I still didn't have time to write a properly formatted investment case on $ONON, but I will do so after the earning season. In the meantime, if you do not know the company, you can find everything here.

https://twitter.com/WealthyReadings/status/1759627282329506021

Overview. No currency issues for this quarter, and the market is reacting properly this time, to another great quarter for the Swiss shoe brand.

EPS. $0.16 | $0.31 | +93.7% beat

Revenue. $547.49M | $560M | +2.3% beat

"We have continued to grow very substantially, just shy of 30% on a constant currency basis and made great progress in every region, channel and category."

Pretty easy takeaway: everything is going well, I'd even say better & better.

Business. There are some comments to be made, but the overall conclusion here is that their products are more & more demanded and their clients are reaching directly to the brand to get their shoes or apparel. Which is always a good sign as it shows the difference between "oh let's try those shoes in the store" and "Okay I need to buy myself an On pair." I'm sure you can see the difference in those behaviors.

"[Record net sales] is led by exceptionally strong demand and momentum in On's DTC channel, with DTC net sales growing in the f irst quarter by 39.0% year-over-year and by 48.7% on a constant currency basis."

The company is now selling 37.5% of its products DTC. But it's not the only growth vector as wholesales also grew +12.2%. People want On products, and it shows in the company's market share which they estimate as high as 10% in some specific geographies.

"The market share gains are clearly driven by the success and fast adoption of our latest high performance running franchises, Cloudmonster, Cloudsurfer and Cloudrunner."

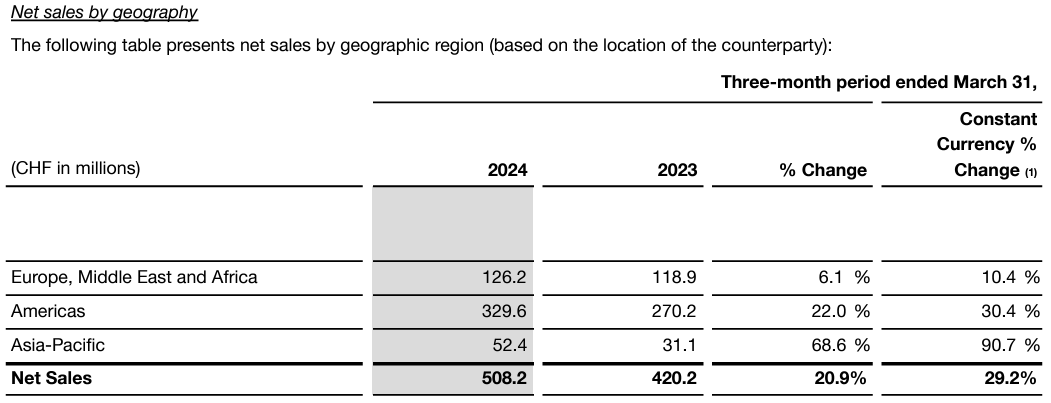

There are two more interesting trends in this quarter. Firstly, the geography dispatch of their sales.

Unsurprisingly, the U.S is the biggest part of it with strong growth, but what catches my eyes is the Asia-Pacific part. We know that many sportswear companies are now focusing on eastern countries where they have a very large TAM & populations are getting richer & having more activities. The company used Japan as an example as their sales in Tokyo "more than doubled YoY".

There is a huge market to reach there. And I wouldn't be surprised if it were to grow faster and maybe even to bring higher revenues than EMEA in the next years.

I won't be kind here as this region is disappointing, hard to exactly know why although first, the region is surely struggling lately and second, On has been shifting strategy for the region.

"the closure of a number of non-strategic doors allows us to focus on the premium performance position of the brand."

An impact which is estimated at as much as 10% for the region and which should also be seen in Q3. Short-term fluctuation for stronger & healthier long-term growth.

"significant traction and growth in some of our still nascent markets such as France, Spain and Italy, largely driven by our D2C channel."

