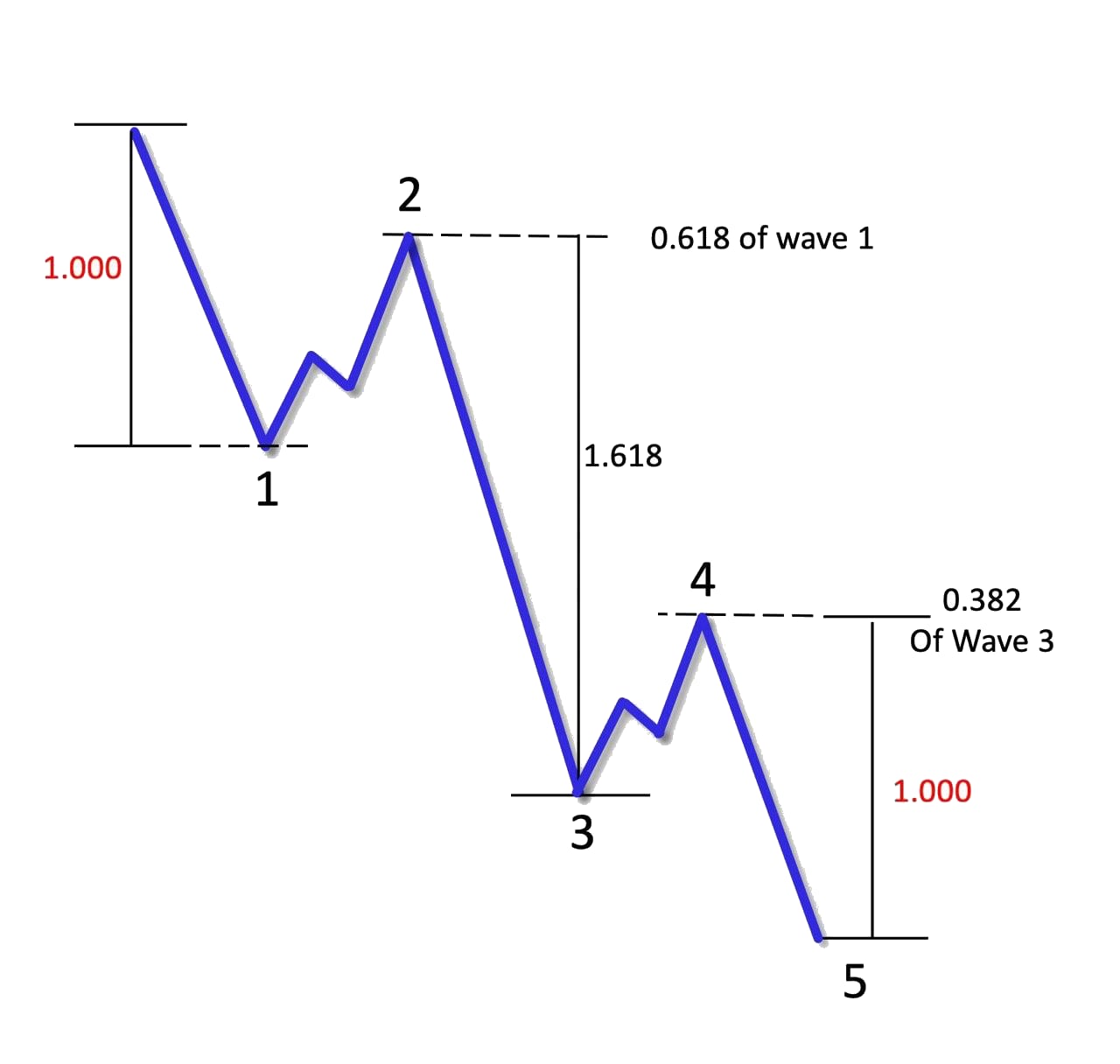

It takes very little time or experience in studying the Elliott Wave Theory in order to recognize that Fibonacci ratios are clearly relevant in predicting locations where prices can be expected to pivot, and in quickly confirming that a pivot is a genuine turning point as opposed to a simple "headfake" by the market. In the sections below we will identify the expected Fibonacci levels where the various waves are more likely to pivot.

