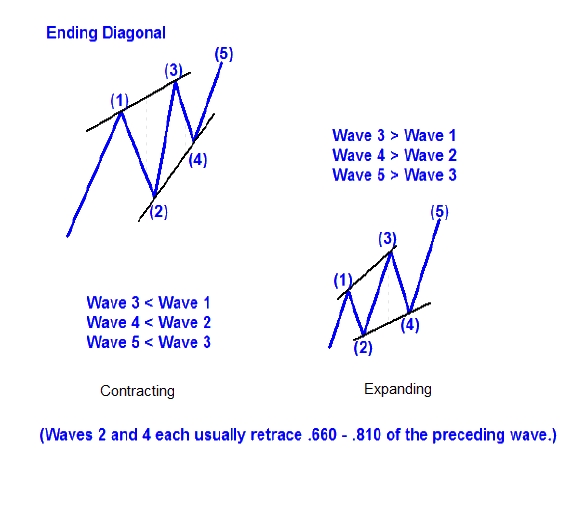

Structure (3-3-3-3-3)

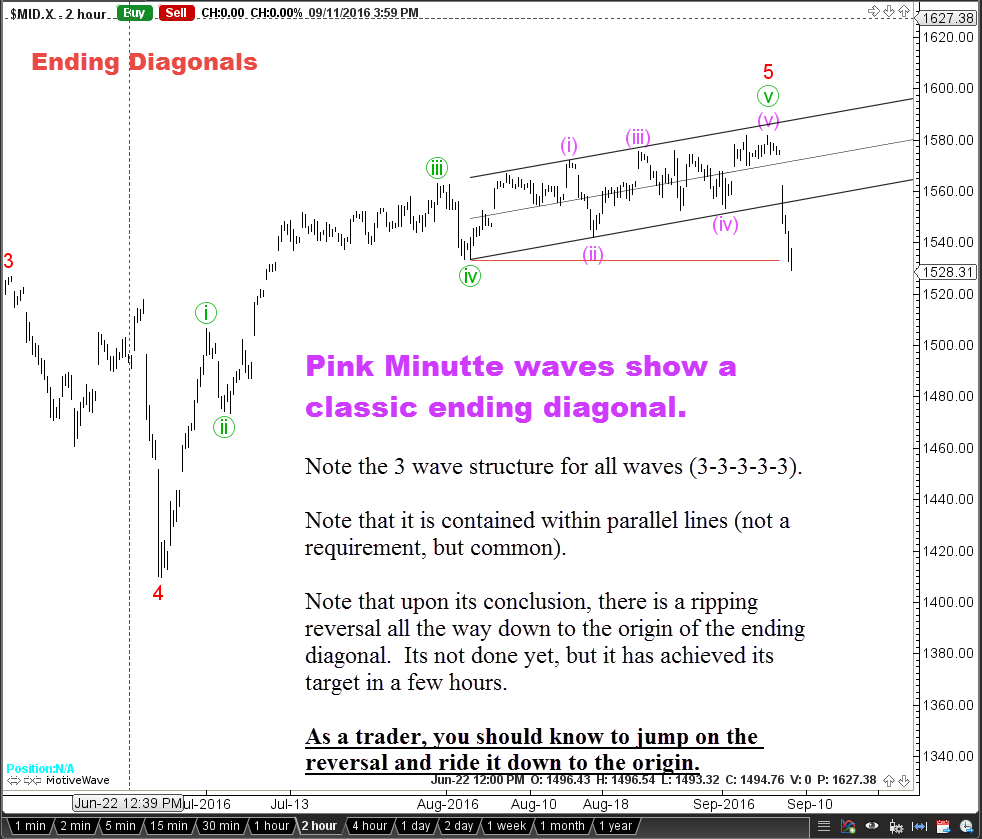

A terminating wave pattern. May only form as Wave 5 or as Wave C in a Flat or Zigzag (nothing else).

It is a Motive Wave, therefore shares the same general characteristics as an impulse wave, EXCEPT that W4 will always cross into the W1 territory and that all 5 waves of the ending diagonal will divide into 3 wave substructures (3-3-3-3-3)

95% of the time they are the contracting variety and demonstrate zigzags, or double or triple zigzags, but they are always comprised of the 3 wave structure.

