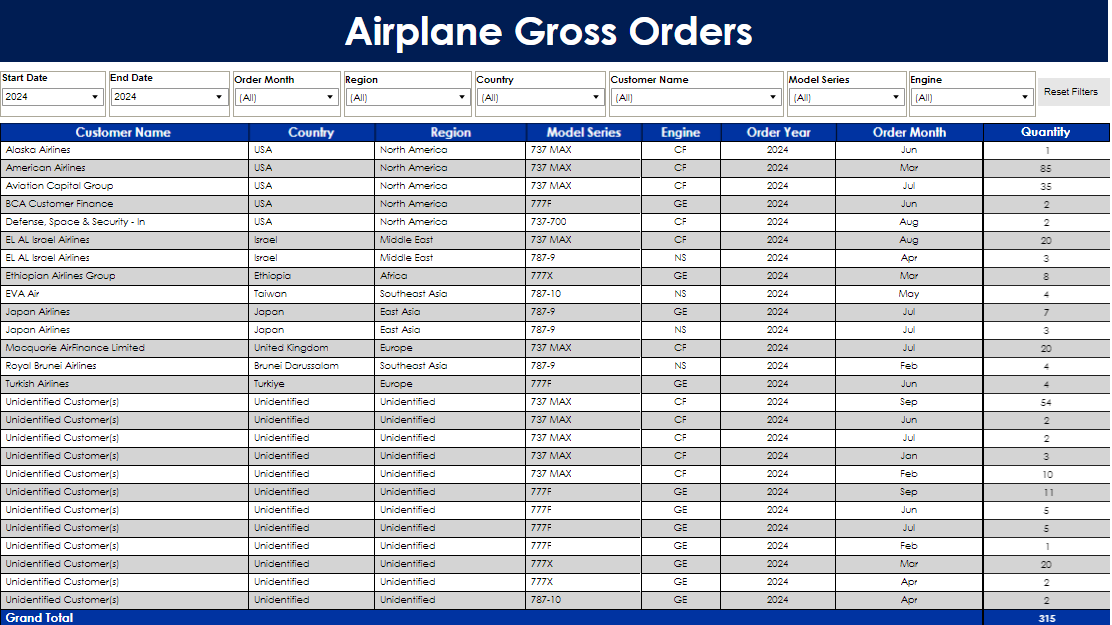

Boeing holds a backlog of 5,430 aircraft, valued at $390 billion. This backlog signals strong demand for Boeing’s aircraft, but delivery delays caused by supply chain disruptions and the ongoing union strike could jeopardize conversions of these orders into revenue.

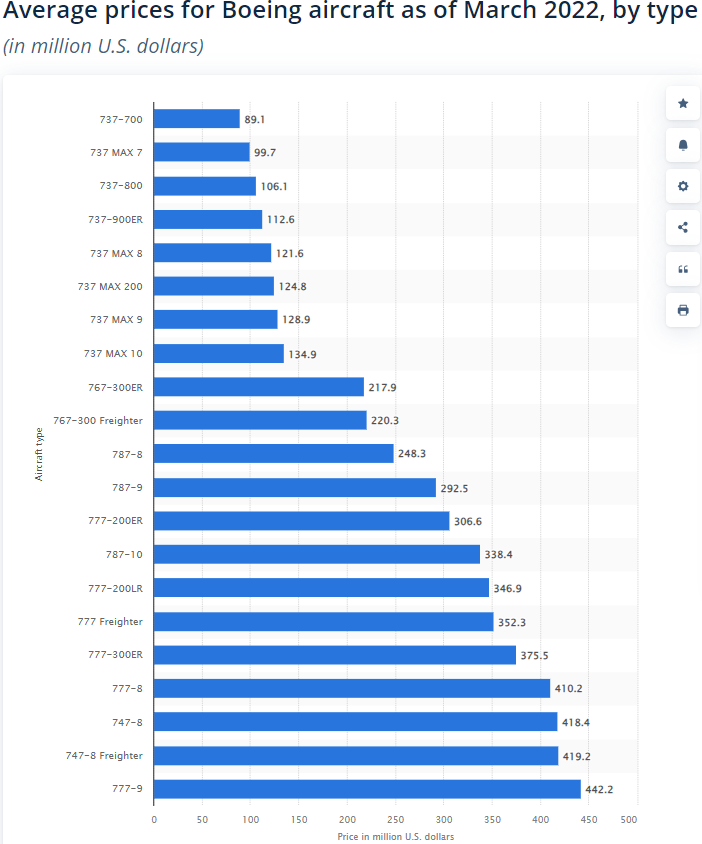

Key Aircraft Pricing (Backlog Estimates):

737 MAX: $50M–$60M (list price ~$120M)

787 Dreamliner: $150M–$175M (list price ~$300M)

777X: $250M–$275M (list price ~$410M)

This puts potential revenue between $320 billion and $400 billion, contingent on Boeing’s ability to ramp up production and secure FAA certifications.

Growth Drivers:

Increased Air Travel: Post-pandemic recovery in Asia-Pacific and Latin America is driving new aircraft demand.

Fleet Modernization: Airlines are investing in new fuel-efficient models like the 787 Dreamliner and 777X to reduce emissions.

E-commerce Growth: Air cargo demand is rising due to e-commerce, increasing orders for freighter aircraft.

Emerging Markets: Regions like India, Southeast Asia, and Africa are key to future narrow-body jet growth.

Standing Out in Defense

Competitive Edge: Boeing balances a range of defense offerings across manned, unmanned, and reconnaissance aircraft.

Autonomous Defense Focus: With projects like the T-7A trainer and Shield AI partnerships, Boeing is building capabilities in autonomous systems, crucial for future air combat.

International Reach: Defense contracts in Japan, Australia, and other countries help reduce reliance on U.S. defense budgets.

Broader Product Portfolio: Boeing’s defense lineup spans fighters (F-15EX), reconnaissance (P-8 Poseidon), and transport (C-17 Globemaster III).

Future-Ready: Emphasis on advanced tech positions Boeing to stay competitive against Lockheed, Raytheon, and Northrop in the global defense market.

Plane Models, Orders, and Best Sellers

Boeing 737 Family (737 MAX Series)

Models: 737 MAX 7, 737 MAX 8, 737 MAX 9, 737 MAX 10

Best Seller: 737 MAX 8

The 737 MAX family is Boeing's top-selling aircraft series, known for its fuel efficiency and short- to medium-haul capabilities.

The MAX 8 is the most popular variant, favored by low-cost carriers and major airlines globally.

Notable Orders:

Ryanair: Over 200 orders for 737 MAX 8.

Southwest Airlines: Over 200 orders for 737 MAX 7.

United Airlines: More than 270 orders across the 737 MAX family.

Total Orders: Over 5,100 as of 2024, making it Boeing’s best-selling aircraft family in history.

(Size difference between 737 & 777, typical commercial flights are the 737 size)

Boeing 777 Family

Models: 777-200ER, 777-300ER, 777F (Freighter), 777X (777-8, 777-9 – Next Generation)

Best Seller: 777-300ER

The 777 series is the preferred aircraft for long-haul international routes, and the 777-300ER is widely popular for its range and capacity.

Next Generation: 777X

The 777X is designed to redefine long-haul travel with advanced fuel efficiency and increased capacity. One of its standout features is its innovative wing design, which includes folding wingtips. This allows the massive aircraft to fit into standard airport gates, making it more versatile in airport operations

Notable Orders:

Emirates: The largest customer with over 150 777 models, including 115 orders for the 777X.

Qatar Airways: 60 orders for the 777X.

Lufthansa: First European carrier to place orders for the 777X (20 orders).

Total Orders: Over 2,100 across all variants.

Boeing 787 Dreamliner

Models: 787-8, 787-9, 787-10

Best Seller: 787-9

The 787 Dreamliner is highly sought after for its fuel efficiency and range, making it ideal for both long-haul and medium-range international routes. The 787-9 is the most popular due to its balance of range and passenger capacity.

Notable Orders:

American Airlines: 45 orders for 787-9.

Qatar Airways: 60 Dreamliners ordered across variants.

Etihad Airways: 50 orders for 787-9 and 787-10.

Total Orders: Over 1,600 as of 2024, making the 787 one of Boeing’s top-performing aircraft families in the widebody segment.

