Recently, Amazon.com (AMZN) and Walmart (WMT) announced they were closing stores in areas where crime is eroding profits.

According to CNBC, Amazon is closing eight of its non-cashier, self-serv, Go convenience stores; two in Seattle, two in New York City, and four in San Francisco effective April 1, 2023. This follows the prior announcement of 18,000 layoffs and the more recent announcement that the company would be shutting down the construction of its second corporate headquarters in Virginia.

Meanwhile, Walmart is closing its remaining two stores in Portland, Oregon as soaring crime rates in the area are increasing merchandise theft in the stores. Other store closings will take place in New Mexico, Wisconsin, Arkansas, and Florida.

There are several potential repercussions to these store closures including:

· Inconvenience to customers;

· Potential loss of revenues for the companies;

· Potential loss of tax revenue for the cities affected;

· Loss of jobs; and

· More woes for the beleaguered commercial real estate sector.

Customers who have become accustomed to shopping in these stores will be affected. According to reports, the two stores in Portland are central shopping centers in their neighborhoods. In addition, there are 580 jobs which will be lost, although workers are reportedly being offered jobs elsewhere.

Why these Stocks are not on my Shopping List

As I noted in my initial post, one of the reasons for this addition to Joe Duarte in the Money Options.com is to provide some insight into how I develop my market views as well as to offer insights into my shopping list of potential stocks to add to the portfolios.

In this post, I am discussing my thoughts on Amazon.com in detail.

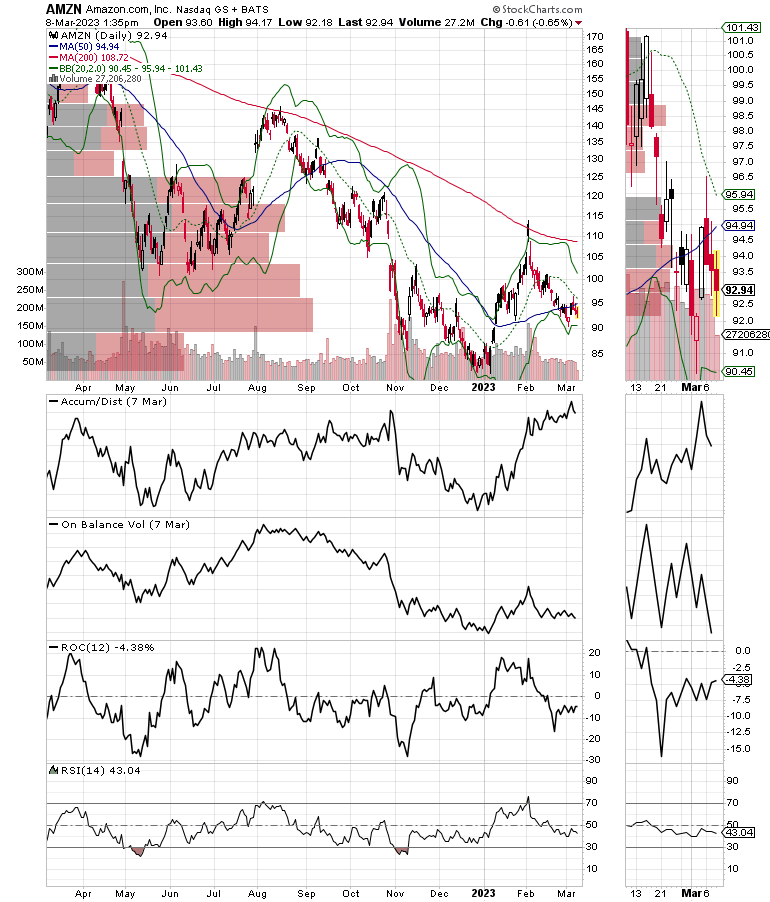

Amazon’s Woes Are Reflected in its Price Chart

The Amazon price chart shows a stock that has been in trouble for months. They’ve missed their earnings, have had to write down investments in other ventures (Rivian). Now they are laying off thousands of workers, shutting down construction of a new headquarters in Virginia, and pulling back their horns on existing warehouse space. All of which adds up to business isn’t doing well.

There are two indicators on the chart which are worthy of examining in detail. One is the Accumulation Distribution (ADI) and the other is the On Balance Volume (OBV)

You can See ADI is rising, which is a sign that short sellers are bailing out. On the other hand, you can see that OBV is rolling over and threatening to make a new low. That’s a sign that even as short sellers are no longer interested, neither are the buyers.

A closer look at ADI, however, shows that the shorts may be returning as the line has recently rolled over.

Moreover, the stock remains well below its 200-day moving average and has recently failed to rise above its 50-day moving average.

When you put these signs together, the only conclusion is that for now, Amazon shares should be avoided.

On the other hand, I am keeping a close eye on the shares. That’s because at some point, there will be signs that the situation is turning around.

If you decide to support this venue, I thank you wholeheartedly. All I ask is that you keep this process civil. This site is intended only for adding information that is useful to subscribers or anyone who is interested in the stock market and related topics. It is not a support site for Joe Duarte in the Money.com (JDIMO) or a venue to be negative. If you have any operational issues with the (JDIMO) web site itself, please contact support as usual.

Until next time

Joe Duarte