An ending diagonal appears at the termination point of larger movements, most often as wave 5. Rarely as wave C.

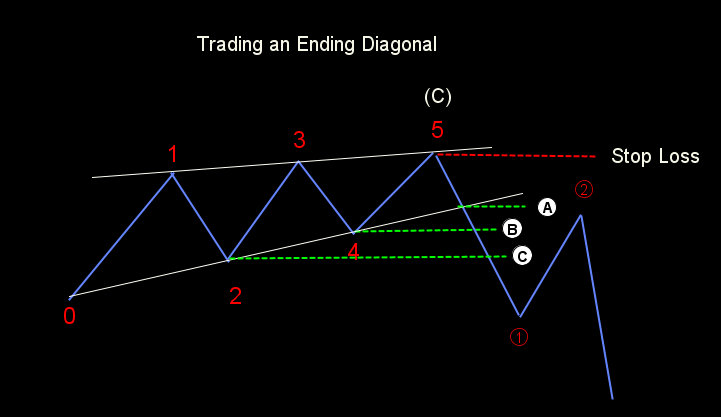

Frequently you will see a through-over the trend line in wave 5. You can almost expect to see it. Very normal attempt to shake out weak hands before moving in the opposite direction.

The retracements always start with a swift drop, commonly down to the wave 2 low of the diagonal, and ultimately ending about even with the origin of the pattern.

Are generally thought to occur when the preceding waves have gone "too far, too fast."

Sample Ending Diagonal in wave 5

Sample Ending Diagonal in wave 5

Retracement within the diagonal

W2 retraces to the range- .618 to .812 of W1

W4 retraces to the range .382 to .5 of W3

W5 frequently .618 of W3

Trading

In the diagram below, you will see three possible entry points (A-C) where the pattern has been confirmed and which can be used as the location for a trade. The placement of the stop loss reflects the Elliott Wave rule that wave 2 can never retace more than the origin of wave 1, so if the labeling is correct and W5 is in fact finished, the trade will be profitable. Each entry point, point has it benefits and drawbacks. is

Using point A, the break of the trend line has the potential of yielding greater ultimate profit. It also has a better chance of never resulting in a drawdown during the corrective wave 2 that is to follow. The risk to using point A is that Wave 5 may not be finished. It may cross the trend line only to pull back through it to a new high.

Using point B is more conservative. Once the wave 4 pivot is passed, Wave 5 is clearly finished, but by waiting until then you have reduced the ultimate profit on the trade and run the risk of a bigger drawdown, especially if W2 retraces up to near the origin of Wave 1, near the stop loss line. Using point C is even more conservative and has an even bigger reduction in profits and possible drawdown.

From the author's perspective, you may be better off taking the unconfirmed trade right after the wave 5 pivot. While wave 5 may not yet be done, your potential loss is very limited because you have a tight stop loss. Other considerations would be to raise your stop loss up to the point where, should wave 5 reach it, wave 3 would be the shortest wave. Contracting diagonals provide the unique opportunity to use this technique.

CONTENT OF ELLIOTT WAVE CHEAT SHEETS

1 Home Rules and Guidelines Applicable to All Motive and Corrective Waves

2 Wave 1 Characteristics and Structure

3 Wave 2 Characteristics and Structure

4 Wave 3 Characteristics and Structure

5 Wave 4 Characteristics and Structure

6 Wave 5 Characteristics and Structure

7 Wave A Characteristics and Structure

8 Wave B Characteristics and Structure

9 Wave C Characteristics and Structure

10 Extensions Structure and Trading

11 Fibonacci Targets Price Targets for Retracement and Extension

12 1-2/1-2 Structures Wave 1-2 /1-2 Characteristics

13 Zigzags Structure and characteristics

14 Flats This is All FLAT Rules

15 Triangles Triangles (3-3-3-3-3) Description and samples

16 Complex Corrections Characteristics of Complex Corrections (Combinations)

17 Declaring X Waves When to declare an X wave and a complex correction

18 Ending Diagonals Description and samples.

19 Leading Diagonals Description and samples. This is quite rare.

21 Channeling How to Use Channels to Identify Waves

22 Correction Times Use the appropriate time frame to analyze the correction.