Boeing 747 Family

Models: 747-8 Intercontinental, 747-8 Freighter

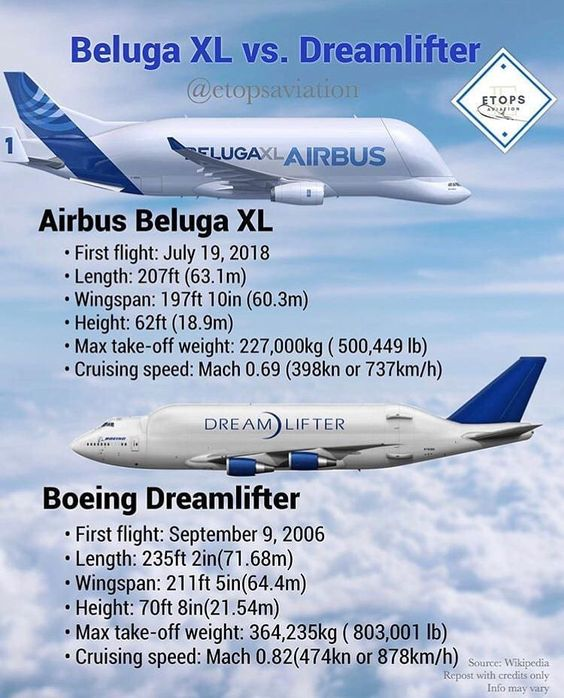

Best Seller: 747-400 (Older Model), Dreamlifter

Known as the "Queen of the Skies," the 747 has been a symbol of international long-haul travel for decades.

Air Force One: Air Force One is the call sign for any US Air Force aircraft carrying the president of the United States, which is a Boeing 747-200B model

Production Status

The last Boeing 747 was produced in December 2022, marking the end of an era for this iconic aircraft

Notable Orders:

UPS and Cargolux were major customers of the 747-8 Freighter.

Total Orders: Over 1,570 across all variants

Dreamlifter: A unique variant within the 747 family, the Dreamlifter is a modified 747-400 designed specifically to transport large components for Boeing’s production line, especially for the 787 Dreamliner. With an expanded cargo hold, it can carry oversized parts that would not fit in traditional cargo planes, making it an essential asset in Boeing's global supply chain.

Competitor to the Airbus Beluga

Boeing 767 Family

Models: 767-300ER, 767-400ER, 767F (Freighter)

Best Seller: 767-300ER

The 767 remains popular in cargo markets. Its reliability has made it a workhorse for both cargo and military applications.

Production Status:

Boeing stopped making the passenger version of the 767 jet in 2014.

As of May 2024, Congress is considering a waiver to allow Boeing to continue producing the 767 freighter for an additional five years, with original production expected to end by 2027 due to stricter emissions and noise limits.

*Update - Production to cease by 2027 officially per CEO.

Market Popularity:

The 767 remains popular in cargo markets, with the 767 Freighter continuing to see new orders.

Its reliability has established it as a workhorse for both cargo and military applications.

Notable Orders:

Major customers include FedEx and UPS for the 767 Freighter.

The U.S. Air Force uses the 767 as the basis for its KC-46 Pegasus tanker aircraft.

Total Orders:

Over 1,200 orders, demonstrating strong demand in the freighter market.

Boeing 757

Models: 757-200, 757-300 (Production ended)

Best Seller: 757-200

The 757 was a popular narrow-body aircraft used for transatlantic and domestic routes. While production ended in 2004, many 757s remain in service today.

Current Role: The 757 has seen extended service as a freighter and is still in use by carriers like Delta Air Lines and FedEx.

Defense Aircraft:

Boeing KC-46 Pegasus (Tanker)

Role: Aerial refueling, cargo, and personnel transport.

Key Customers: U.S. Air Force, Japan Air Self-Defense Force.

Notable Features: Based on the 767 platform, the KC-46 offers enhanced fuel efficiency and multi-mission capabilities.

Total Orders: Over 170, with potential for more international sales.

Boeing P-8 Poseidon (Maritime Patrol Aircraft)

Role: Anti-submarine warfare, anti-surface warfare, intelligence, surveillance, and reconnaissance.

Key Customers: U.S. Navy, Royal Australian Air Force, Indian Navy, and others.

Notable Features: Built on the 737 platform, the P-8 offers advanced anti-submarine capabilities and long-range patrol capabilities.

Total Orders: Over 150 from various countries.

Boeing F/A-18 Super Hornet (Fighter Jet)

Role: Multi-role fighter for air superiority, strike missions, and carrier-based operations.

Key Customers: U.S. Navy, Royal Australian Air Force, and other allied nations.

Notable Features: Versatile combat capabilities, can operate from aircraft carriers.

Total Orders: Over 600 delivered globally.

Boeing AH-64 Apache (Attack Helicopter)

Role: Close air support, anti-armor, armed reconnaissance.

Key Customers: U.S. Army, United Kingdom, Egypt, India, and other international partners.

Notable Features: Heavily armed and armored, the Apache is considered one of the most advanced attack helicopters.

Total Orders: Over 2,400 Apaches have been delivered globally.

Boeing C-17 Globemaster III (Transport Aircraft)

Role: Strategic and tactical airlift of troops and cargo.

Key Customers: U.S. Air Force, Royal Air Force, Indian Air Force, Royal Australian Air Force, and other international air forces.

Notable Features: The C-17 is capable of rapid strategic airlift, can carry oversized cargo, and has the ability to operate from small airfields.

Total Orders: 279 globally, with production ending in 2015, but the C-17 remains in active use around the world.

Boeing F-15 Eagle (Fighter Jet)

Role: Air superiority and strike missions.

Key Customers: U.S. Air Force, Royal Saudi Air Force, Qatar Air Force, Japan Air Self-Defense Force.

Notable Features: The F-15 is one of the most successful fighter jets with a perfect air-to-air combat record and is continuously being upgraded with advanced avionics, radar, and weapons.

Variants: Includes the F-15EX (the latest version with advanced capabilities for the U.S. Air Force).

Total Orders: Over 1,600 since its introduction, with ongoing production for new variants.

Boeing EA-18G Growler (Electronic Warfare Aircraft)

Role: Electronic attack, jamming enemy radar, and communications systems.

Key Customers: U.S. Navy, Royal Australian Air Force.

Notable Features: A variant of the F/A-18 Super Hornet, the EA-18G specializes in electronic warfare to support fleet operations.

Total Orders: Over 160 have been delivered, with potential upgrades to extend operational capabilities.

Boeing T-7A Red Hawk (Trainer Aircraft)

Role: Advanced pilot training for fighter and bomber aircraft.

Key Customers: U.S. Air Force (primary customer for the new T-X program).

Notable Features: The T-7A is a new generation advanced trainer, designed with a focus on affordability and ease of maintenance while simulating the performance of modern combat aircraft.

Total Orders: 351 planned by the U.S. Air Force, with future international sales potential.

Projected size of the global aircraft fleet from 2020 to 2024, with a forecast for 2032

Airlines that Rely on and Support Boeing the Most

Southwest Airlines

Fleet: Primarily operates Boeing 737 aircraft, making it the largest operator of the 737 in the world.

Support: Southwest was one of the most vocal supporters of the 737 MAX, being among the first to bring it back into service after the grounding was lifted.

Ryanair

Fleet: Primarily operates Boeing 737 aircraft. Ryanair has consistently placed large orders for 737 MAX planes.

Support: Ryanair’s confidence in Boeing remained strong even during the grounding period, with additional orders placed to expand its fleet.

American Airlines

Fleet: Operates a significant number of Boeing 737, 777, and 787 Dreamliners for both domestic and long-haul flights.

Support: American Airlines continued supporting Boeing throughout the 737 MAX crisis, quickly integrating the aircraft back into their service once it was recertified.

United Airlines

Fleet: A major operator of Boeing 737, 777, and 787 Dreamliners for both short and long-haul routes.

Support: United Airlines is a loyal Boeing customer and has committed to orders for Boeing’s upcoming models, including next-generation aircraft.

Qatar Airways

Fleet: Operates Boeing 777 and 787 Dreamliners and has significant orders for the Boeing 777X.

Support: Qatar Airways has remained a strong advocate for Boeing, especially with their large order for the 777X wide-body aircraft to support long-haul operations.

Emirates Airlines

Fleet: A major customer of Boeing 777 wide-body aircraft, and a launch customer for the 777X.

