I've been accumulating $CELH for some months now and am pretty happy about the returns. It's time to write a deep dive to understand everything necessary before investing in $CELH or not - especially since it's currently trading at an interesting price - under $70.

We'll follow the same pattern as usual, starting with te company's presentation, its business & market, the financials and opportunity.

[Company]

Celsius Holdings is a company selling a well-known product in a pretty large & known market: soda. More precisely, energy drinks, but we will talk about both.

Celsius sells energy products, beverages and cereal bars. Most of their revenues coming from their drinks. They compete directly with Monster, Red Bull, and broadly, the entire soda industry.

Although they have one more arrow to their bow, their products are marketed as healthy (not that Red Bulls are unhealthy...):

"Energy drinks and energy bars with no sugar, high fructose, corn syrup, artificial colors, aspartame. Clinically proven to accelerate metabolism and burn body fat when exercising." And that is "backed by multiple clinical/university studies and peerreviewed medical journals"

Would probably need to dig this up a bit... But I won't comment on it here as this isn't the place. What matters is their products and branding:

Celsius. Live fit.

[How do they make money]

In an easy market, monetization is straightforward although in Celsius' case, it involves complex infrastructures because delivering a product like energy drinks isn't easy logistically. That's why they work with third parties.

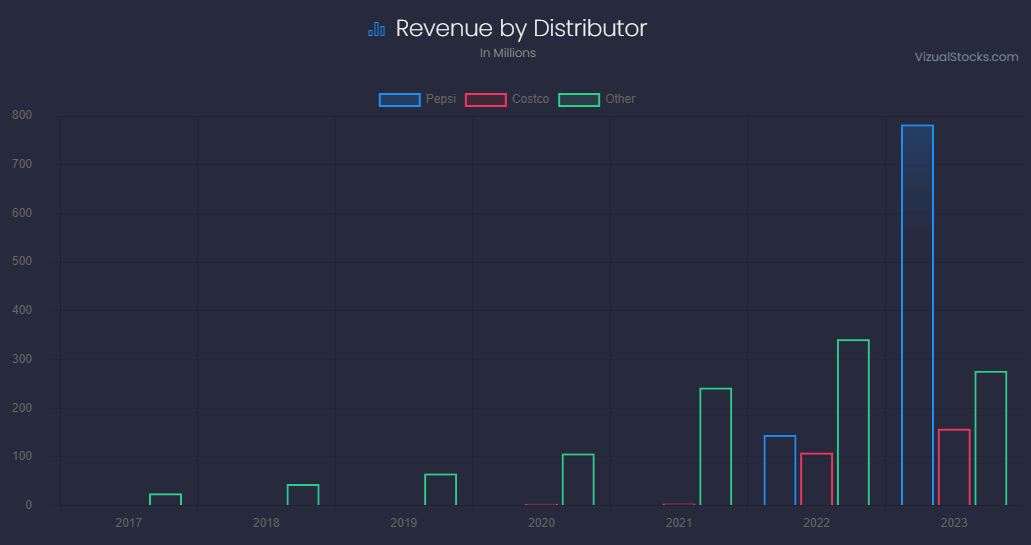

Celsius collaborates with a few of them, but three are more important than other.

First, the most important one, as you can see in the graph, is Pepsi. Probably one of (if not the) biggest distributor for this kind of products in the U.S, they give Celsius the opportunity to be sold almost everywhere, especially with their coolers in hospitals, schools, beaches and more.

The second one is Costco. I won't elaborate much, as it's self-explanatory; you can buy their products in their stores.

The third one, not mentioned here is Amazon, which is interesting as it gives many the opportunity to access those products even if there are no resellers around. And the company is doing pretty well on Amazon!

Of course, each distributor will charge different fees but that's a necessary step for any soda company - they need to sell after all. Celsius actually renegotiated its contract with Pepsi a few weeks ago without many details publicly released but we know from Pepsi's teams that it was meant for a stronger partnership.

[The market]

We'll talk about both markets,energy drinks & soda globally. Something important to understand is how complex both those markets are despites having such simple products.

At then end, soda is nothing special but some bubbly water with different tastes. I'm not saying everyone could do it, as it still requires infrastructures, etc... But it's not a lot of R&D, doesn't need much tech nor any specificity in your products manufacturing or else.

