I’m getting an early start this week as the financial markets aren’t taking a break. This one goes out to everyone, but especially all the new members and followers. Thanks for your support.

Over the past few months, I’ve been increasingly bullish on the oil market. I highlighted my long term views in this report, which has been well received by supporters of this page and is available to members free of charge.

I wrote the report in March 2023, before the crowd started to turn bullish on oil. And while oil prices have risen since I wrote it, I’m expecting them to move higher, after a pause. That’s because there is a rising number of reports which suggest China’s economic slowdown will lead to lower fuel imports.

At the same time, there is plenty of data which suggests that China's imports aren't slowing at all. I tend to believe these reports. That's because oil trade is based on long term contracts. And since there are contracts in place which stipulate that certain amounts of oil be traded at certain times, the changes in demand take a while to be implemented. So while China's economy may be slowing, it still has to honor its long term oil contracts.

The Market is Misguided

Thus, until proven otherwise, I think the market is wrong, and that as supply tightness becomes more apparent, the market will have to adjust. So any weakness that does not completely reverse the current uptrend in prices will likely offer an opportunity to buy oil related assets on the dip.

The reason is that, until proven otherwise, OPEC’s production cuts, combined with decreased shale drilling in the U.S. has led to a reduction in oil supply. We saw this a couple of weeks ago when the American Petroleum Institute (API) reported a 15 million barrel draw in a week. The next morning, the U.S. Energy Information Agency (EIA) confirmed the supply reduction by reporting an even bigger 17 million barrel draw.

The following week’s data showed minimal increases in supply which did not come close to offsetting the prior week’s draws.

Moreover, gasoline and diesel supplies remain tight, just as the U.S. is quietly starting to refill the Strategic Petroleum Reserves (SPR).

Price Charts

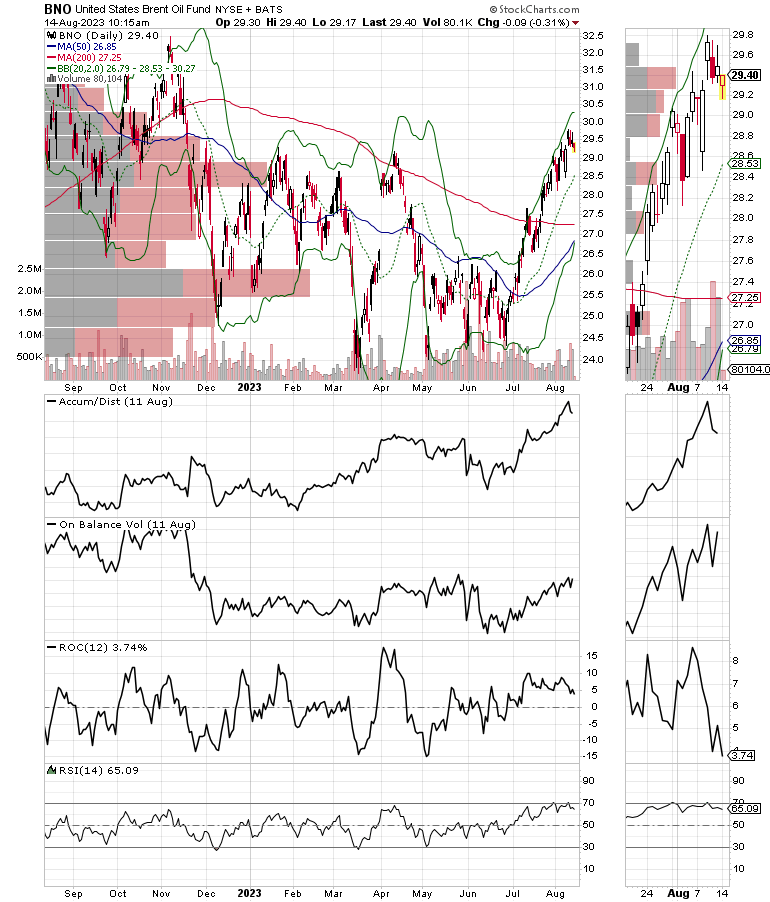

Let’s look at some charts. First, the U.S. Brent Oil ETF (BNO). This ETF tracks the international benchmark Brent Oil crude oil price and offers a real time appraisal of the price trend for Brent Crude. As you can see BNO is selling off slightly this morning in tandem with the futures markets.