Support: Emirates has been one of Boeing's most vocal supporters, particularly regarding the Boeing 777X, which they see as critical for their future fleet expansion. Emirates' President, Tim Clark, has repeatedly expressed confidence in Boeing’s long-term outlook despite the delays in 777X deliveries.

Customer Support & Keeping Airlines Happy

Boeing Global Services (BGS): Offers robust support to keep airlines’ planes running smoothly.

Warranty & Maintenance Packages: Covers essential repairs and routine check-ups, reducing out-of-pocket costs for airlines.

Predictive Maintenance: Uses data to identify issues before they impact flights, partnering with airlines like Southwest for real-time insights.

Global Service Hubs: Expanding service centers, especially in high-growth areas like Asia-Pacific, to stay accessible to customers globally.

Competitive Advantage: Focus on after-sales support and proactive solutions gives Boeing an edge over Airbus, keeping airlines coming back.

Boeing's 737 Delivery Plan (Pre Strike)

42 aircraft per month: This production rate plan began in early 2024, slightly delayed from the initial target due to production challenges.

47 aircraft per month: Planned for mid to late 2024.

52 aircraft per month: Targeted for early 2025.

57 aircraft per month: Expected by mid-2025, with the goal of reaching 60 aircraft per month likely pushed into 2026

Boeing's 737 MAX Deliveries (2024)

January 2024:

Approximately 35-38 737 MAX aircraft delivered (based on typical proportions of MAX deliveries to total).

February 2024:

Approximately 32-36 737 MAX aircraft delivered.

March 2024:

Approximately 35-38 737 MAX aircraft delivered.

April 2024:

Approximately 30-34 737 MAX aircraft delivered, with some reduction due to production issues.

May 2024:

Approximately 34-37 737 MAX aircraft delivered.

June 2024:

Approximately 40-42 737 MAX aircraft delivered, hitting the monthly target.

July 2024:

Approximately 42-44 737 MAX aircraft delivered, clearing part of the backlog.

August 2024:

Approximately 44-46 737 MAX aircraft delivered, as production ramped up.

September 2024:

27 737 MAX aircraft delivered, as confirmed in the latest data for that month.

October 2024 (estimate based on trends):

Approximately 42-45 737 MAX aircraft expected.

Next-Gen for Boeing?

AI & Automation: Streamlining manufacturing processes with AI, reducing assembly time and increasing precision.

Autonomous Systems: Partnering with Shield AI to develop autonomous defense aircraft, future-proofing Boeing’s defense segment.

Sustainable Fuels: Investment in SAF and hybrid-electric aircraft aligns with industry-wide push for lower emissions.

Urban Air Mobility: Through Wisk Aero, Boeing is entering the eVTOL market, aiming to serve urban transport demand by 2028.

R&D Spending: $4 billion annually directed toward new technologies and sustainability, helping Boeing lead in emerging aerospace tech.

Next-Generation Breakdown

New Midsize Airplane (NMA or "797")

Target Market:

Boeing’s rumored next-gen aircraft, sometimes referred to as the 797.

The 797 aims to compete with the Airbus A321neo and A330neo by providing a solution for medium-range routes that are too long for the 737 but too short for the 787.

Entry to Service likely mid 2030s

Specifications:

The NMA is expected to have a twin-aisle design.

Capable of carrying 225 - 275 passengers with a range of 4,000-5,000 nautical miles.

Provides flexibility for medium-range routes.

Mid Sized - Between 757 and 767 sizes to fill massive gap in model lineup since both of these models are retired.

So the 797 would fall between 737 and 787 Dreamliner

Strategic Advantage:

The 797 would target the midsize market, a segment currently underserved by Boeing’s fleet.

Provides airlines with an efficient aircraft for the medium-length routes.

2. Next Generation Air Dominance (NGAD) Fighter Jet

Target Market:

The NGAD fighter jet will replace the F-22 Raptor, targeting the U.S. military and allies seeking advanced air dominance.

It aims to outclass fifth-generation fighters like the F-35 and will compete with offerings from Lockheed Martin and Northrop Grumman.

Specifications (Expected):

Stealth Technology: Enhanced beyond current models.

AI Integration: AI co-pilot and autonomous capabilities.

Manned and Unmanned: Designed for both piloted and fully autonomous missions.

Next-Gen Weaponry: Hypersonic missiles, lasers, and advanced sensor systems.

Networking: Seamless operation with drones and other assets.

Strategic Advantage:

The NGAD will revolutionize air combat with superior stealth, AI, and modular adaptability.

Its manned-unmanned teaming offers flexibility in future combat scenarios, ensuring U.S. air superiority for decades.

3. Wisk eVTOL Aircraft

Target Market:

Boeing’s Wisk eVTOL (Electric Vertical Take-Off and Landing) aircraft is aimed at the urban air mobility market.

It targets short-range, all-electric passenger transport in cities, offering an alternative to traditional ground-based transportation.

Expected to compete with other eVTOL manufacturers like Joby Aviation, Archer Aviation, and Lilium.

Specifications:

The Wisk eVTOL is designed as an autonomous, electric-powered aircraft.

It is expected to carry up to 4 passengers.

Fully electric with zero emissions.

Range: 25-50 miles (depending on urban route and battery technology).

Vertical take-off and landing capabilities, ideal for urban and congested areas.

Strategic Advantage:

Wisk’s autonomous eVTOL design offers a significant advantage by reducing the need for human pilots, making operations more cost-effective for airlines and passengers.

Backed by Boeing, it benefits from the aerospace giant’s deep expertise in safety, manufacturing, and certification.

The all-electric, zero-emissions approach aligns with the push toward sustainable aviation solutions.

Positioned to serve growing urban mobility needs with minimal infrastructure changes due to its vertical take-off and landing capability.

This technology is particularly critical as it targets the 2028 LA Olympics, where the demand for eco-friendly transportation is expected to surge..

Innovation & Future Technologies at Boeing:

AI & Automation

AI-Driven Manufacturing:

Boeing has integrated AI into its manufacturing processes, improving production efficiency and precision. These AI systems reduce errors, streamline workflows, and speed up delivery times across its assembly lines. Airbus has automated more than Boeing and is reaping the benefits.Autonomous Defense Aircraft:

Boeing has formed a significant partnership with Shield AI, a defense tech company, to integrate Shield AI's Hivemind AI pilot system into large defense aircraft.Hivemind allows aircraft to fly autonomously, removing the need for human pilots and enhancing operational efficiency in defense scenarios.

Key Benefits of AI Pilots:

Reduced Risk to Human Life: AI pilots eliminate the need for humans onboard, lowering the risk of casualties in high-risk military operations.

Extended Operational Capabilities: AI pilots can endure longer missions and higher G-forces than human pilots, enabling more complex missions. Watch Top Gun 2 if you want to see what G-forces can do to the pilot.

New Tactical Maneuvers: AI systems can execute maneuvers in high-stress situations that would be challenging for human pilots, unlocking new military strategies.

Urban Air Mobility and eVTOL: Wisk Aero, Boeing’s eVTOL project, is focused on urban air mobility solutions, aiming for market entry by 2028 to meet growing demand for sustainable, electric short-haul travel options.

Environmental Initiatives and ESG Strategy

Net-Zero Emissions Commitment: Boeing is dedicated to achieving net-zero emissions, investing in technologies that meet strict environmental standards and ensure compliance with global regulations.

Sustainable Aviation Fuels and Hybrid-Electric Aircraft: Boeing is a leader in developing hybrid-electric aircraft and SAF, combining electric propulsion with sustainable fuels to reduce carbon emissions and meet industry-wide sustainability goals. By 2030, Boeing aims to make all its aircraft SAF-compatible, targeting up to an 80% reduction in lifecycle carbon emissions.

Partnerships for Innovation: Collaborating with fuel innovators, Boeing is scaling SAF production and accessibility, vital for industry adoption and alignment with global carbon-neutral targets.

Governance and Transparency: Boeing has restructured governance by incorporating DEI initiatives within HR, supporting streamlined oversight of employee experience. The company adheres to ESG reporting standards, including TCFD and GRI, ensuring transparency for investors and stakeholders.

Industry Positioning: Competing with Airbus and meeting investor expectations for green aviation, Boeing’s environmental initiatives reinforce its commitment to sustainable aviation and align with global ESG priorities.

