The office vacancy rate in San Francisco is at 33%, and things could get even worse as the carnage from the implosion of the technology sector continues. As I noted in this post, this is not unexpected given the ongoing repercussions of the Silicon Valley Bank (SFV) implosion and the results of the Fed’s interest rates hikes pile up.

Will We Work Survive?

As if commercial real estate wasn’t having enough problems these days, a joint venture between We Work (WE) and Rhone Group has defaulted on a $240 million loan. The loan was for a 20-story building tower in San Francisco’s financial district. The building was anchored by We Work where it offered co-working offices.

According to Bloomberg, defaults are starting to “pile up” as landlords can’t rent enough space due to layoffs in technology companies and the pressures of renegotiating adjustable rate loans at higher rates which have resulted from the Fed’s rate hikes. The tech crunch combined with the persistent work from home are putting a huge squeeze on landlords.

We Work’s problems are likely to mount, despite a recent restructuring. As far back as 2019, the company had 26,000 members across its 26 Bay Area locations along with a large office.

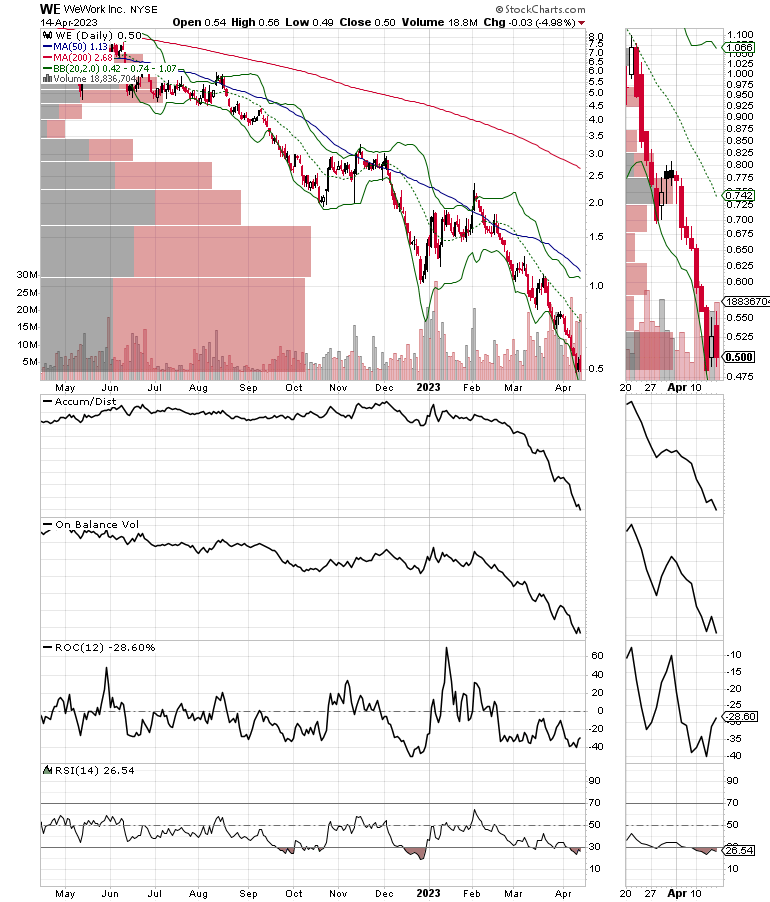

The company is deep in the red having reduced its losses to $2.3 billion recently. But its stock is trading below $1. This is usually the territory where at some point bankruptcy looms as the only possibility other than the company going private.

Certainly, the stock has nowhere to go but up. But the odds of it doing so unless something very positive develops are low. These are the stunning numbers to consider:

· Total Debt: $19.76 billion

· Cash on Hand: $287 million

· Expected revenues for 2023: $3.67 billion

You can see that the company’s cash on hands would barely be good enough to pay off what it owes on this one building’s loans.

Salesforce Bugs Out

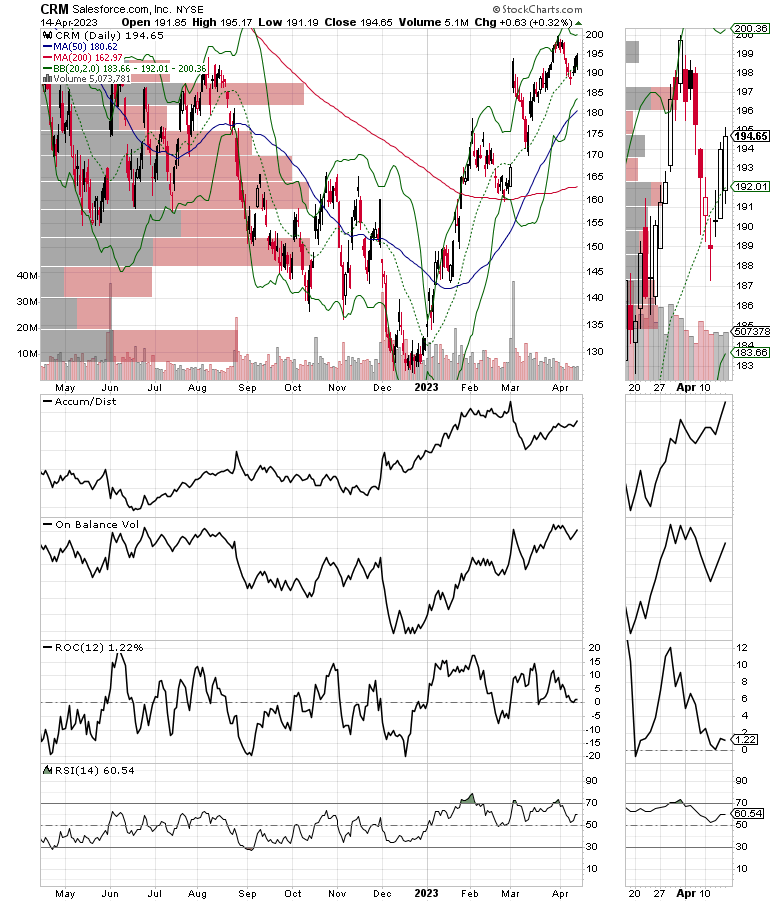

We Work is in deep financial trouble, but Salesforce (CRM) isn’t. Yet, the company’s recent moves suggest that it sees trouble may lie ahead and it’s making some moves in order to avoid them.

According to The Real Deal, Salesforce just moved out of the remaining 104,000 square feet it had left at the Salesforce Tower in San Francisco. This goes along with job cuts and the cancellation of yet another 325,00l square foot San Francisco lease.

Salesforce, San Francisco’s largest private employer, recently announced a 10% cut in its work force.

Under the hood, a Salesforce subsidiary, Slack, moved out of a 250,000 square foot space, also in San Francisco.

Salesforce stock is a complete reverse image of We Work’s. In fact CRM is under accumulation by investors. You can see that in the rising Accumulation Distribution (ADI) and On Balance Volume (OBV) indicators.

I appreciate your support. If you like this post, hit the like button. I appreciate your single donations, as I really like coffee. If you become a member, you will have access to this type of information before anyone else, as I’ll email you when I put up new posts.