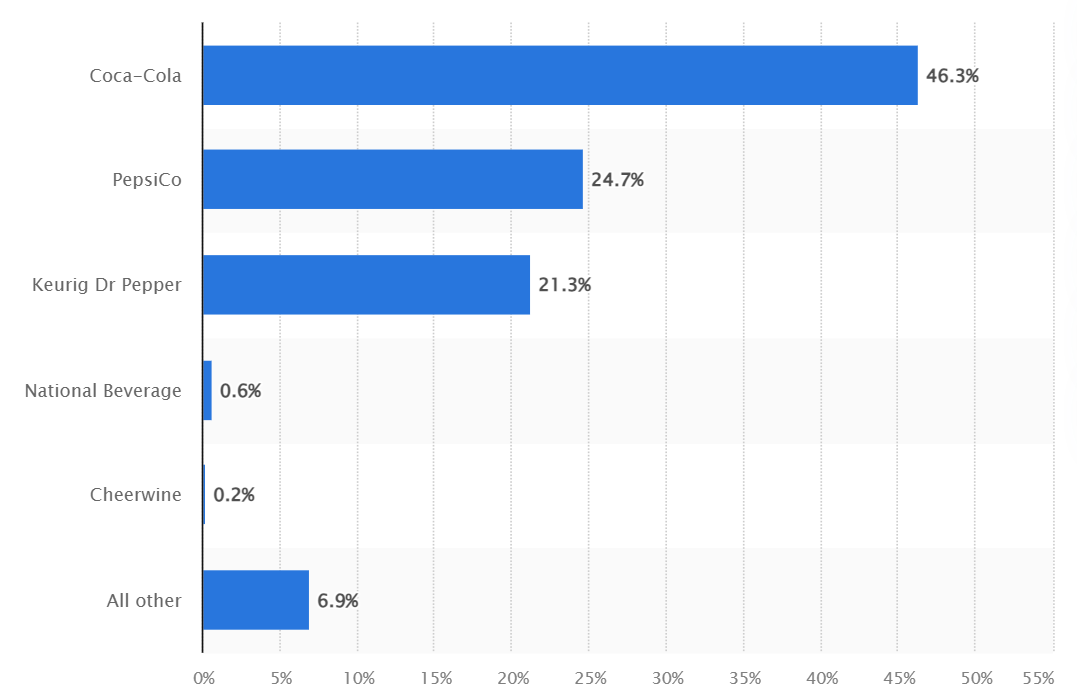

No, it's not about the product itself; it's about the market penetration. Taking share is almost impossible and there's actually not a lot of soda & energy drinks out there if you think about it - lots of products, not lots of comapnies. A few own everything.

Seems ridiculous, right? Yet it is how this market works, and the reason is straightforward: consumer habits & quasi-monopoly. Think about it yourself; if you're in a restaurant, you'll likely order a Coca-Cola or anything from Pepsi -assuming you don't drink alcohol. And if you see things you don't know on the menu, well, you won't try because why would you? A good coke, nothing's better.

Quasi-monopoly comes later because either way, if you go to a fast-food or restaurant, they won't offer you anything but Coca-Cola or Pepsi's products. And they don't need to because it's all you want.

These two factors are why it's so hard to penetrate the soda market, although the products are pretty simple after all. And this is the same in the energy drink market in the U.S.

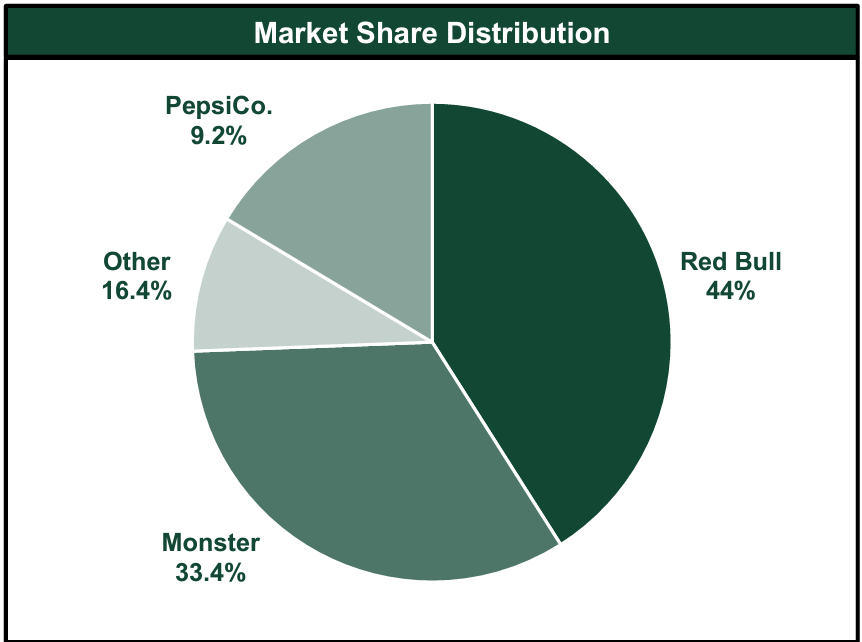

Imagine trying to build something to compete against those two giants which are Monster and Red Bull... You're not going for 100% of the market; you're fighting for 16% of it with the other small guys.