Boeing's Major Challenges Over the Last Six Years

737 MAX Crashes (2018-2019):

Two fatal crashes led to a global grounding of the aircraft for over 1.5 years.

Estimated cost: $20 billion in fines, settlements, and canceled orders.

Severely damaged Boeing’s reputation; rebuilding customer trust remains a long-term effort.

The MAX is recertified, but recovery is still ongoing.

Leadership Changes:

Dennis Muilenburg was removed due to his mishandling of the 737 MAX crisis.

David Calhoun’s tenure provided limited improvement.

Kelly Ortberg, appointed in 2024, is now focused on:

Improving operational efficiency.

Enhancing safety protocols.

Driving cultural changes to prioritize long-term stability and safety.

COVID-19 Impact (2020):

The pandemic drastically reduced air travel, leading to widespread order cancellations.

Boeing reported a $12 billion loss in 2020, with $8 billion of that loss occurring in Q4.

To stabilize, Boeing secured a $17 billion loan, reinforcing its position as "too important to fail."

Production Issues and Financial Losses (2021-2023):

Even after the 737 MAX was cleared to return in late 2020, Boeing faced 787 Dreamliner production delays and quality issues, incurring additional costs.

In 2021, Boeing posted a $4 billion loss in Q4 due to these issues.

In 2023, Boeing’s revenue was approximately $78 billion, but ongoing challenges and pandemic effects limited profitability.

Expenses for 2023 were around $76 billion, primarily driven by production problems and R&D investments.

Union Strike (2024):

In September 2024, the International Association of Machinists initiated a strike, halting production of the 737 MAX and 787 Dreamliner.

The strike is costing Boeing an estimated $50 million per day, or around $1.5 billion per month.

A quick resolution is vital to avoid further financial setbacks.

Debt Load (2024):

As of 2024, Boeing carries around $51.4 billion in debt.

The company is prioritizing cash flow improvements and backlog fulfillment to manage this debt and stabilize its financial position.

Defense Program Delays:

Programs like the KC-46 tanker and F-15EX experienced setbacks and cost overruns, weakening Boeing's defense positioning.

Recent leadership changes, especially in the defense sector, aim to:

Improve execution and program delivery.

Regain momentum and credibility in the defense market.

Safety and Cost-Cutting Criticism:

Boeing's aggressive cost-cutting measures and frequent leadership changes have led to:

Design shortcuts and production delays.

Criticism of Boeing’s commitment to safety.

Addressing these systemic issues is critical for the company's long-term success and stability.

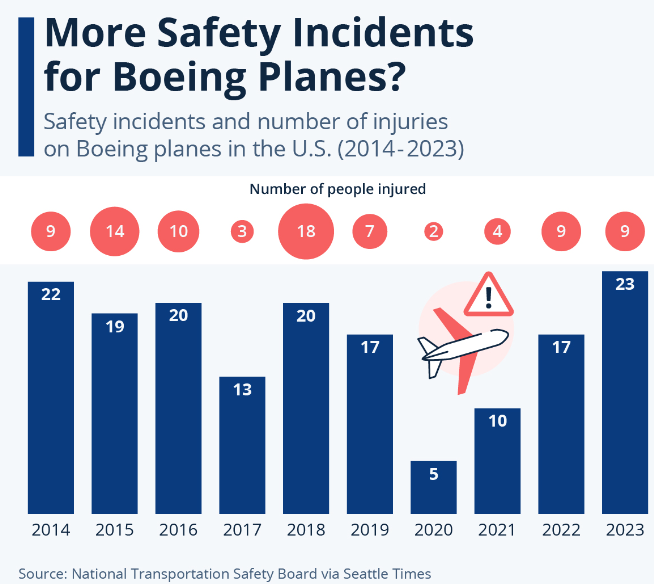

Boeing's Major Struggles Timeline (2018-2024)

October 29, 2018: Lion Air Flight 610 crashes into the Java Sea, killing all 189 onboard.

March 10, 2019: Ethiopian Airlines Flight 302 crashes, killing all 157 onboard; 737 Max grounded globally.

January 13, 2020: Boeing halts 737 Max production.

November 18, 2020: FAA clears the 737 Max for return to service.

January 25, 2021: United Airlines Boeing 777 experiences an engine failure after takeoff from Denver, prompting a global inspection of Pratt & Whitney engines used on older 777 models.

October 28, 2021: Boeing settles deferred prosecution with the U.S. Justice Department, paying $2.5 billion in penalties for 737 Max crashes.

December 2021: The FAA delays certification of the Boeing 777X, citing the need for more tests.

June 2022: Technical issues continue to delay Boeing’s Starliner spacecraft

July 2023: Boeing identifies new problems with fuselage components on some 737 Max aircraft, causing further delivery delays.

September 2023: Boeing temporarily halts 787 Dreamliner deliveries after discovering quality issues related to gaps in the fuselage.

January 5, 2024: Alaska Airlines experiences a mid-flight door panel blowout.

March 2024: Boeing whistleblower John Barnett found dead; questions about safety practices rise.

April 2024: Boeing begins tense negotiations with union workers as benefits set to expire by October.

May 2024: Multiple Boeing whistleblowers raise new safety concerns; FAA deepens investigations.

June 2024: Boeing faces production delays due to supplier issues, specifically Spirit AeroSystems defects.

July 2024: Alaska Airlines door panel incident prompts more scrutiny over component quality.

August 2024: Critical failure occurs during Boeing’s CST-100 Starliner mission, leaving astronauts stranded in space due to a malfunction in the spacecraft's propulsion system

August 2024: Union machinists vote on strike, delaying negotiations and impacting production.

September 1, 2024: Whistleblower shares new evidence with regulators, complicating Boeing’s legal outlook.

September 6, 2024: FAA fines Boeing over safety violations stemming from 737 Max production issues.

September 8, 2024: Boeing machinists and Textron workers go on strike, halting key production lines.

September 10, 2024: Boeing halts 737 Max and 777X production due to strikes.

Responsibility Breakdown for Aircraft Component Issues

Landing Gear Problems:

Airline responsibility:

Landing gear maintenance is generally handled by the airline or a third-party Maintenance, Repair, and Overhaul provider.

Boeing’s involvement:

If a design flaw or manufacturing defect is identified, Boeing could be held accountable. However, routine wear and tear remains the airline's responsibility.

Engine Failures:

Airline/Third-party responsibility:

Engines are manufactured by third-party companies such as GE Aviation or Rolls-Royce. Maintenance contracts are typically between the airline and these engine manufacturers.

Boeing’s involvement:

While Boeing is not responsible for engine maintenance, it may be involved if the failure is due to the engine's integration with the aircraft’s design.

Hydraulic Issues:

Airline responsibility:

Airlines or MROs manage hydraulic systems maintenance, including those for brakes and landing gear.

Boeing’s involvement:

Boeing could be liable if a system-wide hydraulic failure is due to a design defect. However, regular maintenance and troubleshooting are the responsibility of the airline or MRO provider.

Electrical Malfunctions:

Airline responsibility:

Routine electrical maintenance, such as fixing wiring or power system issues, is managed by the airline or MRO.

Boeing’s involvement:

If an electrical malfunction is traced back to a design defect, Boeing may need to resolve the issue, especially if it's under warranty.

Cabin Systems:

Airline responsibility:

Maintenance of in-flight entertainment systems, cabin pressure systems, and other cabin electronics typically falls under the airline or MRO’s scope.

Boeing’s involvement:

Boeing’s responsibility comes into play if a cabin system issue is due to a design flaw. In such cases, Boeing may troubleshoot or replace components, especially during the warranty period.

Airframe Wear:

Airline/MRO responsibility:

Normal airframe wear (cracks, dents) is typically managed by the airline’s MRO.

Boeing’s involvement:

If structural damage is due to a defect or design flaw, Boeing would be responsible for repairs, especially if it affects safety.

Brakes:

Airline responsibility:

Airlines or their MRO providers handle routine brake maintenance, including pad replacements.

Boeing’s involvement:

Boeing would intervene if a systemic brake design issue is identified. Otherwise, ongoing brake maintenance is the airline’s responsibility.

Tires:

Airline responsibility:

Tire wear and inflation are the responsibility of the airline or MRO.

Boeing’s involvement:

Boeing’s involvement is minimal unless a design flaw is identified that causes premature tire wear or malfunction.