We've grouped all of the Fibonacci targets from the various specific web pages for ease of use.

Motive Waves.

Motive Wave extensions refer to waves that are moving in the same direction (normally with the trend).

Wave 1

In an impulse wave 1 is difficult to predict. As a general rule, it is expected to reach at least 2.618 of wave 1.1

Wave 1 can extend, in which case you should know that it is doing so when wave 1.3 subdivides.

Wave 3

Wave 3 is likely to extend, especially if wave 1 does not.

A normal wave 3 should reach at least 1.618 of wave 1 at a minimum. If it does not do so, it may be putting in a 2nd 1-2 wave indicating that it is going to extend.

An extended wave 3 can reach 2.618 even 4.618 of wave 1

Wave 5

If wave 1 and wave 3 are not extended (wave 3 not > 1.618 of wave 1), look for wave 5 to extend.

If wave 5 is expected to extend, you can expect wave 5 to reach 1.618 of wave 1 + wave 3.

If wave 3 is extended, you can expect wave 5 = wave 1.

Corrective Wave Structures

Retracements deal with movements that are in a counter-direction, or opposite of the wave being compared.

Zigzags

Wave A of a zigzag will frequently drop .38 to .50 of the preceding wave.

Wave B 1st) .382 of WA 2nd) .618 of WA

Wave C 1.00 of WA (equality)

Using the principle of equality, when wave B has pivoted, you can easily plot wave C's expected pivot.

Flats

Wave A will drop .23 to .50 of the preceding wave. .382 is common.

Wave B must retrace at least 90 to 105% of wave A (beyond that is an expanded flat). Less than 90%, declare wave A to be a W and wave B to be a wave X until proven wrong.

Wave C will normally be equal to A, but can be up to 1.618 of wave A.

Expanded Flats

Wave A will drop .10 to .23 of the preceding wave.

Wave B will retrace over 105 to 1.318 of wave A. Beyond that, your count is likely wrong.

Wave C should end BEFORE the pivot of wave A. Wave C is not expected to = A

Triangles - Contracting

Triangle - Barrier

Triangle - Running

Triangle - Expanding

Also known as an expanding wedge

Wave A is not capable of prediction.

Wave B, C, and D are >= the previous wave in the triangle, normally 105 to 125% of the previous wave.

Complex Corrections

Correcting Extended 5th Waves

Expect 2 corrective wave structures, the first correcting the extension, the second correcting the entire 5th wave, down to the prior wave 4.

CONTENT OF ELLIOTT WAVE CHEAT SHEETS1 Home Rules and Guidelines Applicable to All Motive and Corrective Waves

2 Wave 1 Characteristics and Structure

3 Wave 2 Characteristics and Structure

4 Wave 3 Characteristics and Structure

5 Wave 4 Characteristics and Structure

6 Wave 5 Characteristics and Structure

7 Wave A Characteristics and Structure

8 Wave B Characteristics and Structure

9 Wave C Characteristics and Structure

10 Extensions Structure and Trading

11 Fibonacci Targets Price Targets for Retracement and Extension

12 1-2/1-2 Structures Wave 1-2 /1-2 Characteristics

13 Zigzags Structure and characteristics

14 Flats This is All FLAT Rules

15 Triangles Triangles (3-3-3-3-3) Description and samples

16 Complex Corrections Characteristics of Complex Corrections (Combinations)

17 Declaring X Waves When to declare an X wave and a complex correction

18 Ending Diagonals Description and samples.

19 Leading Diagonals Description and samples. This is quite rare.

21 Channeling How to Use Channels to Identify Waves

22 Correction Times Use the appropriate time frame to analyze the correction.