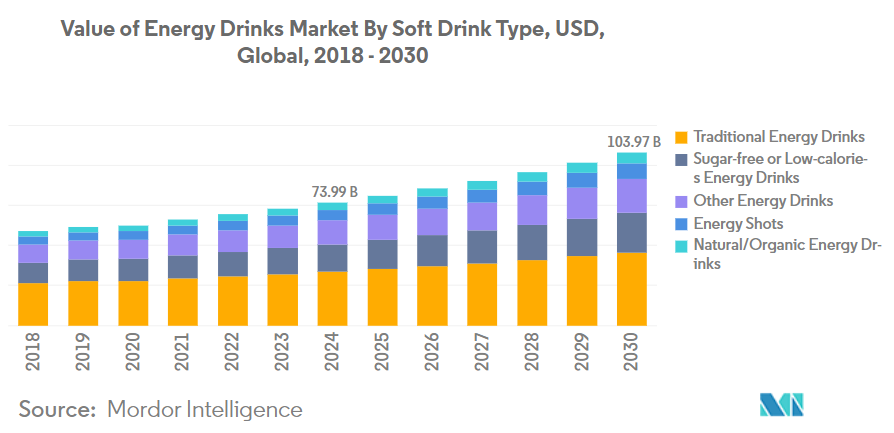

Is it worth it? Well, Celsius thought so, and they went for it - the conquest of what is today a $74B market and should be a $100B market by 2030. I will use the energy drink market from here to do any computations.

And they have been doing pretty well, eating quarter after quarter a lot of market share until today, being the fastest-growing energy drink beverage company and targeting the shares of the two giants.

They did it thanks to a very known and well-executed playbook stolen to competition & a little distinction that both colossi do not have.

[The playbook & Competitive Advantages]

Let's talk about the playbook first, which simply is a set of goals companies need to focus on if they want to create their brand, eat market share and grow awareness around their products. When it comes to energy drinks, the king is Red Bull and I think we all know most of the steps they used to be where they are today.

Omnipresence. You can see Red Bull everywhere. They're focused on elite sports, but you end up seeing their marketing everywhere on TV, on YouTube, around lots of events, and sponsoring lots of different personalities, mainly inside but outside of sports as well.

That's a very important rule. Be everywhere. Be seen. Celsius did it.

Brand. Being seen is good but not enough; you have to work on creating a brand; consumers need to identify with the values you create.

"Red bull gives you wings." It allows you to do things you never thought you could do and show it to you through their athletes or accomplished professionnals. It's the drink of the ambitious, always in need of energy to accomplish more.

Monster doesn't have such a banger slogan but it is one of the manlier drinks you can find on the market. Their black cans with the green M are famous around the world and you'd feel manly, strong with it in your hands at your barbecue. It even became a problem for the brand which never caught the feminine market.

That's where Celsius shined as they communicated different values, healthy values in a world where it's becoming trendy to be veggie and go to the gym.

Simple and white packaging and cans with a simple drawing of the flavor, accessible to everyone but remember, the goal is to "live fit." You won't feel many nor accomplish the impossible but you'll have energy to work on yourself. What's more important than yourself?

Expand. It goes with being seen and being everywhere, but the global market isn't just in the U.S, it's everywhere. You also have to be everywhere, and that is what Celsius is focused on by now. The brand expanded itself to more than 10 countries during 2023 and will continue to do so this year.

Data. This one is only to illustrate the competitive advantage; it isn't part of the playbook. As I presented for $LULU earlier, it's hard to see a definite MOAT here -although the brand is enough developed with Celsius to consider it.

The combo is the same.

Growth + high margins + high ROIC. Combine those three financial data and you're in the presence of a company with a competitive advantage. Although in my opinion, eating Red Bull's & Monster's market share is an indication enough.

If you want a data comparison, Monster has an ROIC of 20% and a gross margin of 36.18%. Strong metrics for our newcomer.

[Finances]

We're once more with a growth company here, although the biggest part of the rapid growth is done, but there's still room for lots of it.