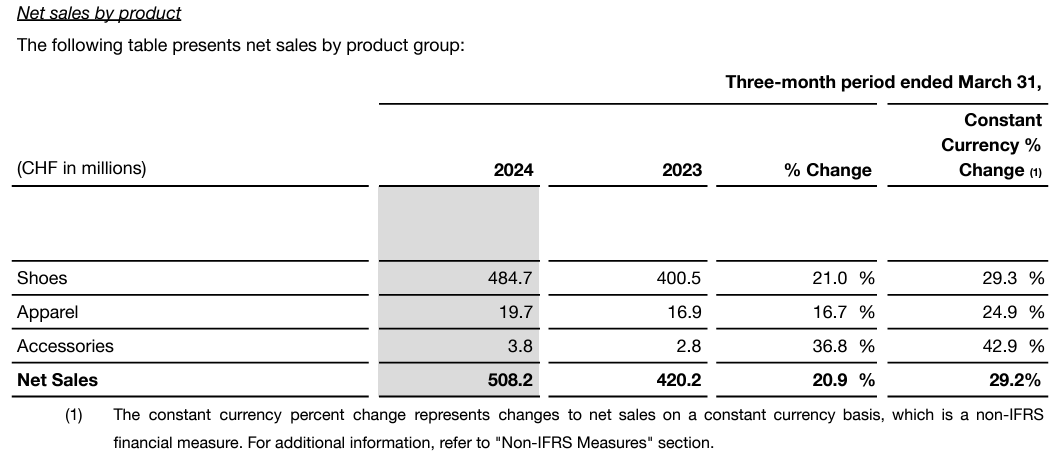

The second interesting trend is the kind of products the company sells.

Apparel & accessories are growing fast and now represent almost 5% of revenues - kinda flat YoY. My point here is that as for Nike years ago, people come for the shoes but buy everything else, which is usually sold at higher margins. Seeing strong growth - in value here - in those three categories is important as it also is an indicator of retention.

"we are very optimistic for the remainder of the year with many more highlights to come, not least being the Olympics in Paris."

It goes without saying but On is still working, as any sports brand should, to endorse more athletes and reach more clients besides the running community, especially focused on the tennis market for now, shoes & accessories - with the one and only Roger Federer working closely with On.

"Over the past weeks, we have also rolled out our first apparel collection in tennis and fans can now wear the same key looks as seen on Ben Shelton and Iga Swiatek."

But they don't forget their main business with new innovations.

"a groundbreaking new footwear technology, which On will reveal in Paris this summer."