Key Catalysts for Recovery

Union Strike Resolution:

The International Association of Machinists initiated a strike in September 2024, halting production of the 737 MAX and 787 Dreamliner.

Boeing is losing approximately $50 million per day, translating to around $1.5 billion per month.

A swift resolution is essential to minimize losses and restart production lines to meet existing delivery commitments.

Certification of New Aircraft:

Boeing should push to obtain FAA certification for the 737 MAX 7 by the end of 2024 and for the 777X by late 2025.

These certifications are critical to fulfilling Boeing’s backlog and meeting the demand for wide-body aircraft.

737 MAX Production:

Boeing aims to increase 737 MAX production to 52 aircraft per month by 2025, up from current levels.

Achieving this production target is vital for Boeing's return to profitability and backlog clearance.

Emerging Market Growth:

Boeing’s growth strategy focuses on expanding its presence in Asia, Latin America, and Africa, which are experiencing rising air travel demand.

However, competition from COMAC’s C919 in the narrow-body segment is increasing, making it essential for Boeing to differentiate and strengthen its market position in these regions.

Financial Stability & Debt Reduction

Boeing's recovery strategy is centered on managing its $51.4 billion debt while maintaining investments in R&D.

The company is focusing on improving cash flow by:

Fulfilling backlog orders efficiently.

Implementing strategic cost-cutting measures across the organization.

A significant portion of generated cash flow will be directed towards debt reduction, enhancing Boeing's financial stability and allowing for reinvestment in new aircraft technologies and innovations.

Boeing may also seek additional government-backed support if needed to sustain operations and fund long-term innovation projects, ensuring the company remains competitive in the global aerospace market.