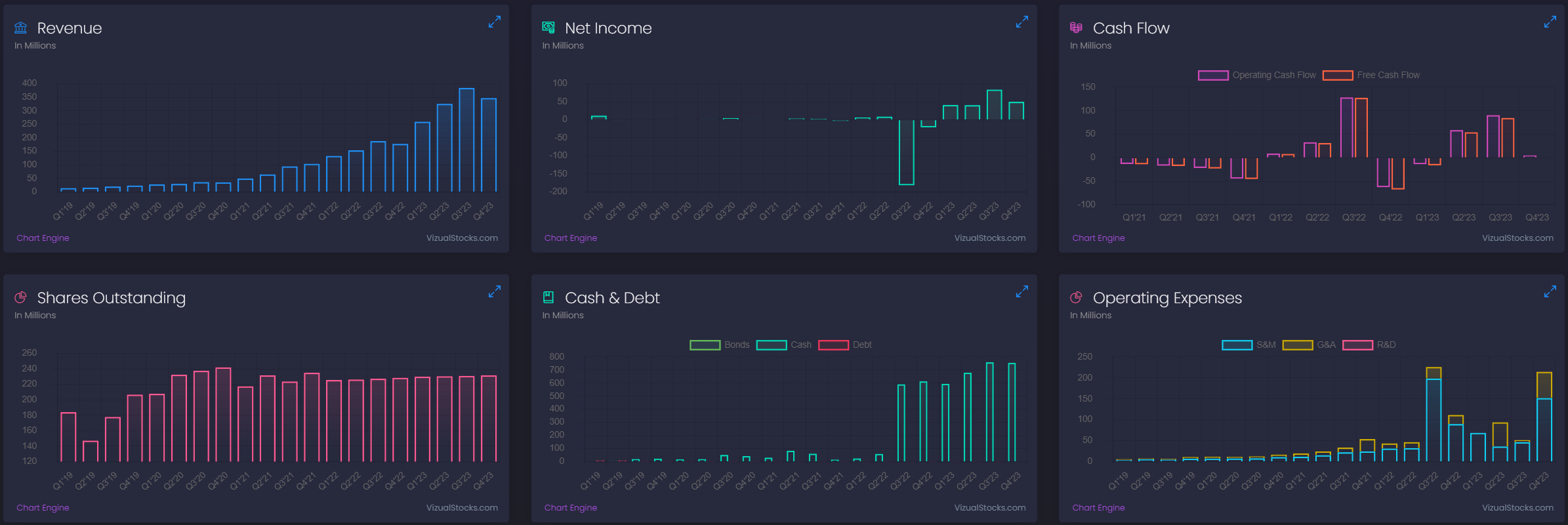

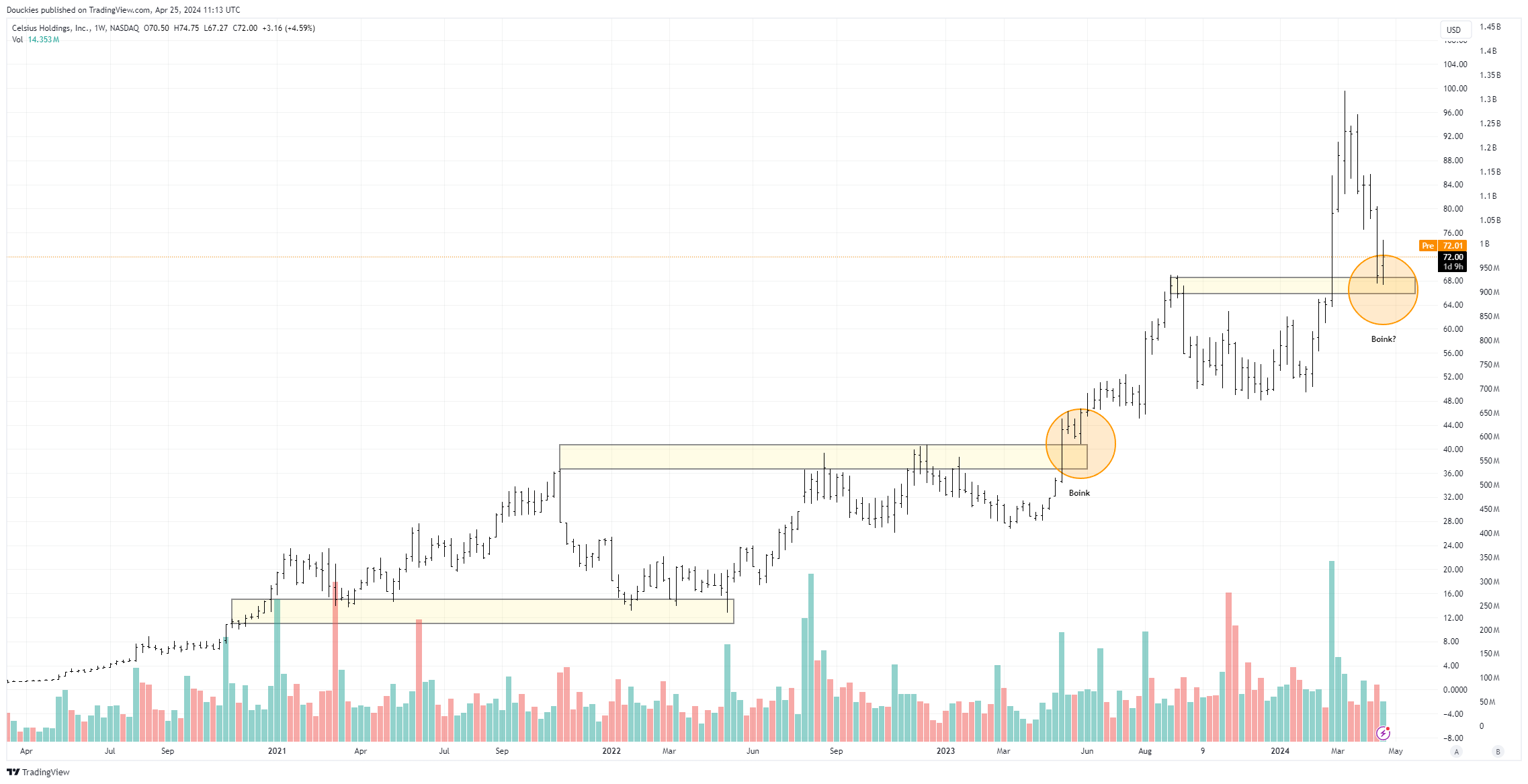

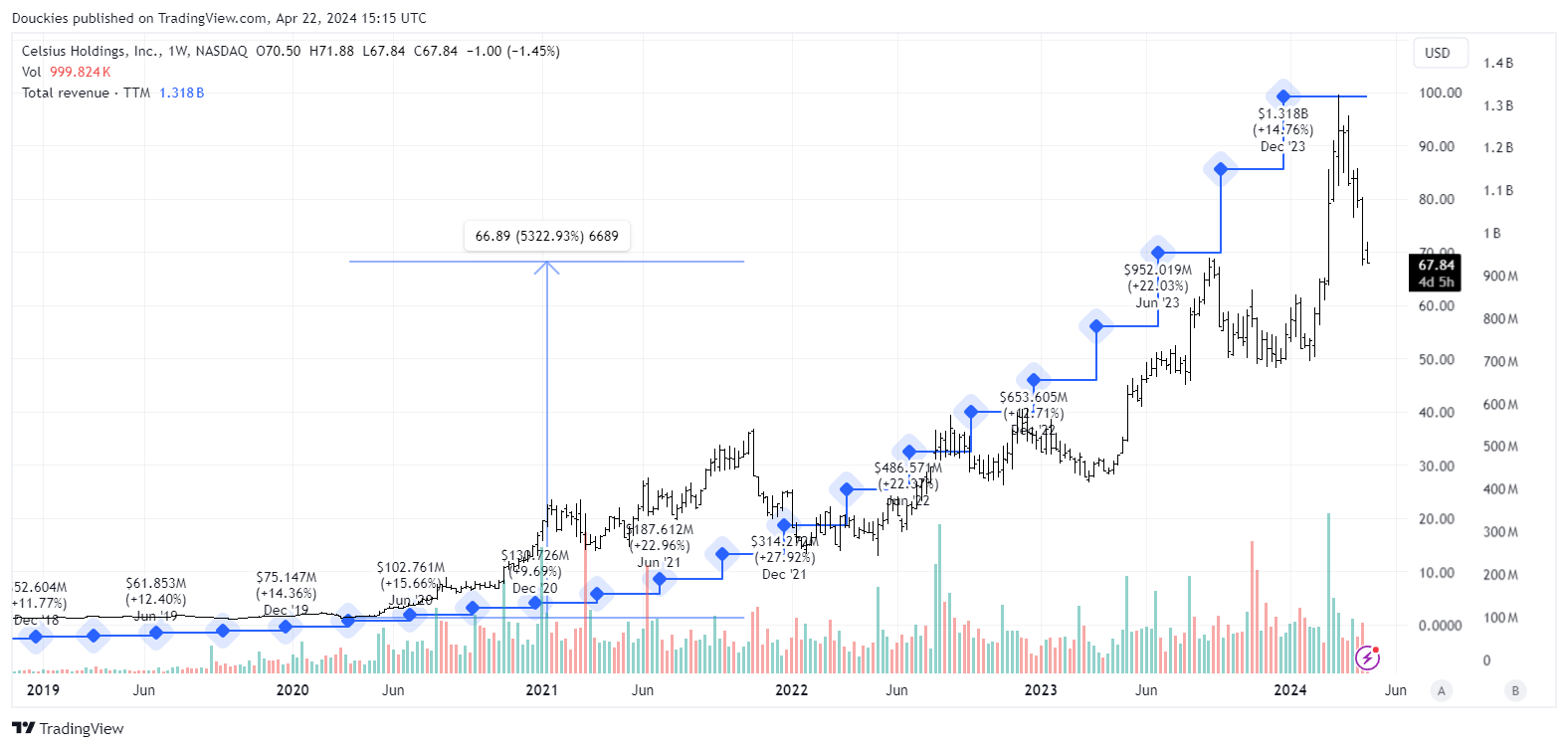

Revenues. We're with quarters here, not years - easier to read - so we sure see a small dip during Q4-23 but that simply is due to seasonality, so nothing to worry about; the growth is still here - we can see the same in Q4-22. The company grew at a 10-year CAGR of 62%, 5-year CAGR of 90.45%, and 3-year CAGR of 116%... Hard to find better growth in the market.

Income. But growth isn't everything, and we can see it here. Celsius is a profitable company since a year now, and that will change a lot of things for shareholders, as we'll see later.

Cash & FCF. The FCF has been neutral or positive over the last years thanks to the issuance of shares, of course. It allowed the company to grow a strong balance sheet which will certainly be used in the future as they're now profitable.

Expenses. Very important to grow your brand. The trend seems like the company is spending tons - and they are - but the data that matters is how much they are burning compared to revenues and how much their marketing is bringing in futur revenues.

And on this, Celsius has actually spent less over time, and pretty efficiently.

Around 70% of their S&G went to marketing - hence around $300M in 2022 which brought back a 101% YoY revenue growth of more than $650M. Everything doesn't come simply from the marketing so the math are a bit simple here but there's something to take from those numbers.

