September 7, 2023

Contrarian investors known for their ability to pick bargains at the bottom of real estate cycles are starting to dip into the commercial real estate mess created by higher interest rates. I’m not surprised given what I’s seeing on price charts.

I’ve been suggesting to subscribers of Joe Duarte in the Money Options.com that patience is warranted when investing in real estate stocks, both on the residential side (homebuilders and residential rentals) and to a lesser degree on the commercial side (CRE); warehouses and related subsectors.

Yet, I recently saw a story on the RealDeal.com website which caught my attention as it details a recent, mostly under the radar transaction in CRE which is worth reviewing.

According to the report, private equity company Fortress Investment Group just bought a $1 billion CRE loan portfolio from Capital One. The loans are concentrated in New York.

Aside from the fact that Fortress forked over a billion dollars for a batch of potentially troubled loans, what’s important to note here is that Capital One sold the portfolio. That’s because it could be a sign that banks are starting to panic while seasoned bottom fishing investors sense an opportunity.

And, of course, panic is often a sign that a bottom is forming in an investment cycle.

If more deals follow, it will be a potentially bullish development as it could signal that the worst may be over. For now, the news continues to focus on loan payment delays, delinquencies, foreclosures, defaults, and the difficulties encountered by borrowers trying to refinance maturing short term CMBS (collateralized, mortgage backed security) loans. This has hit the multifamily and office sectors the hardest.

The Bond Market Remains Stubborn

Of course, the most important influence on real estate, is interest rates. The Federal Reserve meets in mid-September and there is no way to tell what they will do as some voting members of the Federal Open Market Committee (FOMC) have suggested the central bank should pause while others are pressing the case for more rate increases.

Recent data isn’t helpful as consumer and producer prices have flattened but may have reached a low for the present and could reignite. The jobs market may be slowing but wage pressures, especially due to labor strikes persist. And of course, oil prices continue to rise, which is a major factor on consumer inflation.

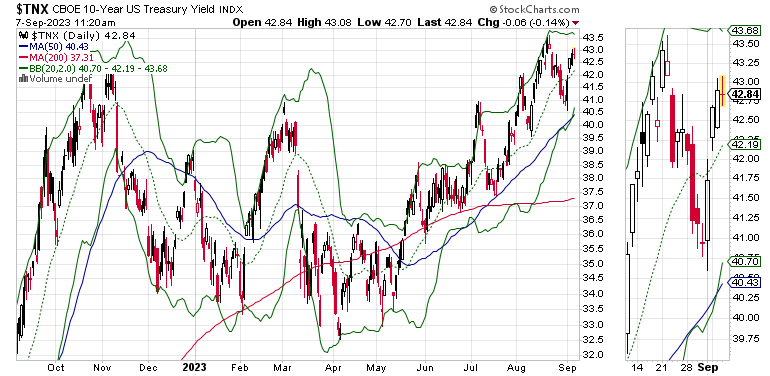

The U.S. Ten Year Note yield (TNX), the benchmark for most 30 year mortgages and the market’s bellwether for rates continues to hover near the top of its recent trading range. A sustained move above 4.3% would be very negative for real estate but also for the broad stock market. A drop below 4% would be very bullish.

