I’m not bearish on homebuilders. But high mortgage rates continue to crush the housing market, and the odds of significant fall in rates remain worse than even. That means that investors in the homebuilder sector need some patience.

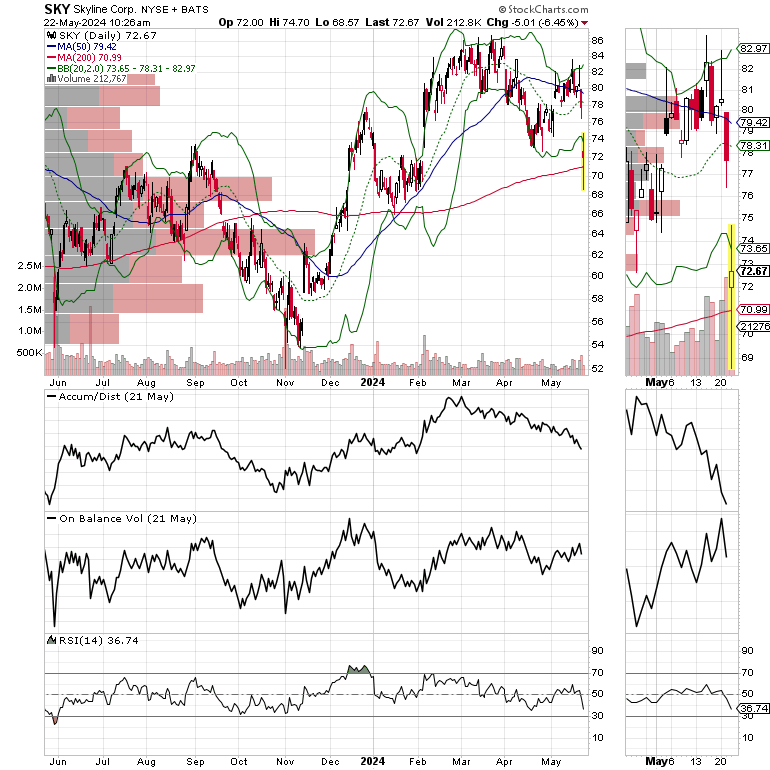

You can see it in the data. Existing home sales failed to impress this morning, and the recent earnings report from Skyline Champion (SKY) suggests the low end of the market is starting to crumble.

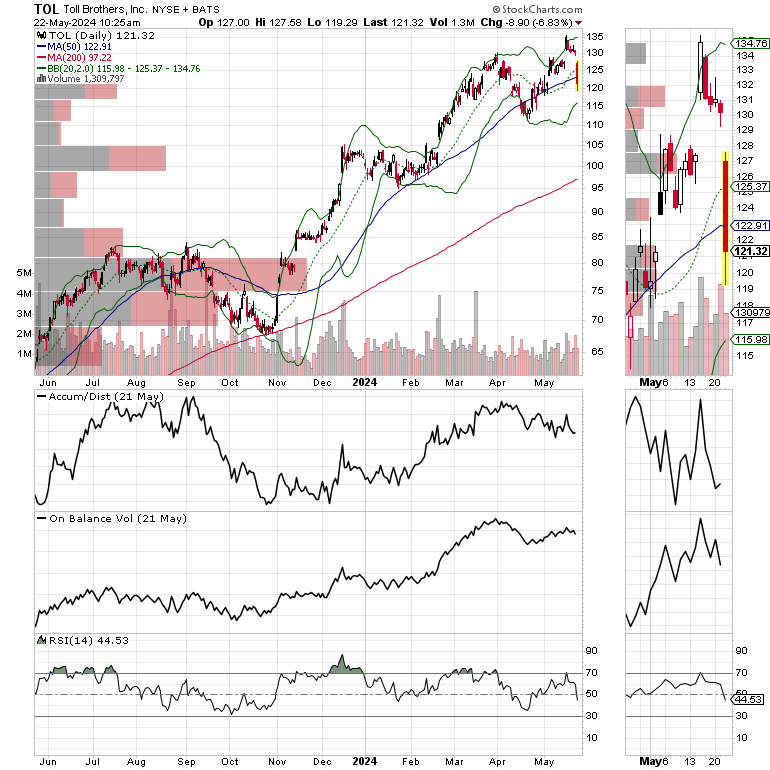

In yesterday’s post, titled “Housing Data is a Big Deal this Week. Possible Short Squeeze Evident in Homebuilders,” I suggested that earnings from luxury homebuilder Toll Brothers (TOL) could shed light into the current action in the homebuilder sector.

I also noted that I wasn’t seeing much action in the existing home sales side of my “kicking the tires” expeditions and that smaller homebuilders were struggling in comparison to the larger builders who were in a hurry to finish out their existing developments and having success doing it, especially while bringing in customers with “final phase” signs warning that the party was coming to an end.