Their marketing works, money well spent.

Shares. We had a 26% dilution over the last five years. It is never good for shareholders to be diluted, but a 26% dilution for a 62% CAGR... I'm sure long-term holders have been fine with it.

We'll talk more about this later as it's a very important part of the investment thesis.

[Risk]

I probably won't be exhaustive here, but I will try to present the risks which I judge important and possible in the future.

Regulations. This is very important for energy drinks as those products are carefully watched by lots of different institutions and the rules are very different depending on the countries. You won't commercialize the same product in Europe, in the U.S & in Asia for example, which doesn't make the task easy. But it could make it even harder if those regulations were to change or if you were to have issues with the institutions and that could lead to modifications, recalls, or even retracting your entire offering from a country in the worst case.

Brand damages. This is true for lots of companies that are based on the image they create. Even more for Celsius and its "Live fit" which could easily be damaged if it was proven to be inefficient for weight loss or even unhealthy for athletes. But brand damage can be larger than the product with mismanagement or wrong things said during public presentations.

Prime. I'll illustrate both points with the actual lawsuit against Logan Paul's drinks "Prime".

"Prime Hyrdration LLC was sued April 8 in the Southern District of New York over "misleading and deceptive practices" regarding the company's 12-ounce energy drinks containing between 215-225 milligrams of caffeine as opposed to the advertised 200 milligrams, according to the class action suit."

A perfect example of an issue with regulators plus a new hurting your brand. I am not saying it's always justified and always hurts companies long term, but those are risks.

Distributors. Everything goes really well for Celsius at the moment, king on both Amazon and Pepsi distribution chains and very demanded at Costco, everyone seems very happy with the product and volumes they're doing. So there's no worries to have, but the future might be different and an issue with a main distributor would really hurt Celsius' sales volumes.

Growth & market share. This is more about the stock itself than the company & product. The investment thesis is based on the fact that Celsius has eaten market share aggressively over the last years and should continue to do so. Any of the risks above would impact volumes and market shares, and if growth were not to be as big as expected, it would surely tank the stock's multiples.