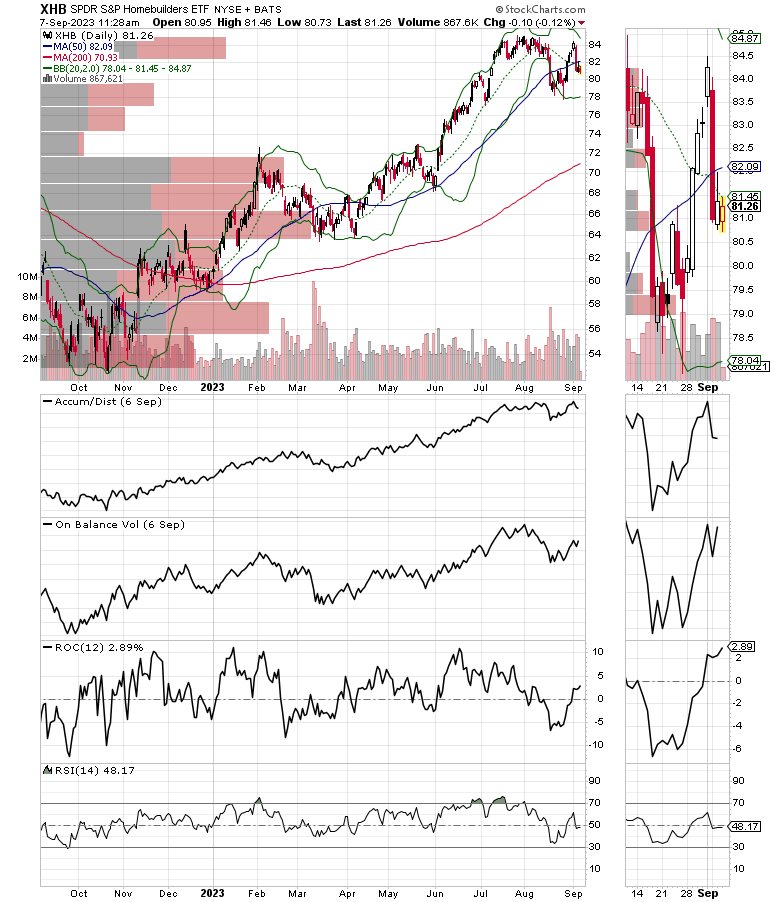

The SPDR S&P Homebuilders ETF (XHB) recently tumbled as higher bond yields rattled investors. But XHB has not totally broken down. In fact, as the On Balance Volume line (OBV) shows by its recent rise, money flowed in and bought the dip.

As I’ve noted many times, the supply and demand side in housing is tilted toward the homebuilders. That does not guarantee that homebuilder stocks will hold up in the short term. But it is highly suggestive that once rates stabilize or come down, XHB will likely move up in response.

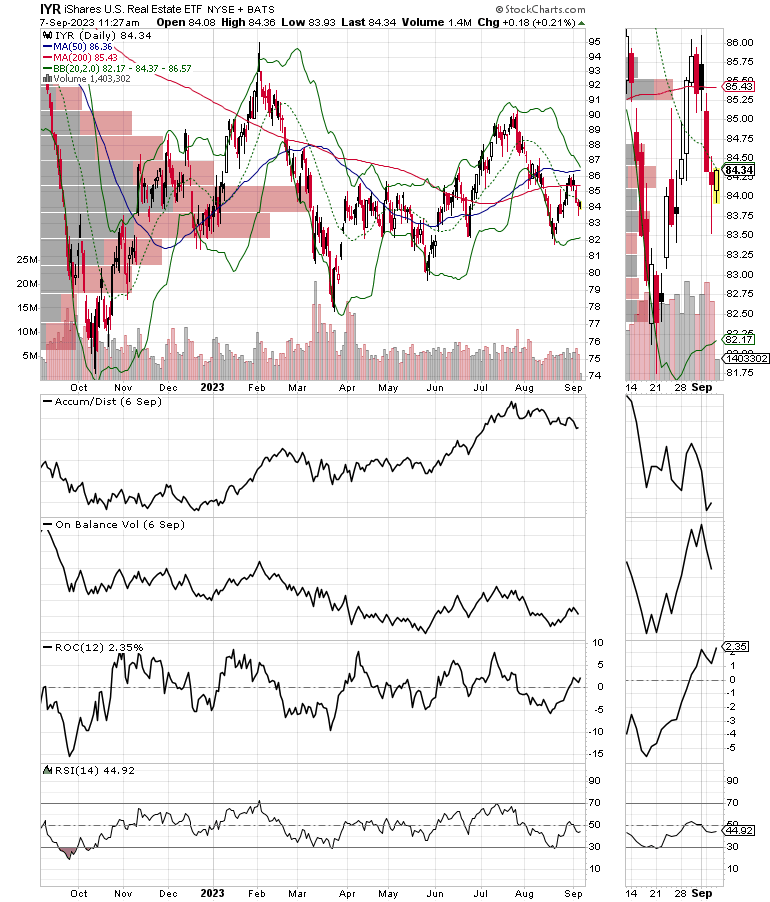

Meanwhile, the iShares Real Estate ETF (IYR) remains in a trading range with support in the $80-$82 area. IYR invests in both commercial and residential REITs. The commercial REITs are weighing on the ETF more than its residential holdings, which is why the ETF is weaker than XHB.

Bottom Line

There are some encouraging signs appearing in CRE. It's clearly still early in the game and certainly there could be more setbacks over time.

Much depends on what the Federal Reserve says and does at its upcoming September meeting.

Staying vigilant and patient is the best approach to investing in real estate during periods such as the current one.

If you’re interested in individual REITs which are outperforming the real estate sector consider a subscription to Joe Duarte in the Money Options.com here.

As always thanks to everyone, donors, members, and followers for their support. This page is growing steadily thanks to you. I really appreciate it.

I am offering this report to new followers as a token of my appreciation. It is usually a member’s only publication.

So, if you like this report and want to receive it on a weekly basis, consider becoming a member.

I also appreciate single coffees, which you can buy me here.

Special shout out goes to supporter ST-QI. Thank you for your generosity.

Please hit the Like button. It helps to spread the word.

You’re the music. I’m just the band.