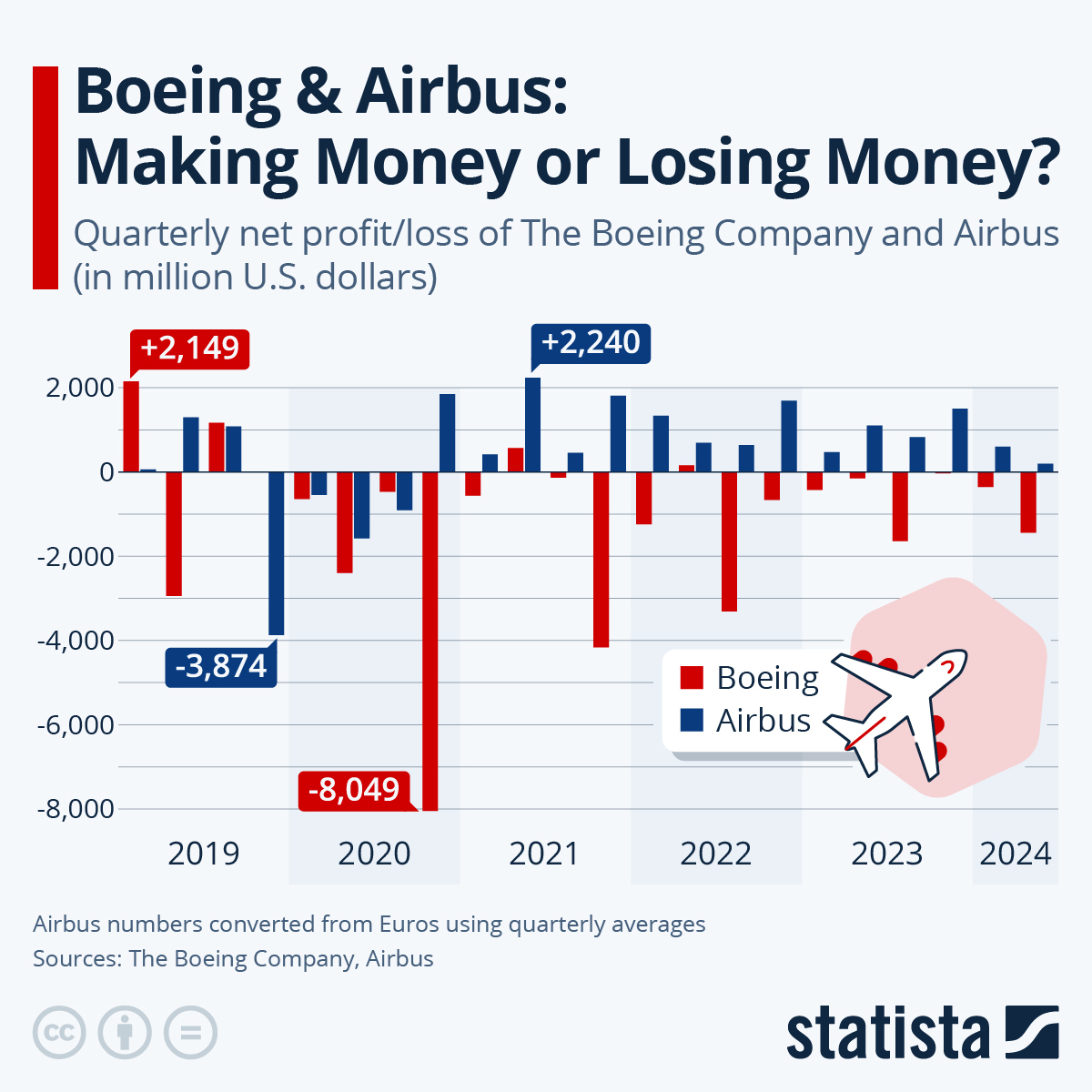

Boeing vs. Airbus: Profitability and Financial Performance

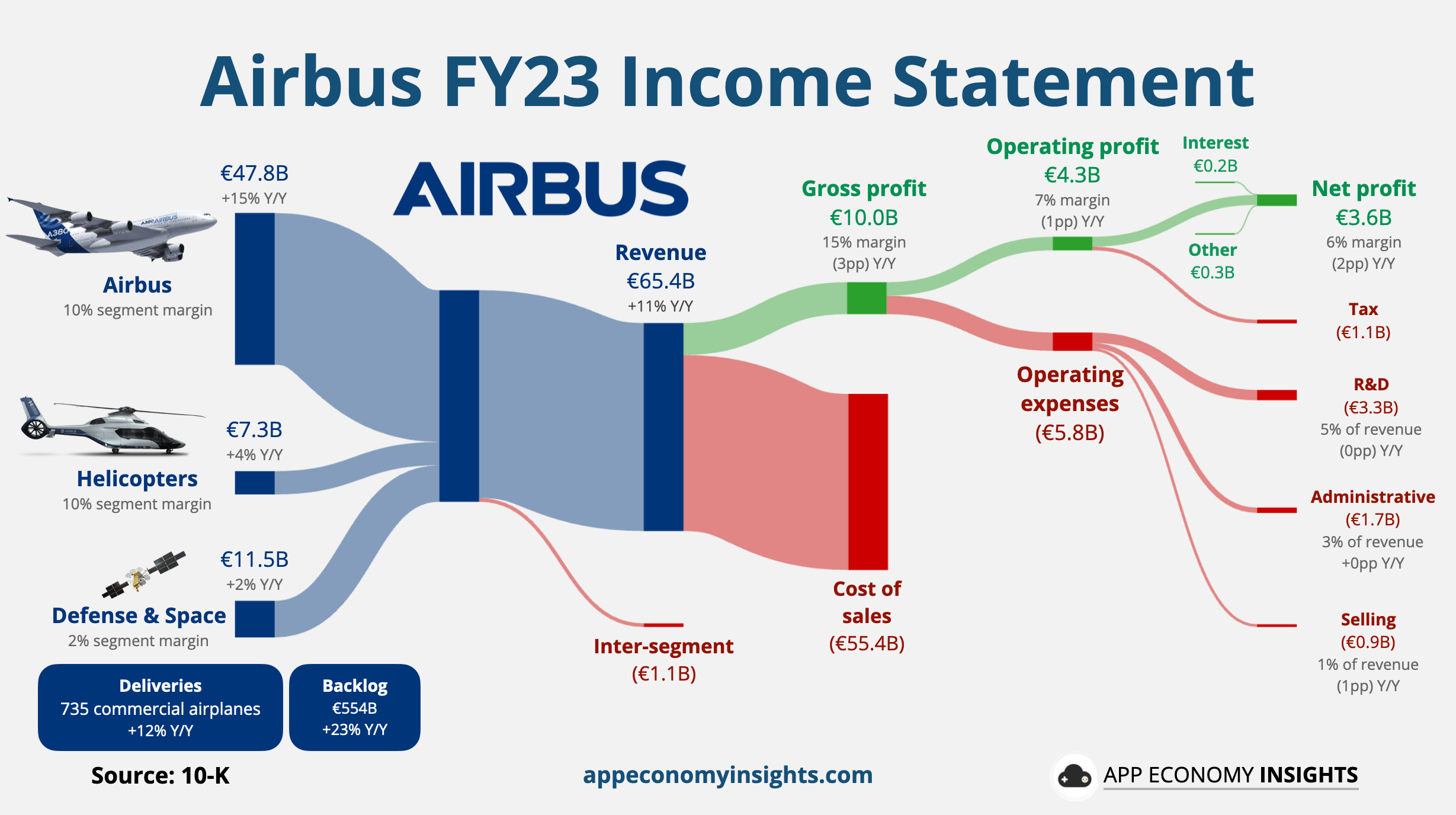

When comparing Boeing’s financial performance to Airbus, a stark contrast emerges. While Airbus has been consistently profitable since 2021, Boeing has faced several setbacks, leading to losses over multiple quarters.

High Debt-to-Equity: Ratio of 5.5 indicates significant leverage compared to Airbus’s 0.9.

Cash Reserves: $10.5 billion on hand, but under pressure due to ongoing strike costs and production delays.

Improving Cash Flow: Focusing on backlog fulfillment and cost-cutting to balance cash burn.

Boeing Global Services (BGS): Maintains strong operating margins (around 17%) to provide steady income.

Outlook: With planned improvements in cash flow and operational efficiency, Boeing aims to stabilize its financial position.

Airbus's Resilience:

2019:

Airbus faced its own challenges with a €3.6 billion ($4 billion) fine related to a corruption case in Q4 2019, but it managed to contain the impact and move forward.

2021:

Airbus returned to profitability in 2021, recovering swiftly from the pandemic and benefiting from stable production operations without the same safety and production challenges as Boeing.

2023:

Airbus generated €58.8 billion ($62 billion) in revenue in 2023, with expenses totaling €54 billion ($57 billion), allowing the company to post a €4 billion ($4.2 billion) net profit.

Unlike Boeing, Airbus maintained stable production, allowing it to reduce debt, which stood at around €13 billion ($13.7 billion) by 2023.

Comparison View:

Revenue (2023): Boeing $78 billion vs. Airbus $62 billion

Debt (2024): Boeing $51.4 billion vs. Airbus $13.7 billion

Net Profit (2023): Boeing negative vs. Airbus $4.25 billion

Expenses (2023): Boeing $76 billion vs. Airbus $57 billion

Firings & Restructuring at Boeing

Defense Sector Overhaul:

Theodore Colbert III was removed as CEO of Boeing Defense as part of Ortberg's restructuring to address project delays, such as with the KC-46 tanker program.

Boeing is merging teams and cutting management positions across the defense division, targeting $500 million in annual savings. These savings are planned for reinvestment into research and development for defense technologies.

Commercial Segment Leadership Changes:

Stanley Deal, previously CEO of Boeing’s Commercial Airplanes division, retired as part of the restructuring. This leadership shift is intended to revitalize the commercial segment and address delivery issues.

DEI Department Restructuring:

Boeing dismantled its Diversity, Equity, and Inclusion (DEI) department in October 2024. DEI staff were either let go or reassigned to other HR roles focused on talent and employee experience, reflecting a shift in Boeing’s organizational priorities.

Workforce and Cultural Transformation:

These restructuring measures are part of Ortberg’s broader effort to streamline operations, enhance safety, and transform Boeing’s corporate culture.

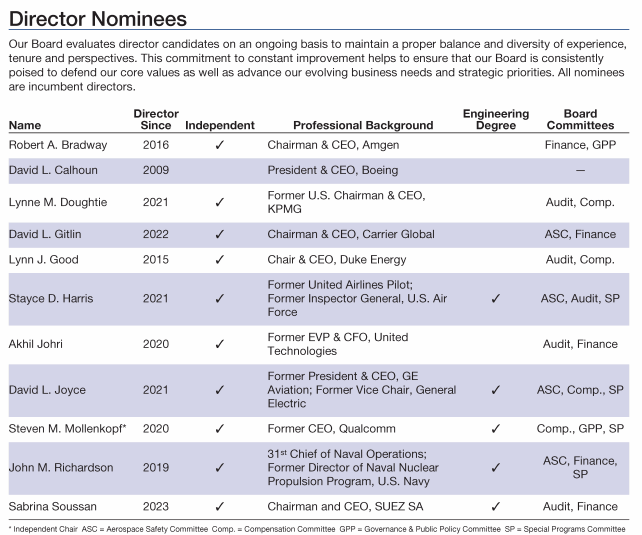

Current Boeing Board of Directors (As of September 2024):

Kelly Ortberg – President & CEO of Boeing, appointed in August 2024. Formerly CEO of Rockwell Collins and Collins Aerospace.

Steven M. Mollenkopf – Chair of the Board and former CEO of Qualcomm, serving on the board since 2020; appointed Chair in March 2024.

Robert A. Bradway – Chairman & CEO of Amgen, serving on the board since 2016.

Lynn L. Good – Chairman & CEO of Duke Energy, on the board since 2015.

Sabrina Soussan – Chairman & CEO of SUEZ, joined the board in 2023.

Adm. John M. Richardson (Ret.) – Former Chief of Naval Operations, serving since 2019.

David L. Gitlin – Chairman & CEO of Carrier Global, appointed in 2022.

Akhil Johri – Former EVP & CFO of United Technologies, serving since 2020.

Lynne M. Doughtie – Former U.S. Chairman & CEO of KPMG, appointed to the board in 2021.

David L. Joyce – Former President & CEO of GE Aviation, serving on the board since 2021.

Stayce D. Harris – Former U.S. Air Force Inspector General, serving since 2021.

(Below picture is from before Ortberg took over)

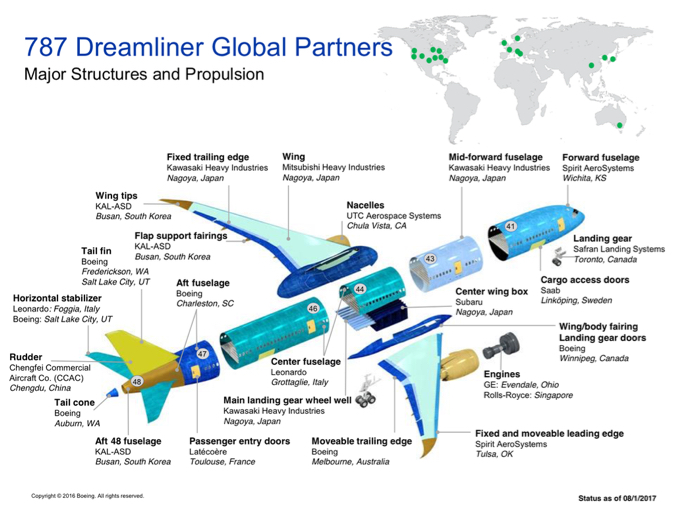

Key Boeing Suppliers / Partners

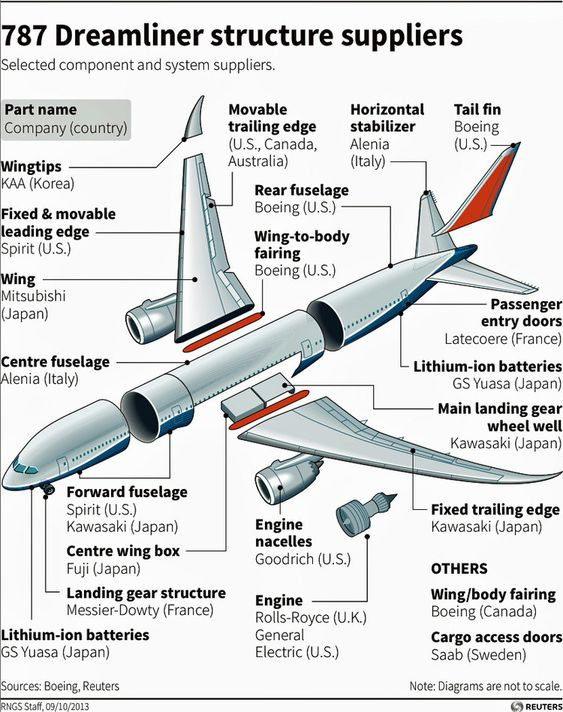

Boeing’s recovery and long-term success heavily depend on its strong network of suppliers across critical aircraft components, avionics, materials, and maintenance solutions. Below is a ranked list of Boeing’s most important suppliers, outlining their roles and the impact they have on Boeing's turnaround.

