The homebuilder sector seems to be expecting a weak set of numbers later this week. If existing home and new home data comes in better than expected, we should see a nice short squeeze in the homebuilders develop.

Waiting for the Data

I’ve been bullish about the housing sector for the past few months with moderate success as the homebuilder stocks have had some excellent short term rallies when the bond market has rallied in response to better than expected inflation data. The main premise behind my bullishness is the fact that housing supply remains tight while demand remains stable to rising.

Moreover, there has been an aspect of market timing in the housing market, as I’ve discussed here multiple times which favors homebuilders. This is best summarized by noting that every time interest rates drop, mortgage rates eventually follow and potential buyers who’ve been sidelined by high interest rates move in during the temporary breaks in rates.

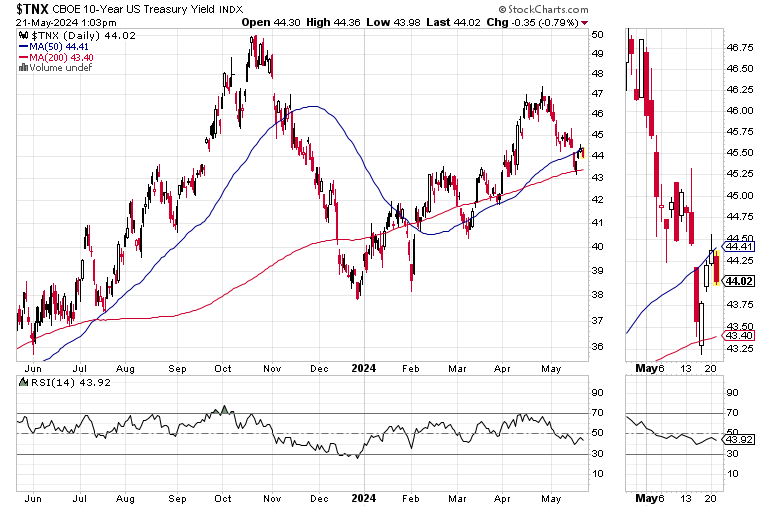

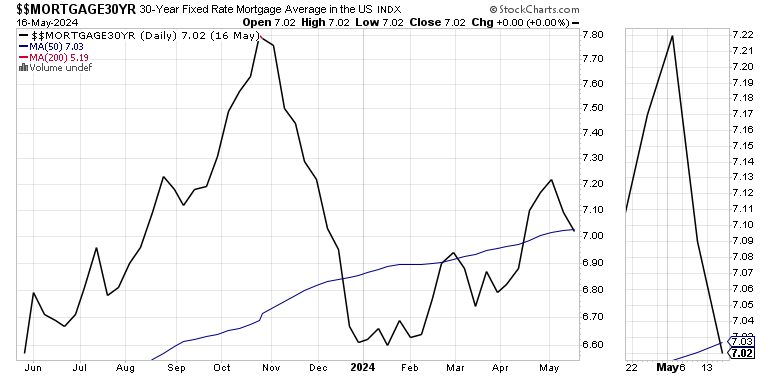

Last week, we saw the U.S. Ten Year Note yield (TNX), the benchmark for the average 30-year mortgage dropped below 4.5%, where it has remained for the past few days. The average 30-year mortgage also dropped, closing the week just above 7%.

All of which brings me to this week’s data; Existing Home Sales for April, due out on 5/22, and New Home Sales, to be released on 5/23. In between, we’ll get the release of the most recent minutes from the Fed’s FOMC meeting.

Expectations are for 4.21 million existing home sales and 674,000 new home sales. The bond market is likely to respond, at least momentarily to the Fed minutes. The key is whether TNX bounces back above 4.5%.

Ahead of the numbers, TNX is well below its recent high near 4.7%. But, as I describe below, based on my “kicking the tires” observation, it doesn’t seem as if the fall in rates has spurred buyers to come off the sidelines yet.

That’s because mortgage rates are still above 7%. The latest mortgage data average is due for release after the New Home Sales data. It should be just above or just below 7%, unless something very dramatic happens ahead of the release.

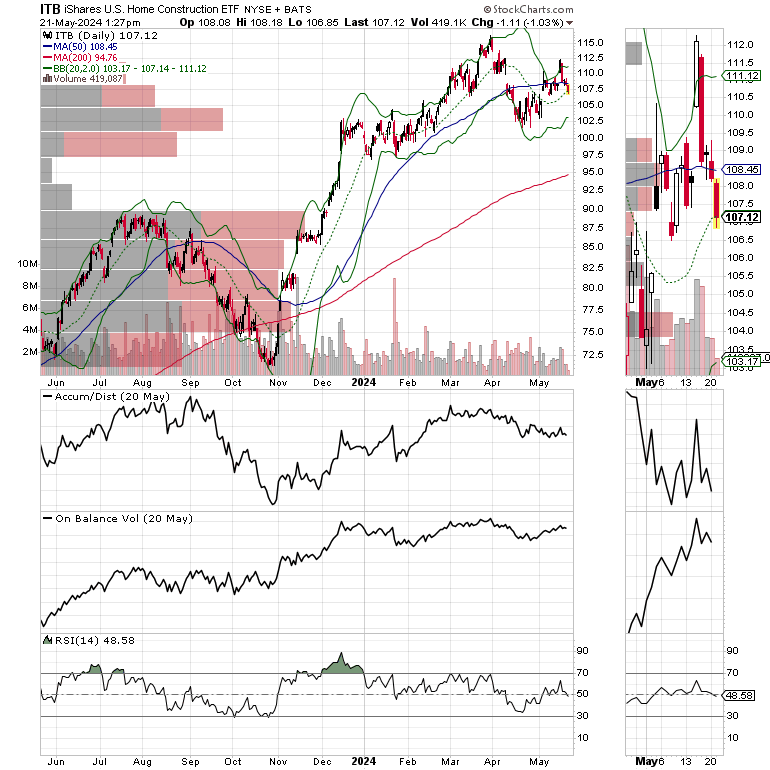

For its part, the iShares U.S. Home Construction ETF (ITB) is showing some weakness as it struggles to stay above its 50-day moving average. Here’s where it gets interesting. The ADI line is moving lower but the OBV line is holding steady. That suggests that if the data comes in better than expected we may see a short squeeze develop.