But this looks like a short term pause. There is good support at the 20-day moving average, and there are two stout looking Volume by Price (VBP) bars in the same price range. That’s two levels of good support. So, if prices fall below that general price area, we would be looking at further down side, which may end near the 200-day moving average.

Neither Accumulation/Distribution (ADI) or On Balance Volume (OBV) are showing signs of major selling action.

If you’re new to the page, you can check out how these indicators work in this video.

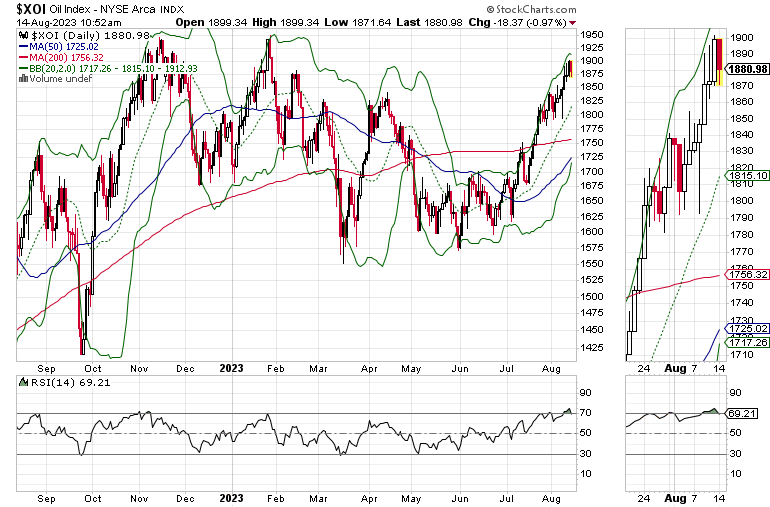

The next chart looks at the NYSE Oil Index (XOI), where big oil stocks like Exxon Mobil (XOM) and Chevron Texaco (CVX) reside. XOI is approaching the 1950 area, where it topped out in November 2022, and March 2023. This is a crucial price area, and is a likely place for a sideways consolidation pattern.

You can see that the RSI indicator is above 70, an overbought reading. That means that, for now, there is likely to be some backing and filling in the oil stocks. This should not surprise anyone, given the advance from the March-May bottom, which I predicted in this audio post.

Bottom Line

The oil sector has come a long way since its spring 2023 price bottom, which members of this page and subscribers to Joe Duarte in the Money Options.com were prepared for and have been profiting from. In fact, I just added a new oil stock which you can check out with a FREE trial to the service by clicking the link in this paragraph.

As a result, I am expecting a short term pause in prices, which if it holds, as I expect it will, will offer an opportunity to enter the sector at a lower price.

I will certainly be watching the support levels I highlighted above and will update my expectations should anything change.

Thanks to everyone for their support. This page is growing steadily thanks to you. I really appreciate it. A very special shout out goes to new members JCF and RW.

I also appreciate those who follow this page. But you’re missing out on key Members Only reports. This post is a sample of the kind of reporting members receive. So, if you want full access, consider becoming a member.

If you like this report and want frequent access to others like it, consider becoming a member.

I also appreciate single coffees, which you can buy me here.

As always, I appreciate everyone’s support. Please hit the Like button. It helps to spread the word.

Finally, if you’re wondering how I can keep up with all this work and are looking for an excellent way to support the page, have a look at my secret energy drink here.

You’re the music. I’m just the band.