[Technical]

I don't do that often as I focus on fundamentals but I'll add a technical part to this deep dive as $CELH has been and still is behaving like the perfect stock.

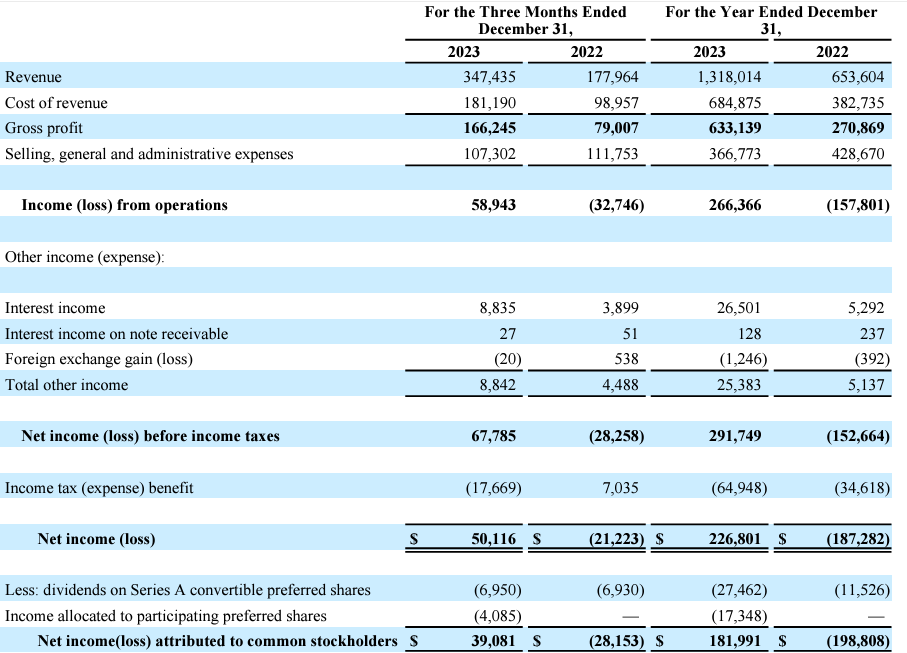

A perfect continuation of resistances breaking out and becoming supports over the years, and we are actually retesting the previous resistance which was broken on Q4-23 earnings around $70. I am not saying this will be the perfect entry, I am simply saying this is an interesting behavior and coupled with fundamentals and what could be the stock's actual fair value - spoiler, I judge it around... $70.

Well, I'll just say it's a lot of positive indications.

[Opportunity]

The stock has already brought very strong returns for early investors over the last years, but I think we're far from over if you agree to hold for the next years. The growth has been healthy so far, as it has been following earnings pretty well.

When the company executes, the stock follows, making this a perfect case of what investors should focus on. A growing company with an understandable business and market, bought around fair value. Then, simply verify how things unfold over the years.