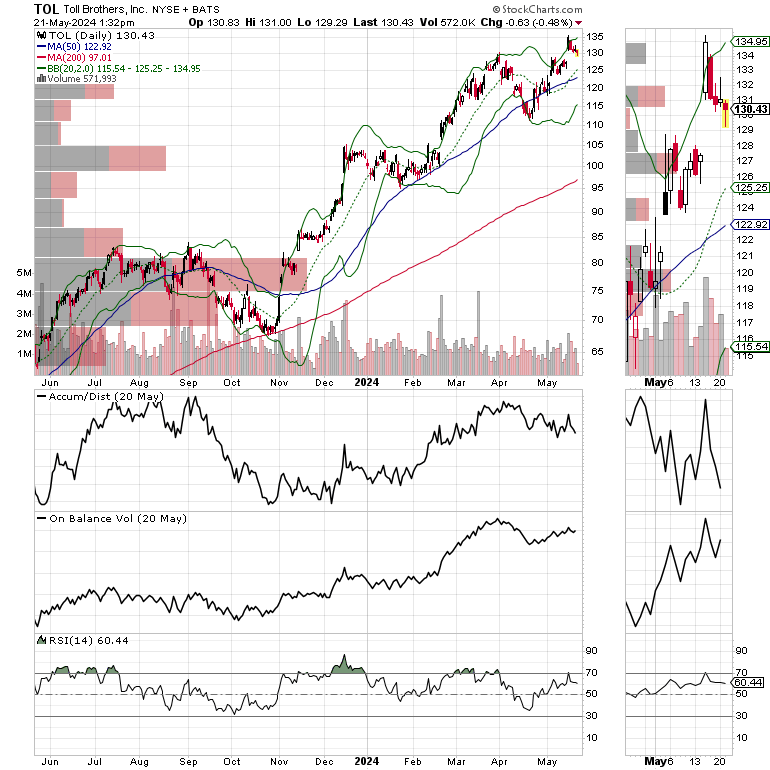

Ahead of the data, we'll get the latest earnings from luxury homebuilder Toll Brothers (TO), after the market closes today. Inside the report, we may get some hints about what's likely ahead of the data. Interestingly, the ADI and OBV configuration for TOL is even more dramatically set up for a short squeeze than what's evident in the price chart for ITB.

What I’m Seeing on the Streets

Forecasting is a fool’s game. So, this is not a forecast, but a set of observations.

When it comes to existing home sales, I’m seeing a very slight bump in the number of new homes that are for sale. Most of them seem to be overpriced and not in the best condition. They are not gathering much traffic, and I haven’t seen any sales.

New home sales are a bit more variable. Large developments from upscale builders are steady. Many of them are in their late stages of development and building and are advertising it, trying to create a sense of urgency among potential buyers. There are more SOLD signs in these communities than in front of the few existing homes that are for sale. On the other hand, smaller builders with recent builds aren’t experiencing much traffic. In addition, there are few new developments starting.

I continue to see a resurgence in out of state license plates featuring the usual origins. California, Illinois, Florida, and Mississippi account for the majority. Sprinkle in a few from Oregon, Alabama, Tennessee, Oklahoma, Arkansas, Kansas, Nevada, and Missouri, and you’ve got a trend; the migration to Texas has not slowed.

That means that demand for housing in the face of tight supplies has not ebbed.

Bottom Line

Certainly, my “kicking the tires” observations are limited. I count license plates, look for “For Sale” and “SOLD” signs and drive past or sometimes walk around new developments. I talk to builders and realtors when I get a chance, but most of them aren’t very talkative or positive these days. I certainly get a feel for the market; but I admit it’s anecdotal data.

Nevertheless, what I’m seeing, is that the recent drop in mortgage rates hasn’t likely been large enough to spur widespread buying activity. The existing home supply is still tight. New homes sales seem to be limited to upscale communities which are in their last stages of development.

In other words, demand is likely to be rising in the face of tight supplies. The problem is high mortgage rates. We’ll see whether the FOMC minutes and perhaps the next round of inflation data moves the needle lower in rates.

The bottom line is that I’m not sure as to what new home, or existing home sales data will be like.

But unless there is a huge surge in both, until proven otherwise and until rates drop, all I see is a stalemate where homebuilders are in better position than existing homeowners when it comes to selling a house.

From a trading standpoint, the action in the iShares Homebuilding Industry ETF (ITB) and Toll Brothers (TOL) suggests that a potential short squeeze is developing in the sector. You can learn how to spot potential short squeezes here.

Thanks to everyone for your ongoing support. I really appreciate it. If you like this post, hit the Like Button. It really helps the service and gets the word out.

Thanks to all the current Buy Me a Coffee members and supporters. Special shout out to new members who now have access to the Sector Selector ETF Service, which is included, at no extra charge with your Buy Me a Coffee membership.

I also appreciate single coffees, which you can buy me here.

For intermediate and long term trend trades take a Free Two Week Trial to Joe Duarte in the Money Options.com.

If you’re an active trader, check out the Smart Money Passport.

You’re the music. I’m just the band.