The stock market has been trending upwards this year, despite some recent fluctuations. Bank of America predicts that small-cap stocks are set to outperform the broader market over the next decade, with potential annualized returns of over 10%. This is double the gains expected from the S&P 500. Cathie Wood, known for her risk-taking approach and focus on disruptive companies, has been investing in two small-cap stocks that have seen significant year-to-date gains, but are still down considerably over the past year.

Accolade, Inc. (ACCD) is a healthcare management platform for enterprises that offers tech-enabled solutions and health assistant services to customers. The company's financial results for the third quarter of 2023 showed a 9% YoY increase in revenue to $90.9 million, beating the Street's call by $3.37 million. EPS came in at -$0.56, exceeding the anticipated -$0.62. ACCD shares are up 47% YTD but still down 42% over the past year. Cathie Wood has shown confidence in the stock by purchasing over 355,905 shares this month through her ARK Genomic Revolution ETF fund. Raymond James analyst John Ransom rates ACCD shares an Outperform and has set a price target of $15, suggesting that the shares could climb 30% higher over the next 12 months.

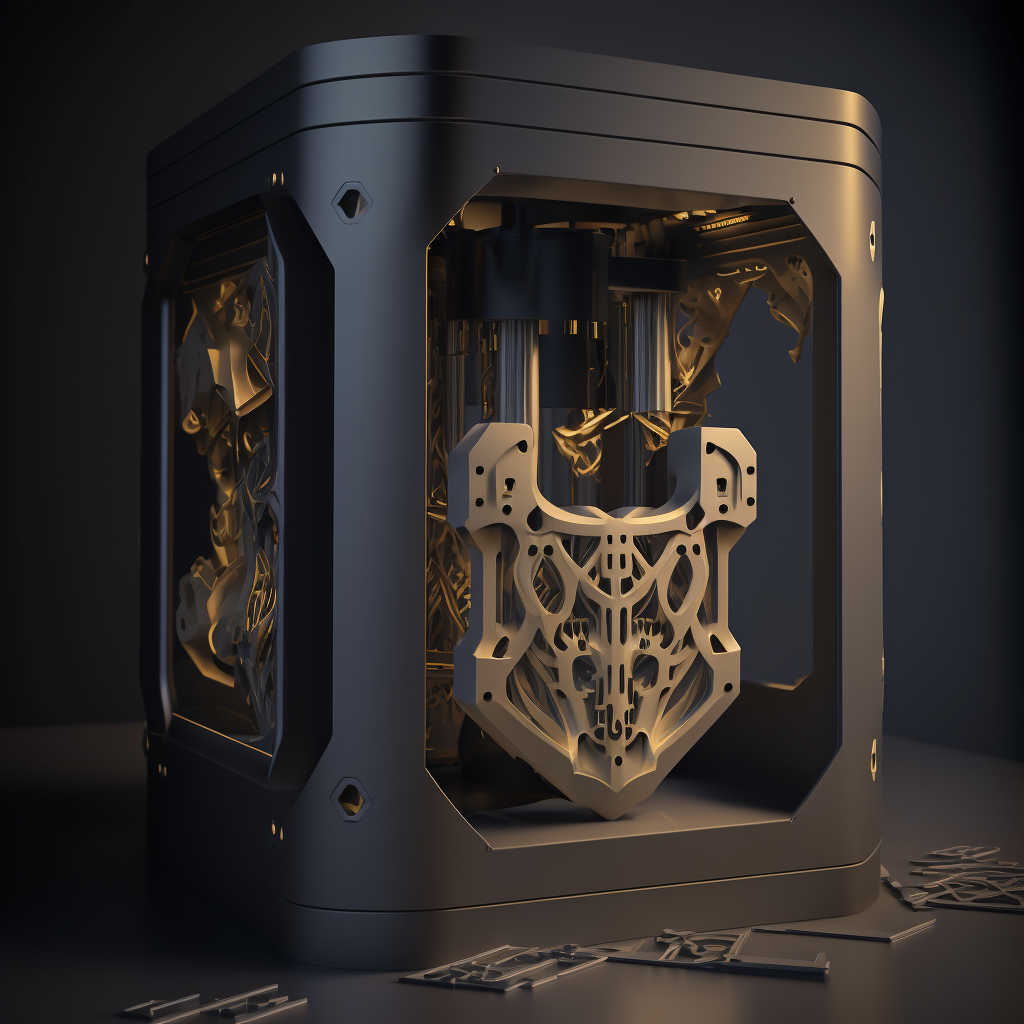

Velo3D is a company that sells industrial 3D printers used by companies to create intricate, mission-critical metal parts without sacrificing design, reliability, or performance. The company's revenue increased by 119.5% YoY to $19.1 million in Q3 2022, but it lowered its 2022 revenue forecast from $89 million to $75-80 million due to shipment delays, potential supply chain, and production snags. However, the company recently announced preliminary unaudited Q4 and full-year results, with revenue in the range of $80-81 million for the year and $29-30 million for Q4, which exceeded its prior forecast. The company's shares have gained 77% so far this year but are down by 55% over the past 12 months. Cathie Wood's ARK Autonomous Technology & Robotics fund has purchased 567,328 VLD shares this year, and William Blair's Brian Drab has rated the company as Outperform (Buy), expecting greater than 50% revenue growth in 2023.