Spirit AeroSystems (SPR)

Role: Largest supplier; provides fuselage sections and key structures.

Importance: Supplies approximately 70% of the fuselage for the 737, 777, and 787 models.

Recent Developments: Boeing is closely monitoring Spirit's operations, considering taking a more hands-on approach to stabilize supply and reduce disruptions.

General Electric (GE Aviation)

Role: Supplies LEAP engines for the 737 MAX and GEnx engines for the 787 Dreamliner.

Importance: Critical for aircraft performance and fuel efficiency, playing a vital role in Boeing’s recovery.

Rolls-Royce (RYCEY)

Role: Provides Trent 1000 engines for the 787 Dreamliner.

Importance: Key supplier for Boeing’s long-haul aircraft models.

Honeywell Aerospace (HON)

Role: Supplies avionics systems, auxiliary power units, and mechanical systems.

Importance: Ensures Boeing’s aircraft meet modern efficiency and safety standards.

Collins Aerospace (RTX)

Role: Provides avionics, landing gear, and cabin interiors.

Importance: Enhances safety and passenger experience, integral to Boeing’s commercial and defense offerings.

Heico Corporation (HEI)

Role: Supplies cost-effective replacement parts and aftermarket services.

Importance: Supports maintenance solutions for airlines, ensuring long-term partnerships and operational efficiency.

Safran

Role: Collaborates with GE Aviation (through CFM International) to provide LEAP engines for the 737 MAX; also supplies wheels and landing gear.

Importance: Safran’s joint venture is crucial for Boeing’s narrow-body aircraft performance.

PPG Industries (PPG)

Role: Supplies aircraft coatings and sealants.

Importance: Essential for the safety and longevity of Boeing’s aircraft.

Panasonic Avionics

Role: Supplies in-flight entertainment (IFE) systems.

Importance: Enhances customer experience, particularly in long-haul flights.

GKN Aerospace

Role: Provides key aerostructures such as fuselage sections, wing components, and engine nacelles.

Importance: Supports Boeing’s structural and performance capabilities.

Hexcel Corporation

Role: Supplies advanced composite materials used in the 787 Dreamliner and 777X.

Importance: Vital for maintaining Boeing’s competitiveness in fuel efficiency and lightweight design.

Raytheon Technologies (RTX)

Role: Supplies military avionics and missile defense systems for Boeing’s defense division.

Importance: Key partner in Boeing’s defense initiatives.

Woodward, Inc.

Role: Supplies control systems for engines and airframes.

Importance: Enhances aircraft performance and reliability.

Jacobs Engineering (J)

Role: Provides engineering and construction services, particularly in defense and aerospace projects.

Importance: Supports Boeing’s project execution and infrastructure needs.

Potential Partnership with Embraer 2.0?

Partnering with Embraer offers Boeing several strategic advantages, particularly in expanding their reach across various segments of the commercial aviation market. They were partners before the 737 MAX crisis & covid pandemic hit. Personally I'm a huge fan of Embraer and would love this partnership. Embraer runs smooth and healthy and could show Boeing how to get back on track with production.

Pros for Boeing:

Expanded Product Line:

Complements Boeing's portfolio by adding Embraer's regional jets, allowing Boeing to offer a full range of aircraft from regional to wide-body.

Enhances competitiveness against Airbus, especially in regions where demand for both regional and narrow-body aircraft is growing.

Access to New Markets:

Strengthens Boeing's position in high-growth regions, particularly in Asia and Latin America, where smaller, fuel-efficient regional jets are in high demand.

Embraer has strong customer relationships in these markets, which Boeing could leverage.

Innovation and Efficiency Synergies:

Embraer’s focus on fuel efficiency and advanced technology could align well with Boeing’s goals for sustainable aviation and innovation.

Potential for joint research in emerging technologies like electric or hybrid aircraft, which could position Boeing as a leader in sustainable aviation.

Enhanced Global Services Network:

Embraer’s customers could benefit from Boeing’s extensive customer support and maintenance services, creating added value for the partnership and deepening Boeing’s presence in the regional aircraft service market.

Cons for Boeing:

Regulatory and Antitrust Challenges:

A formal partnership or acquisition could face scrutiny from regulatory bodies due to potential antitrust concerns, as seen in previous partnership attempts.

Approval processes could be lengthy and complicated, delaying potential synergies.

Integration and Cultural Differences:

Integrating Embraer’s operations, corporate culture, and business practices with Boeing’s could be challenging and costly.

Differences in organizational structure and management style may lead to friction in aligning goals and processes.

Financial and Operational Risks:

Entering the regional jet market carries financial risks, especially given market volatility and fluctuating demand in the regional sector.

Embraer’s profitability and performance could impact Boeing’s financials, and there may be unforeseen costs in aligning production or operations.

Potential for Limited Synergies in Defense:

Unlike Boeing, Embraer’s focus in defense is more regionally concentrated, and there may be limited synergies in this area.

Overlapping interests in defense contracts might also create competition rather than collaboration in certain cases.

Boeing’s Engine Portfolio

Boeing uses a range of advanced engines on its aircraft, developed by top manufacturers like GE, Rolls-Royce, and CFM International.

1. GE9X (Boeing 777X)

Strengths: Largest and most fuel-efficient commercial jet engine in the world, with advanced materials that improve durability and performance.

Competitive Edge: 10% more fuel-efficient than previous engines, giving Boeing a cost advantage for long-haul routes.

2. GEnx (Boeing 787 Dreamliner)

Strengths: Composite fan blades reduce weight, and advanced combustion technology lowers emissions.

Competitive Edge: 15% more fuel-efficient than its predecessor, ideal for the long-range, fuel-conscious 787.

3. CFM LEAP-1B (Boeing 737 MAX)

Strengths: Lightweight, highly efficient, and quieter, with new materials that withstand higher temperatures.

Competitive Edge: Up to 15% better fuel economy, making it highly competitive in the narrow-body market.

4. Rolls-Royce Trent 1000 (Boeing 787 Dreamliner)

Strengths: Known for reliability and efficiency on long-haul flights.

Competitive Edge: Consistently performs well for long-range routes, supporting Boeing’s wide-body models with a reliable power source.

5. Next-Generation GE Engine (In Development)

Strengths: Open-fan design for breakthrough fuel efficiency, designed to be hydrogen-ready.

Competitive Edge: Expected to be 20% more fuel-efficient, positioning Boeing for future sustainable aviation.

Supply Chain and Supplier Strategy in Boeing’s Turnaround

Boeing’s recovery heavily depends on building a resilient, efficient, and innovative supply chain. Strengthening relationships with critical suppliers and managing supply chain risks are essential for stabilizing production and meeting delivery targets for high-demand aircraft.

Supply Chain Resilience and Regionalization: Boeing is enhancing supply chain resilience by strengthening relationships with key suppliers such as Spirit AeroSystems, GE Aviation, and Collins Aerospace. These suppliers are vital to the 737 MAX and 787 Dreamliner production, and any disruptions could delay Boeing’s delivery timelines. Additionally, Boeing is shifting towards regionalizing its supply chain to mitigate risks related to geopolitical tensions, labor shortages, and component supply issues.

Potential Spirit AeroSystems Acquisition: To regain control over its supply chain amid ongoing production issues, Boeing is exploring the acquisition of Spirit AeroSystems. Spirit's considerable debt is a concern, but this move could reduce Boeing’s vulnerability to supply disruptions and enhance operational stability.

Cost Efficiency and Technological Innovation: Suppliers like Heico play a critical role in cost efficiency, providing affordable replacement parts and services, while partnerships with Hexcel and Safran focus on improving aircraft sustainability and performance. Collaborative efforts with Honeywell, Rolls-Royce, and Collins Aerospace ensure the integration of advanced avionics and engine technologies, furthering Boeing’s competitive advantage across both commercial and defense sectors.