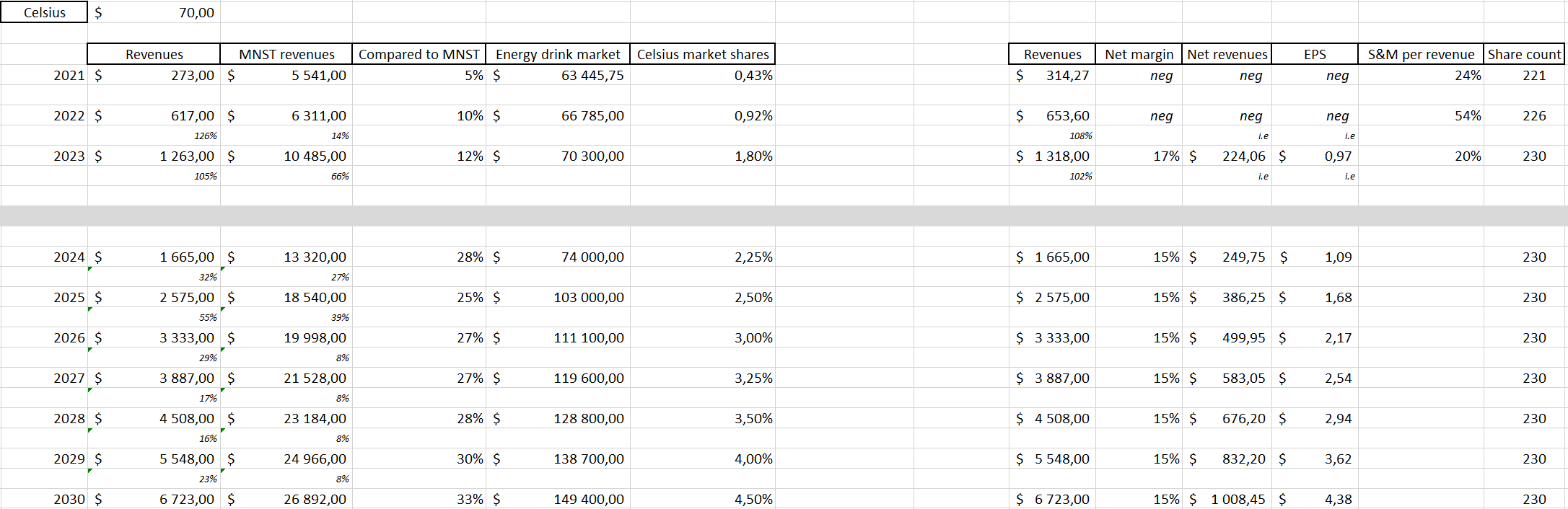

Now let's vaudou and try to forecast where the business could go over the next years. The method is pretty straightforward; I computed the revenues depending on the company's market shares, which I anticipate to grow over the years, as it has been growing lately. I also grew the net margins to 20%, while the company's actually doing 17% as I expect them to work on improving them. After all, Monster's are slightly above 20%.

This would be pretty fair to my opinion, as Monster controls less than 20% of the world market (I considered it around 18% in its forecast, but this value doesn't really matter; the comparison matters with real data, not with forecasts here). I hardly see why 4.5% of market share would be overly optimistic for Celsius.

Many already consider the company holds more than 5% of the U.S market share already - Jefferies to name them. So holding 5% of the global market by 2030 when the company is expanding aggressively in Europe during 2023/2024 seems doable. I wouldn't go as far as to call it conservative, though.

Those numbers would give us a 25% CAGR over the next 6 years, which sure is big but again, doable. However, it's not a conservative estimate. It would make a good base case. Let's move to different cases now and talk about stock price growth.

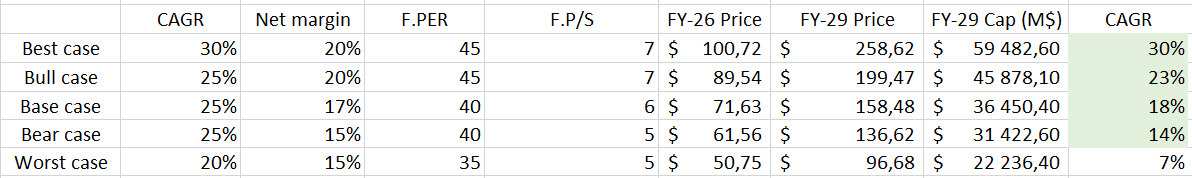

About the assumptions, to give some colors, Monster trades today with a PER & P/S of respectively x35.5 & x5.5. And the energy drink market trades with ratios respectively at x28.5 & x4. Celsius has a bigger growth than both and should surely trade at least at equal ratios. The net margins range between 15% and 20%, as the last one is the end goal to reach Monster's, and the first one would be very bearish, as it means lower than today's - Celsius has 17% of net margins today. Lastly, computations are done without shares reduction nor dilution - we stay flat at 230M shares.

I always find it complicated to juggle with the potential ratios for a growth company, but I find it hard to believe that an energy drink brand growing 20% CAGR would sit at its market's average ratios or even equals to Monster's actual ones when the company grew 13.5% over the past 5 years. So I easily could make the case those ratios are pretty conservative in all of those assumptions, as growing 30% CAGR would probably deserve more, while 20% CAGR would... also deserve more.

The growth and margin for the base case are doable, and they are in the expectations of many analysts. Growing faster would require a bigger market share in foreign countries and a focus on those margins, but both are long-term focuses for Celsius. Add to this their future capacity to buy back shares once profitability will be properly established and recurrent.

The CAGR is computed based on a share price at $70, which, as you can see, could easily be considered a fair value for the company's stock with today's data and expectations.

[Conclusion]

I covered most of what is important for Celsius, and although there'd still be some specifics to dig to really finalize a thorough investment case, this should give a pretty strong overview of the business, market, and opportunity.

I'm personally long already with a position under $60 and will keep accumulating with a maximum medium price around $70 - which I consider a pretty fair value with even enough security margin actually.

That concludes my write-ups! Remember that I do me & you guys do you.