As a result, I wasn’t surprised when TOL beat expectations after the market closed yesterday, or this morning when existing home sales missed expectations to the tune of only 4.14 million units versus expectations of 4.21 million. Interestingly, the supply of upper end existing homes is rising, and boosting sales in the subsector, according to the National Association of Realtors (NAR).

Other notable aspects of the report include:

· Existing home inventory for sale is rising;

· Unsold inventory is now at 3.5 months up from 3.2 months;

· The median home price continues to rise. It’s now at $407,300; and

· Sales were down in all four regions of the U.S.

A Tale of Two Different Sectors

Toll Brothers’ earnings report beat headline expectations – no surprise there. The company beat both earnings and revenues expectations handily and offered bullish guidance for the rest of the year. That’s becoming boiler plate these days.

A closer look at the report, though, shows that a big chunk of the earnings ($117 million) came from the sale of an undeveloped plot of land and that, although sales are steady, the company’s backlog – a sign of expectations for the future – is actually shrinking. In addition, profit margins are slightly shrinking, although not collapsing.

That combination of data suggests, as I’ve noted multiple times, that homebuilders are going to make money for the foreseeable future; just not as much as we’ve seen in the past; and with some wrinkles. Moreover, TOL is joining the crowd of builders that is slowing down its production in order to keep supplies tight and thus ensure that they will be able to keep prices from falling apart.

The price chart for Toll Brothers shows that the market didn’t like what it saw in the report.

On the other side of the homebuilder spectrum is Skyline Champion (SKY), a specialist in mobile homes. In contrast to TOL, SKY missed both its earnings, and revenues. That’s because even though it sold 15% more homes during Q4 than a year earlier, sales for the whole year dropped significantly. Moreover, its average selling price dropped by 3.1% and it took a $34 million charge to fix water leak issues in some of its models. It gets worse: Gross margins, the amount generated by net sales, EBITDA and gross margins all decreased. And it all happened when the company bought a competitor, Regional Homes during the year.

The balance sheet also took a hit with cash on hand dropping to $495 million from over $700 million a year earlier.

The price chart speaks for itself.

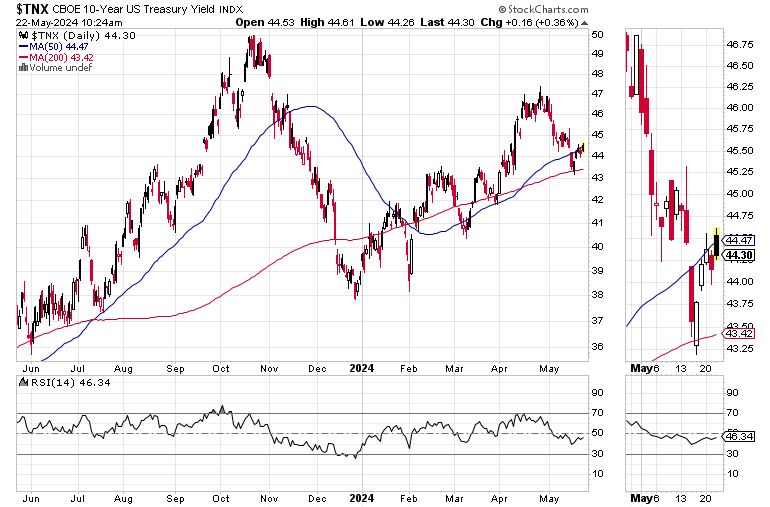

It’s All About Interest Rates

Investors will be watching what the FOMC minutes from the Federal Reserve say this afternoon. Of course, it’s old news. But bond traders, and their algos, will have to react to the headlines. That means that if the U.S. Treasury Ten Year Note yield (TNX) climbs back above 4.5% we can expect lots of stock market volatility, especially during an options expiration week.

Ahead of the report, TNX was holding just below 4.5%. Let’s see what happens.

Bottom Line

I still like the homebuilders as supply is on their side. That said, I would not hold my breath expecting a beat of expectations for new home sales on Thursday.

The higher end of the housing market is holding up. But the low end is not. That’s worrisome as it goes along with other signs that consumers are struggling.

The Fed isn’t going to back off from its “higher for longer” posture on interest rates, which means that mortgage rates may not fall below 7%, for an extended period of time; even if they creep below the key number in the short term.

Staying patient with any homebuilder holdings is advisable. On the other hand, if mortgages fall below 7%, it will likely push this sector nicely higher.

Thanks to everyone for your ongoing support. I really appreciate it.

Thanks to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

I also appreciate single coffees, which you can buy me here.

For intermediate and long term trend trades take a Free Two Week Trial to Joe Duarte in the Money Options.com.

If you’re an active trader, check out the Smart Money Passport.

You’re the music. I’m just the band.