Maintenance, Repair, and Overhaul (MRO)

Boeing’s Global Services Division (BGS) generates substantial revenue through maintenance, spare parts, and digital solutions, helping to maintain long-term customer relationships and ensure Boeing’s aircraft remain operational and efficient.

Financial Turnaround Strategy

Boeing’s strategy involves managing its $51.4 billion debt while ensuring investments in R&D are maintained. The company is prioritizing:

Backlog fulfillment

Cost-cutting measures

Potential debt restructuring

Exploring government-backed support programs to stabilize finances and fund future innovation.

Challenges & Opportunities

Supply Chain Bottlenecks: Addressing risks related to labor strikes, material shortages, and geopolitical challenges is crucial for Boeing’s recovery and ramp-up plans.

Partnership Innovation: Boeing must continue innovating with suppliers like Heico for affordable parts and Hexcel for advanced materials, ensuring it maintains a competitive edge in the aircraft market.

Agility in Operations: Developing a more resilient and agile supply chain will help Boeing adapt quickly to changing market demands and minimize disruption impacts.

Navigating the Regulatory & Political Terrain

U.S.-China Tensions: Demand for narrow-body jets in China is high, but geopolitical tensions are delaying orders. Boeing is shifting focus to Southeast Asia as a backup market.

China: A critical market for Boeing; however, U.S.-China tensions and the rise of COMAC’s C919 present challenges. Boeing is diversifying into other high-growth regions like India and Southeast Asia, where air travel demand is booming and opportunities for narrow-body aircraft are expanding.

FAA Certifications: 737 MAX and 777X certifications are priorities to ensure on-time deliveries and meet order commitments.

Defense Contracts: Boeing leverages its influence in Washington to secure key military contracts, reinforcing its role in U.S. defense.

Political Advocacy: Ramping up lobbying efforts to address regulatory and trade concerns, balancing global market access and U.S. compliance.

Market Resilience: Strategic moves to navigate regulatory and political shifts, keeping Boeing’s international growth intact.

Kelly Ortberg’s Leadership:

Newly appointed CEO Kelly Ortberg relocated to Seattle to oversee Boeing’s recovery.

Ortberg’s experience at Rockwell Collins brings confidence in his ability to drive Boeing’s turnaround, particularly with a focus on improving operational efficiency, navigating crises, and rebuilding customer trust.

Key Takeaways

Pros:

Vast Industry Experience: Kelly Ortberg has a strong background in aerospace and defense, leading Collins Aerospace and working with Raytheon Technologies. His experience gives him the tools to navigate Boeing’s current issues.

Technological and Operational Expertise: Ortberg's focus on innovation and improving production processes can help Boeing reduce costs and enhance performance, making him well-suited to lead Boeing's recovery, hopefully.

Crisis Management Skills: Ortberg has successfully handled crises before, positioning him to guide Boeing through current production delays and safety concerns.

Strong Supplier Relationships: His connections with key suppliers like GE Aviation and Honeywell are crucial for stabilizing Boeing’s supply chain, which has faced disruptions.

Hands On Approach: From Day 1 he's wanted to be at the heart of Boeing in Seattle, big confidence boost for employee morale.

Regularly visits production floors to stay connected with employees.

Quality Over Speed: Ortberg’s approach emphasizes doing things right, addressing past issues with rushed production.

Employee Initiatives: Retention bonuses, safety training, and team-building activities aim to improve morale.

Long-Term Goal: Stabilizing production and aligning employees around Boeing’s new direction to build a strong, unified culture.

Cons:

Short-Term Leadership: Ortberg's age and previous retirement suggest his tenure might be short, raising concerns about long-term leadership stability at Boeing.

Cultural Challenges: Boeing faces deeper structural and cultural issues that may require more comprehensive leadership changes, which Ortberg may not fully address.

Boeing’s Government Lifeline:

Boeing remains “too important to fail” due to its critical role in U.S. national defense and employment.

Secured a $17 billion government loan during the pandemic and may receive further support if necessary to sustain operations and strategic development.

AKA if Boeing was down bad enough, the government would step in.

Boeing's Freighter Leadership

Boeing remains a leader in the freighter market with models like the 747-8 Freighter and 777 Freighter. The boom in e-commerce has fueled demand for air cargo, allowing Boeing to offset challenges in the narrow-body market.

E-commerce Growth: The rise of online shopping has greatly increased the need for air transportation. Boeing estimates that 2,845 new freighters will be required in the next 20 years to meet this demand.

Dominance in Widebody Freighters: Boeing has a strong position in the widebody freighter segment, with the 777 Freighter being the most popular model. The upcoming 777X also aims to enhance this market by offering improved capabilities and efficiency.

Innovations on the Horizon: New models like the 777-8 Freighter, which is expected to deliver superior fuel efficiency and operational performance, will help replace aging fleets.

Need for Modern Alternatives: As older freighters like the 747-400 retire, there is a growing demand for newer, fuel-efficient models, which is expected to drive new orders.

Challenges from Airbus, Embraer, & COMAC

Narrow-Body Market Dynamics

Airbus Dominance: Holds over 60% of the narrow-body market (2023), primarily due to the success of the A320neo. Boeing needs innovation, possibly a new model, to stay competitive, particularly in short-haul routes.

Embraer’s Rise: The E2 jet series is gaining traction, targeting regional and low-cost carriers, directly challenging Boeing in the regional aircraft space.

COMAC’s C919: Backed by Chinese government support, the C919 is gaining market share in China. COMAC's expansion plans aim to grow beyond China, posing a global threat to Boeing’s market presence.

Regional Focus & Strategic Expansion

Boeing’s Counter Strategy:

Targeting high-growth markets like India, Southeast Asia, and Africa, where air travel is projected to grow at 5.3% annually over the next decade.

Partnerships: Collaborating with regional airlines to strengthen its presence and develop competitive solutions, leveraging its strengths in the wide-body segment.

Competitor Strategies

COMAC: Expanding beyond the C919 to diversify its aircraft offerings, increasing global competition for Boeing.

Embraer: Scaling up its E2 jets and investing in new technologies like eVTOL to diversify and challenge Boeing and Airbus across multiple aviation segments.

Boeing’s Competitive Edge

Trust & Reputation: Despite past challenges (737 MAX), Boeing's long-standing safety record still holds value compared to newer entrants like COMAC.

Customer Retention & Diversification:

Boeing is enhancing customer support, product reliability, and offering loyalty-building measures to retain clients post-737 MAX crisis.

It is also diversifying by targeting cargo airlines, low-cost carriers, and eVTOL developers to reduce reliance on traditional commercial orders.

Global Service Network: Boeing’s extensive relationships and service capabilities give it a competitive advantage over Airbus, Embraer, and COMAC.

Aftermarket Growth & Digital Services: Boeing’s Global Services Division is focusing on AI-driven maintenance, digital solutions, and expanded aftermarket support. This division is becoming a key profit center, offsetting fluctuations in aircraft sales and reinforcing Boeing’s long-term value.

Activist Involvement and Potential Influence on Boeing

As Boeing faces operational challenges, such as the union strike and cash flow issues, the attention of activist investors is likely to grow.

Potential Areas of Influence:

Operational Efficiency: Activists may urge Boeing to streamline operations, potentially accelerating its acquisition of Spirit AeroSystems and improving supply chain management.

Capital Allocation: They might advocate for aggressive cost-cutting measures and debt reduction strategies to better manage Boeing's $51.4 billion debt.

Leadership Changes: While CEO Kelly Ortberg is currently at the helm, activists could push for changes at the board level, seeking directors with aerospace and manufacturing expertise.

Shareholder Returns: Activists typically push for share buybacks or dividend reinstatements, likely once Boeing stabilizes its cash flow and addresses supply chain issues. An area Boeing previously focused too much on.

Historical Context: Activist investors have previously influenced companies like General Electric, leading to significant changes that improved operational efficiency and shareholder returns.

Notable Activists: Investors like Elliott Management and Third Point have shown interest in aerospace companies, leveraging strategies that align with Boeing's current challenges.

Regulatory Impact: Changes in corporate governance regulations may empower activists to push for structural changes within Boeing.

Long-term Strategy: Activists might also encourage Boeing to invest in sustainable aviation technologies, which are increasingly important in today's market.