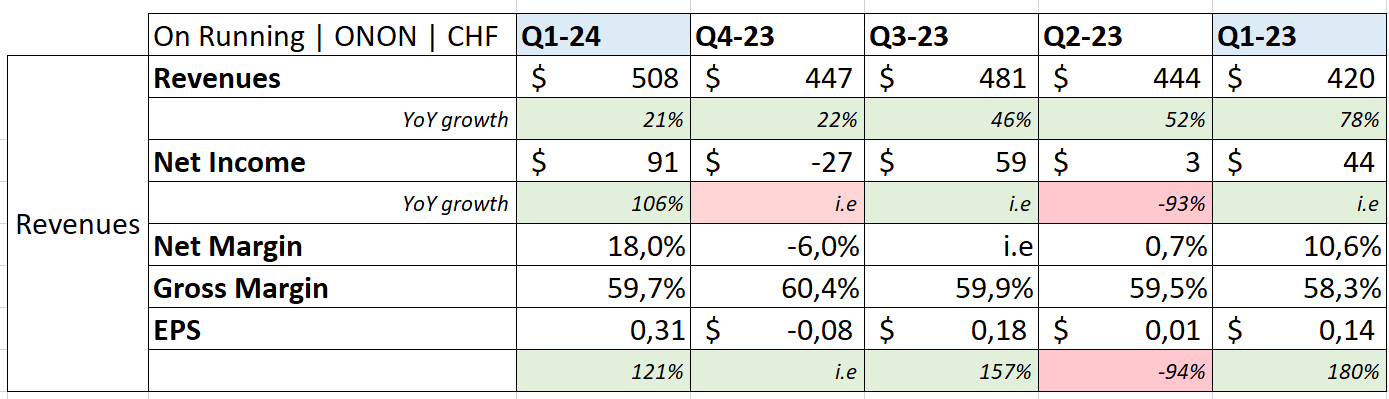

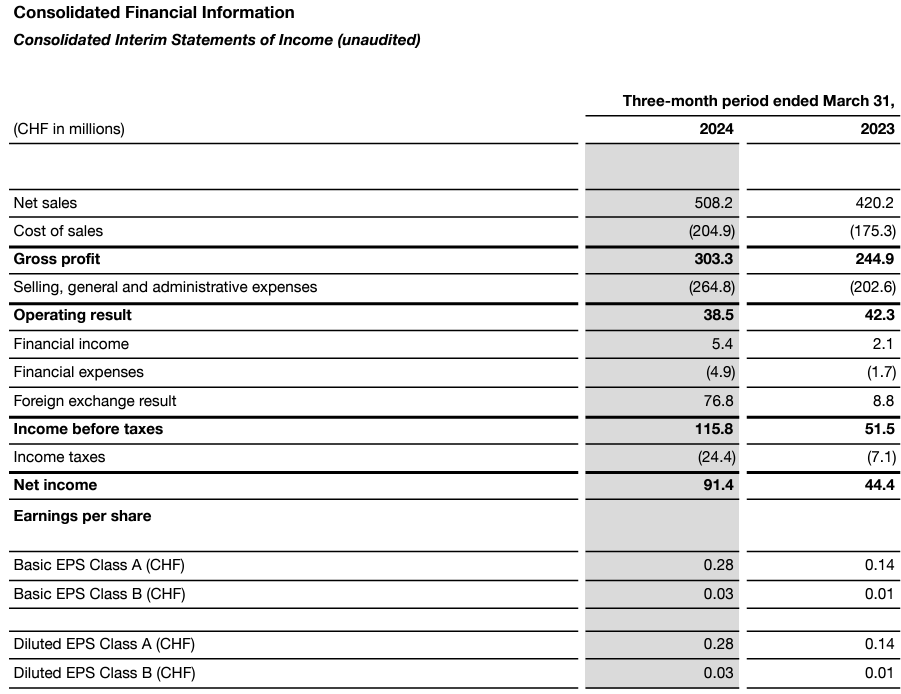

Revenues.

When On delivers a great quarter, it delivers everything.

I can list it all, although it's on the excel visual at the beginning. But for the sport.

YoY revenue grew +20.9%, net income grew +106%, both net & gross margin grew YoY getting close to the company's target, EPS grew +121% thanks to their strong profitability & margins growth. What more can one ask from its companies?

It still is worth noting than a big part of revenues came from currencies as the CHF finally lost some value compared to the dollar, helping the Swiss exportations - complete opposite than last quarter. It should get quieter going forward.

"we expect the translation impact to be less pronounced during the remainder of 2024, if the current U.S. dollar Swiss franc spot rate persists."

It's also worth noting that inventories are flat YoY which is what the company wants. Demand is there, they simply need to manage it properly not to run out of anything.

In terms of balance sheet, it's slowly growing with net debt up to CHF 311M & a positive OpCF with small share-based compensation - although stock has been diluted big time over the last year (around 20%). But the company needed financing & will buy those back over the next years once stable profitability is reached.

Guidance. Nothing to say about the guidance as the company isn't changing anything, at least 30% growth in net sales on a constant currency basis, gross profit margin of around 60% and a net margin around 16.0% FY-24.

Call. Some more information coming from the earning call.

Presence. I'll say it again, stores really matter for brands, it's part of their image and On continues to grow their reach through them - and it seems to work well with this DTC growth I talked about earlier.

"In Q1, we opened stores in Berlin and Portland, Oregon, which brings us to over 50 stores globally, 34 of which are owned and operated by On. Stores in Paris, Champs-Elysees, Milan and Austin, Texas will open in the coming months."

They also partnered with new third-party resellers, notably Zalando in EMEA which kinda is a big deal - tons of younger potential clients, my younger brother & all his friends buy tons of things there. It's always nice to have personal insights for those things.

Olympics. This is of course a big subject as they will be held in Paris this year, close enough to On's home as they say.

"We expect over two dozen On athletes to hit the starting lines across track, triathlon, tennis and of course, the marathon."

This will be a very exciting time for the company and a tremendous opportunity to grow awareness around their brand.

"With everything else we have planned for the next few months, we are fairly certain the world will be talking about On more than ever before."

Conclusion. You probably understood it, I'm really satisfied with this quarter and I'm glad to see the market also is. Although I also liked that time when the market didn't realize the "bad" numbers were only due to the CHF strength and I got to buy shares under $28.

This time we get to enjoy a nice rally, so I won't complain, I'll simply sit on my hands and hold my shares.